The Home Mortgage Interest Deduction Reinforces Racial Disparities

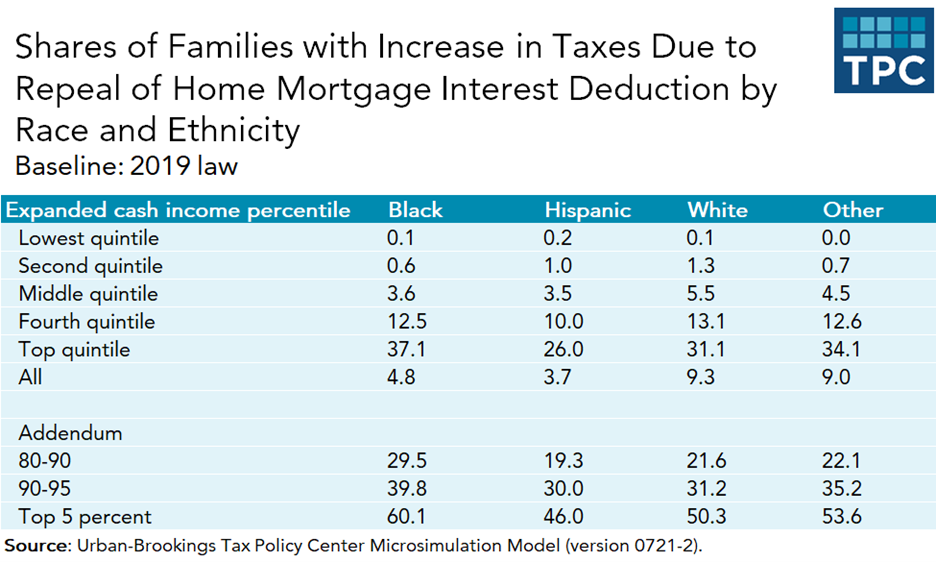

In a new report, we find that the US tax code’s home mortgage interest deduction (HMID) favors White families relative to Black and Hispanic or Latino families. That’s not surprising. A legacy of discrimination in the housing market and mortgage lending industry has contributed to lower homeownership rates among Black and Hispanic families than among White families.

Consequently, while about three-quarters of White families owned their homes in 2019, only 45 percent of Black and 48 percent of Hispanic families did. And through most of the income distribution, White families are also more likely to pay interest on mortgages, thereby benefiting from the deduction.

We estimate that after the passage of the 2017 Tax Cuts and Jobs Act (TCJA), the average tax benefit of the HMID was $199 across all White families (including those who did not claim it or file a tax return) in 2019. In contrast, the benefit was, on average, $88 for Black families and $66 for Hispanic families. Overall, Black and Hispanic families received just 54 percent and 38 percent, respectively, of the average benefit for all families. White families got 21 percent more than the average.

More surprising is the finding that at the top of the income distribution, Black families in the highest income quintile more frequently held a mortgage and received disproportionately larger benefits from the mortgage interest deduction than White and Hispanic families. Among families in the top 5 percent, Black families’ tax benefits from the HMID were 25 percent higher than the average for all families.

Our findings suggest that factors other than income can contribute to disparities between Black and White families. For example, structural racism has historically limited the opportunities for people of color to accumulate assets, which could be passed on to their descendants. Consequently, Black families are less likely than White families to receive bequests or assistance from relatives—perhaps leading to greater reliance on mortgage financing among those who qualify.

Importantly, the tax code—even without referring to race and ethnicity—reinforces the external forces rooted in structural racism. First, taking the standard deduction may be more advantageous than itemizing: In some cases, taxpayers find that their income tax liabilities are lower if they claim the standard deduction because it’s larger than the sum of their deductible expenses (including not only their mortgage interest but also state and local taxes, charitable contributions, and medical expenses).

Second, the value of deductions depends on people’s tax rate brackets, in addition to the amount of mortgage interest payments. Tax rates rise as people’s income pushes them into higher brackets. But that progressive structure has the inverse result of making the HMID more valuable for higher-income taxpayers because its tax value is the product of the amount of deductible expenses and the tax rate.

