Las Vegas And The Washington, DC Region Are Making Suckers’ Bets On Publicly Funded Sports Stadiums

Huge tax and other subsidies for sports facilities are almost never good ideas. But two new, and especially egregious, examples of how public funds can be wasted on these projects are popping up—one in the Washington, DC area and the other in Las Vegas.

The Vegas Story

The Nevada legislature has agreed to provide $380 million in tax breaks and other subsidies to help John Fisher, the billionaire owner of the Oakland A’s baseball team, move his franchise to the Vegas Strip. The public would pay for nearly one-third of the cost of a planned $1.5 billion stadium.

And, according to some estimates, the deal might be worth as much as $500 million to Fisher. The legislation is unclear and it may be that all tax revenue generated by the stadium and a newly-created special district surrounding it would be kicked back to the project.

Here are just three reasons why it is a sucker’s bet for taxpayers.

Las Vegas is pretty much only about entertainment and sports. A well-documented consequence of economic development tax subsidies for these industries is that they tend to move consumption around rather than increase overall economic activity.

Think of it this way: Visiting Las Vegas, I can spend my money at a show, a casino, a restaurant, or a wide variety of sporting events. It seems improbable that I’ll be going to Vegas for the explicit purpose of watching a baseball game. And it is even less likely if it involves the A’s, who have the worst record in major league baseball.

But let’s say I do go to the ball game. That means I won’t be going to a show. So I’ll be doing little more than shifting my consumption from a casino to a ballyard. The net benefit to Vegas and the state: roughly zero.

Worse, think about the local sports bar owner who is struggling to make it without the benefit of millions of dollars in tax breaks. Unless his bar happens to be within a few blocks of the new ballpark, the owner is likely to lose business to his new, heavily subsidized competitor.

A major league baseball team may give the city some bragging rights, though the A’s current record of 20 wins and 60 losses isn’t much to talk about. Besides, the city already has a championship hockey team and a popular (if losing) NFL football team. Will a baseball stadium bring in enough new money to cover the cost of those fat tax subsidies? About as likely as beating the house at Bally’s.

More Bad Bets

Here’s the second reason why this is a bad bet. Nevada pols have been talking for years about the importance of diversifying the local economy beyond sports and entertainment. They are right. But this initiative won’t help. While these industries provide lots of jobs, they tend to pay relatively little.

