Guide to Tax Form 1099 S

You may receive Form 1099 S this year if your sold a home, land, or other property. What does this form mean to your income tax return, and how can you e-file it? Don’t worry — we’ll walk you through everything you need to know about this form, why you got it, and how to easily e-file it.

At a glance:

- Form 1099-S reports real estate transactions, which you must report on your tax return.

- The person or entity responsible for closing the sale fills out and sends Form 1099-S.

- Selling property doesn’t automatically mean you owe taxes, as you may qualify for an exclusion.

What is Form 1099-S?

Form 1099-S, Proceeds from Real Estate Transactions, reports the sale or exchange of real estate property to the Internal Revenue Service (IRS). This could include any of the following:

- Your main home or another residential building

- Developed or undeveloped land (including air space)

- Condominium units (including any fixtures or land)

- Commercial or industrial buildings

- Shares in a cooperative housing corporation

- Non-contingent interest in standing timber

Who sends Form 1099-S?

Depending on the specific transaction circumstances, different parties may be responsible for sending Form 1099-S. IRS instructions state that the person who is responsible for closing the deal should fill out the form. Often, this falls on the title company, escrow company, or mortgage lender who helped you close the transaction.

However, just because you sold a piece of property doesn’t automatically mean you owe taxes. Whether you’re on the hook depends on factors like the type of property, any exclusions you qualify for, and your overall capital gains.

IRS Form 1099-S example

Form 1099-S looks like this:

On the left side of the form, you’ll find two types of contact information:

- The filer: This is the closing agent or entity that sent you the form. You will see the name, address and taxpayer identification number of the filer.

- The Transferor:As the seller, you’re also known as the “transferor”. You’ll see your own contact info, account number, and TIN (often your Social Security number or SSN).

Here’s what the boxes on the right mean:

- Box 1: Date of closing – The date when the real estate transaction was finalized.

- Box 2: Gross proceeds – The total amount you received from the property sale.

- Box 3: Address or legal description – The property sold or transferred.

- Box 4: Non-cash consideration – If this box is checked, it means you received or will receive services or property other than cash or notes.

- Box 5: Foreign person – This box is checked if you (the seller) are a nonresident alien, foreign partnership, foreign estate, or foreign trust.

- Box 6: Buyer’s part of real estate tax – This box shows the remaining real estate tax to be paid by the buyer for the tax year. If you paid all of your real estate tax for the remainder of the year, but sold your primary home at the end October, this box will show the remaining real estate tax that the buyer is responsible for. The buyer would then be responsible for the final two months of tax payments, indicated in this box.

Instructions for Form 1099-S

Once you have your Form 1099-S, follow these steps to ensure you report it correctly:

- Determine if the transaction is reportable: First, find out if your real estate sale qualifies for any exclusions, like the home sale exclusion. TaxAct(r), by asking you questions about the transaction, can help you determine if it is a reportable one. TaxAct can simplify this process by filling out the necessary tax forms for you step by step.

- Check for state-specific requirements: Some states have their own tax forms you need to file, so check with your state’s tax agency. TaxAct can also pull data from your federal tax return to streamline the efiling of your state tax return. If you meet the requirements for the home sales exclusion, then your mortgage lender or escrow firm may not be required to issue Form 1099-S. If you’re unsure whether the sale of your home is reportable, check out our FAQ page. Check out our FAQ page if you’re unsure whether the sale of your home is reportable.

- Who is exempt from 1099-S?The IRS has a detailed list of exceptions for Form 1099-S. If the transaction falls under one of these exceptions, then it doesn’t need to be reported. You can view the complete list of exceptions on the IRS website. TaxAct will guide you through the process to help you report the details of the sale (see the next section). TaxAct will walk you through the process to help you report the details of the sale (see the next section).

How to file Form 1099-S with TaxAct

You can report your real estate proceeds in TaxAct using various methods depending on the type of property you sold.

