Tax Cuts and Jobs Act Permanence: Details & Analysis

The 118th Congress returns to Washington this week with a major taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities.

elephant in the room—most of the 2017 tax reform law will expire after the end of next year. If lawmakers allow full expiration to occur, most Americans will see their personal tax bills rise and incentives for working and investing worsen. Extending the entire tax reform, however, would come with a $3.7 trillion price tag at a time when the country’s fiscal outlook is already bleak.

Lawmakers should use the year ahead to thoroughly review and debate lasting, fundamental tax reform and prioritize policies that best boost work and investment incentives in a fiscally responsible manner.

The 2017 tax law made wide-ranging reforms to the individual income taxAn individual income tax (or personal income tax) is levied on the wages, salaries, investments, or other forms of income an individual or household earns. The U.S. imposes a progressive income tax where rates increase with income. The Federal Income Tax was established in 1913 with the ratification of the 16th Amendment. Though barely 100 years old, individual income taxes are the largest source of tax revenue in the U.S.

code and cut taxes for the vast majority of American taxpayers. Broadly speaking, extending the 2017 tax law would entail 11 separate tax cuts:

- Altering tax rates and brackets

- Expanding the standard deductionThe standard deduction reduces a taxpayer’s taxable income by a set amount determined by the government. It was nearly doubled for all classes of filers by the 2017 Tax Cuts and Jobs Act as an incentive for taxpayers not to itemize deductions when filing their federal income taxes.

- Expanding the child tax creditA tax credit is a provision that reduces a taxpayer’s final tax bill, dollar-for-dollar. A tax credit differs from deductions and exemptions, which reduce taxable income, rather than the taxpayer’s tax bill directly.

- Retaining the new 20 percent deduction for noncorporate businesses

- Repealing the Pease limitation on itemized deductions

- Reducing the alternative minimum tax (AMT)

- Allowing full expensingFull expensing allows businesses to immediately deduct the full cost of certain investments in new or improved technology, equipment, or buildings. It alleviates a bias in the tax code and incentivizes companies to invest more, which, in the long run, raises worker productivity, boosts wages, and creates more jobs.

for business investment in equipment - Allowing full expensing for research and development (R&D) costs

- Retaining current rates for international tax provisions

- Retaining the EBITDA limitation for business interest expense

- Reducing the estate taxAn estate tax is imposed on the net value of an individual’s taxable estate, after any exclusions or credits, at the time of death. The tax is paid by the estate itself before assets are distributed to heirs.

by increasing the exemption thresholds

Altogether, we estimate the 11 tax cuts would reduce federal tax revenue by $6.7 trillion from 2024 through 2033, before factoring in the 2017 tax law’s base broadeners and tax offsets that partially pay for the tax cuts.