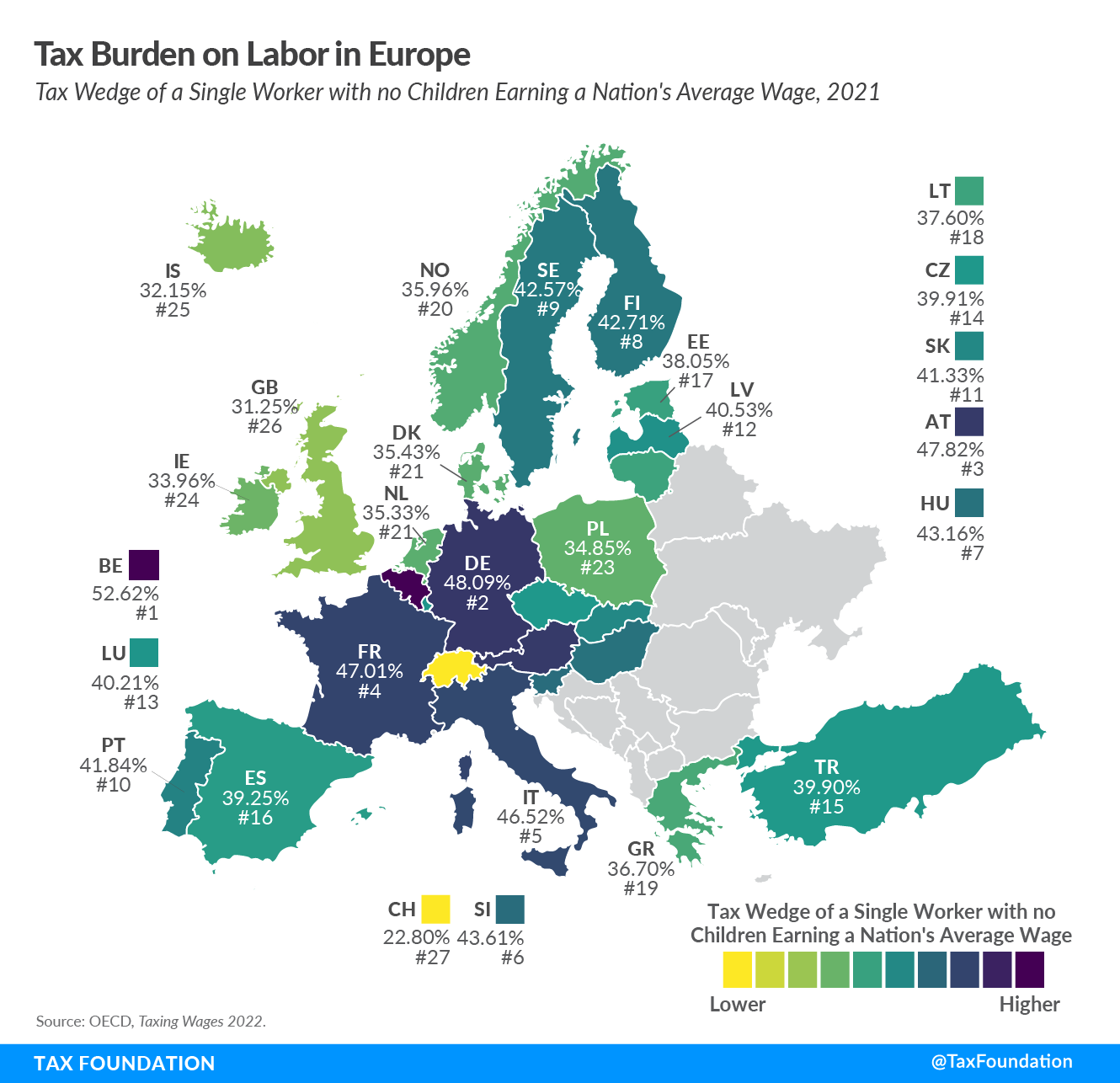

The median household income in Las Vegas was about $61,356 in 2021, roughly 15 percent below the $70,784 median income in the US. And most stadium employees will be low-wage maintenance, security, and food service workers.

The third reason: Nevada is a state with a booming population and no income tax. And it is struggling to fund growing demand for public schools. Is a baseball stadium a better investment of public funds?

Another Bidding War

Then there is the NFL Washington Commanders.

The woebegone franchise is playing in a dilapidated stadium built for it with public funds decades ago in the Maryland suburbs of Washington, DC.

The team’s soon-to-be former owner, Dan Snyder, lobbied Maryland, Virginia and the District of Columbia for a new stadium that also would be built with public money. But Snyder was so disliked by lawmakers of both parties that the talks went nowhere.

But now the team is about to be sold to a consortium led by billionaire Josh Harris. And local governments seem to be lining up for a bidding war to get the team. Hundreds of millions in tax subsidies to build a stadium where a football team will play for fewer than 10 days a year.

Other Owners Get In Line

It gets worse. Another billionaire, Ted Leonsis, who owns the NBA Wizards and the NHL Capitals, threw down some chips of his own. He now is threatening to move these teams to the Virginia suburbs unless he gets more subsidies from DC to upgrade his arena.

And Mark Lerner, the billionaire owner of the Washington Nationals baseball team, wants a seat at the table too. He’s asking for money from DC to upgrade the stadium where his team plays. A facility largely built with public funds.

Nationals Park was the rare case where a stadium may have encouraged some local economic development, though it is not entirely clear how displaced former residents of that neighborhood benefitted. But since that development already has happened, why should the city continue to subsidize improvements on behalf of a team worth somewhere in the neighborhood of $2 billion?

A rule of poker: If you sit down at the table and don’t see the sucker, get up. You are the sucker. It is a rule that local pols never seem to learn.