Two More Weeks To Avoid A Government Shutdown

Congress has a lot to do and not a lot of time to do it. Sen. Lindsay Graham (R-SC) told CNN’s State of the Union yesterday that he expects the Senate to pass an aid package for Israel and Ukraine. The House passed a $14.3 billion bill for aid only to Israel, offset with cuts to the IRS. Senate Majority Leader Chuck Schumer (D-NY) already ruled out that approach. Meanwhile, Speaker Mike Johnson (R-LA) has proposed a continuing resolution to fund the government through Jan. 15. He also said House Republicans are considering extending government funding for different time periods to avoid a single deadline, but that proposal faces some headwinds.

Sen. Daines wants to double the penalty for leaking tax information. Senate Finance Committee member Steve Daines (R-MT) introduced the Increasing Rightful Sentences Act last week. The “IRS Act” would increase penalties for future unauthorized disclosures of confidential taxpayer information, following the guilty plea of former IRS contractor Charles Littlejohn, who leaked thousands of individuals’ private IRS tax records to news outlets. It calls for fines of no less than $5,000 and imprisonment of 10 years.

Johnstown, Ohio will ask its voters to more than double their income tax. City voters will decide whether to increase the city’s income tax from 1 percent to 2.25 percent—the first increase in over 40 years. It would raise an estimated $1.5 million annually to help pay for public safety, economic development, and capital improvements. Total city revenue from the tax would eventually climb to $4.2 million annually.

Canada’s digital services tax could do more than raise revenue. TPC’s Renu Zaretsky reviews the status of Canada’s planned digital services tax (DST). Set to go into effect on Jan. 1 but applying retroactively through 2022, the DST will largely affect American multinational corporations like Google, Facebook, and Amazon. “Americans might not notice the DST as we scroll through apps or click ’buy‘ online, but we would notice the trade war it might prompt.”

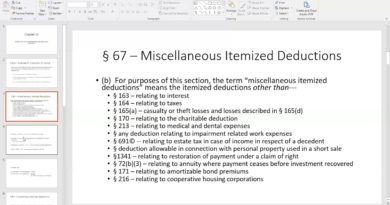

This week on Capitol Hill. The House Ways & Means Committee will hold a hearing tomorrow on tax-advantaged retirement plans affected by investment decisions spurred by non-financial factors, such corporate environmental, social and governance (or ESG) efforts. The Senate Budget Committee will hold a hearing on Wednesday on tax fairness and fiscal responsibility as it relates to enforcement against wealthy tax cheats. The Senate Finance Committee will hold a hearing on Thursday on how the tax code affects high earners’ tax planning strategies.

For the latest tax news, subscribe to the Tax Policy Center’s Daily Deduction. Sign up here to have it delivered to your inbox weekdays at 8:00 am (Mondays only when Congress is in recess). We welcome tips on new research or other news. Email Renu Zaretsky at [email protected].

![[Podcast]: In a World Without Non-Competes [Podcast]: In a World Without Non-Competes](https://www.lawandtheworkplace.com/wp-content/uploads/sites/29/2017/08/channel-logo-300x300.jpg)