Twitter vs. Musk: The Complaint

IN THE COURT OF CHANCERY OF THE STATE OF DELAWARE

TWITTER, INC.,

Plaintiff, v.

ELON R. MUSK, X HOLDINGS I, INC., and X HOLDINGS II, INC.,

Defendants.

Verified Complaint

Plaintiff Twitter, Inc. (“Twitter”), by and through its undersigned counsel, as and for its complaint against defendants Elon R. Musk, X Holdings I, Inc. (“Parent”), and X Holdings II, Inc. (“Acquisition Sub”), alleges as follows:

Nature of the Action

1. In April 2022, Elon Musk entered into a binding merger agreement with Twitter, promising to use his best efforts to get the deal done. Now, less than three months later, Musk refuses to honor his obligations to Twitter and its stockholders because the deal he signed no longer serves his personal interests. Having mounted a public spectacle to put Twitter in play, and having proposed and then signed a seller-friendly merger agreement, Musk apparently believes that he—unlike every other party subject to Delaware contract law—is free to change his mind, trash the company, disrupt its operations, destroy stockholder value, and walk away. This repudiation follows a long list of material contractual breaches by Musk that have cast a pall over Twitter and its business. Twitter brings this action to enjoin Musk from further breaches, to compel Musk to fulfill his legal obligations, and to compel consummation of the merger upon satisfaction of the few outstanding conditions.

2. Musk, the Chief Executive Officer of Tesla, Inc. and leader of SpaceX and other entities, opened a Twitter account in 2009. His presence on the Twitter platform is ubiquitous. With over 100 million followers, Musk’s account is one of the most followed on Twitter, and he has Tweeted more than 18,000 times. He has also suggested he would consider starting his own company to compete with Twitter.

3. On April 25, 2022, Musk, acting through and with his solely-owned entities, Parent and Acquisition Sub, agreed to buy Twitter for $54.20 per share in cash, for a total of about $44 billion.

4. That price, presented by Musk on a take-it-or-leave-it basis in an unsolicited public offer, represented a 38% premium over Twitter’s unaffected share price. The other terms Musk offered and agreed to were, as he touted, “seller friendly.” There is no financing contingency and no diligence condition. The deal is backed by airtight debt and equity commitments. Musk has personally committed $33.5 billion.

5. After the merger agreement was signed, the market fell. As the Wall Street Journal reported recently, the value of Musk’s stake in Tesla, the anchor of his personal wealth, has declined by more than $100 billion from its November 2021 peak.

6. So Musk wants out. Rather than bear the cost of the market downturn, as the merger agreement requires, Musk wants to shift it to Twitter’s stockholders. This is in keeping with the tactics Musk has deployed against Twitter and its stockholders since earlier this year, when he started amassing an undisclosed stake in the company and continued to grow his position without required notification. It tracks the disdain he has shown for the company that one would have expected Musk, as its would-be steward, to protect. Since signing the merger agreement, Musk has repeatedly disparaged Twitter and the deal, creating business risk for Twitter and downward pressure on its share price.

7. Musk’s exit strategy is a model of hypocrisy. One of the chief reasons Musk cited on March 31, 2022 for wanting to buy Twitter was to rid it of the “[c]rypto spam” he viewed as a “major blight on the user experience.” Musk said he needed to take the company private because, according to him, purging spam would otherwise be commercially impractical. In his press release announcing the deal on April 25, 2022, Musk raised a clarion call to “defeat[] the spam bots.” But when the market declined and the fixed-price deal became less attractive, Musk shifted his narrative, suddenly demanding “verification” that spam was not a serious problem on Twitter’s platform, and claiming a burning need to conduct “diligence” he had expressly forsworn.

8. Musk’s strategy is also a model of bad faith. While pretending to exercise the narrow right he has under the merger agreement to information for “consummation of the transaction,” Musk has been working furiously—albeit fruitlessly—to try to show that the company he promised to buy and not disparage has made material misrepresentations about its business to regulators and investors. He has also asserted, falsely, that consummation of the merger depends on the results of his fishing expedition and his ability to secure debt financing.

9. On July 8, 2022, a little over a month after first using bad-faith pursuit of spam-related evidence to assert a baseless claim of breach, Musk gave Twitter notice purporting to terminate the merger agreement. The notice alleges three grounds for termination: (i) purported breach of information-sharing and cooperation covenants; (ii) supposed “materially inaccurate representations” in the merger agreement that allegedly are “reasonably likely to result in” a Company Material Adverse Effect; and (iii) purported failure to comply with the ordinary course covenant by terminating certain employees, slowing hiring, and failing to retain key personnel.

10. These claims are pretexts and lack any merit. Twitter has abided by its covenants, and no Company Material Adverse Effect has occurred or is reasonably likely to occur. Musk, by contrast, has been acting against this deal since the market started turning, and has breached the merger agreement repeatedly in the process. He has purported to put the deal on “hold” pending satisfaction of imaginary conditions, breached his financing efforts obligations in the process, violated his obligations to treat requests for consent reasonably and to provide information about financing status, violated his non-disparagement obligation, misused confidential information, and otherwise failed to employ required efforts to consummate the acquisition.

11. Twitter is entitled to specific performance of defendants’ obligations under the merger agreement and to secure for Twitter stockholders the benefit of Musk’s bargain. Musk and his entities should be enjoined from further breaches, ordered to comply with their obligations to work toward satisfying the few closing conditions, and ordered to close upon satisfaction of those conditions.

The Parties

12. Plaintiff Twitter, Inc. is a Delaware corporation headquartered in San Francisco, California that owns and operates a global platform for real-time self-expression and conversation.

13. Defendant Elon R. Musk is a sophisticated entrepreneur who owns approximately 9.6% of Twitter’s stock. He is the CEO of Tesla and leads SpaceX, among other entities he founded or co-founded. Musk is referred to in the merger agreement as Equity Investor, and is the President, Secretary, Treasurer, and sole shareholder of both Parent and Acquisition Sub. Musk signed the merger agreement on behalf of both Parent and Acquisition Sub, and agreed to be a party to the agreement in his individual capacity as Equity Investor with respect to several “Specified Provisions.” Ex. 1, Preamble.

14. Defendant X Holdings I, Inc., or Parent, is a Delaware corporation formed on April 19, 2022 solely for the purpose of engaging in, and arranging financing for, the transactions contemplated by the merger agreement.

15. Defendant X Holdings II, Inc., or Acquisition Sub, is a Delaware corporation and a wholly owned subsidiary of Parent. Acquisition Sub was formed on April 19, 2022 solely for the purpose of engaging in, and arranging financing for, the transactions contemplated by the merger agreement.

Jurisdiction

16. This Court has subject matter jurisdiction under 10 Del. C. § 341, 8 Del. C. § 111(a), and 6 Del. C. § 2708.

17. Personal jurisdiction over Parent and Acquisition Sub is proper because both are incorporated under the laws of Delaware and consented to jurisdiction by agreeing to “expressly and irrevocably submit[] to the exclusive personal jurisdiction of the Delaware Court of Chancery . . . in the event any dispute arises out of [the merger agreement] or the transactions contemplated by [the merger agreement].” Ex. 1 § 9.10(a).

18. Personal jurisdiction over Musk is proper pursuant to 10 Del. C. § 3104(c)(1) because, among other things, (a) Musk formed Parent and Acquisition Sub, both Delaware corporations wholly owned by Musk, for the sole purpose of acquiring Twitter, a Delaware corporation; and (b) Musk agreed to undertake “reasonable best efforts” to consummate the contemplated transaction, including by causing Parent and Acquisition Sub to deliver a Certificate of Merger to the Delaware Secretary of State. Id. §§ 2.3(a), 6.3(a).

Factual Allegations

I. Musk sets his sights on Twitter

19. Musk is active on Twitter’s platform and has expressed a keen interest in the use and inherent potential of the platform. Starting in January 2022, Musk began purchasing Twitter stock. By March 14, 2022, he had secretly accumulated a substantial position—about 5% of the company’s outstanding shares. SEC regulations required that he disclose that position no later than March 24, 2022. Musk failed to disclose, and instead kept amassing Twitter stock with the market none the wiser. By April 1, 2022, Musk had accumulated about 9.1% of the company’s outstanding shares, still in secret. Not until April 4, 2022 did Musk finally disclose his holdings, which made him Twitter’s largest stockholder. Twitter’s stock price jumped 27% upon the disclosure. Between March 24 and April 4, over 112 million Twitter shares traded in ignorance of Musk’s mounting ownership.

20. Meanwhile, on March 26, 2022, Musk spoke with two Twitter directors, Jack Dorsey and Egon Durban, about the future of social media and the prospect of Musk’s joining the Twitter board. Soon after, Musk told Twitter CEO Parag Agrawal and Twitter board chair Bret Taylor that he had in mind three options relative to Twitter: join its board, take the company private, or start a competitor.

21. Musk would repeat this statement over the coming days. His contemplation of building a rival platform to Twitter was not a secret. On March 26, 2022, he had Tweeted that he was giving “serious thought” to the idea.

22. In early April, after further discussion among Musk, Agrawal, Taylor, and Twitter director Martha Lane Fox, chair of Twitter’s nominating and corporate governance committee, the Twitter board evaluated Musk’s candidacy as a director. Having considered, among other things, Musk’s interest in the platform, his technical expertise, and the perspectives he could bring, the board offered Musk the position on April 3. Musk accepted, the parties signed a letter agreement, and the agreement was announced on April 5.

23. Not a week later, Musk abruptly changed tack. On April 9, the day his appointment to the board was to become effective, Musk told Twitter he would not join the board. Instead, he would offer to buy the company.

II. Musk offers to buy Twitter

24. On April 13—four days after reversing course on the board seat—Musk texted Taylor that he planned to make an offer to acquire all of Twitter. His unsolicited offer, conveyed by letter later that day, was accompanied by a threat:

I am offering to buy 100% of Twitter for $54.20 per share in cash, a 54% premium over the day before I began investing in Twitter and a 38% premium over the day before my investment was publicly announced. My offer is my best and final offer and if it is not accepted, I would need to reconsider my position as a shareholder.