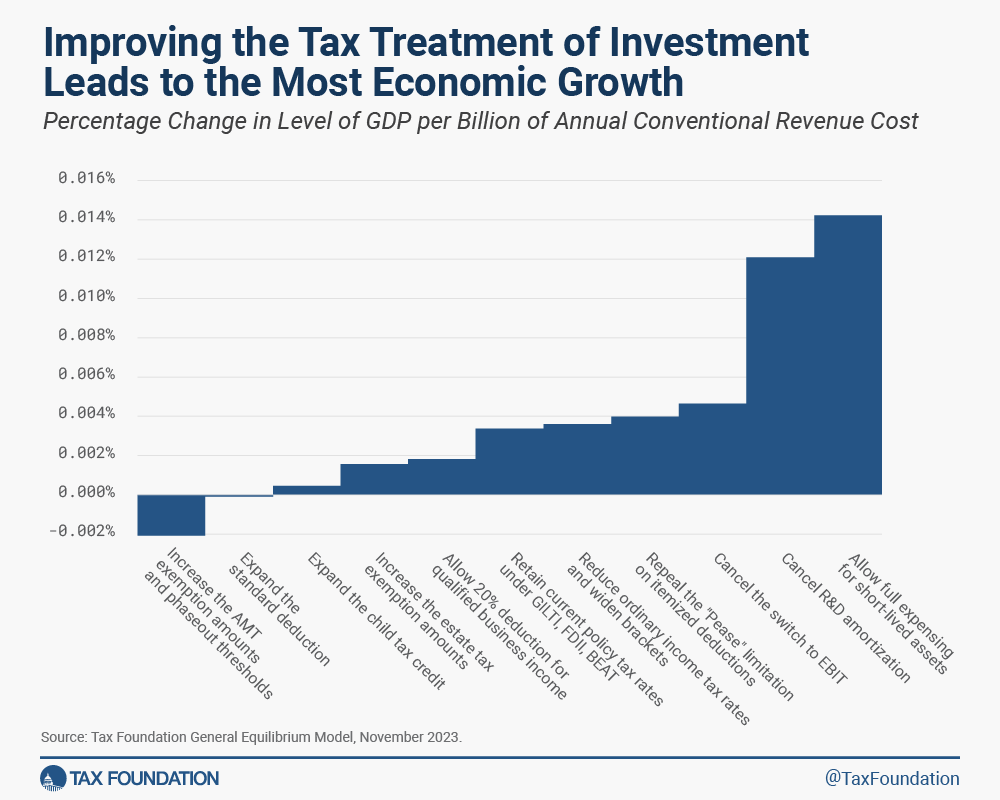

The 11 tax cuts vary widely in how they would affect people’s decisions to work and invest. Some tax cuts create a larger economic boost than others. One indicator is to compare the estimated change in long-run GDP to the estimated change in annual tax revenue in the final year of the budget window. Using the last year of revenue is a proxy for the ongoing, long-run cost of a policy change.

The most powerful provision under that metric is full expensing for business investment in equipment, followed by expensing for research and development costs. At the other end, some tax cuts counterintuitively reduce economic output because of their interactive effects with marginal tax rates. Other tax cuts have middling effects, improving incentives to work or invest but not as powerfully as full expensing.

Another indicator to compare provisions is the way the tax changes impact debt-to-GDP. A more pro-growth tax cut will increase debt-to-GDP to a smaller degree than a similarly sized but less efficient tax cut.

For instance, the debt-to-GDP effect of lowering the tax rates and widening the tax brackets falls by about 40 percent dynamically compared to conventionally. The difference of a less pro-growth tax change, such as expanding the standard deduction, is just 1.4 percent. On the other hand, the debt-to-GDP effect of full expensing reverses; the decrease in long-run revenue is very small compared to the increase in long-run economic output such that full expensing reduces the long-run debt-to-GDP ratio by 0.3 percentage points.

To be sure, no single metric can convey all the trade-offs of a given tax policy. For instance, Tax Foundation modeling does not consider how administrative and compliance costs or behaviors like tax planning would change under various policies. While our modeling illustrates how eliminating the AMT, for example, increases marginal tax rates, it does not capture the compliance cost savings generated by getting rid of the policy.

Policies can also differ in their distributional effects. Additionally, if tax cuts increase the deficit, the higher deficit would require the federal government to increase interest payments to foreigners, reducing American incomes compared to the change in American output. Given the trade-offs, lawmakers should embrace provisions that simplify the tax code, reduce compliance costs, and have a relatively strong bang for the buck.

Though lawmakers may not address the looming expirations this year, they should prepare for the upcoming expirations by weighing the trade-offs of each change the 2017 tax law made. The expirations provide lawmakers a chance to rewrite the tax code. That rewrite should prioritize the best provisions of the 2017 tax law, or better yet, build on them with internationally proven tax reforms. For example, Tax Foundation research has shown how the Estonian tax system could be a model for the United States and would enhance growth, raise additional revenue, and simplify the filing process for taxpayers. Ultimately, lawmakers should cement into law a tax code that promotes growth and opportunity without worsening U.S. debt.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Subscribe

Share