World Competition Law and Economics Review, Volume 47, Issue 2, 2024

We are happy to inform you that the latest issue of the journal is now available and includes the following contributions:

Michael G. Aguinaldo, Reflections and Musings from My First Year as Chairperson of a Young Competition Authority

When the Philippines passed into law its competition act in 2015, it was one of the last countries to enact such law in the region. Its competition authority was formed a year later. Eight years since, and the Philippine Competition Commission’s (PCCs) implementation of the law remains an uphill climb. As a new set of leadership took the helm of the Commission, its chairperson outlines reflections, musings, and lessons learned in heading a young agency one year in.

Konstantinos Pantelidis, The DMA Procedure: Areas to Improve

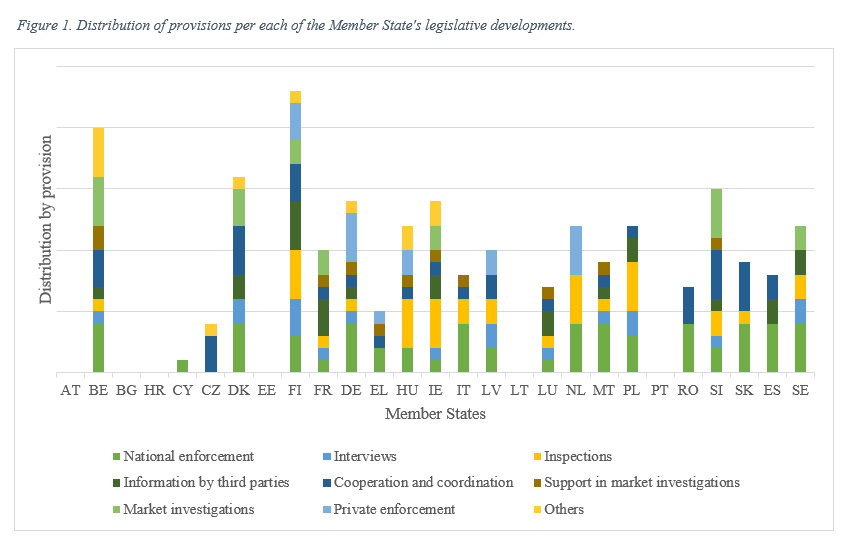

The introduction of the Digital Markets Act (the ‘DMA’) marked the beginning of a new regulatory framework for limiting the impact of strong platforms in digital markets. With the aim of ensuring fairness and contestability in digital markets, the new Regulation provided for a detailed administrative process, in the form of market investigations, for determining which of the digital platforms act as gatekeepers in their respective markets, whether the designated gatekeepers comply with their obligations, and to what extent new obligations must be introduced to account for new developments.

This article discusses some preliminary issues related to the European Commission’s administrative procedure for enforcing the new regulation. Upon summarizing the key elements of the DMA procedure, it focuses on four issues: the relationship between the DMA and competition law and problems regarding their parallel application; the obligation for recording interviews conducted for the purposes of gathering information regarding the subject matter of a market investigation; access to file limitations; and the absence of provisions regarding private enforcement and the possibility for third parties to claim damages.

Gergely Csurgai-Horváth, Regulating Algorithmic Bias as a Key Element of Digital Market Regulation

This paper addresses the rules applicable to algorithmic bias taking the form of self-favouring by hybrid digital platforms in the EU. In this paper, it is argued that the recently introduced prohibition of self-favouring by digital platforms should not apply across the board in the same manner. It may be necessary to consider the nature of the underlying products or services, the business models, and the monetization strategies of digital platforms. Differences in these aspects may alter their ability and incentives to engage in self-favouring potentially leading to foreclosing rivals and harming consumers. This suggests that the approach put forward by section 19a of the German Competition Act (GWB) may be better from an error-cost perspective than that of the Digital Markets Act (DMA). Section 19a of the GWB grants more discretion to enforcers and allows for a broader justification of the impugned conduct. In the context of the DMA, some sort of balancing exercise seems to be possible only if the European Commission makes extensive use of the possibility to further specify the prohibition of self-favouring contained in Article 6(5) of the DMA in light of the principles of effectiveness and proportionality. Finally, the paper touches upon the potential disproportionate burden, legal fragmentation, and legal uncertainty across the EU resulting from the interplay between EU competition law, the DMA, and national laws tackling similar self-favouring practices.

Alan Mccarthy, Sub-threshold Transactions under EU Merger Control – an Analysis of the Relevant EU Guidance and a Comparison With Certain Other ‘Call-in’ Systems

The EU Merger Regulation (EUMR) provides the European Commission with exclusive jurisdiction to assess mergers, acquisitions and full-function joint ventures with an EU dimension on the basis of turnover-based thresholds. The EUMR also contains corrective mechanisms allowing the Commission, under certain circumstances, to review smaller transactions. Until recently, these corrective measures have not been frequently applied but the picture is changing. The Commission believes that market developments (particularly in digital and pharma markets) are resulting in more acquisitions of companies that play or may play a significant competitive role in the EU despite generating little or no turnover. Similar considerations may apply to companies with valuable assets, intellectual property rights, data or infrastructure. This article analyses the development in the Commission’s guidance instruments which look to give merging parties a sense of the circumstances in which smaller deals may be referred by Member States to the Commission for EUMR assessment (mindful though that these developments may yet be checked by the EU’s highest court in the light of Advocate General Emiliou’s recent opinion on the subject – matter). Legislation has also been evolving at the Member State level (e.g., recently in Ireland) to allow national competition authorities to review sub-threshold deals. This article also provides a comparison of the EU system with certain other non-EU ‘call-in’ systems and which reflects that merging parties have an increasingly complex merger control picture to navigate in 2024 and beyond before they can safely implement deals (such as in digital and pharma sectors).

Giuseppe Colangelo, ‘(Not So) Elementary, My Dear Watson’: A Competition Law & Economics Analysis of Sherlocking

Sherlocking refers to an online platform’s use of non-public third-party business data to improve its own business decisions, for instance by mimicking successful products and services of edge providers. Such a strategy emerges as a form of self-preferencing and, together with other hypotheses on preferential access to data, it has been targeted by some policy makers and competition authorities because of the competitive risks originating from the dual role played by hybrid platforms. The paper investigates the competitive implications of sherlocking, maintaining that an outright ban is unjustified. Firstly, the paper shows that, by aiming to ensure platform neutrality, such a prohibition would cover two scenarios (i.e., the use of non-public third-party business data to calibrate business decisions in general, rather than to adopt a pure copycat strategy) that should be analysed separately. Indeed, in these scenarios sherlocking may affect different forms of competition (inter-platform v. intra-platform competition). Secondly, the paper argues that, in both cases, the anticompetitive effects of the practice are questionable and that the ban is fundamentally driven by the bias towards hybrid and vertical integrated players.

Vinícius Klein & Gabriela Pepeleascov Gomes, Common Ownership in Brazil After Steel Sector Privatization

Privatization processes present a multifaceted challenge, especially in countries with fragile market institutions. This article delves into the complex dynamics of privatization, emphasizing the importance of balancing different interests with a particular focus on the role of competition law. While asset maximization has traditionally dominated privatization discussions, this study advocates for a broader perspective that uses privatization to enhance market institutions. As a base study and drawing on the Brazilian experience of the steel sector privatization, the article unravels the consequences of partial privatizations and the risk of common ownership and interconnected influence through the state. Ultimately, the article contributes to a comprehensive understanding of privatization’s role in competitive markets and economic progress.