25. The following day, on April 14, Musk announced his offer publicly and noted that it was conditioned on customary business due diligence and financing. At a public event the same day, Musk—whose enormous personal wealth exceeds the capital of most public companies—boasted that he could “technically afford” to purchase Twitter outright.

26. Also on April 14, the Twitter board met to discuss Musk’s proposal. It established a transactions committee composed of independent directors Taylor, Lane Fox, and Patrick Pichette to evaluate the proposal, oversee negotiations, and explore strategic alternatives. The board was assisted in its review by Goldman Sachs and J.P. Morgan as financial advisors, and Simpson Thacher as independent counsel.

27. Faced with Musk’s rapid accumulation of Twitter stock and take-it-or-leave-it offer, and concerned that he might launch a hostile tender offer without notice, the board adopted a customary shareholder rights plan to protect its stockholders from “coercive or otherwise unfair takeover tactics.” The board took this action to reduce the likelihood of a takeover without payment of an appropriate control premium and to ensure that the board had sufficient time to make an informed judgment on Musk’s or any other offer. Under the rights plan’s terms, a single investor or group’s acquisition of more than 15% of the company’s outstanding common stock without board approval gives other stockholders the opportunity to acquire additional stock at a considerable discount. The plan was adopted and announced on April 15, 2022.

28. The board’s concerns proved well-grounded. Musk began making all-too-obvious public references to a hostile tender offer:

29. At the same time, Musk worked to strengthen the offer he had made and might make by tender. By April 20, he had personally committed $21 billion in equity financing and lined up $25.5 billion of committed debt financing, with $12.5 billion of that secured by his Tesla stock.

30. Having obtained these commitments, Musk announced in an April 21, 2022 securities filing that his offer was no longer conditioned on financing or subject to due diligence:

At the time of delivery, the Proposal was also subject to the completion of financing and business due diligence, but it is no longer subject to financing as a result of the Reporting Person’s receipt of the financing commitments. . . and is no longer subject to business due diligence.

Musk proclaimed himself prepared to begin negotiations “immediately,” and confirmed he was “exploring whether to commence a tender offer.”

31. On Saturday, April 23, 2022, Musk asked to speak with Twitter representatives about his offer. At the direction of the transactions committee, Taylor engaged with Musk, who reiterated that his offer was “best and final” and threatened once again to take it to Twitter’s stockholders directly if the board did not engage immediately.

32. The following day, on Sunday, April 24, 2022, Musk tried again to force Twitter’s hand. He delivered a letter to the board repeating that his $54.20 per share offer was “best and final,” threatening once more to sell all of his shares if his bid were rejected, and saying he would propose a “seller friendly” merger agreement to be signed before the market opened the next day. Musk’s counsel sent over a draft agreement, reiterated that Musk’s offer was not contingent on any due diligence, and underscored that the form of the proposed agreement was “intended to make this easy on all to get to a deal asap.”

33. The agreement was negotiated through the night and, in the process, became even more seller-friendly. Among the provisions not contained in Musk’s proposal but included at Twitter’s insistence were an undertaking by defendants, including Musk, to “take or cause to be taken . . . all actions and to do, or cause to be done, all things necessary, proper or advisable” to obtain the financing (already committed) to consummate the transaction, Ex. 1 § 6.10(a); a clear disclaimer of any financing condition to closing, id. § 6.10(f); and a right on Twitter’s part to request and promptly receive updates from Musk about his progress in obtaining financing, id. § 6.10(d). These provisions ensured that financing would be no obstacle to closing and that the company would have the right to stay informed of Musk’s progress in arranging his financing.

34. Twitter also negotiated for itself a right to hire and fire employees at all levels, including executives, without having to seek Musk’s consent. Musk’s initial draft of the merger agreement would have deemed the hiring and firing of an employee at the level of vice president or above a presumptive violation of the ordinary course covenant absent Musk’s consent. Twitter successfully struck that provision before signing.

35. Twitter further negotiated to narrow the circumstances under which defendants could escape the deal by claiming a “Company Material Adverse Effect.” In addition to excluding, for example, market-wide and industry-wide effects and circumstances and declines in stock price and financial performance, the final definition excluded matters relating to or resulting from Musk’s identity or communications, “performance” of the agreement, and any matter disclosed by Twitter in its SEC filings other than the “Risk Factors” and “Forward-Looking Statements” sections of those disclosures. Id. Art. I.

36. Finally, and critically, Twitter negotiated for itself a robust right to demand specific performance of the agreement’s terms that encompassed the right to compel defendants to close the deal, and ensured that Musk personally was bound by that provision (among others). Id. § 9.9(a)-(b), Preamble.

37. At a board meeting on April 25, 2022, Goldman Sachs and J.P. Morgan each presented their fairness opinions, and the board discussed the agreement. The board ultimately approved the merger agreement and decided to recommend stockholder approval, both because the price was fair to stockholders and because the merger agreement promised a high level of closing certainty. Twitter had taken Musk’s claimed “seller friendly” draft agreement and secured other key concessions to make it even more so. Not only were there no financing or diligence conditions, but Musk had already secured debt commitments that together with his personal equity commitment would suffice to fund the purchase.

38. Twitter had been buffeted by Musk’s reversals before. For the benefit of stockholders and employees, the board needed assurance that this agreement would stick. It received that assurance in the terms it was able to negotiate.

III. The final, agreed-upon deal terms

39. The terms of the transaction are governed by the merger agreement executed on April 25, 2022.

40. Under the agreement, at closing, Acquisition Sub will merge into Twitter, and Twitter will continue as a private corporation owned by Musk through his wholly owned shell companies. Twitter stockholders will receive $54.20 per share in cash, and the company’s common stock will be delisted from the New York Stock Exchange.

A. Closing Conditions

41. The conditions to closing are few. The transaction is subject to a majority vote of Twitter’s stockholders and to specified regulatory approvals. Id. § 7.1. The deal is also conditioned on the non-occurrence of a Company Material Adverse Effect that is continuing at the time of closing. Id. § 7.2(c). The agreement contains various representations by Twitter, including that its SEC filings since January 1, 2022, at the time filed or at the time amended or supplemented, are complete and accurate in all material respects, fairly depict the financial condition of the company in all material respects, and were prepared in accordance with GAAP. Id. § 4.6. Any inaccuracy in these representations does not excuse closing unless it rises to the level of a Company Material Adverse Effect. Id. § 7.2(b).

42. Company Material Adverse Effect is defined as:

any change, event, effect or circumstance which, individually or in the aggregate, has resulted in or would reasonably be expected to result in a material adverse effect on the business, financial condition or results of operations of the Company and its Subsidiaries, taken as a whole . . . .

Id. Art. I. As one would expect with a “seller friendly” merger agreement, the contract identifies numerous changes, events, and circumstances expressly excluded from the determination of whether a Company Material Adverse Effect has occurred:

[C]hanges, events, effects or circumstances which, directly or indirectly, to the extent they relate to or result from the following shall be excluded from, and not taken into account in, the determination of Company Material Adverse Effect:

(i) any condition, change, effect or circumstance generally affecting any of the industries or markets in which the Company or its Subsidiaries operate;

. . .

(iii) general economic, regulatory or political conditions (or changes therein) or conditions (or changes therein) in the financial, credit or securities markets (including changes in interest or currency exchange rates) in the United States or any other country or region in the world;

. . .

(iv) the negotiation, execution, announcement, performance, consummation or existence of this Agreement or the transactions contemplated by this Agreement, including (A) by reason of the identity of Elon Musk, Parent or any of their Affiliates or their respective financing sources, or any communication by Parent or any of its Affiliates or their respective financing sources, including regarding their plans or intentions with respect to the conduct of the business of the Company or any of its Subsidiaries and (B) any litigation, claim or legal proceeding threatened or initiated against Parent, Acquisition Sub, the Company or any of their respective Affiliates, officers or directors, in each case, arising out of or relating to the this Agreement or the transactions contemplated by this Agreement, and including the impact of any of the foregoing on any relationships with customers, suppliers, vendors, collaboration partners, employees, unions or regulators;

. . .

(viii) any changes in the market price or trading volume of the Company Common Stock, any failure by the Company or its Subsidiaries to meet internal, analysts’ or other earnings estimates or financial projections or forecasts for any period, any changes in credit ratings and any changes in analysts’ recommendations or ratings with respect to the Company or any of its Subsidiaries (provided that the facts or occurrences giving rise to or contributing to such changes or failure that are not otherwise excluded from the definition of “Company Material Adverse Effect” may be taken into account in determining whether there has been a Company Material Adverse Effect); and

(ix) any matter disclosed in the Company SEC Documents filed by the Company prior to the date of this Agreement (other than any disclosures set forth under the headings “Risk Factors” or “Forward-Looking Statements”). Id.

43. The parties thus agreed that any circumstance affecting the market generally or other social media companies would not excuse defendants from closing. Nor would any circumstance arising from the existence or performance of the agreement, or from any communication by Musk, “including the impact of any of the foregoing” on any of Twitter’s relationships with, among others, customers. Likewise, matters that Twitter disclosed in sections of its SEC filings other than the “Risk Factors” and “Forward-Looking Statements” sections cannot constitute a Company Material Adverse Effect. And Twitter’s failure to meet financial projections will not excuse closing unless that failure results from an occurrence independently qualifying as a Company Material Adverse Effect (taking into account all of the express exclusions).

44. The agreement also makes clear that financing is not a condition to closing:

Notwithstanding anything contained in this Agreement to the contrary, the Equity Investor, Parent and Acquisition Sub each acknowledge and affirm that it is not a condition to the Closing or to any of its obligations under this Agreement that the Equity Investor, Parent, Acquisition Sub and/or any of their respective Affiliates obtain any financing (including the Debt Financing) for any of the transactions contemplated by this Agreement.

