Building Your Divestiture Playbook: 5 Capabilities in a Quick Litmus Test

5 Capabilities and Custom Design Requirements

by Mark Herndon, Chairman Emeritus, M&A Leadership Council, with contributions by Mark Juergens

A close friend, client and colleague – one who is deeply experienced in both M&A and divestitures – often coaches his team to remember “divestitures are not acquisitions spelled backwards.” We wholeheartedly agree, and if you are trying to run an upcoming divestiture out of your acquisition playbook, please heed this important lesson learned.

First Things First

Definitions matter. We often hear wishful thinking along the lines of: “if we only had a comprehensive divestiture project plan, we’d be OK.” To be certain, a comprehensive divestiture playbook will need a comprehensive project plan, but in our view, the first mistake many organizations make is viewing a playbook as simply a collection of tools, templates and samples. In our work with hundreds of best-in-class companies doing a variety of MA&D, we take the position that in order to be successful, leaders need to concentrate on building internal divestiture capability, not just a playbook. Use this quick litmus test to see what capability components may add the most value for your organization’s next divestiture.

How does your current divestiture capability stack up?

1. A Flexible Framework – MA&D capabilities start with developing a robust but flexible business process map for how your organization determines it will conduct a divestiture. This framework needs to be easily adaptable to deal type (e.g. stock or asset; public or private; deal motive/purpose, etc.); buyer type (e.g. financial or strategic); industry; and other factors. Rather than making this a mechanistic or rote process, think of it more like an à la carte menu of typical decisions, events, processes and actions that need to be completed, but may vary with regard to the “when or how” depending on the deal specifics. Avoid the tendency to apply the same overall deal phase descriptions commonly found in acquisition frameworks. For example, in one recent divestiture client playbook we developed, only 1 of 6 top-level phase descriptions was the same as in their acquisition framework. All others were divestiture specific vs. acquisition focused. Finally, once the enterprise “level one” framework is agreed, this sets the model to guide each functional group so they can map their respective tasks, deliverables and requirements to the overall process.

Litmus Test Question: Does your divestiture playbook look exactly like your acquisition playbook? If yes, consider redrafting your playbook for the divestiture process. The revisions will enhance execution by focusing the team on the right objectives at the right time.

2. Software Solution for Program Management and Tracking – While we are fans of using an industry-leading third-party solution for program management, tracking and results reporting, this is not mandatory, and roughly half of our clients still primarily track and report program data via Excel. But if you are contemplating adopting this capability, the time to do it is before the creation of your overall playbook content, as the solution you adopt will likely impact the design of certain software templates. From a seller perspective, the divestiture process is front-end loaded and driven by defining the divested business, including assets, liabilities, employees, customers and vendors to be divested. The seller needs to capture all this information in a data room, information memorandums, financial data packs and management presentations. Inconsistent information, unreconciled data or delayed responses will erode the Buyer’s trust in the Seller’s management team, and potentially delay or kill the deal. Maintaining the credibility of the Seller’s management team is the number-one objective in the sales process.

Litmus Test Question: Are your program management processes and software tools equipped to manage a complex data room creation? If not, consider upgrading your program management expertise and tools, which will ultimately bolster your management team’s credibility and standing with the buyer.

3. Organization Readiness – Rather than putting this off, no playbook can be complete without validating and, often times, updating or revising the governance model for use during the divestiture program. Similarly, key leaders and their specific roles should be designated well in advance. Resource planning and adequate budgeting are essential for success, and given the demands of divestiture planning and execution, most organizations will need to tap external advisors and potentially independent contractors in additional to internal work-stream leads and subject experts. One caution learned the hard-way: a recent client had a key information technology leadership role open at the same time it was implementing a major ERP change and divesting its first business in company history. This leadership and resource strain created a very challenging obstacle for the divestiture planning and execution resulting in additional risks and delays for both buyer and seller.

Litmus Test Question: Does your divestiture playbook contain a readiness checkpoint with key stakeholders before the formal launch of the divestiture program? If not, consider adding this critical step to your plan.

4. Playbook Content – Now that you are ready to build or populate your specific divestiture tools, templates, sample artifacts and knowledge content, we encourage you to consider some key principles. First, “less is best”. Find the sweet spot of just enough, but not too much. Far too many times, we have seen expensive playbooks with hundreds of tools and templates remain completely unused during the heat of battle. Limit the tool inventory to the critical few and foundational tools that will actually be used, and innovate from there. Separate your template library from actual deal archives. Include a project closeout step that evaluates potential tool library additions or internal best practices to add to the playbook, but keep the total count as manageable as possible. Second, “tell me how.” Given the periodic and specialized nature of divestitures for most organizations, we have found as much value in just-in-time educational modules as we have in tools or templates themselves. For best practice to be established and maintained in your organization, consider developing a quick self-instruction module for each major event, process or phase in your divestiture framework. Once recent client playbook included approximately 20 different free-standing PowerPoint modules that linked together the key objectives and requirements for each phase through the divestiture framework; with best practice principles and specific tools / templates to be used for each particular component or functional requirement.

Litmus Test Question: Does your divestiture playbook contain a well-thought-out divestiture kickoff meeting presentation that outlines the divestiture governance; typical deal timelines and stages; DMO operations; meeting cadence; and immediate first steps? If not, add a fast start kickoff plan to your playbook.

