What are the Benefits of a Chapter 13 bankruptcy?

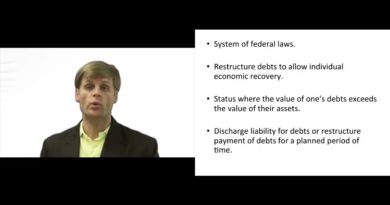

If you are thinking about filing for bankruptcy, you may be deciding between whether a Chapter 7 or a Chapter 13 would be better for you. While a Chapter 7 bankruptcy is known to give you a quick refresh button by wiping out all of your unsecured debt in 3-4 months, there are advantages to a Chapter 13 bankruptcy too. A Chapter 13 bankruptcy also provides benefits that a Chapter 7 cannot.

A Chapter 13 bankruptcy allows for the cure of mortgage arrears. If you are behind on your mortgage payments, then the total amount that you are behind on can be paid through a Chapter 13 plan. A Chapter 13 bankruptcy can be thought of as a government sponsored debt consolidation program, but with benefits. The monthly payments are affordable, you are not paying interest, and you are not paying back all of your creditors. You are only paying back a fraction of your total unsecured debt, and the rest is wiped out, tax free, forever. While mortgage arrears can be paid through a Chapter 13 bankruptcy, it is important to remember that future mortgage payments after a Chapter 13 case is filed, must be made on time.

Another benefit of a Chapter 13 bankruptcy is the ability to keep assets or property that you would otherwise have to pay cash value to keep. Depending on your situation and the type of law that is applied in your case, some of your assets may not be completely protected or exempt, in a Chapter 7 bankruptcy. For instance, additional vehicles, such as an ATV, will not be protected in a Chapter 7 bankruptcy if Minnesota state law, as opposed to federal law, is the governing law to be applied in your case. Minnesota state law does not protect additional vehicles and “toys,” such as trailers, boats, ATV’s, guns, and additional vehicles. To keep these additional assets, you would likely have to pay the trustee cash value. However, in a Chapter 13 bankruptcy, you would be able to keep additional vehicles and “toys,” without having to pay any cash to your bankruptcy trustee.

Moreover, another practical benefit of a Chapter 13 is the ability to pay a car that you are financing through the Chapter 13 plan. Instead of having to make your car payment and Chapter 13 payment separately each month, you have the option of making one payment that includes your monthly car payments. For instance, if your monthly car payments are $300, your Chapter 13 plan payment could be slightly more than $300, and you would be able to pay your Chapter 13 plan payment that takes care of your debt, as well as your car payments each month, with one single payment. If your car loan is set to be paid off before your Chapter 13 bankruptcy is complete, putting your car payment into the Chapter 13 plan can still be beneficial, because the loan amount does not increase, but is rather stretched out over the 3-5 year period. This eases up any financial burdens and can help make your monthly budget more affordable.

CALL NOW FOR A FREE STRATEGY SESSION FROM A MN BANKRUPTCY LAWYER AT LIFEBACK LAW FIRM

To learn more about the benefits of a Chapter 13 bankruptcy and whether it is a better solution for your financial situation, you should consult with an experienced bankruptcy attorney. See us at LifeBackLaw.com!