Id. § 5.4; see also id. § 6.10(f).

45. Nor is there any diligence condition. Indeed, each of Parent and Acquisition Sub represents that it “conducted, to its satisfaction, its own independent investigation, review and analysis of the business, results of operations, prospects, condition (financial or otherwise) or assets of the Company and its Subsidiaries,” and that, in determining to proceed with the merger, each “relied solely on the results of its own independent review and analysis and the covenants, representations and warranties of the Company” in the merger agreement. Id. § 5.11. Parent and Acquisition Sub further acknowledge that “neither the Company nor any of its Subsidiaries, nor any other Person, makes or has made or is making any express or implied representation or warranty with respect to the Company or any of its Subsidiaries or their respective business or operations, in each case, other than those expressly given solely by the Company in Article IV,” and they represent that in agreeing to the merger they were not relying on “any express or implied representation or warranty, or the accuracy or the completeness of the representations and warranties” in the merger agreement about Twitter and its business and its operations “other than those expressly given solely by the Company in Article IV.” Id.

B. Efforts Covenants

46. The agreement requires all parties, including Musk, to use their “reasonable best efforts” to consummate the merger and cause all of the closing conditions to be satisfied. Id. § 6.3(a).

47. Defendants, including Musk, have a “hell-or-high-water” obligation to close on their financing commitments for the transaction. They must:

take, or cause to be taken, all actions and . . . do, or cause to be done, all things necessary, proper or advisable to arrange, obtain and consummate the Financing at or prior to the Closing on the terms and subject to the conditions set forth in the Financing Commitments (including any “flex” provisions). . . .

Id. § 6.10(a). More specifically, Musk and Parent have an unconditional obligation to “take (or cause to be taken) all actions, and do (or cause to be done) all things necessary, proper or advisable to obtain the Equity Financing,” which includes, among other things, Musk’s funding of his personal equity commitment at or before closing. Id. § 6.10(e).

C. Information Sharing

48. The merger agreement requires the parties to share certain information with one another in the run-up to closing.

49. Defendants, including Musk, are required to keep Twitter “reasonably informed on a current basis of the status of [their] efforts to arrange and finalize the Financing” and to “promptly provide and respond to any updates reasonably requested by the Company with respect to the status” of those efforts. Id. § 6.10(d)(iv)-(v). For its part, Twitter is required to use its “commercially reasonable best efforts” to assist defendants with arranging financing, but that obligation is qualified: Twitter need not “prepare or provide any financial statements or other financial information” other than the financial information provided to the SEC, nor provide any “other information that is not available to the Company without undue effort or expense.” Id. § 6.11(a). Moreover, Twitter’s obligations under Section 6.11 are its “sole obligation . . . with respect to cooperation in connection with the arrangement of any financing,” and Twitter may be considered to have breached the provision only if a failure by Parent to obtain the committed debt financing is “due solely to a deliberate action or omission taken or omitted to be taken by the Company in material breach of its obligations.” Id.

50. Subject to certain conditions, including entry into a confidentiality agreement, Twitter must provide Parent and its advisors with “reasonable access” to information about its “business, properties and personnel” as defendants “reasonably” request. Id. § 6.4. The information requested must be for a “reasonable business purpose related to the consummation of the transactions contemplated by this Agreement.” Id. (emphasis added). In addition, Twitter can decline a request if in its “reasonable judgment” it determines that compliance would “cause significant competitive harm to the Company or its Subsidiaries if the transactions contemplated by this Agreement are not consummated” or would “violate applicable Law,” including privacy laws. Id. Parent cannot use the information obtained “for any competitive or other purpose unrelated to the consummation of the transactions contemplated by th[e] Agreement.” Id. And Parent must use its “reasonable best efforts to minimize any disruption to” Twitter “that may result from requests for access.” Id.

D. Ordinary Course Covenant

51. The agreement contains a seller-friendly ordinary course covenant, requiring Twitter to use no more than “its commercially reasonable efforts” to “conduct the business of the Company and its Subsidiaries in the ordinary course of business” unless, among other things, an action outside the ordinary course is “agreed to in writing by Parent (which consent shall not be unreasonably withheld, delayed or conditioned).” Id. § 6.1. There is no requirement of compliance with “past practice.” And, as noted, before the agreement was signed, Twitter succeeded in striking from the covenant a requirement to obtain Parent’s consent for the hiring and firing of employees.

E. Public Statements and Non-Disparagement

52. Section 6.8 of the agreement contains standard language requiring each side to consult with the other before issuing certain public statements, as well as negotiated language concerning Musk’s ability to Tweet about the merger. Under the provision, Musk may so Tweet only “so long as such Tweets do not disparage the Company or any of its Representatives.” Id. § 6.8.

F. Termination

53. Defendants’ ability to terminate the agreement before the presumptive drop-dead date of October 24, 2022 is extremely limited and carefully circumscribed. While there are closing conditions related to the accuracy of Twitter’s representations and warranties and to Twitter’s compliance with its covenants, there is no right for defendants to terminate unless there is a breach sufficiently significant to cause failure of a closing condition, which, after due notice, is either incapable of being cured or is not cured within 30 days after such notice. Id. § 8.1(d). Defendants have no right to terminate, moreover, if any of them are in material breach of their own obligations under the agreement. Id.

G. Specific Performance

54. Twitter may seek specific performance, an injunction, or other equitable relief to enforce any of defendants’ obligations under the merger agreement. Id. § 9.9(a). It has the specific power to compel Musk to fund the equity financing and close the merger, provided the closing conditions are met (or are capable of being met at the time of closing), the debt financing (which is already committed) has been or will be funded at the closing, and the company is itself prepared to close. Id. § 9.9(b).

IV. The financing structure

55. At the time of signing, the financing for the transaction had three components: loans to the post-closing Twitter, a personal loan on margin to Musk (against his Tesla stock), and an equity commitment from Musk himself.

56. The loans to Twitter, of up to $13 billion in the aggregate, are promised by Morgan Stanley Senior Funding, Inc. and other lenders in a debt commitment letter dated April 25, 2022. The committed financing comprises a $6.5 billion term loan, a $500 million revolving credit facility, and $6 billion of bridge financing. Although the debt commitment letter requires Musk to assist the lenders in marketing the debt, his failure to do so does not release the lenders from their obligation to fund and the financing is not conditioned on the lenders’ ability to market the debt. The lenders’ obligation is subject only to the closing of the merger itself and certain other conditions the satisfaction of which lies in defendants’ control.

57. The margin loan of $12.5 billion to Musk personally was promised by Morgan Stanley Senior Funding, Inc. and other lenders in a margin loan commitment letter also dated April 25, 2022. The loan was to be secured by $62.5 billion worth of Musk’s Tesla stock—about 62 million shares at the time of signing.

58. Under an equity commitment letter dated April 20, 2022, Musk also personally agreed to contribute to or otherwise provide to Parent $21 billion of equity capital to be used to fund the purchase price. Because much of his net worth is tied up in Tesla shares, Musk would need to sell—indeed, has already sold—millions of those shares to fund his equity commitment.

59. The structure of Musk’s financing meant that the merger could become significantly more expensive for him if Tesla’s stock price were to decline (and significantly less expensive if Tesla’s stock price were to rise). For the equity component, the lower Tesla’s stock price was, the more shares of Tesla Musk would need to sell to provide the cash he committed. For the margin loans, a substantial decline in Tesla’s stock price would require Musk to pledge more shares or cash as collateral to the financing sources.

V. The market turns

60. The risk of market decline, which was Musk’s alone to bear under the merger agreement, materialized. Soon after signing, the U.S. capital markets took a turn for the worse. Within a week after April 25, 2022, the date the merger agreement was executed, Musk elected to sell 9.8 million Tesla shares to finance the merger at prices as low as $822.68 per share, substantially below their pre-Twitter-signing price of $1,005 per share. He then promptly Tweeted, “No further TSLA sales planned after today.” But the Tesla stock price kept dropping, putting Musk at risk of needing to pledge yet more Tesla shares to consummate his proposed margin loan and to sell still more to fund his equity commitment.

61. On May 4, 2022, Parent and Musk, faced with needing to pledge more Tesla shares to satisfy the condition that the margin loan not exceed 20% of the value of the pledged stock, decreased the amount of that loan. On May 24, without notifying Twitter, they dispensed with the loan entirely and agreed in a new equity commitment letter to increase Musk’s equity commitment to $33.5 billion. That letter, which remains operative, gives Twitter third-party beneficiary rights to enforce directly against Musk his equity commitment in accordance with its terms and the terms of the merger agreement.

62. Musk remains personally responsible for $33.5 billion of the approximately $44 billion required to complete the transaction.

VI. Musk grasps for an out

63. Musk wanted an escape. But the merger agreement left him little room. With no financing contingency or diligence condition, the agreement gave Musk no out absent a Company Material Adverse Effect or a material covenant breach by Twitter. Musk had to try to conjure one of those.

A. False or spam accounts

64. What Musk alighted upon first was a representation in Twitter’s quarterly SEC filings over many consecutive years that based on its internal processes the company estimated “the average of false or spam accounts” on its platform “represented fewer than 5% of our mDAU during the quarter.” “Monetizable Daily Active Usage or Users,” or mDAU, is a non-GAAP metric Twitter employs to measure the number of people or organizations that use the Twitter platform. In its filings, Twitter defines mDAU as “people, organizations or other accounts who logged in or were otherwise authenticated and accessed Twitter on any given day through twitter.com, Twitter applications that are able to show ads, or paid Twitter products, including subscriptions.”

65. In addition to deploying automated and manual processes that suspend on average more than a million suspicious accounts each day, the company undertakes a rigorous, daily process using human reviewers to estimate spam or false accounts remaining on its platform after automated filtering and manual review.

