US Competitiveness Projected to Worsen

Nearly six years ago, the Tax Cuts and Jobs Act (TCJA)The Tax Cuts and Jobs Act in 2017 overhauled the federal tax code by reforming individual and business taxes. It was pro-growth reform, significantly lowering marginal tax rates and cost of capital. We estimated it reduced federal revenue by .47 trillion over 10 years before accounting for economic growth.

brought dramatic changes to U.S. taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities.

policy. The federal corporate tax rate fell from 35 percent to 21 percent, and other reforms improved the tax treatment of business investment, lowered taxes for individuals and families, and introduced a new system for taxing foreign profits.

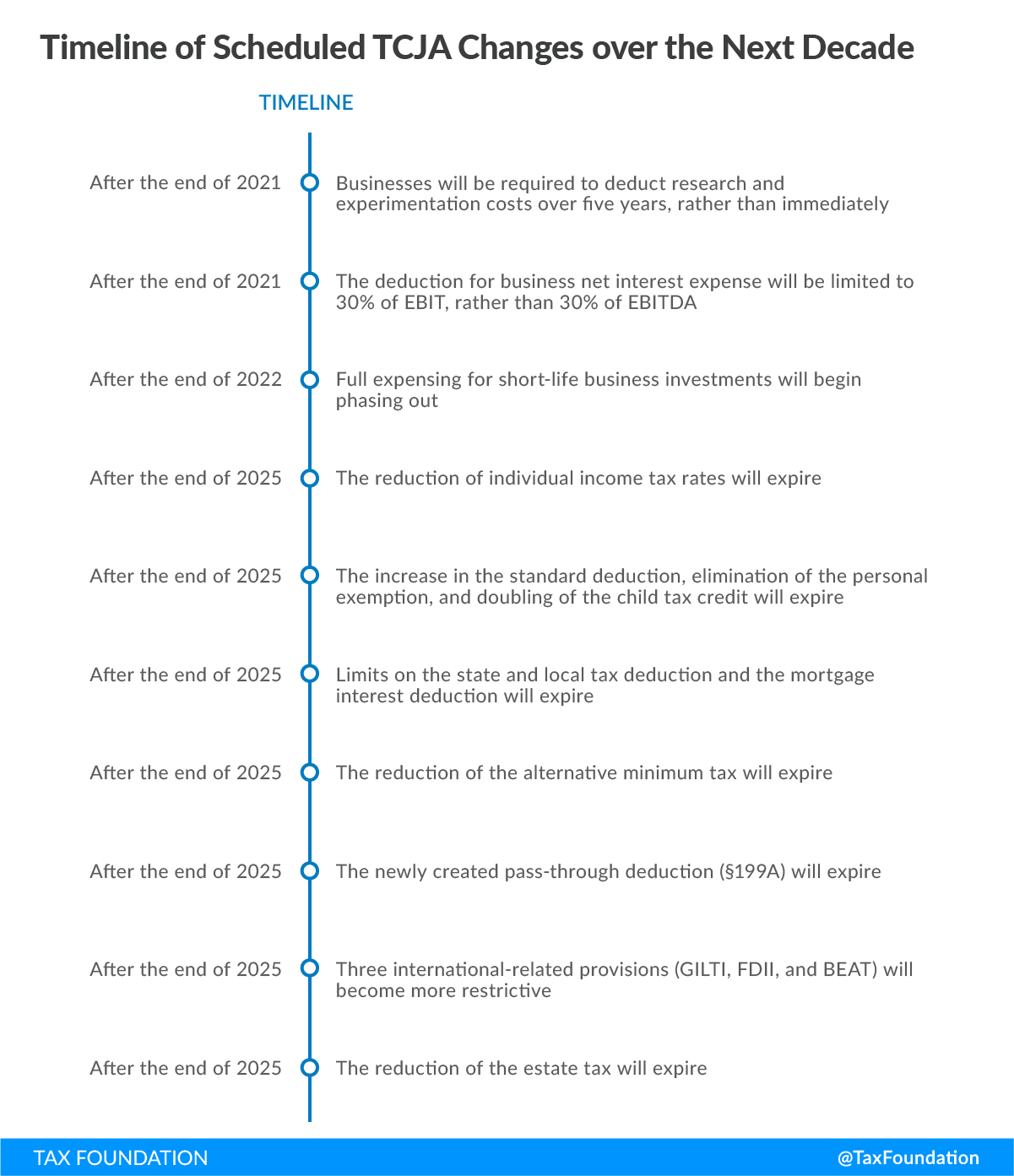

Unfortunately, many changes in the TCJA were temporary. As these policies phase out or expire, they increase the tax burden on investment and reduce the competitiveness of the U.S. tax code. Policymakers on Capitol Hill should prioritize permanent pro-growth policy in the coming years as the economy struggles with inflationInflation is when the general price of goods and services increases across the economy, reducing the purchasing power of a currency and the value of certain assets. The same paycheck covers less goods, services, and bills. It is sometimes referred to as a “hidden tax,” as it leaves taxpayers less well-off due to higher costs and “bracket creep,” while increasing the government’s spending power.

and the recovery from the pandemic.

