Tax Thresholds, The Drawing Board, A Mistake, And A Substitution

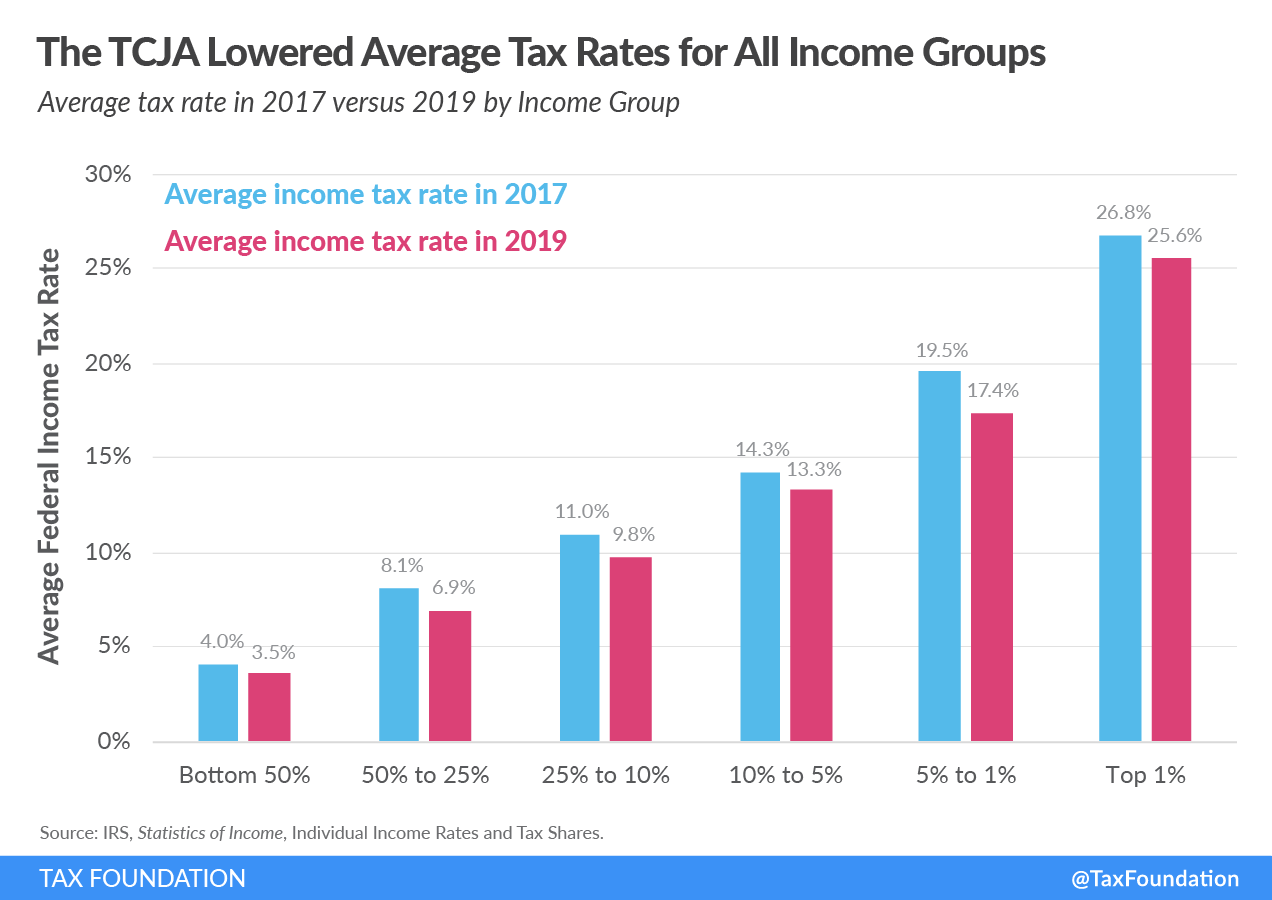

Treasury Secretary Yellen: Biden’s proposed tax increases would not affect those earning under $400,000. In a hearing with the House Ways & Means Committee yesterday, Treasury Secretary Janet Yellen insisted that President Biden’s proposed $3 trillion in tax increases will not apply to taxpayers earning less than $400,000, even if key provisions of the Tax Cuts and Jobs Act of 2017 expire next year. She asserted, “There will be a negotiation over what to do when these tax cuts expire and the president… will negotiate with Congress.”

No tax cuts in Kansas yet. The Kansas Senate failed to override Democratic Gov. Laura Kelly’s veto of a tax cut package that would have restructured the state’s three income tax brackets, eliminated the sales tax on food, exempted Social Security from income taxes, raised the standard deduction on income tax returns, and raised the residential property tax exemption. Gov. Kelly has a plan to lower the state’s income tax rates and promised to call a special session if lawmakers failed to provide tax relief. Lawmakers headed back to the drawing board this week.

A mistake in Colorado means lawmakers have to close a $67 million budget gap ASAP. The state’s Health Insurance Affordability Enterprise, established in 2020, helps fund insurance in high-cost areas of the state, health care for non-citizens, and education and outreach by the state exchange. It has been treating the insurer fees it receives as exempt from state revenue limits established by the Taxpayer Bill of Rights (TABOR). The law establishing the enterprise was not specific about the treatment of the Enterprise’s fees. Still, the state Attorney General determined last month that the fees are not, in fact, exempt from revenue limits. Colorado now owes taxpayers $67 million more in TABOR refunds than anticipated.

A tax on foreign oil in Louisiana? A Democratic member of the Louisiana Public Service Commission is asking Republican Gov. Jeff Landry to repeal the state income tax and replace it with a tax on all foreign and offshore oil processed or refined in Louisiana. The proposal would require an amendment to the Louisiana Constitution: Current law states oil and gas are not subject to taxes other than severance taxes levied on natural resources extracted from Louisiana ground. The idea is neither new nor partisan. Previous efforts advanced by politicians across the ideological spectrum have failed.

For the latest tax news, subscribe to the Tax Policy Center’s Daily Deduction. Sign up here to have it delivered to your inbox weekdays at 8:00 am (Mondays only when Congress is in recess). We welcome tips on new research or other news. Email Renu Zaretsky.