66. Twitter’s SEC disclosures regarding that process and its findings are heavily qualified. As described in the “Note Regarding Key Metrics” section of its filings, Twitter’s “calculation of mDAU is not based on any standardized industry methodology,” “may differ from estimates published by third parties or from similarly-titled metrics of our competitors,” and “may not accurately reflect the actual number of people or organizations using our platform.” As for the estimate of spam or false accounts as a percentage of mDAU, Twitter explains that it is based on “an internal review of a sample of accounts,” involves “significant judgment,” “may not accurately represent the actual number of [false or spam] accounts,” and could be too low. Twitter has published the same qualified estimate—that fewer than 5% of mDAU are spam or false—for the last three years, and published similar estimates for five years preceding that.

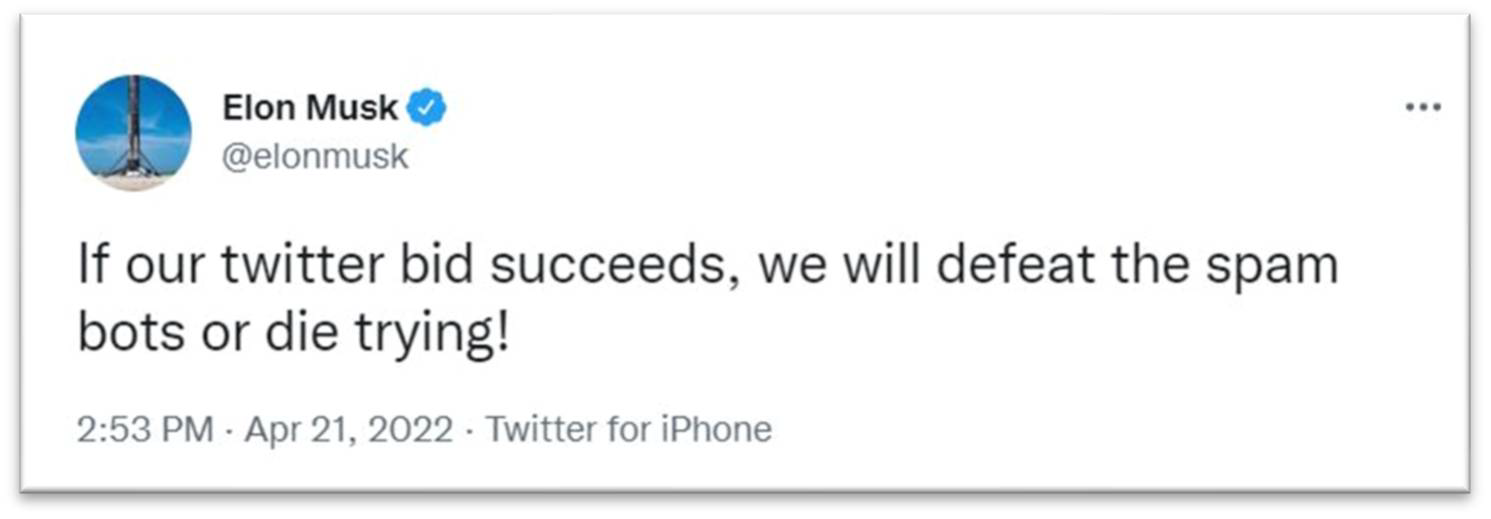

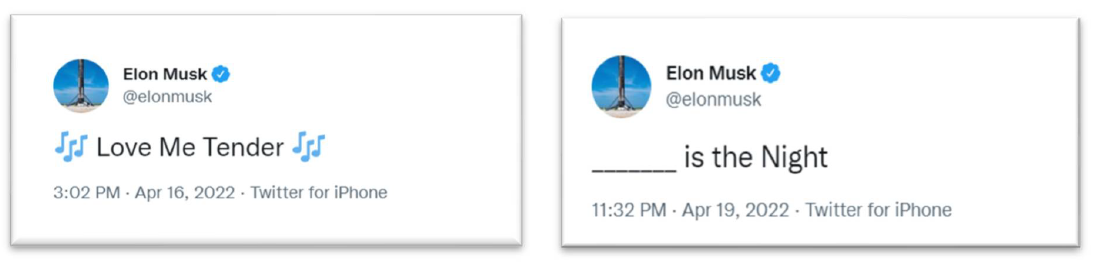

67. Musk was well aware when he signed the merger agreement that spam accounted for some portion of Twitter’s mDAU, and well aware of Twitter’s qualified disclosures. Spam was one of the main reasons Musk cited, publicly and privately, for wanting to buy the company. On April 9, 2022, the day Musk said he wanted to buy Twitter rather than join its board, he texted Taylor that “purging fake users” from the platform had to be done in the context of a private company because he believed it would “make the numbers look terrible.” At a public event on April 14, Musk said eliminating spam bots would be a “top priority” for him in running Twitter. On April 21, days before the deal was inked, he declared:

Musk echoed that same sentiment in the press release announcing the merger on April 25, stating that upon acquiring Twitter he would prioritize “defeating the spam bots, and authenticating all humans.”

68. Yet Musk made his offer without seeking any representation from Twitter regarding its estimates of spam or false accounts. He even sweetened his offer to the Twitter board by expressly withdrawing his prior diligence condition.

69. On May 5, 2022, Musk announced that he had raised an additional $7.1 billion of equity commitments for the deal from 19 investors—including $1 billion from Oracle chairman Larry Ellison, $800 million from Sequoia Capital, $400 million from Andreessen Horowitz, and $375 million from a subsidiary of the Qatari sovereign wealth fund. Musk’s investors, all sophisticated market participants, made these commitments in the face of Musk’s public statements regarding spam accounts, and knowing he had forsworn diligence. Musk made his plans to address spam a key part of his pitch: As Andreessen Horowitz’s co-CEO stated in publicly announcing the investment, the firm thought Musk was “perhaps the only person in the world” who could “fix” Twitter’s alleged “difficult issue[]” with “bots.”

70. Then, however, as the market (and Tesla’s stock price) declined, Musk’s advisors began to demand detailed information about Twitter’s methods of calculating mDAU and estimating the prevalence of false or spam accounts.

71. Twitter had entered into a confidentiality agreement with Musk to share non-public information in preparation for post-closing transition, and convened an in-person meeting with Musk and his team on May 6, 2022. Among the topics of discussion were mDAU and spam-related subjects. In advance of the meeting, Musk’s bankers circulated an agenda with items related to users on the Twitter platform, including: “How do you estimate that fewer than 5% of mDAU are false or spam accounts?” Twitter’s representatives addressed that question at the meeting, summarizing the company’s process.

72. Following up on or about May 9, Musk’s bankers at Morgan Stanley added entries to their diligence tracker requesting user-related information, including a request for “User database containing key metrics including, but not limited to, number of users, number of verified users, number of monthly active users, number of handles, etc.” Neither Musk nor his advisors said what had prompted these requests or identified new information regarding spam or false accounts that had come to light warranting the inquiries. Nothing had changed about Twitter’s estimates concerning the prevalence of spam on the platform in the days since signing. Nonetheless, in the spirit of cooperation, Twitter responded on May 12 with data sets and written descriptions of its audience metrics and its process for sampling the prevalence of false or spam accounts.

73. Early on May 13, 2022, in advance of a diligence meeting that had been scheduled to discuss the data Twitter had provided, Musk Tweeted without any advance notice to the company that the “Twitter deal [is] temporarily on hold” until the company showed him proof for its estimate that less than 5% of Twitter accounts are spam or false:

The Reuters story Musk linked to in his Tweet was a report on Twitter’s 10-Q filing made on May 2, 2022, and contained the same heavily qualified 5% estimate Twitter had been disclosing in its SEC filings for the past three years. Musk had no basis for asserting that the deal was “on hold” based on this longstanding disclosure. Twitter’s deal counsel called Musk’s deal counsel. Two hours after the “on hold” Tweet was published, Musk belatedly Tweeted that he was still “committed” to the deal.

74. Cognizant of its own obligations under the merger agreement, Twitter proceeded with the May 13 diligence meeting, which lasted for about two hours. During this session, Twitter explained, among other things, that its spam estimation process entails daily sampling for a total set of approximately 9,000 accounts per quarter that are manually reviewed.

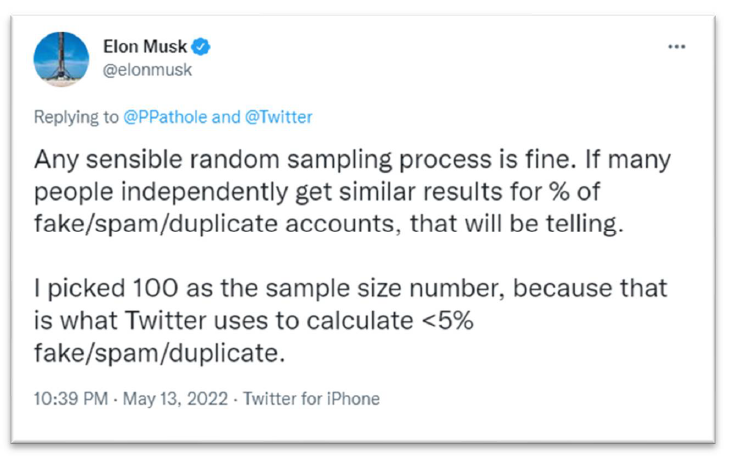

75. Later that day, Musk Tweeted publicly a misrepresentation that Twitter’s sample size for spam estimates was just 100.

76. The next day, he boasted publicly that he had violated his non-disclosure obligations:

77. Musk’s Tweets on May 13 and 14 violated his obligations under the merger agreement, including the provisions prohibiting public comments not consented to by Twitter, disparagement, misuse of information provided under Section 6.4, requiring best efforts to consummate the merger.