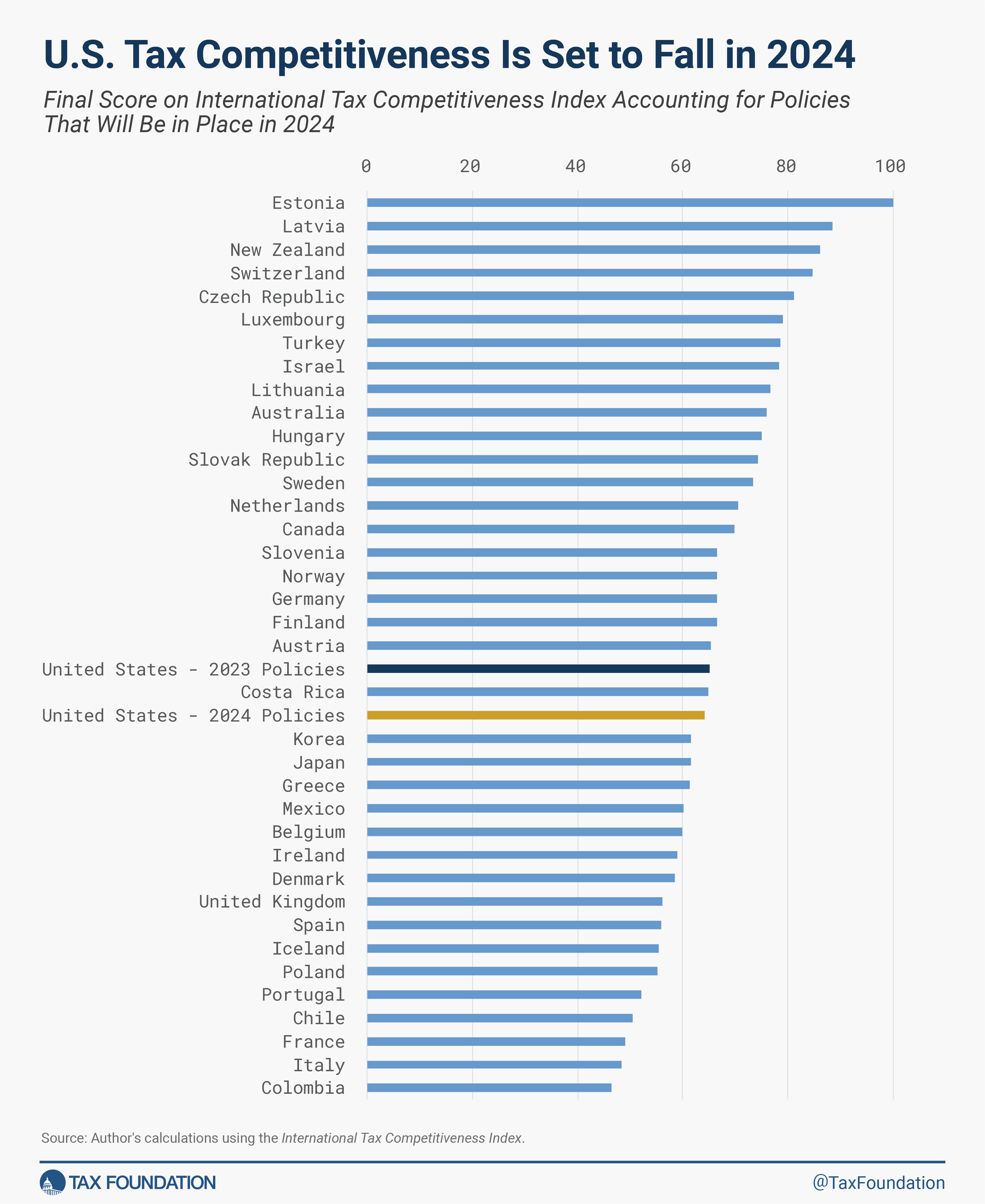

The International Tax Competitiveness Index evaluates the tax systems of the 38 countries in the Organisation for Economic Co-Operation and Development based on their structures.

In the 2023 version of the Index, the United States places 21st behind countries like Canada (15th) and Germany (18th) and a few places ahead of Japan (24th).

While it certainly matters how much a country raises in tax revenue, the Index answers a different question. It measures how a country raises revenue.

To demonstrate this, it is worth comparing how a high-tax country like Sweden ranks against France, which takes third-from-last place in the Index.

Sweden and France both have very high tax burdens; the former raised 42.6 percent of GDP in revenue in 2021, while the latter raised 45.1 percent. However, their ranks are drastically different.

Sweden places 13th on the Index due to its relatively efficient corporate tax and property taxA property tax is primarily levied on immovable property like land and buildings, as well as on tangible personal property that is movable, like vehicles and equipment. Property taxes are the single largest source of state and local revenue in the U.S. and help fund schools, roads, police, and other services.

systems. France, on the other hand, ranks 36th due to multiple distortionary property taxes—with separate levies on estates, bank assets, and financial transactions—and a wealth taxA wealth tax is imposed on an individual’s net wealth, or the market value of their total owned assets minus liabilities. A wealth tax can be narrowly or widely defined, and depending on the definition of wealth, the base for a wealth tax can vary.

on real estate.

For comparison, the U.S. raised 26.6 percent of GDP in total tax revenue in 2021 and places 21st thanks to a relatively complex corporate tax code, a high property tax burden, and complex rules for businesses’ cross-border operations.

With key portions of the tax code changing due to the temporary nature of some of the TCJA provisions, the U.S. rank will slip further in the coming years.

In 2022, business deductions for research and development were reduced and limits on interest deductions were tightened automatically.