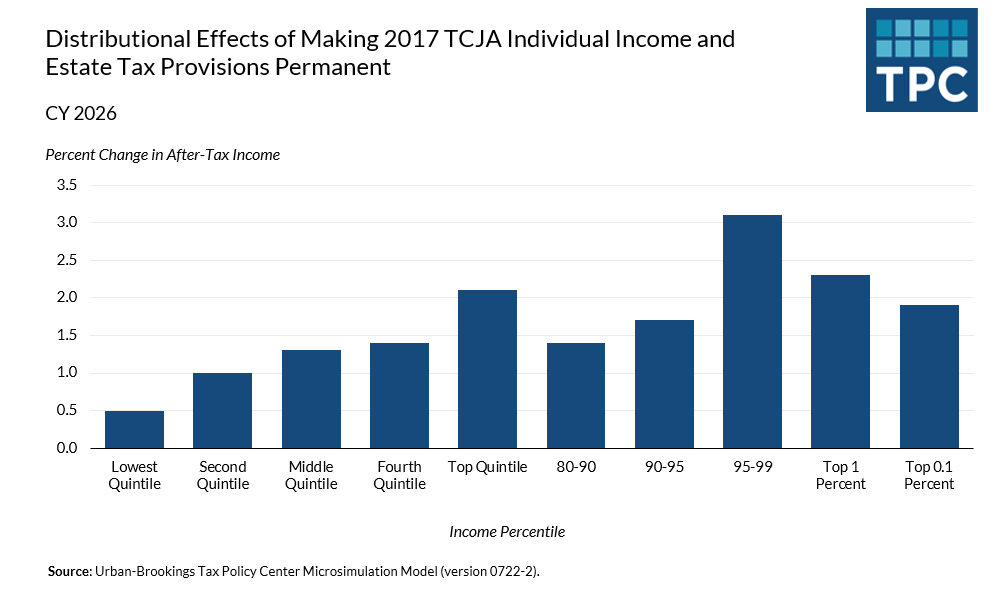

One way to see the impact of those factors is by examining what will happen with the expiration of the individual income tax provisions in TCJA. In 2026, under current law, the standard deduction will fall by nearly half relative to what it would be if TCJA was extended, while the $10,000 cap on the deduction of state and local taxes (SALT) will be lifted. Those changes make itemizing more appealing, as do accompanying increases in income tax rates.

We find that the expiration of TCJA will more than double the shares of each race and ethnicity group that would claim the HMID. That result is largely driven by the reduction in the amount of the standard deduction. Still, the relative disparities in the average amount of the tax benefit would not be substantially different after TCJA’s expiration and the return to 2017 law. But in the top income quintile, the gap between Black and White families would narrow, and Black families would no longer receive disproportionately large benefits once more families claim the deduction.

If policymakers want to reduce those racial disparities, the home mortgage interest deduction could be converted to a tax credit, thus making a subsidy for homeownership available to many more families across the income distribution. But if the credit rate was lower than the top income tax rate, high-income Black families would bear a disproportionate of the tax burden from the change in that income group.

Alternatively, a credit for downpayments would assist people wanting to buy a home but lacking sufficient assets to do so. As our TPC colleague Howard Gleckman has discussed, President Biden’s proposal to create a first-time homebuyer tax credit isn’t perfect, but it’s a start in the direction of helping people overcome that hurdle. And since people of color are far less likely to own a home, a well-designed credit could be a step forward in reducing racial and income disparities, while also increasing homeownership.

But why also keep the HMID? It violates equity considerations on two grounds, both income equity and—for most Black taxpayers—racial equity. Moreover, other research has shown that it doesn’t even encourage home purchases. With its high costs, repeal of the HMID would provide resources to fund better ways to achieve multiple goals—though at the sacrifice of one of the most popular tax provisions in the tax code.