78. On May 16, Agrawal Tweeted that Twitter’s 5% estimate is based on “multiple human reviews (in replicate) for thousands of accounts, that are sampled at random, consistently over time, from *accounts we count as mDAUs*.” He explained that the company’s human review process “uses both public and private data (eg, IP address, phone number, geolocation, client/browser signatures, what the account does when it’s active…) to make a determination on each account”—something Twitter also explains in its SEC filings. Agrawal stood by Twitter’s estimate, and noted that the company is constantly updating its systems and rules to remove as much spam as possible:

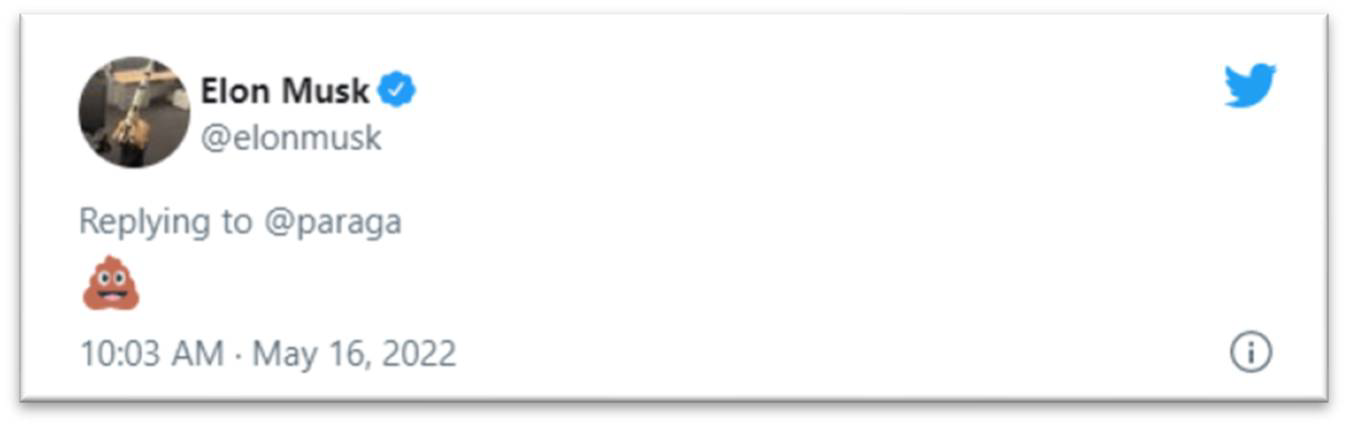

79. Musk responded with another disparaging Tweet:

80. As the market continued to fall, Musk persisted in his public and misleading attacks on Twitter’s handling and disclosure of spam or false accounts. In another Tweet on May 15, 2022 and a statement at a technology conference on May 16, Musk made the baseless claim that fake users might account for as much as 90% of Twitter’s users. Asked whether the “Twitter deal [is] going to get closed,” Musk responded that “it really depends on a lot of factors” and posited that Twitter’s estimate that spam or false accounts comprised fewer than 5% of mDAU might be “a material adverse misstatement” if “in fact it is four or five times that number, or perhaps ten times that number.”

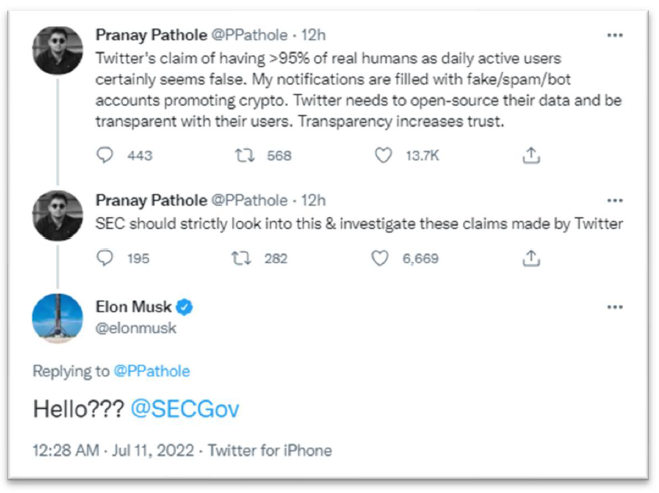

81. On May 17, 2022, Musk Tweeted, without basis or explanation, that “20% fake/spam accounts, while 4 times what Twitter claims, could be *much* higher,” adding that “[t]his deal cannot move forward” pending further analysis of Twitter’s spam estimates. In yet another breach of his non-disparagement obligation and efforts covenants, Musk encouraged the SEC to investigate the accuracy of Twitter’s disclosures:

B. Defendants’ lawyer letters

82. Even as Musk was violating his own contractual obligations, Twitter continued to respond cooperatively to his representatives’ increasingly unreasonable inquiries. Between May 16 and May 20, the company provided detailed written responses to several information requests.

83. On May 20, 2022, Musk’s team sent a request for Twitter’s “firehose” data—which is essentially a live-feed of data concerning activity (Tweeting, Retweeting, and “liking” Tweets, for example) associated with the public accounts on Twitter’s platform. Again, no explanation was offered for how this request furthered a “reasonable business purpose related to the consummation of the transactions contemplated by” the merger agreement, as required by Section 6.4. Nor can the firehose data even be used to accurately estimate the prevalence of spam or false accounts. As Agrawal had explained in his May 16 Tweets, that estimate depends in part on private data not available in the firehose. Conversely, the firehose includes Tweets that Twitter’s systems and processes catch and do not count within mDAU for that day.

84. On May 21, 2022, Twitter hosted a third diligence session with Musk’s team and yet again discussed Twitter’s processes for calculating mDAU and estimates of spam or false accounts. Twitter also provided a detailed summary document describing the process the company uses to estimate spam as a percentage of mDAU.

85. Defendants responded with increasingly invasive and unreasonable requests. And rather than use “reasonable best efforts to minimize any disruption to the respective business of the Company and its Subsidiaries that may result from requests for access,” Ex. 1 § 6.4, defendants repeatedly demanded immediate responses to their access requests. The scope of the requests and the deadlines defendants imposed on their satisfaction were unreasonable, disruptive to the business, and far outside the bounds of Section 6.4.

86. Twitter nonetheless continued to work with Musk to try to respond to the requests. It extended an ongoing offer to engage with Musk and his representatives regarding its calculation of mDAU, and held several more diligence sessions through the end of May. It also provided detailed written responses, including custom reporting, to his escalating requests for information.

87. On May 25, 2022, defendants’ counsel sent the first of a series of aggressive letters copying their litigation counsel at Quinn Emmanuel. This one falsely asserted that Twitter had “failed to respond to any” of defendants’ information requests and insisted that defendants be granted access to the firehose data so Musk could “make an independent assessment of the prevalence of fake or spam accounts on Twitter’s platform.” Though the letter called Twitter’s own spam detection methodologies “lax,” it identified no basis for that charge.

88. Nor, again, did defendants explain how fulfillment of the firehose data demand would further consummation of the merger or what basis they had to demand the right to “make an independent assessment” of the prevalence of false or spam accounts on the platform. Even assuming that was a proper purpose, reviewing the full firehose data would not result in an accurate assessment or mimic the rigorous process that Twitter employs by sampling accounts and using public and private data to manually determine whether an account constitutes spam—as Twitter’s representatives had already repeatedly explained to Musk’s team.

89. On May 27, 2022, Twitter responded by noting its weeks-long active engagement with Musk’s team and explaining that some of defendants’ requests sought disclosure of highly sensitive information and data that would be difficult to furnish and would expose Twitter to competitive harm if shared. After all, Musk had said he would do one of three things with Twitter: sit on its board, buy it, or build a competitor. He had already accepted and then rejected the first option, and was plotting a pretextual escape from the second. Musk’s third option—building a competitor to Twitter—remained. Still, Twitter again responded constructively and reiterated its commitment to work with Musk’s team to provide reasonable access to requested information.

90. On May 31, 2022, defendants lobbed another missive, again falsely asserting that Twitter had “refused” to provide requested data and that the company’s spam or false account detection methods were “inadequate.” The letter claimed Musk was willing to implement protocols to protect against “damage or competitive harm to the company.”

91. On June 1, 2022, Twitter responded by refuting that it had “refused” provision of data, demonstrating that, to the contrary, it had been working with Musk’s team to honor their requests within the bounds of the contract. To help set the protocols Musk had said he was willing to honor, Twitter asked a series of questions directed at how the data would be used and by whom, and how it would be protected.

92. Defendants’ response on June 6, 2022 made no effort to answer those questions or identify data-protection protocols; instead, it accused Twitter of breach and advanced a false narrative that Twitter had been stonewalling Musk’s requests. Musk publicly filed the letter, which repeated his baseless and damaging charge that Twitter had “lax” detection methods. He included none of Twitter’s correspondence in that filing and omitted all details about the information Twitter had provided. He thus continued to present the public with a misleadingly incomplete narrative about his communications with Twitter, with equally misleading implications about the likelihood that the merger would be completed and about Twitter’s operations.

93. Steadfast in its commitment to consummate the merger, Twitter continued to try to get Musk’s team what it demanded while safeguarding its customers’ data and harboring very real concerns about how Musk might use the data if he succeeded in escaping the deal. On or about June 9, 2022, Musk’s counsel indicated that granting access to 30 days’ worth of historical firehose data would satisfy Musk’s request for the firehose data. So, on June 15, the company gave Musk’s team secure access to that raw data—about 49 tebibytes’ worth. It did so even though the merger agreement did not require the sharing of this information.

94. Musk’s next lawyer letter, dated June 17, 2022, skimmed over this massive data production. Like the earlier correspondence, the June 17 letter described an alternative reality in which Twitter had failed to cooperate in supplying Musk with information, entirely contrary to the facts, apparently in the belief that repeating a falsehood enough can make it true. The letter also continued to move the goal posts by adding a new request for “the sample set” and “calculations” Twitter used to estimate that fewer than 5% of its mDAUs are false or spam accounts over the past eight quarters. Thus, with no basis, defendants sought to audit information Twitter consistently had caveated as an “estimate” requiring “significant judgment” to prepare.