In 2023, those changing policies have been paired with reduced deductions for investment as full expensingFull expensing allows businesses to immediately deduct the full cost of certain investments in new or improved technology, equipment, or buildings. It alleviates a bias in the tax code and incentivizes companies to invest more, which, in the long run, raises worker productivity, boosts wages, and creates more jobs.

for equipment (bonus depreciationBonus depreciation allows firms to deduct a larger portion of certain “short-lived” investments in new or improved technology, equipment, or buildings, in the first year. Allowing businesses to write off more investments partially alleviates a bias in the tax code and incentivizes companies to invest more, which, in the long run, raises worker productivity, boosts wages, and creates more jobs.

) begins to phase out. In addition, the Inflation Reduction Act’s new and complex minimum tax on financial income has taken effect.

In 2024 and 2025, the deductions for equipment will be limited even further until full expensing phases out completely in 2026. Taxes will also increase on foreign profits and certain profits connected to exports. Personal income taxes will also rise significantly in 2026 based on current law.

These changes will increase the tax burdens on business investment, the profits companies earn from their global success, and workers and families. And they will occur automatically.

That is, unless Congress is willing to prioritize a better tax system founded upon the principles of transparency, simplicity, neutrality, and stability. Perhaps even one modeled after the first-place country in the Index: Estonia.

It is likely (some may say guaranteed) that instead of making tax policy for the long term, Congress will choose to simply extend current rules. But replacing temporary policies with more temporary policies would not actually improve things and instead would contribute to the ongoing uncertainty of federal tax policy.

Making policies like full expensing permanent would provide a supportive environment for business investment. This is especially true at a time when the supply side of the economy needs to expand to meet demand and mitigate inflationary pressures.

In the current global economy, policymakers should be doing everything they can to support certainty and growth. It would be irresponsible to allow a relatively messy and uncompetitive tax code to become even worse.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Subscribe

Share