Could A Boost In The Standard Deduction Kill The Mortgage And Charitable Deductions?

House Republicans are moving a proposal to temporarily increase the standard deduction. There is a lot to be said for raising the deduction. But doing it on a temporary basis as an inflation-fighting tool (the rationale of its sponsors) makes no sense. Not fully paying for it with offsetting tax increases would be fiscally irresponsible.

However, increasing the standard deduction may have one unintended but beneficial consequence: By accelerating the recent trend of making itemized deductions useless for the vast majority of households, it may encourage more lawmakers to ask themselves, “Why even keep them?”

Shrinking Benefits For Many

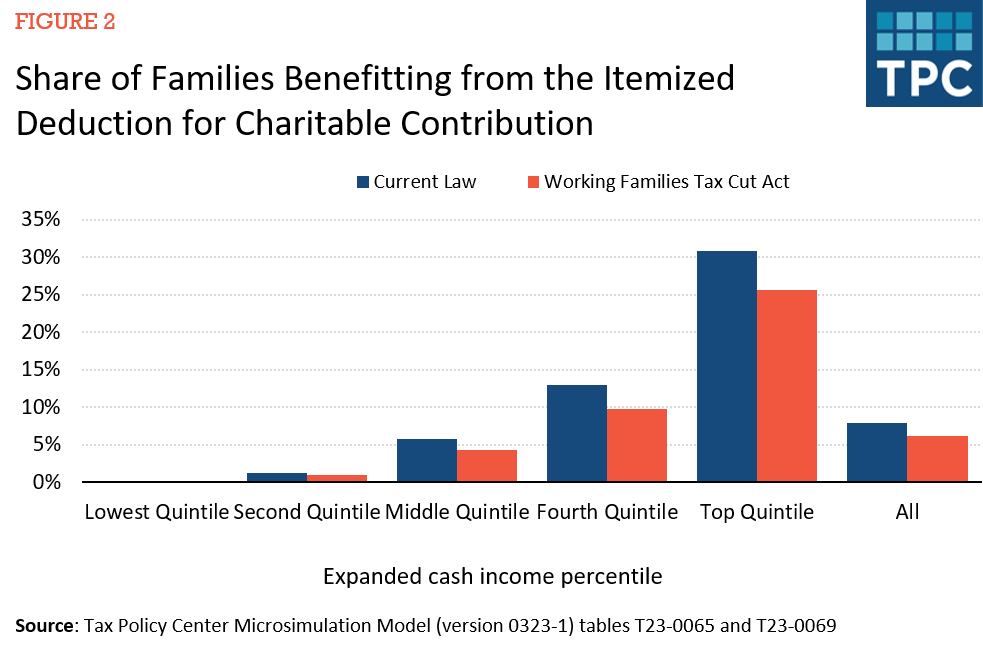

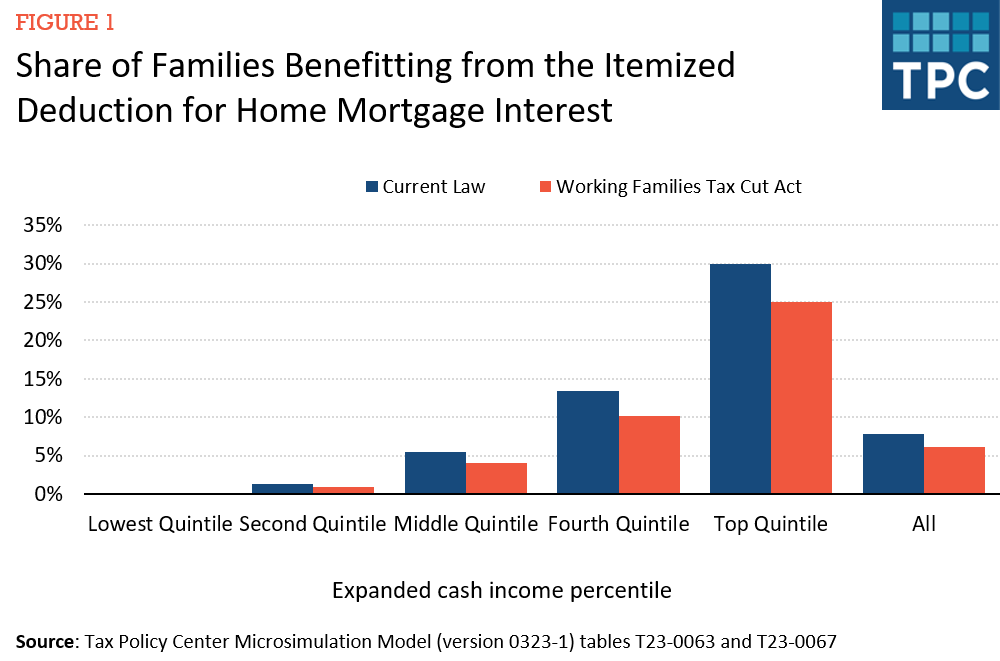

The bill would, for example, reduce to only about 6.1 percent the share of households who’d benefit from the mortgage interest deduction (MID) in 2024, down from 7.8 percent under current law, according to a new Tax Policy Center analysis. And the fraction of those who’d benefit from taking a deduction for making charitable gifts would be reduced from 7.9 percent to only about 6.2 percent, TPC found.

Even though the extra standard deduction would phase out at high incomes, the highest-income 5 percent of households (those making $400,000 or more) still would get half the tax benefit of the mortgage interest deduction and 85 percent of the benefit of the charitable deduction.

Here’s how the bill would work: It would increase the standard deduction, which it would rename the guaranteed deduction, by $2,000 for single filers and $4,000 for couples filing jointly. The standard deduction this year is $13,850 for singles and $27,700 for joint filers.

For now, the boost would apply only to tax years 2024 and 2025 and be indexed for inflation. It would gradually phase out at higher incomes and be unavailable to singles making more than $240,000 or couples making more than $480,000. It would reduce federal revenues by almost $100 billion over three years, according to the congressional Joint Tax Committee.

Little Help For Most

When Congress roughly doubled the standard deduction in the Tax Cuts and Jobs Act (TCJA), it shrunk the number of itemizers from about 25 percent in 2017 to about 10 percent in 2018 as low and moderate-income households switched to the more generous standard deduction. This proposal would continue that decline.

For example, with the higher standard deduction, TPC found that fewer than 1 percent of households making about $60,000 or less would benefit from the charitable deduction. Only about 4 percent of middle-income households would get a tax break for giving to charity. The average tax benefit across all middle-income households: $20.