Sale of your main home:

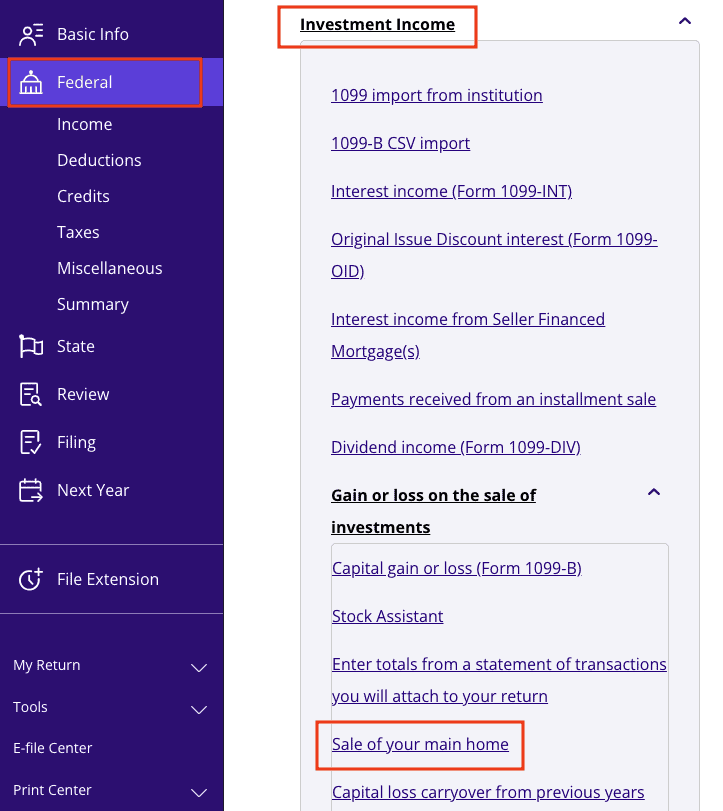

From within your TaxAct return (

Online

or Desktop), click

Federal

(on smaller devices, click in the top left corner of your screen, then click

Federal

).

- Click the Investment Income dropdown, click the Gain or loss on the sale of investments dropdown, then click Sale of your main home.

- 3. Continue with the interview process to enter your information.Sale of a timeshare, vacation home, or investment property:A timeshare or vacation home is considered a personal capital asset and should be reported on Schedule D for Capital Gains or Losses. You must report the income if you make a profit. In this case, you should enter a cost equal to the sale price so that the reported gain/loss is zero (0). In this case, you should enter a cost equal to the sale price so that the reported gain/loss is zero (0).To report the sale of your vacation home, timeshare, or investment property in TaxAct:

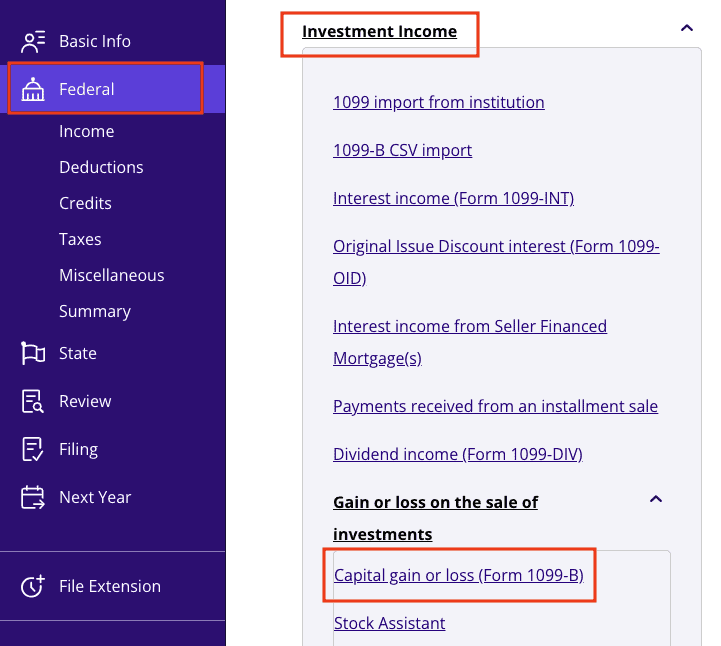

From within your TaxAct return (

Online

or Desktop), click Federal (on smaller devices, click in the top left corner of your screen, then click Federal

).Click the

Investment Income

- dropdown, click the Gain or loss on the sale of investments dropdown, then click Capital gain or loss (Form 1099-B).3.Click + Add

- Form 1099-B to create a new copy of the form or click Edit to edit a form already created (desktop program: click Review instead of Edit).

4. Continue with the interview process to enter your information.Sale of business property (reportable on Form 4797 and Schedule D):From within your TaxAct return (Online or Desktop), click Federal (on smaller devices, click in the top left corner of your screen, then click Federal).

