US Competitiveness Projected to Worsen Amid Changing Tax Landscape

Nearly five years ago, the Tax Cuts and Jobs Act (TCJA) brought dramatic changes to U.S. tax policy. The federal corporate tax rate fell from 35 percent to 21 percent and other reforms improved the tax treatment of business investment, lowered taxes for individuals and families, and introduced a new system for taxing foreign profits.

Unfortunately, many changes in the TCJA were temporary. As these policies phase out or expire, they increase the tax burden on investment and reduce the competitiveness of the U.S. tax code. Policymakers on Capitol Hill should prioritize permanent pro-growth policy in the coming years as the economy struggles with inflation and recovers from the pandemic.

The International Tax Competitiveness Index evaluates the tax systems of the 38 countries in the Organisation for Economic Co-Operation and Development. In the 2022 version of the Index, the U.S. placed 22nd, just behind Japan (at 21st) and a few places ahead of the United Kingdom (at 26th).

While it certainly matters how much a country raises in tax revenue, the Index answers a different question: how a country raises revenue.

To demonstrate, consider how a high-tax country like Sweden, which ranks 12th, compares to France (last place) and the U.S.

Both Sweden and France have very high tax burdens, raising 42.6 and 45.4 percent of GDP in 2020, respectively. By contrast, the U.S. raised 25.5 percent of GDP.

Despite Sweden’s high taxes, it has a relatively efficient corporate tax system, which boosts its ranking. France, on the other hand, has multiple distortionary property taxes with separate levies on estates, bank assets, and financial transactions, as well as a wealth tax on real estate—dropping it to last place. The U.S.’s relatively complex corporate tax code and high property tax burden put it in the middle of the two.

With key portions of the U.S. tax code changing as some TCJA provisions expire, the U.S. rank will slip further in the coming years. In 2022, business deductions for research and development were reduced and limits on interest deductions were tightened automatically.

In 2023, those policies will be paired with reduced deductions for investment as full expensing for equipment (bonus depreciation) begins to phase out. In addition, the Inflation Reduction Act’s new and complex minimum tax on financial income will take effect.

If the changes due to the Inflation Reduction Act and the reduced deductions for investment were reflected in the 2022 version of the Index, the U.S. would place 24th rather than 22nd.

Unless lawmakers act, 2022 will be the first of several years that the U.S. tax system automatically changes for the worse. In 2024 and 2025, the deductions for equipment will be limited even further until full expensing phases out completely in 2026. Taxes will also increase on foreign profits and certain profits connected to exports. Personal income taxes will also rise significantly in 2026 based on current law.

These changes will happen if lawmakers do nothing. They will increase the tax burden on business investment, companies’ profits from global success, and workers and families.

That is, unless Congress is willing to prioritize a better tax system founded upon the principles of transparency, simplicity, neutrality, and stability.

It is likely (some may say guaranteed) that instead of making tax policy for the long term, Congress will choose to simply extend current rules. But replacing temporary policies with more temporary policies would not actually improve things; it would simply prolong the ongoing uncertainty of federal tax policy.

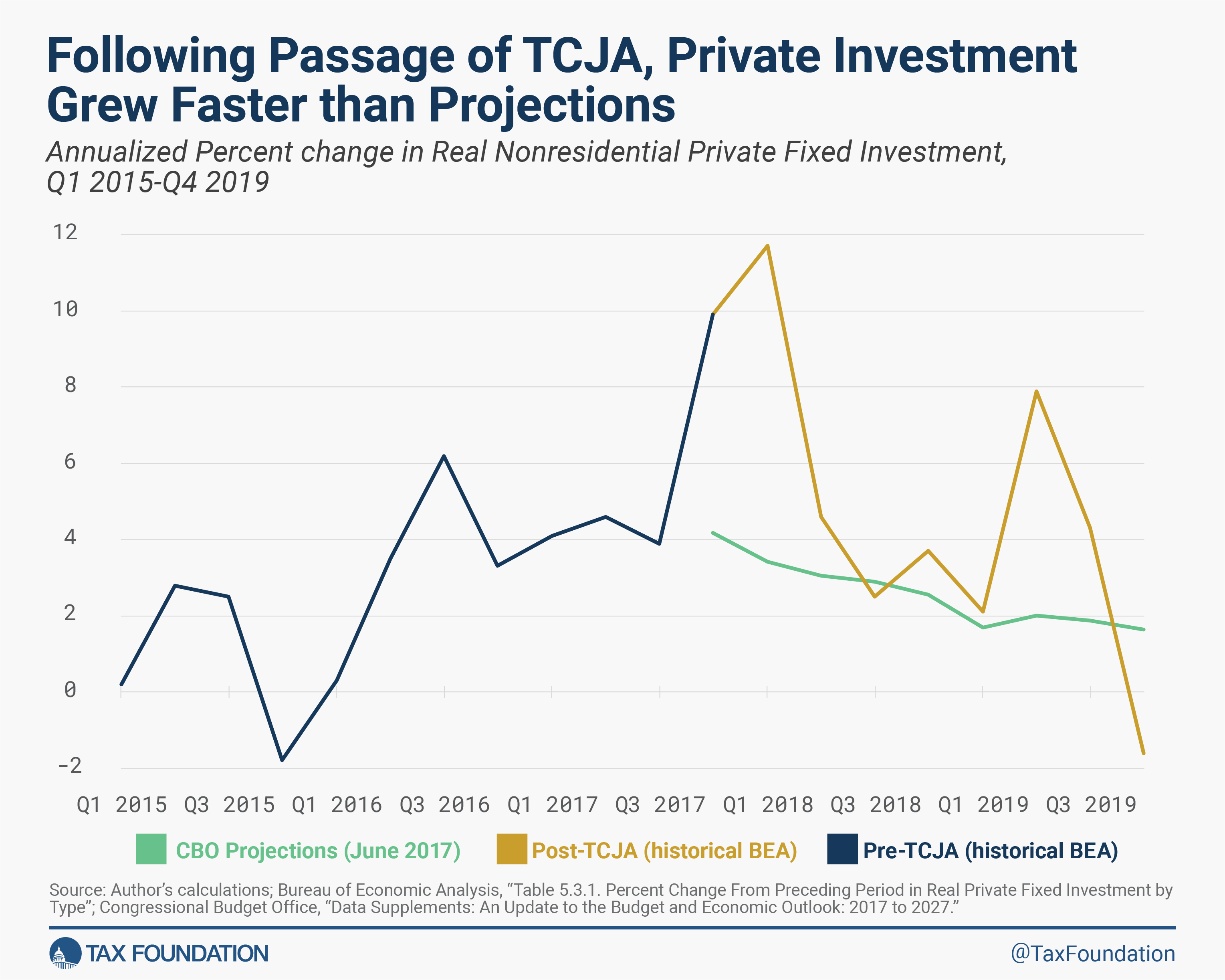

Making policies like full expensing permanent would provide a supportive environment for business investment. This is especially necessary at a time when the supply side of the economy needs to expand to meet demand and mitigate inflation.

In the current global economy, policymakers should do everything they can to support certainty and growth. It would be irresponsible to allow a relatively messy and uncompetitive tax code to become even worse.