5. Education & Skill Building – One of the most important, yet continually overlooked success factors in building an overall divestiture capability is the advantage that formal training can provide for executives, program managers and functional work-stream leaders before commencing a live divestiture. Practical experience consistently demonstrates the positive impact of training through the ability to meet accelerated project timelines and deliver cost optimization targets. Effective divestiture training should include an overview of the end-to-end divestiture process and specific objectives and requirements to achieve in each phase. In addition, we’ve found it is important to provide a good balance of best practices, case studies and opportunities to practice skills such as developing a Transition Services Agreement (TSA) along with the clear expectations for governance, statusing and familiarity with specific tools and templates to be used. We generally suggest investing in 1 to 2 days of training in advance with the top 20 to 30 key work-stream leaders once they are formally read-in to the deal, if pre-announcement, or as soon as possible post-announcement, but prior to engaging with the counterpart’s respective divestiture planning team.

Litmus Test Question: Can your core divestiture team members identify the deal structure differences between an “asset sale” versus a “stock sale,” explain the implications related to the deal structure and describe TSA best practices? If not, pre-deal training will accelerate the preparation timeline as the core team will better understand the nuances of a divestiture and be well-equipped for upcoming buyer interactions.

How Customized Should Your Playbook Be?

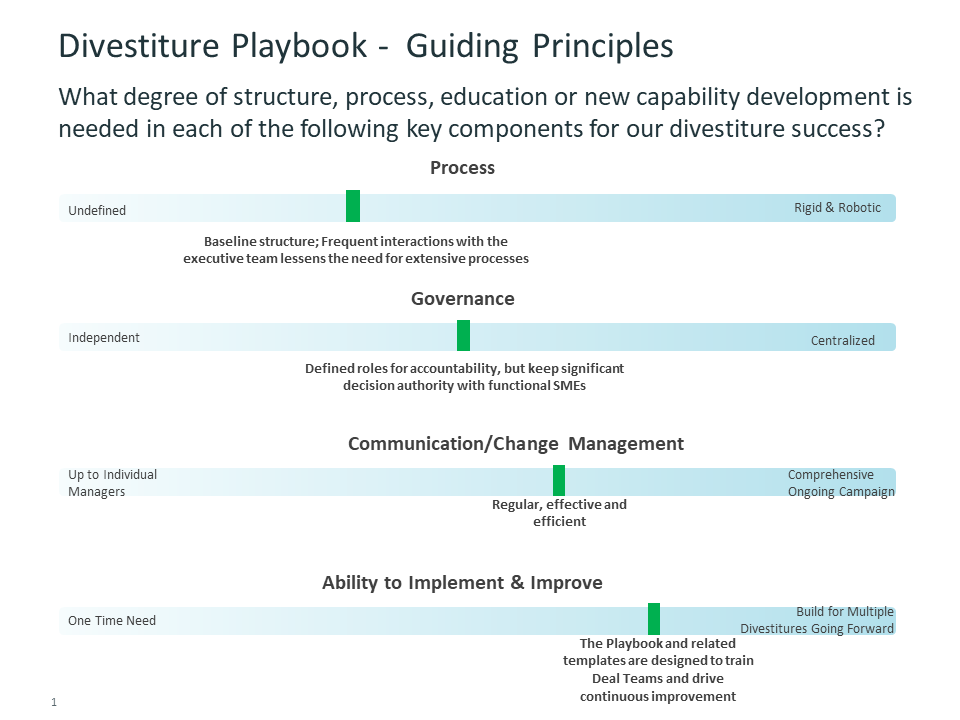

While there is clearly a baseline set of tools and processes that are fairly generic and widely applicable, we have seen far better results in organizations that have adapted, invented and innovated the framework, playbook and skill building to their company, culture, industry and anticipated deal type. Working through the separation management office, one recent client identified 4 different factors to customize and adapt when building their internal divestiture playbook. For each of these 4 factors – Process, Governance, Communications / Change Management, and Education / Skill Building – a “sliding-scale” continuum was created that ranged from least structured / least formal at the left end of the continuum; to most robust / most well developed at the right end of the continuum.

As Exhibit 1 indicates, examples, definitions and set-points were established along each continuum so the scale provided relevant and easy to understand “choice points” for what the organization intended to accomplish in its divestiture playbook given their entity size; deal and resource experience; and strategic mandate in terms of number and magnitude of pending divestitures over the next 2 to 3 years. Informal inputs were gathered from the executive committee, work-stream leads and the separation office and a choice point was selected by consensus along each design continuum. This guidance directed the degree of custom vs. generic build out, and the level of new capability development needed vs. existing core strength to leverage internally.

Exhibit 1: Gauging the Custom Design Requirements for Anticipated Future Divestitures

______________________________________________

Learn more about M&A Frameworks and Capabilities at our two upcoming in-person training events:

These sessions include face-to-face networking with presenters, peer interaction, small-group breakouts, team challenges, roundtable discussions and more. Join us!

The Art of M&A® for Due Diligence Leaders / In-Person / Boston, MA / Sep 2023 – September 12-14, 2023

The Art of M&A® for Integration Leaders / In-Person / San Diego, CA / Oct 2023 – October 11-13, 2023