Vaping Taxes by State, 2024

The vaping industry has grown rapidly in recent decades, becoming a well-established product category and a viable alternative to cigarettes for those trying to quit smoking.

A wide variety of vaping products and electronic nicotine delivery systems (ENDS) exist. Open systems vaping products allow users to refill their vaping devices with vaping liquids, giving users more customization options and control over flavor. Closed system vaping products use pre-filled disposable cartridges or pods of vaping liquid and are not refillable. Closed system products are simpler to use and have become the more popular option, but many of these products that are sold in the US haven’t been authorized for sale by the Food and Drug Administration (FDA).

US states levy a variety of taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities.

structures on vaping products. Higher taxes on vaping and ENDS products discourage smokers from switching to the less unhealthy vapor products.

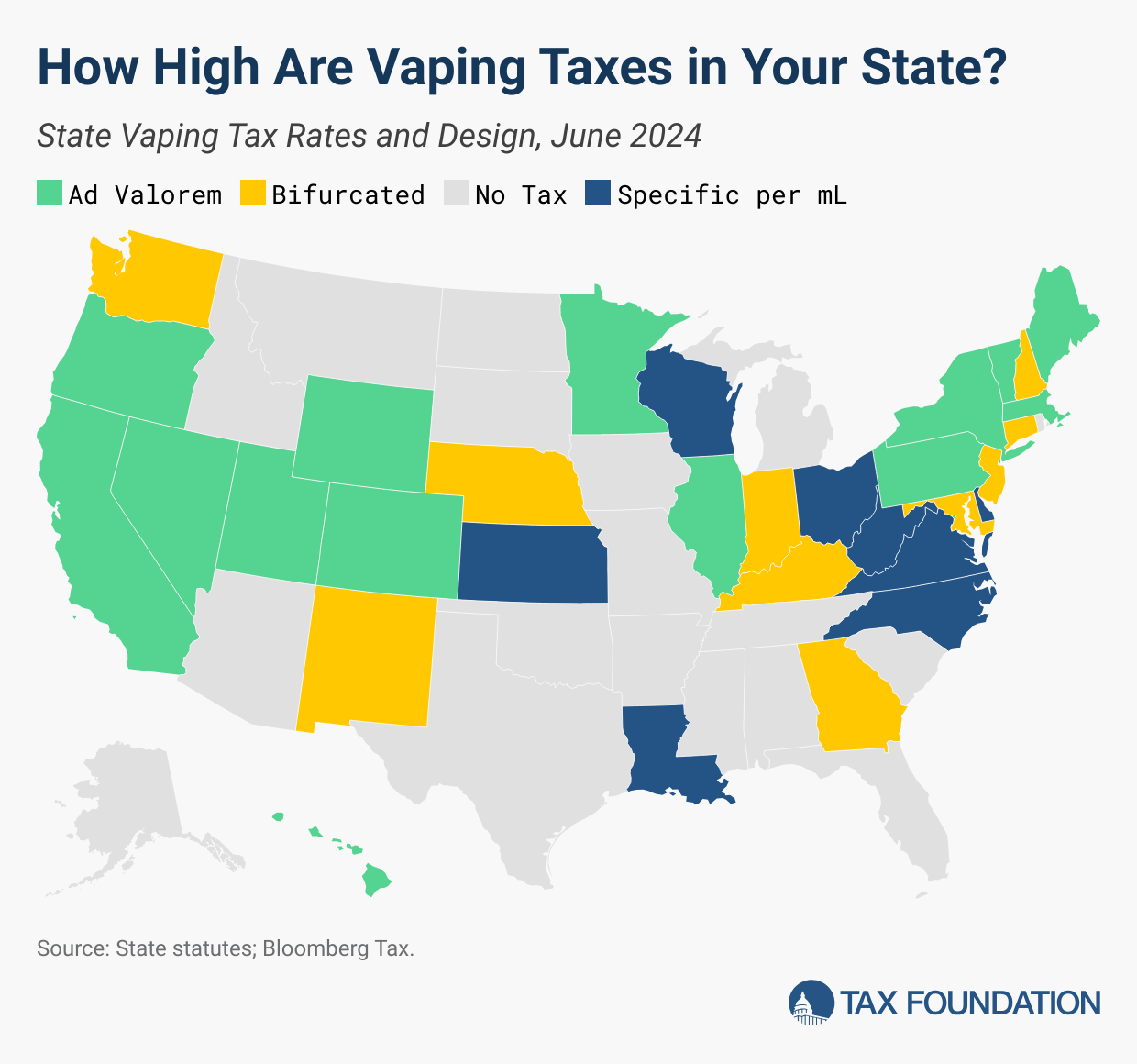

As of June 2024, 32 states and the District of Columbia levy an excise taxAn excise tax is a tax imposed on a specific good or activity. Excise taxes are commonly levied on cigarettes, alcoholic beverages, soda, gasoline, insurance premiums, amusement activities, and betting, and typically make up a relatively small and volatile portion of state and local and, to a lesser extent, federal tax collections.

on vaping products. Some states tax based on manufacturer, wholesale, or retail price (ad valorem), while other states tax based on product volume or number of cartridges (ad quantum). And some apply a bifurcated system with different rates for open and closed systems.

Minnesota imposes the heaviest wholesale tax of 95 percent, followed closely by Vermont at 92 percent. Of states that apply a tax to vaping, the states with the lowest burden at the wholesale level are Georgia at seven percent for open systems and New Hampshire at eight percent. Retail-level taxes can be as high as 60 percent in Maryland for closed systems or as low as 10 percent in Nebraska for containers greater than 3 mL.

The following map shows vapor taxes as of June 1, 2024.

Delaware, Georgia, Kansas, Nebraska, North Carolina, and Wisconsin all share the lowest per milliliter tax rate at $0.05 per mL on all or some vapor products. Per milliliter taxes are highest in Connecticut at $0.40 per mL for closed systems, followed by New Hampshire at $0.30 for closed systems and Louisiana at $0.15 per milliliter on all systems. Kentucky and New Mexico levy a tax per cartridge of $1.50 and $0.50, respectively.

Vapor and ENDS products facilitate the delivery of nicotine, the addictive component of cigarettes and tobacco products, without the combustion and inhalation of tar inherent to traditional cigarettes. While more research into the harm-reduction potential of vapor products is needed, especially for the long-term health effects of vaping, the present consensus is that vapor products are significantly less harmful than traditional combustible tobacco products. The English Ministry for Health, through Public Health England, has concluded that vaping is 95 percent less harmful than cigarettes.

The disparity in harmful health effects emphasizes the importance of understanding and incorporating harm reduction into the design of excise taxes on vapor products. Vaping, while itself unhealthy to some degree, is a highly attractive, much less harmful alternative to smoking. One of the primary obstacles to those trying to quit smoking is the addictive properties of nicotine. Harm reduction refers to the concept that it is more practical to reduce the harm associated with using certain products rather than attempting to eliminate that harm completely through counterproductive policies like ineffective bans or punitive levels of taxation.

Protecting access to harm-reducing vapor products is crucial for excise tax policy because nicotine-containing products are economic substitutes. Lower tax rates on vaping encourage consumers to switch from more harmful combustibles. High excise taxes on less harmful alternatives risk harming public health by pressuring vapers back to smoking. A relatively recent publication found that 32,400 smokers in Minnesota were deterred from quitting cigarettes after the implementation of a 95 percent excise tax on vapor products within the state.

If the goal of taxing cigarettes is to encourage cessation, vapor taxation must be considered a part of that policy design. For more discussion on the ideal design for vapor taxes and other alternative nicotine products, see our recent report.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Subscribe

Share