Tax Law

Tax Law

Tax Thresholds, The Drawing Board, A Mistake, And A Substitution

Treasury Secretary Yellen: Biden’s proposed tax increases would not affect those earning under $400,000. In a hearing with the House Ways & Means Committee yesterday, ...

Tax Law

Georgia Tax Reform: Details & Analysis

On April 18, Georgia Governor Brian Kemp (R) signed several bills into law that will make the state’s taxA tax is a mandatory payment or ...

Tax Law

Navigating The Looming Commercial Property Tax Shortfall

Cities, counties, and other local governments have traditionally relied on property taxes as a substantial and stable revenue stream. But with remote work taking hold ...

Tax Law

How auditors can ensure an accurate data review

In the world of accounting audits, accuracy and completeness are paramount. Auditors rely on data review to ensure the reliability and integrity of financial statements. ...

Tax Law

Mastering the art and science of exceptional client service

There is no doubt that the accounting profession is in the midst of change. Gone are the days of transactional tax preparation confined solely to ...

Tax Law

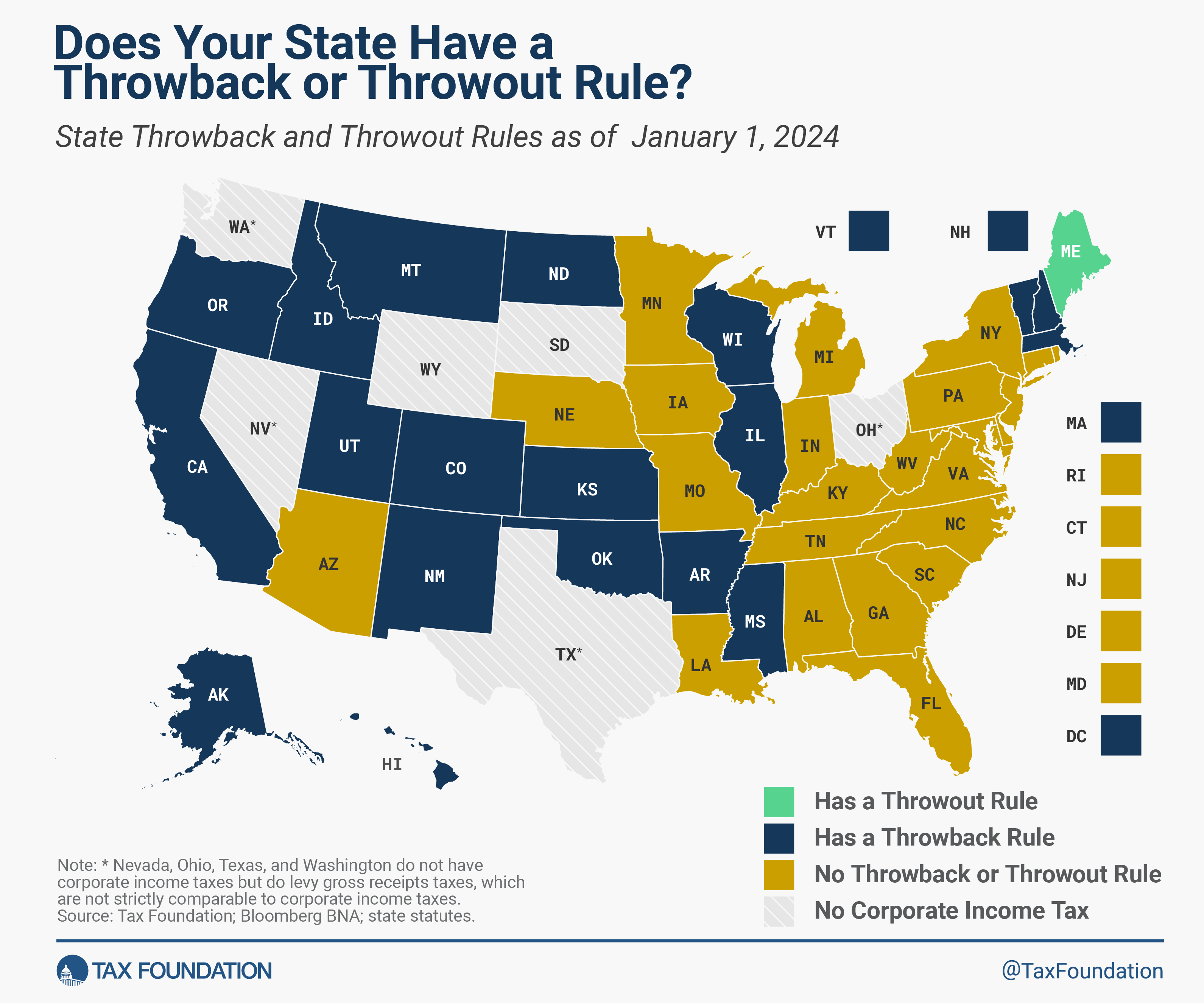

State Throwback Rules & Throwout Rules, 2024

Today’s taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of ...

Tax Law

5 things accountants need to do after tax season

Once tax season comes to an end, it’s time to breathe a sigh of relief — and then shift your focus to the future. Below ...

Tax Law

Digital Taxation around the World

Key Findings There is a geographic mismatch between the location of individuals who use digital platforms and the location where those products are developed. In ...

Tax Law

Beta Test Success, Fixing Mistakes, Expanding A SALT Workaround

Another year of Direct File would tell the IRS—and taxpayers—a lot. TPC’s Janet Holtzblatt reviews the IRS development and rollout of Direct File, the agency’s ...