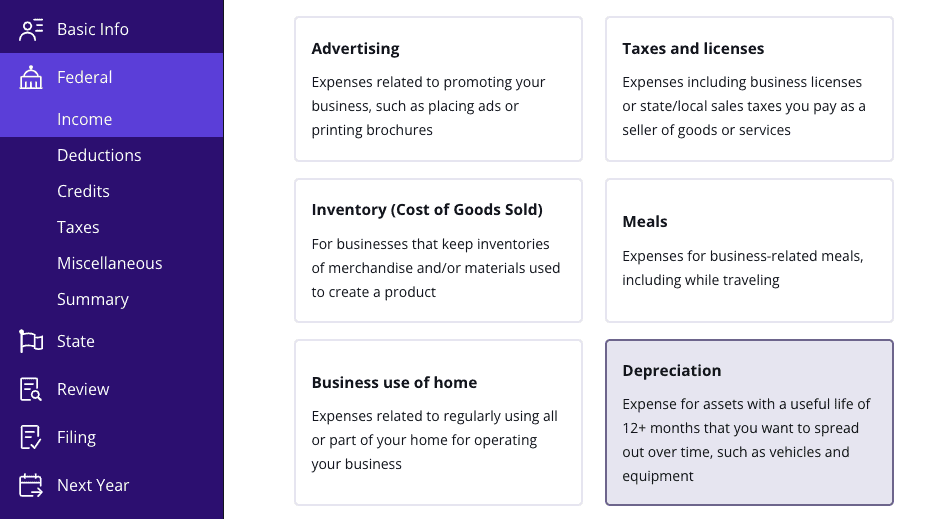

Click the

Business Income

- dropdown, then click Business income or loss from a sole proprietorship (or Farming income or loss, if applicable).3. Continue the interview process until the screen titled “Here is a list of some of the most common expenses