Similarly, fewer than 1 percent of households in the lowest 40 percent of the income distribution would benefit from the MID. Only about 4 percent of middle-income households still would claim the tax break. The average benefit across all middle-income households: $40.

By contrast, those in the highest-income 1 percent (those making about $975,000 or more) would continue to benefit by an average of about $5,000 from the mortgage deduction and about $38,000 from the charitable deduction, averaged across all households in the income group.

The measure would have similar effects on all itemized deductions, including the state and local (SALT) deduction, further complicating efforts to repeal the TCJA’s $10,000 cap on those levies.

Unlikely To Slow Inflation

Raising the standard deduction would make filing simpler for many households. It also would help get the government out of the business of picking winners and losers. For example, why give a tax break to those who borrow lots of money to buy a house while providing little support to renters?

The bill is unlikely to slow inflation. In fact, putting more money into the pockets of consumers would boost demand for goods and services and very likely increase inflation.

A temporary bump also would skew taxpayer behavior in other unproductive ways. For example, middle-income donors might simply delay contributions until 2025 when the standard deduction is scheduled to return to pre-TCJA levels.

Postponing charitable gifts would let them benefit from the higher standard deduction for the first couple of years while still getting the full tax benefit once the deduction reverts to current law. But it would be terrible for cash-strapped charities.

A Chance For Reform

The bump in the standard deduction is, however, an opportunity to rethink many itemized deductions. Why even bother with complex tax breaks that under this bill would be of no value to roughly 95 percent of middle-income households and even fewer low-income households?

For example, if Congress wants to subsidize home ownership at all, it could turn the mortgage deduction into a credit for all homebuyers, not just those who take out big mortgages.

Similarly, it could make the charitable deduction available even to non-itemizers, as long as they donate more than a fixed percentage of their income, say 1 percent or 2 percent. That would encourage people to increase their giving.

There are lots of ways to improve both subsidies. And by limiting billions of dollars in tax breaks to a relative handful of mostly high-income households, the Tax Cuts for Working Families Act may just encourage Congress to seriously think about how.