95. The June 17 letter further contained a litigation-style discovery demand for information Musk asserted was needed to investigate “the truthfulness of Twitter’s representations to date regarding its active user base, and the veracity of its methodologies for determining that user base.” It broadly demanded board materials relating to mDAU and spam, as well as emails, text messages, and other communications about those topics—highly unusual requests in the context of good faith efforts toward completion of any merger transaction, and absurd in the context of this one, which has no diligence condition. Musk propounded these unreasonable requests and touted his contrived narrative about Twitter’s methodologies, all without ever identifying a basis for questioning the veracity of Twitter’s methodologies or the accuracy of its SEC disclosures.

96. On June 20, 2022, Twitter set the record straight in a detailed response letter. It noted that the two sides had been working collaboratively to clear regulatory hurdles and “address voluminous data requests” from defendants, that Twitter had “dedicated significant resources” to providing defendants with the data requested, and that Twitter had already provided a wealth of data sweeping far beyond the bounds of what might conceivably be deemed reasonably necessary to consummate the transaction. Twitter noted that Musk, while continuing to accuse Twitter of misrepresenting its spam or false account estimate, had offered not a single fact to support the accusation. And Twitter observed that defendants’ “increasingly irrelevant, unsupportable, and voluminous information requests” appeared directed not at consummating the merger but rather the opposite: trying to avoid the merger.

97. Nonetheless, in a continuing effort at cooperation, Twitter agreed to provide Musk everything he now demanded regarding the firehose, including access to “100% of Tweets and favoriting activity.” Twitter cautioned, as it had so many times before, that this data would not allow Musk to accurately assess the number of spam or false accounts. But on June 21, 2022, it gave defendants’ counsel the demanded access.

98. Meanwhile, Agrawal and Twitter CFO Ned Segal had been trying to set up a meeting with Musk to discuss the company’s process in estimating the prevalence of spam or false accounts. On June 17, 2022, Segal proposed a discussion with Musk and his team to “cover spam as a % of DAU.” Musk responded that he had a conflict at the proposed time. When Agrawal sought to reengage on the matter, Musk agreed to a time on June 21, but then bowed out and asked Agrawal and Segal to speak with his team not about the spam estimation process but “the pro forma financials for the debt.”

99. On June 29, 2022, Musk complained through counsel that Twitter purportedly had “placed an artificial cap on the number of searches” Musk’s experts could run on the firehose data, and had failed to respond to certain of the new requests made on June 17. (False again, as explained below.) The June 29 letter notably did not take issue with Twitter’s refusal to provide responses to the discovery-like requests for emails, text messages, and other communications in the June 17 letter. But it contained a slew of new demands—several asking Twitter to create more custom reporting.

100. On July 1, 2022, Twitter pointed out just how far beyond the scope of Section 6.4 defendants’ requests had strayed. Nonetheless, Twitter noted that it was providing yet more information in response to recent requests and would continue to devote the “time and considerable resources” necessary to respond to outstanding requests. Twitter also explained that it had placed “no artificial throttling of rate limits.” In follow-up correspondence, it became clear that the “limit” Musk had bumped up against was not the result of throttling but a default 100,000-per-month limit on the number of queries that could be conducted. With his undisclosed team of data reviewers working behind the scenes, Musk had hit that limit within about two weeks. Twitter immediately agreed to, and did, raise the monthly search query limit one hundred-fold, to 10 million—more than 100 times what most paying Twitter customers would get.

101. From the outset of this extraordinary post-signing information exchange process, Musk accused Twitter of “lax” methodologies for calculating spam or false accounts. Knowing that his actions risked harm to Twitter and its stockholders, wreaked havoc on the trading price of Twitter’s stock, and could have serious consequences for the deal, Musk leveled serious charges, both publicly and through lawyer letters, that Twitter had misled its investors and customers. But Musk exhibited little interest in understanding Twitter’s process for estimating spam accounts that went into the company’s disclosures. Indeed, in a June 30 conversation with Segal, Musk acknowledged he had not read the detailed summary of Twitter’s sampling process provided back in May. Once again, Segal offered to spend time with Musk and review the detailed summary of Twitter’s sampling process as the Twitter team had done with Musk’s advisors. That meeting never occurred despite multiple attempts by Twitter.

102. From the outset, defendants’ information requests were designed to try to tank the deal. Musk’s increasingly outlandish requests reflect not a genuine examination of Twitter’s processes but a litigation-driven campaign to try to create a record of non-cooperation on Twitter’s part. When Twitter nonetheless bent over backwards to address the increasingly burdensome requests, Musk resorted to false assertions that it had not.

C. Financial information

103. In seeking to manufacture a record of covenant breach, Musk seized not just on Section 6.4 but also on Section 6.11, which obligates Twitter to reasonably cooperate with Parent to facilitate arrangement of debt financing.

104. Throughout the post-signing period, Twitter’s advisors had been working with Musk’s representatives to furnish them relevant financial information about the company. These discussions had been productive under the supervision on Musk’s side of Bob Swan, a respected Silicon Valley financial professional and former CEO of Intel Corporation. Swan had been in regular contact with Segal, and had been leading defendants’ purported effort to consummate the debt financing.

105. Then, in his June 17 lawyer letter, Musk demanded a collection of financial information he claimed was necessary to “better understand the state of Twitter’s business and outlook, which is related to his acquisition plans and his financing for the transaction.” He demanded a “working, bottoms-up financial model for 2022,” budget plans with underlying modeling, and a “working copy” of Goldman Sachs’s “valuation model underlying its fairness opinion.” This demand is extremely unusual in merger transactions, and neither in conveying the demand nor at any time since have defendants pointed to a request from any lender that would justify it. Notably, Musk’s debt financing commitments are not conditioned on receipt of any financial information about Twitter other than that contained in its quarterly SEC filings. Ex. 2 § 1, E-2 (Ex. E) § 6.

106. Around the same time as the request, on June 21, 2022, Musk falsely represented in a Bloomberg interview that an item requiring resolution “before the transaction can complete” is “will the debt portion of the round come together?” As Musk well knew, financing expressly is not a condition to closing under the agreement.

107. Still, intent on facilitating the merger’s consummation, Twitter provided Musk with significant supporting detail for its proxy case projections, shared some of its financial plans, and gave him a copy of its bankers’ final presentation to Twitter’s board.

VII. Defendants materially breach their obligations to work toward closing and refrain from unreasonable withholding of consent to operational changes

108. Consummating a merger agreement involves substantial effort and requires a serious deployment of resources by the seller. Defendants thus are subject to contractual obligations requiring them to take actions necessary to close and to allow Twitter to operate as efficiently as possible in the interim. Defendants violated two important obligations of this kind: the duty to work toward finalizing the financing for the closing and the obligation to consider consents reasonably.

A. Defendants abandon financing-related efforts and breach Section 6.10(d)

109. Musk’s distortive public statements about the deal, and his increasingly aggressive information demands through counsel, raised Twitter’s suspicion that he was secretly abandoning efforts to finalize the committed debt financing in time for a prompt closing. Section 6.10 requires defendants to take all steps necessary to secure the already-committed financing for the closing.

110. Twitter’s concern deepened when, on June 23, 2022, Musk texted Twitter management to say that he had asked Swan “to depart the deal proceedings, as we are not on the same wavelength.” At the same time, Musk said he was “trying to prepare the cash flow projections necessary to secure the debt,” and asked for Twitter’s “cash flow projections over the next three years” and a comparison of historical projections to actuals—to assist “debt issuers” who “are much more conservative than equity investors.” Customarily, projections are needed well in advance of closing and before approaching ratings agencies, which is a key first step in consummating debt financing. They are the buyer’s, not the seller’s, responsibility. See Ex. 1 § 6.11.

111. Over the ensuing days, Twitter’s repeated requests for a contact in lieu of Swan generated no response. Outreach by Goldman Sachs and J.P. Morgan to Morgan Stanley likewise was met with silence.

112. Faced with this uncertainty and with Musk’s insinuations about his lenders, on June 28 and again on July 6, Twitter exercised its rights under Section 6.10(d) of the merger agreement to formally seek information about the status of Musk’s financing.

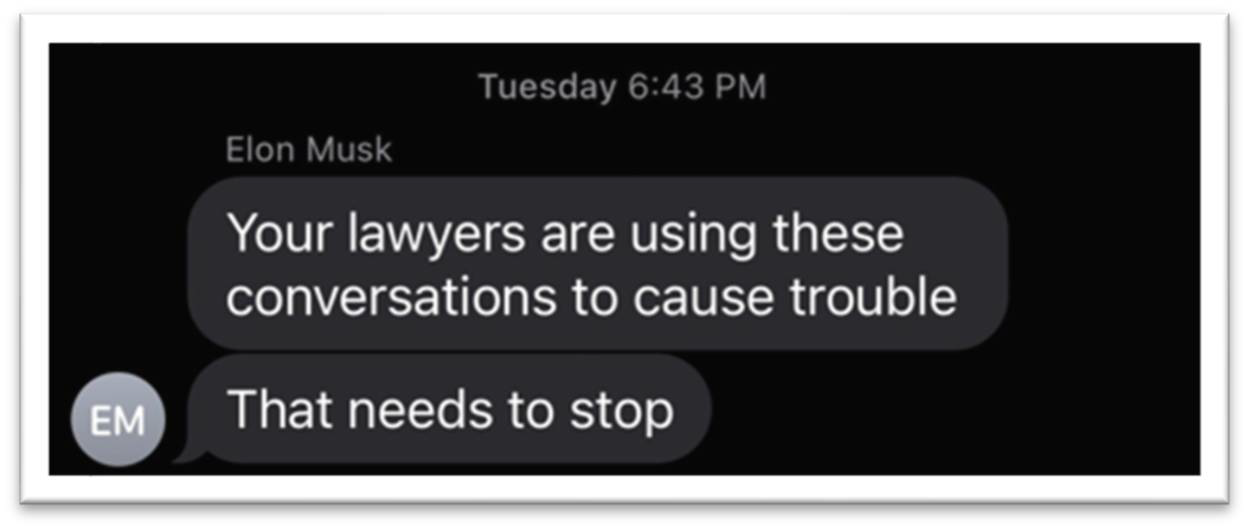

113. Defendants still have provided no substantive response. Instead, the day after the first of these requests, Musk warned Agrawal and Segal to back off:

114. On June 30, 2022, Musk informed Segal that replacement team member (and long-time Musk confidant) Antonio Gracias would be taking over the financing effort that Swan had helmed. But Gracias never appeared.