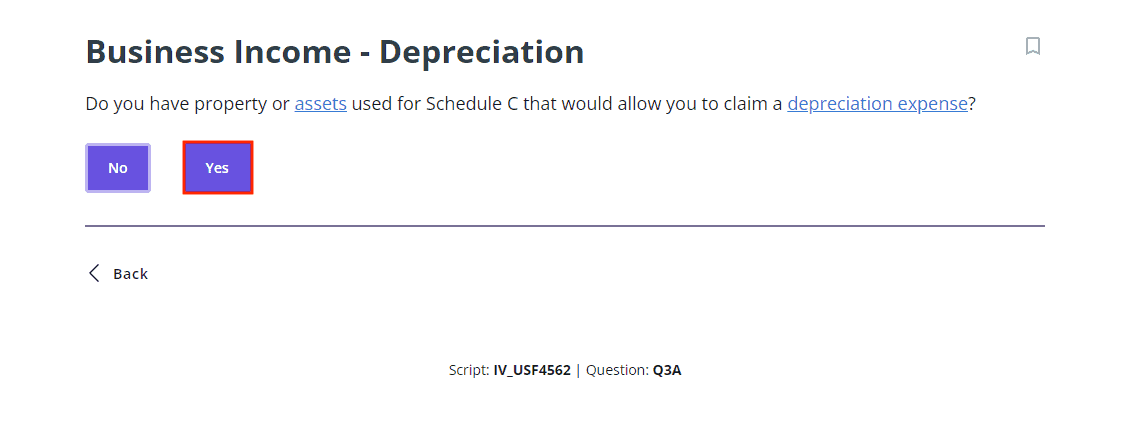

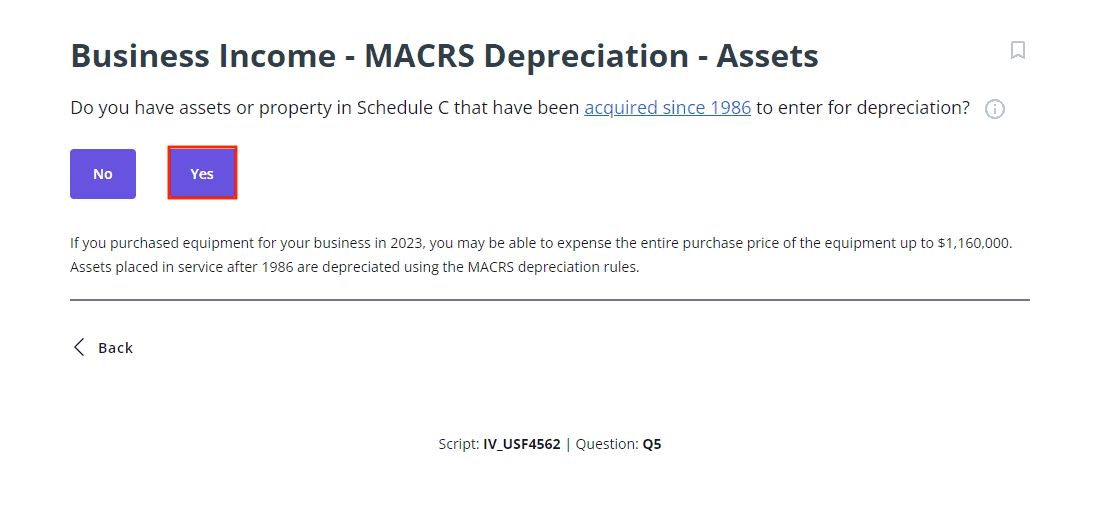

- “. Choose Depreciation from the list below.4. On the page titled Business Income – Depreciation, click Yes to the question shown below.

5. On the screen titled Business (or Farm)

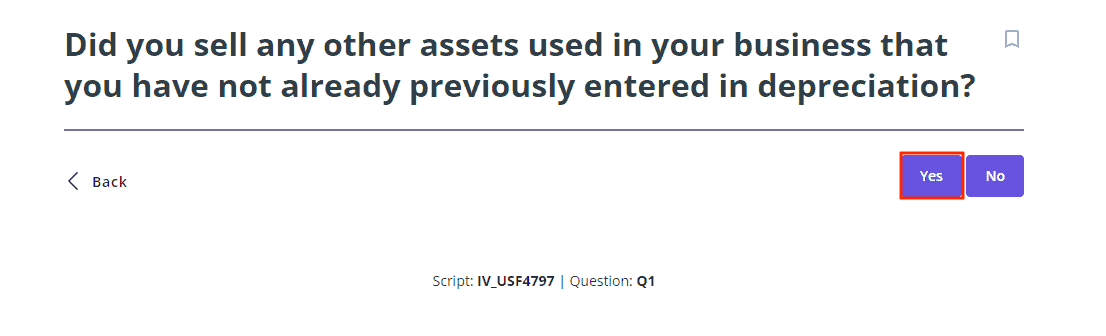

Income – MACRS Depreciation – Assets, click Yes as shown below.6. Click

Step-by-Step Guidance and continue with the interview process to enter your information.Sale of business property (if the property never depreciated):Follow the steps for reporting the sale of business property in the previous section. You’ll see the screen below after entering depreciation or expenses. Click Yes.2. Continue with the interview process to enter information for the asset that you sold.Sale of rental property (reportable on Form 4797 and Schedule D):From within your TaxAct return (

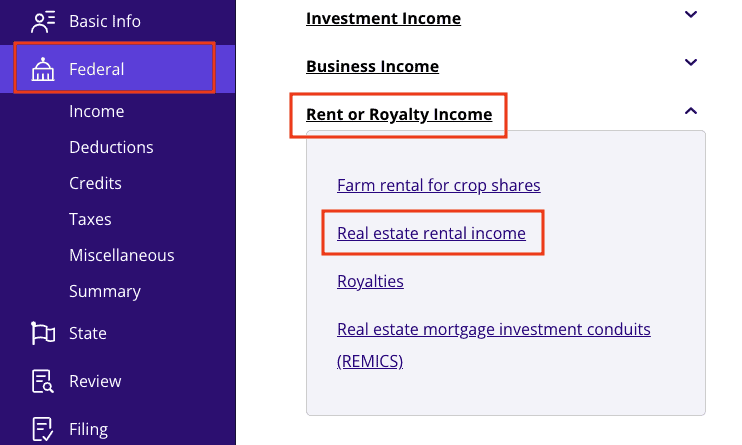

Online or Desktop), click Federal

(on smaller devices, click in the top left corner of your screen, then click

- Federal).Click the

Rent or Royalty Income

dropdown, then click

- Real estate rental income.3.Click + Add Schedule E, Pg 1 to create a new copy of the form or click Edit to edit a form already created (desktop program: click

- Review instead of Edit).4. Continue with the interview process until you reach the screen titled

Rental Income – Depreciation as shown below, then click Yes.5. On the screen titled Rental Income – MACRS Depreciation – Assets as shown below, click Yes.

6. Click Step-by-Step Guidance, and continue with the interview process to enter your information.The bottom lineForm 1099-S doesn’t have to be intimidating. If you’re a first-time DIY tax filer or a seasoned pro, knowing what the form means and how to properly report it can save a lot of stress and headaches when tax season rolls around. TaxAct has the tools to help you with your 1099 forms.