Would Biden Really Scrap The TCJA? Would That Raise Everyone’s Taxes?

President Biden set off a kerfuffle when he posted on “X,” formerly Twitter, “Donald Trump was very proud of his $2 trillion tax cut that overwhelmingly benefited the wealthy and biggest corporations and exploded the federal debt. That tax cut is going to expire. If I’m reelected, it’s going to stay expired.”

Critics are blasting him for vowing to allow the individual provisions of the 2017 Tax Cuts and Jobs Act (TCJA) to expire as scheduled at the end of 2025. This is, in the words of a breathless New York Post headline, a promise of “Tax Hikes For All.”

Wall Street Journal columnist James Freeman predicted similar dire consequences (paywall). He wrote, “Voters should…understand that failing to extend the expiring provisions of Donald Trump’s signature reform would raise taxes on most Americans, not just the wealthy.”

This would be true if Biden let the TCJA expire and didn’t replace it with anything. And by saying he’d let the law “stay expired,” Biden’s political hyperbole opened the door to such criticism.

What’s In A Name?

But there is plenty in the old law that Biden almost certainly would keep.

Indeed, his most recent budget included multiple ways Biden could revise the TCJA while not raising taxes for “all” or even most households. He could cut taxes for some and raise them for others. He could let the law expire and immediately replace it with a package that retains many provisions of the TCJA, but with a new name.

For months before that tweet, Biden had been vowing to never raise taxes for those making $400,000 or less while paying for extending many of the TCJA’s individual provisions by raising taxes on high-income households and corporations. Biden never made clear whether his pledge applies only to direct taxes on individuals or also includes the share of corporate taxes paid by workers and shareholders.

Still, even in the heated rhetoric of a presidential campaign, claiming that Biden is flip-flopping on his long-time promise to protect those under $400,000 tax filers seems a stretch. Not raising taxes on 95 percent of households is not the same as preserving in amber every TCJA tax provision for that group. His most recent tweet is consistent with his long-standing pledge, if somewhat dramatic.

An Age-Old Question

But is rewriting parts of the law the same as scrapping it? The answer to that question rests on a premise that philosophers have debated for centuries but barely matters to actual taxpayers.

It goes back to a mythological Greek vessel called the Ship of Theseus. Two thousand years ago, the Greek philosopher and historian Plutarch explained the problem: If over time each individual piece of a ship is replaced, is it still the same ship?

Biden seems to be sailing a similar vessel.

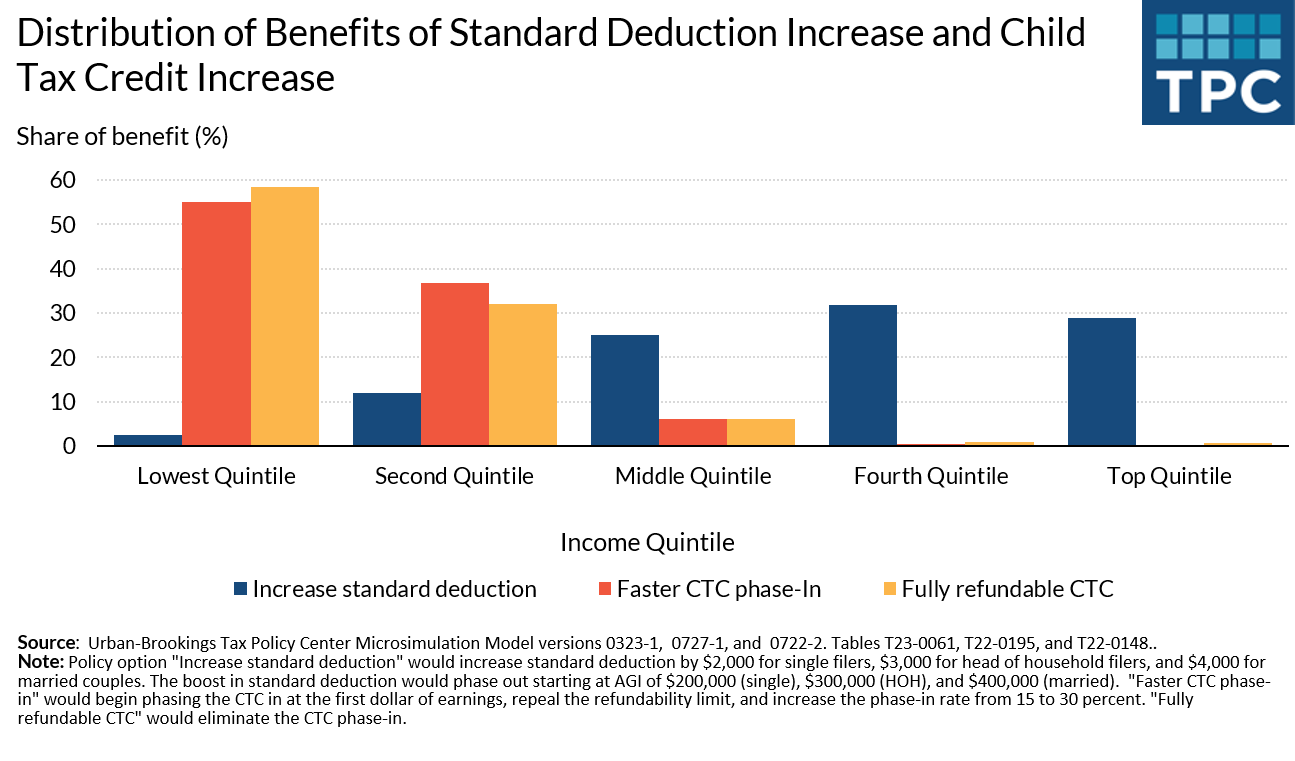

He’d likely retain many key features such as the TCJA’s higher standard deduction and its repeal of the old personal exemption. But in this year’s State of the Union and previous budget proposals, he also said he’d raise the TCJA’s top individual income tax rate, expand its the Child Tax Credit, raise its corporate and capital gains tax rates, and make dozens of other changes.

After all that hammering, sawing, and re-timbering, would it still be the TCJA? Or would Biden have repealed the Trump law and replaced it with an individual income tax code that retains some key features but changes others? Does it matter?

It should surprise no one that Biden seems eager to consign what is arguably Trump’s signature presidential accomplishment to the scrapyard. Although the TCJA cut taxes for the majority of households across all income groups, it was remarkably unpopular with the public. Hence, Biden’s promise to let it die, at least in name.

Taxes Never Stay The Same

The pols will say what they say. But the rest of us should take a deep breath and acknowledge that changing major sections of the tax code never is a binary exercise. Some provisions of the old law inevitably will survive while others are remade, sometimes substantially, much like that old Greek ship.

Indeed, the tax law is constantly evolving. In the many decades I have been following tax policy, there has been barely a year when the revenue laws did not change. And even transformative overhauls, such as the Tax Reform Act of 1986 (TRA86), had relatively short half-lives as Congress chipped away bits and pieces over time.

When did TRA 86 stop being TRA 86? Good question. But one best answered by Plutarch.

Instead of thinking about whether Biden replaces enough of the TCJA to justify renaming the vessel, we’d all be better off if lawmakers spend 2025 focusing on how to keep the seaworthy timbers and how best to replace the worm-eaten ones.