Tax Law

Tax Law

State Tax Exclusion of Overtime Wages

All across the nation, employers are struggling to fill open jobs. The National Conference of State Legislatures reported that it is a job seekers market ...

Tax Law

Partnering with the right AI-powered technology

Artificial intelligence (AI) is transforming the way accounting professionals work. Generative AI, specifically, offers compelling opportunities for auditors, accountants, and tax professionals, especially when it ...

Tax Law

On-demand pay arrangements

For the third year in a row, the Treasury Department’s annual revenue proposals include clarifying the tax treatment of on-demand pay arrangements by amending the ...

Tax Law

How to Improve the Base Erosion and Anti-Abuse Tax (BEAT)

One significant international provision of the 2017 TaxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or ...

Tax Law

How BOI reporting combats tax fraud

Help small business clients understand the impact of the Corporate Transparency Act. Jump to: In an effort to fight financial crimes like tax fraud and ...

Tax Law

Taxocracy Tales with Scott Hodge

All taxes tell a story, and today we’ll explore how taxes influenced Bob Dylan’s decision to sell his music catalog, how the “chicken taxA tax ...

Tax Law

AI solutions for advisory firms of the future

There is a lot of hype around artificial intelligence: that it will transform the jobs of every knowledge worker or change the whole face of ...

Tax Law

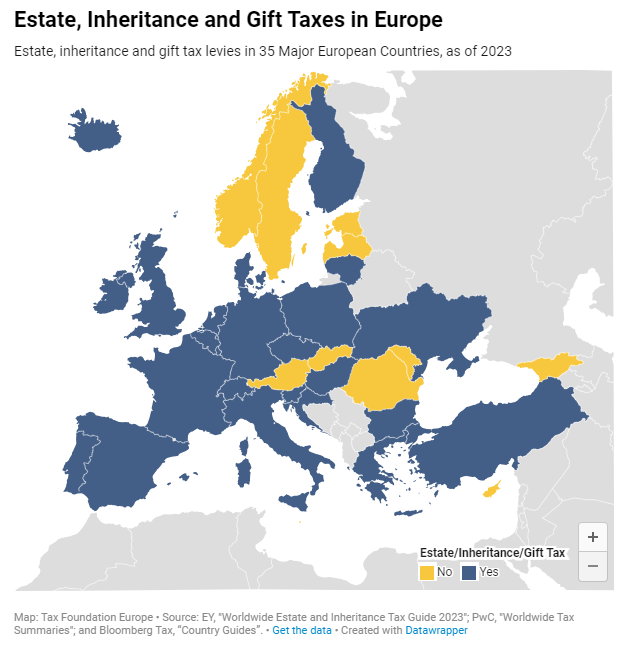

Estate, Inheritance, and Gift Taxes in Europe, 2024

Inheritance taxes date back to the Roman Empire, which collected 5 percent of all inherited property to pay its soldiers’ pensions. Today, the practice is ...

Tax Law

How Zero-Sum Thinking May Affect Attitudes About Taxes

Do you think about the world as “zero-sum,” where resources are limited and my gain is your loss? Or do you believe that resources are ...