B. Musk delays and stymies key operational decisions

115. Since signing, Twitter has complied in all respects with its obligation under Section 6.1 of the merger agreement to operate the business in the ordinary course. In an excess of caution, the company has sought Musk’s consent even for matters falling well within the zone of commercial reasonableness. Though Musk has approved some of Twitter’s requests, he has been slow to respond to ones that required urgency and has unreasonably withheld his consent to others, in breach of his own obligations under Section 6.1.

116. Most notably, Musk has unreasonably withheld consent to two employee retention programs designed to keep selected top talent during a period of intense uncertainty generated in large part by Musk’s erratic conduct and public disparagement of the company and its personnel.

117. During negotiation of the merger agreement, Twitter had sought Musk’s consent to a broad retention plan. Musk’s team deferred decision on the matter; the plan Twitter proposed was detailed, and time for negotiation was short. But Musk indicated he was open to further discussion.

118. During a May 6, 2022 post-signing diligence session, Twitter management again broached the subject of retention, and Musk was non-committal. He suggested the matter be tabled pending further clarity on the expected interval before closing the deal.

119. Over the weeks that followed, Swan discussed with Twitter management a narrower retention plan than the one that had been discussed during the merger agreement negotiations. Consistent with those discussions, on June 20, 2022, Twitter sent defendants a formal request for consent to two tailored employee retention programs that had been vetted by the board and its compensation committee with the assistance of an outside compensation consultant.

120. Musk initially failed to respond at all to the June 20 consent request. (It would soon become clear that he had fired Swan.) After a follow-up request for consent, Musk’s counsel stated tersely that “Elon is not supportive of this program and has declined to grant consent for it.” Twitter offered to arrange a meeting between Musk and Lane Fox to explain the importance and utility of the proposed programs. Musk’s counsel repeated that Musk “doesn’t believe a retention program is warranted in the current environment,” and said Musk was unwilling to consider the advice of compensation consultants, but left open the possibility of speaking with Lane Fox.

121. On June 28, 2022, following further stonewalling from Musk’s counsel, Twitter urged that a discussion would be fruitful. After initially suggesting Musk might be “amenable to a call next week,” Musk’s counsel replied, “Elon already gave his response but I’ll remind him of Martha’s request for a call.” The call never happened—Musk has continued to duck it—and neither retention program has been implemented due to defendants’ unexplained and unreasonable withholding of consent. Employee attrition, meanwhile, has been on the upswing since the signing of the merger agreement.

122. Defendants have unreasonably withheld consent in other domains as well. On June 14, 2022, Twitter sought consent to terminate Twitter’s existing revolving credit facility, noting that no amounts were presently drawn under the facility and that the facility would have to be terminated in connection with the merger’s consummation. Maintaining the facility requires Twitter to incur ongoing monthly costs. After initially saying he would consent to the termination, Musk withdrew it the next day without explanation.

VIII. Defendants purport to terminate the merger agreement

123. On July 8, 2022, defendants’ counsel sent a letter to Twitter purporting to terminate the merger agreement.

124. The notice alleges three grounds for termination: (i) purported breach of the information-sharing and cooperation covenants contained in Sections 6.4 and 6.11; (ii) supposed “materially inaccurate representations” incorporated by reference in the merger agreement that allegedly are “reasonably likely to result in” a Company Material Adverse Effect; and (iii) purported failure to comply with the ordinary course covenant by terminating certain employees, slowing hiring, and failing to retain key personnel. Ex. 3.

125.These accusations are pretextual and have no merit.

A. Twitter has not breached its information-sharing or cooperation covenants

126. Twitter has provided defendants far more information than they are entitled to under the merger agreement. Section 6.4 serves the narrow purpose of giving Parent reasonable access to information necessary to close the merger. It does not give defendants a broad right to conduct post-signing due diligence of a kind they specifically forswore pre-signing. Much less does it give Musk the right to hunt for evidence supporting a bogus misrepresentation theory developed to try to torpedo the deal.

127. In any event, Twitter has bent over backwards to provide Musk the information he has requested, including, most notably, the full “firehose” data set that he has been mining for weeks—and has been continuing to mine since purporting to terminate—with the assistance of undisclosed data reviewers. Twitter has also spent weeks and dedicated considerable resources to compiling information responsive to Musk’s numerous other requests for custom reporting of user data. Musk and his representatives have received extensive data underlying Twitter’s process for estimating false or spam accounts as a percentage of mDAU, including the granular monthly reporting identifying each of the sampled accounts by “user id” and the determination as to whether the account was false or spam, along with the calculations supporting Twitter’s estimates, going back to January 1, 2021.

128. In their termination notice, defendants list categories of information they claim Twitter has withheld. Most of this information does not exist, has already been provided, or is the subject of requests only made recently, in response to which Twitter had been yet again compiling responsive information when it received the termination notice. All of this information sweeps far beyond what is reasonably necessary to close the merger. Defendants also complain about rate and query limits initially accompanying the firehose data. But those limits were part of the customary commercial terms defendants initially requested, and, as defendants acknowledge, Twitter increased the limits immediately upon request before the purported termination.

129. As to Twitter’s cooperation obligation under Section 6.11, the company has again gone well beyond what is required. The point of this provision is to assist Parent in furnishing the lenders and underwriters with information to facilitate syndication of the already-committed financing. Twitter is not obligated to provide financial information not already in existence, or to provide copies of its bankers’ valuation models, which are outside the company’s control. Parent, not Twitter, is responsible for providing the “prospects, projections and plans for the business and operations of” the company. Ex. 1 § 6.11.

130. Even so, in response to the request defendants lodged for the first time on June 17, Twitter made the extraordinary ask of its bankers to give Musk the final board deck they presented in connection with the merger. It furnished Musk with other financial information he requested. It did so even though Musk has cited no demand from any lender—and no reason related to any obligation under any relevant contract—that would support these requests. There has been no breach, and there would be none even if the state of Twitter’s cooperation remained the same at the end of the cure period.

B. Twitter’s representations in its SEC filings supply no basis for termination

131. Nor can defendants show that Twitter has made any representation or collection of representations the inaccuracy of which is “reasonably likely to result in” a Company Material Adverse Effect. They do not even try. Notwithstanding that defendants have received mountains of information regarding Twitter’s processes, far beyond what they are entitled to under the merger agreement, their termination notice asserts only that “[p]reliminary analysis by Mr. Musk’s advisors” of the vast data set Twitter provided to Musk after signing “causes Mr. Musk to strongly believe” Twitter’s reported estimates have been inaccurate. Ex. 3 at 6. Musk’s claimed “belie[f]” is of course no proof of misrepresentation, much less of a Company Material Adverse Effect—which can be established only by clearing an extraordinarily high bar that is nowhere in sight here.

C. Twitter did not breach the ordinary course covenant

132. Having unreasonably withheld consent to programs designed to retain key personnel, Musk now claims that Twitter breached Section 6.1 by terminating some employees and failing to retain others who wished to leave. Like the others, this claim is meritless and contrived.

133. While erring on the side of seeking consent, Twitter has continued to operate in the ordinary course respecting routine management decisions, including decisions concerning termination and hiring of individual employees. In early May, Twitter let go of two executives and announced it would be “pausing most hiring and backfills” as positions became vacant. Musk’s counsel was notified of those decisions at the time and raised no objection.

134. Consistent with its hiring slowdown, Twitter announced on July 7, 2022 that it was reducing its recruiting staff—a small segment of Twitter’s total employee base—by about 30%.

135. These decisions aligned with Musk’s own stated priorities. Days after signing, on April 28, 2022, Musk texted Twitter’s board chair to say his “biggest concern is headcount and expense growth.” In a meeting with Twitter management on May 6, 2022, Musk again asserted that the company’s headcount was high and encouraged management to consider ways to cut costs. Musk repeated these themes in conversations with Agrawal and Segal throughout May and June. On June 16, Musk held a virtual meeting with Twitter employees. Asked what he was “thinking about layoffs at Twitter,” Musk responded that “costs exceed the revenue,” “so there would have to be some rationalization of headcount and expenses.” In his final conversation with Segal before purporting to terminate, Musk expressed his concern about Twitter’s expenses and asked why Twitter was not considering more aggressive cost cutting. And, as noted, Musk has refused to approve—or even discuss—Twitter’s proposed retention programs for key employees.

136. Twitter specifically negotiated for the right to terminate employees, including executives, without first having to obtain Musk’s consent. Musk had notice back in early May of many of the actions about which he now complains for the first time. He did not object then or at any point prior to his purported termination notice on July 8, because there was no violation.

D. Having materially breached the merger agreement, defendants are contractually barred from terminating

137. The merger agreement provides that if defendants are in material breach of their own obligations under the merger agreement, they cannot exercise any termination right they might otherwise have. Ex. 1 § 8.1(d)(i).

138. As set forth above, defendants materially breached their obligation to use their reasonable best efforts to complete the merger, id. § 6.3(a), materially breached the hell-or-high-water covenant requiring them to do all things necessary to consummate and finalize financing, id. § 6.10(a), materially breached their obligation to provide Twitter with information regarding the status of debt financing, id. § 6.10(d), materially breached their obligation to refrain from unreasonably withholding consent to operational decisions, id. § 6.1, materially breached their obligations to seek Twitter consent to public comments about the deal and refrain from disparaging the company or its representatives in Tweets about the merger, id. § 6.8, and materially breached their obligation not to misuse confidential information, id. § 6.4. They therefore cannot terminate the agreement even assuming they otherwise had such a right.

