Tax Law

Tax Law

Do you know where your blind spots are in relation to indirect tax? Do you know where your data on indirect tax blind spots are?

Understanding the problems and consequences can help set a proactive path forward “If you want to change the future, you must change what you’re doing ...

Tax Law

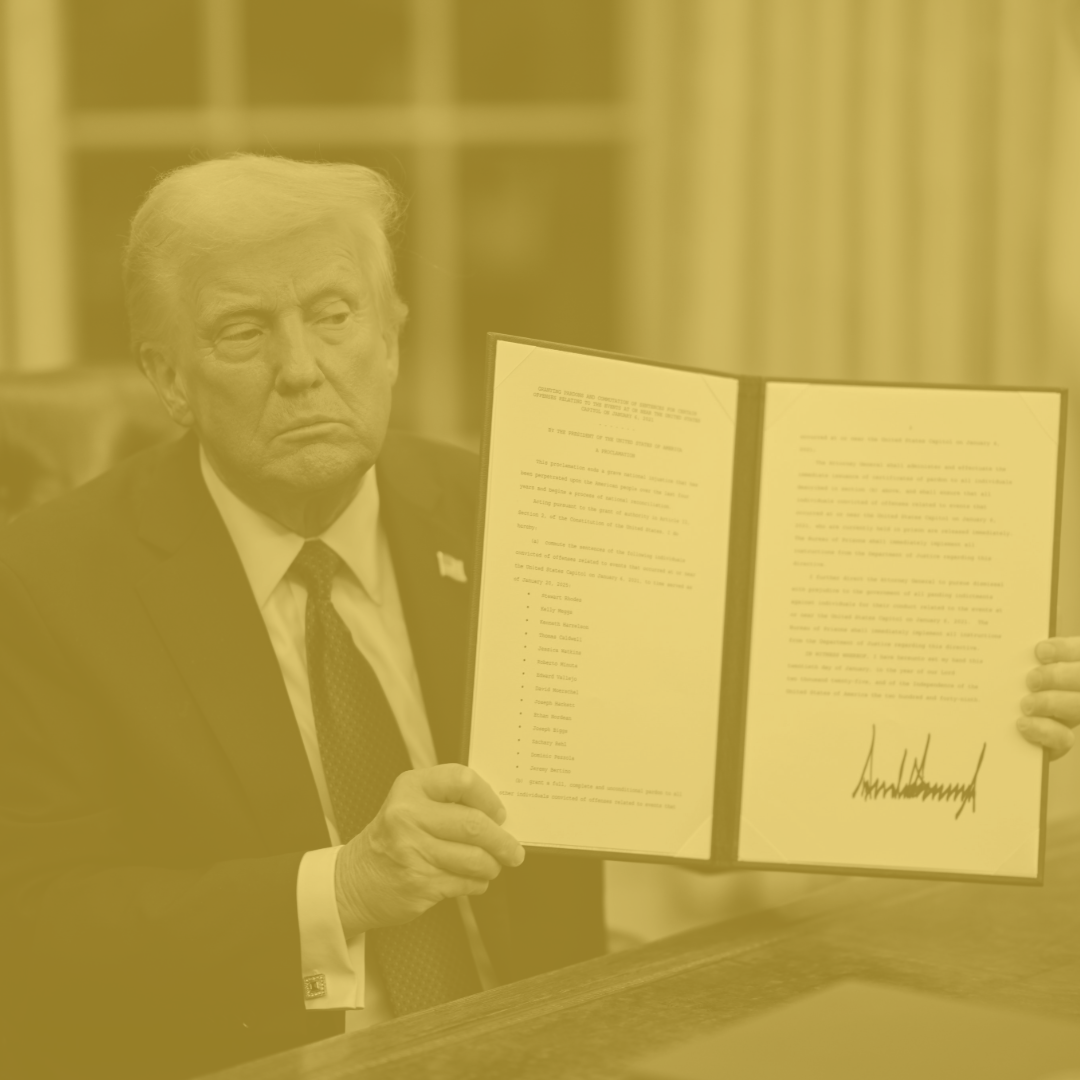

Are Trump’s Tariffs Legal Tariffs?

It’s been a whirlwind 24 hours in tariffTariffs are taxes imposed by one country on goods imported from another country. Tariffs are trade restrictions that ...

Tax Law

Tax management software that is reliable

Answers to frequently asked questions about ONESOURCE. What is Thomson Reuters ONESOURCE? Thomson Reuters ONESOURCE is a state-of-the-art tax platform that provides everything corporate tax ...

Tax Law

199a Deduction – Pass-Through Business

The One, Big, Beautiful Bill includes multiple tax provisions which will impact state- and local-level taxA Tax is a mandatory payment collected by local, State, ...

Tax Law

What To Know About Your Summer Job and Taxes

A summer job is a great way to add extra money to your bank account. Whether you’re a cash-strapped student, a teacher trying to stay ...

Tax Law

Integration of ONESOURCE Pagero with Oracle for e-invoices

A pre-built, embedded integration for e-invoicing that eliminates the need to use traditional, time-consuming, ERP connections. As global regulatory requirements for electronic billing (e-invoicing), become ...

Tax Law

Are Daycare Expenses Tax-Deductible? Tax

01 The The Child and Dependent Care Tax Credit (CDCC) is a federal tax break designed to help ease the cost of care for eligible ...

Tax Law

Top 5 priorities of modern tax and accounting firms

Learn how adapting to client needs and optimizing pricing strategies can drive success. Learn how adapting to client needs and optimizing pricing strategies can drive ...