IX. After purporting to terminate, Musk keeps violating and confirms his earlier violations

139. After purporting to terminate the deal, Musk continued to make public statements disparaging Twitter and confirming the pretextual nature of his post-signing conduct.

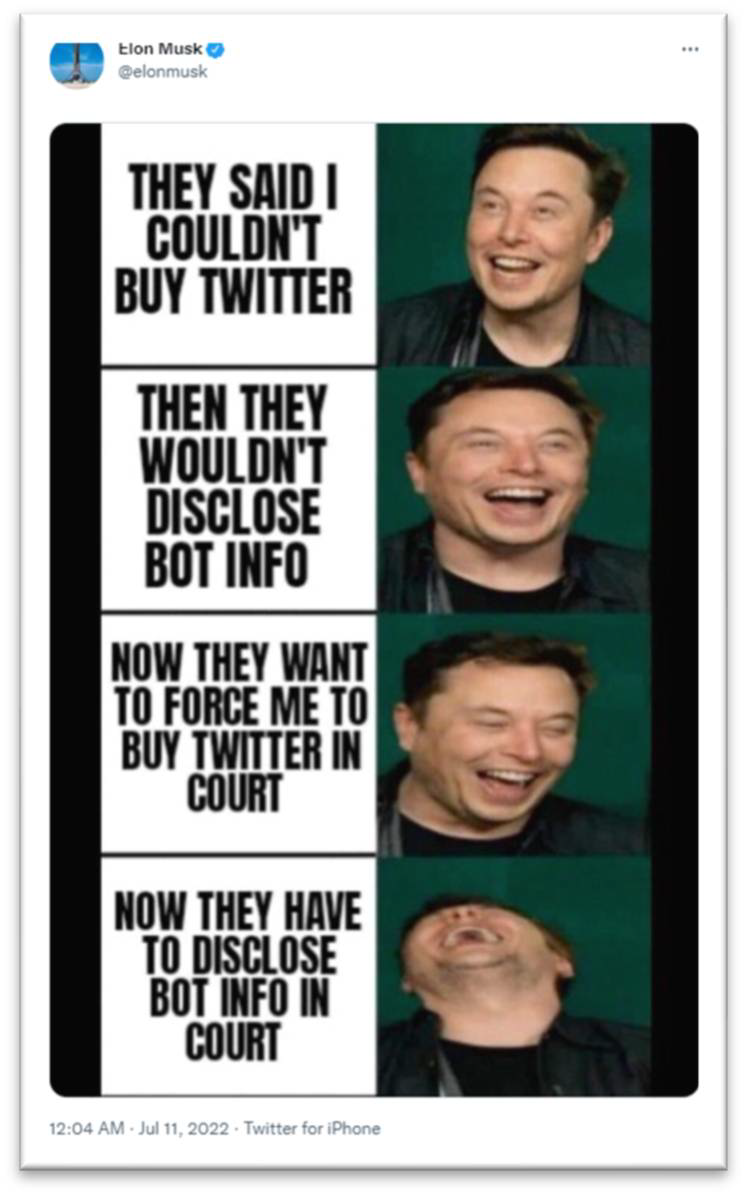

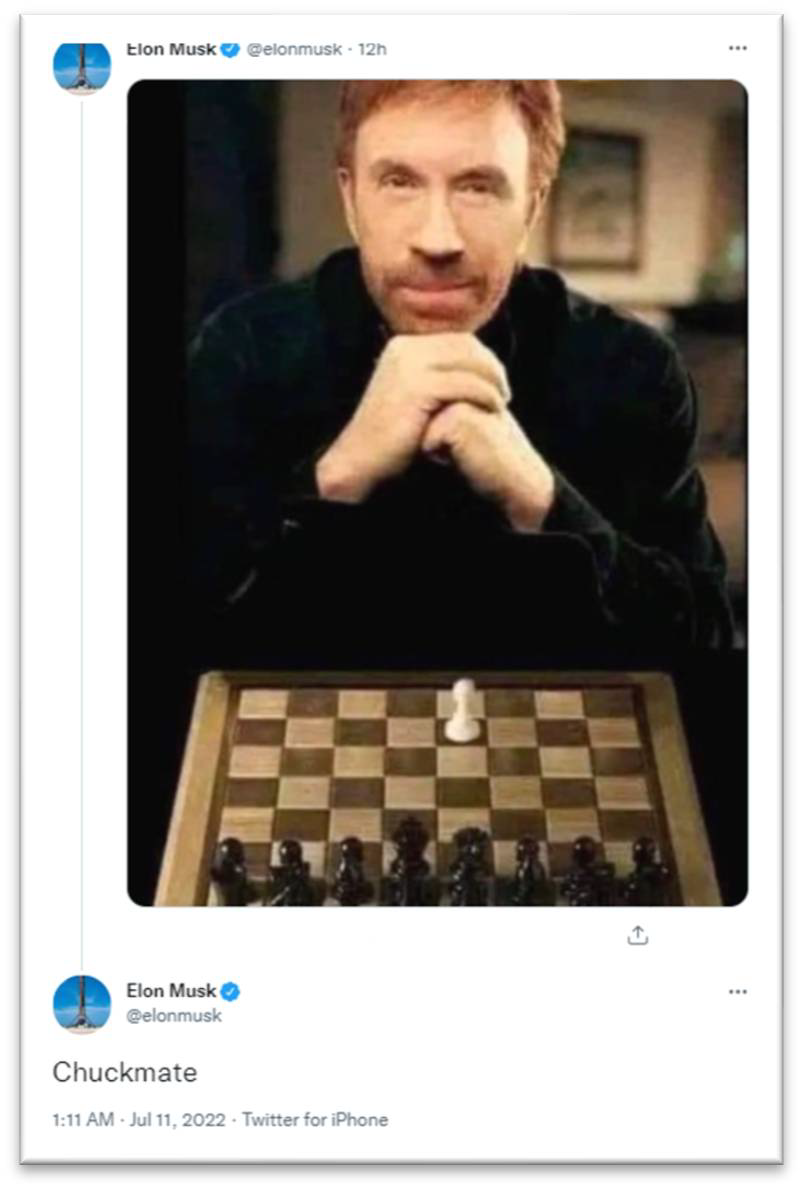

140. In the early morning of July 11 (Eastern time), Musk posted Tweets implying that his data requests were never intended to make progress toward consummating the merger, but rather were part of a plan to force litigation in which Twitter’s information would be publicly disclosed:

141. For Musk, it would seem, Twitter, the interests of its stockholders, the transaction Musk agreed to, and the court process to enforce it all constitute an elaborate joke.

124. Musk also, once again, publicly called for the SEC to investigate Twitter’s disclosures regarding false and spam accounts:

143. Musk’s conduct simply confirms that he wants to escape the binding contract he freely signed, and to damage Twitter in the process.

X. Twitter faces irreparable harm absent relief

144. Because of defendants’ breaches and the uncertainty they have generated, Twitter faces irreparable harm. Defendants stipulated in the merger agreement that “irreparable damage for which monetary damages, even if available, would not be an adequate remedy would occur in the event that the parties hereto do not perform the provisions of this Agreement (including failing to take such actions as are required of it hereunder to consummate this Agreement) in accordance with its specified terms or otherwise breach such provisions.” Ex. 1 § 9.9(a).

145. The expected closing date for the merger is fast approaching. The lone remaining application for regulatory approval is under consideration and the parties have received no indication of any obstacle on that front. Twitter is prepared to schedule a stockholder vote immediately upon clearance by the SEC of its proxy statement, as early as mid-August. Defendants must close “no later than” two business days after satisfaction of the closing conditions. Id. § 2.2.

146. Defendants’ actions in derogation of the deal’s consummation, and Musk’s repeated disparagement of Twitter and its personnel, create uncertainty and delay that harm Twitter and its stockholders and deprive them of their bargained-for rights. They also expose Twitter to adverse effects on its business operations, employees, and stock price.

147. Swift remedial action in the form of specific performance and injunctive relief is warranted.

Cause of Action

(Breach of Contract—Specific Performance & Injunction)

148. Twitter repeats and incorporates by reference the allegations above.

149. The merger agreement is a valid and enforceable contract.

150. Twitter has fully performed all of its obligations under the merger agreement to date, and is ready, willing, and able to continue so performing.

151. Defendants have breached the merger agreement by, among other things, violating Sections 6.1, 6.3, 6.4, 6.8, and 6.10.

152. In Section 9.9(a), each of the parties agreed that, without posting bond or other undertaking, the other parties “shall be entitled to an injunction, specific performance and other equitable relief to prevent breaches of this Agreement and to enforce specifically the terms and provisions hereof, in addition to any other remedy to which they are entitled at law or in equity.”

153. In Section 9.9(b), the parties expressly “acknowledged and agreed that the Company shall be entitled to specific performance or other equitable remedy to enforce Parent and Acquisition Sub’s obligations to cause the Equity Investor to fund the Equity Financing, or to enforce the Equity Investor’s obligation to fund the Equity Financing directly, and to consummate the Closing” if three conditions are met: (i) all of the conditions set forth in Section 7.1 and Section 7.2 have or will be satisfied at the closing; (ii) the debt financing has been funded or will be funded at the closing if the equity financing is funded; and (iii) the company has confirmed that the closing will occur.

154. All of the conditions set forth in Sections 7.1 and 7.2 have been satisfied or waived, or are expected to be satisfied or waived at the closing, and the closing will occur if the debt and equity financing are funded, which funding is solely within the control of defendants.

155. Twitter has suffered and will continue to suffer irreparable harm as a result of defendants’ breaches.

Prayer for Relief