Trump Tax Plan 2024: Details & Analysis

Former President Donald Trump has not released a fully detailed taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities.

plan as part of his current bid for reelection, but he has floated several tax policy ideas. Among the various ideas, he has made it clear he seeks to extend the expiring 2017 Tax Cuts and Jobs Act (TCJA) changes, further reduce the corporate income taxA corporate income tax (CIT) is levied by federal and state governments on business profits. Many companies are not subject to the CIT because they are taxed as pass-through businesses, with income reportable under the individual income tax.

rate, impose a 10 percent or higher universal baseline tariffTariffs are taxes imposed by one country on goods or services imported from another country. Tariffs are trade barriers that raise prices and reduce available quantities of goods and services for U.S. businesses and consumers.

on all imports, and lift current tariffs on China to at least 60 percent. He has also discussed a host of other tariff increases and additional tax cuts, which we do not model due to lack of detail.

We estimate that if the two major tariff increases are implemented and met with in-kind retaliation from all trading partners, it would more than offset the entire benefit of the major tax cuts for economic output and jobs, resulting in a net loss for the US economy.

Modeling the Major Trump Tax Proposals

Using the Tax Foundation’s Taxes and Growth model, we estimate the five major tax changes proposed by Trump would reduce US output by 0.1 percent, employment by 121,000 full-time equivalent jobs, and federal revenue by $1.7 trillion on a conventional basis and by $1.6 trillion on a dynamic basis. The capital stock and wages would be slightly larger, as the lower tax burden on business investment would not be entirely offset by tariffs. American incomes, as measured by GNP, would be 0.4 percent lower, as the increased budget deficit and national debt would require higher interest payments to foreigners.

While the major tax provisions would be pro-growth, a global trade war would threaten to undermine all the potential growth from better tax policy.

We estimate making the TCJA permanent and further reducing the corporate income tax rate would be pro-growth, boosting long-run GDP by 1.2 percent, the capital stock by 1.1 percent, wages by 0.4 percent, and employment by 926,000 full-time equivalent jobs.

The tax cuts would decrease federal tax revenue by $4.3 trillion on a conventional basis and by $3.6 on a dynamic basis. That reduction in revenue would come over a decade when the federal government is already projected to run deficits totaling $22 trillion.

Accordingly, a deficit-financed extension of the TCJA, plus additional deficit-financed tax cuts, would not be fiscally responsible. Finding offsets, whether reductions in spending or tax increases elsewhere, will entail tough but necessary trade-offs.

Those trade-offs, however, do not mean that pro-growth tax reform is out of reach. If policymakers focus on the least distortionary offsets to pay for the most pro-growth tax changes, it is absolutely possible to craft a pro-growth and fiscally responsible tax reform package.

Unfortunately, Trump has proposed a highly distortionary way to raise additional tax revenue through worldwide tariffs.

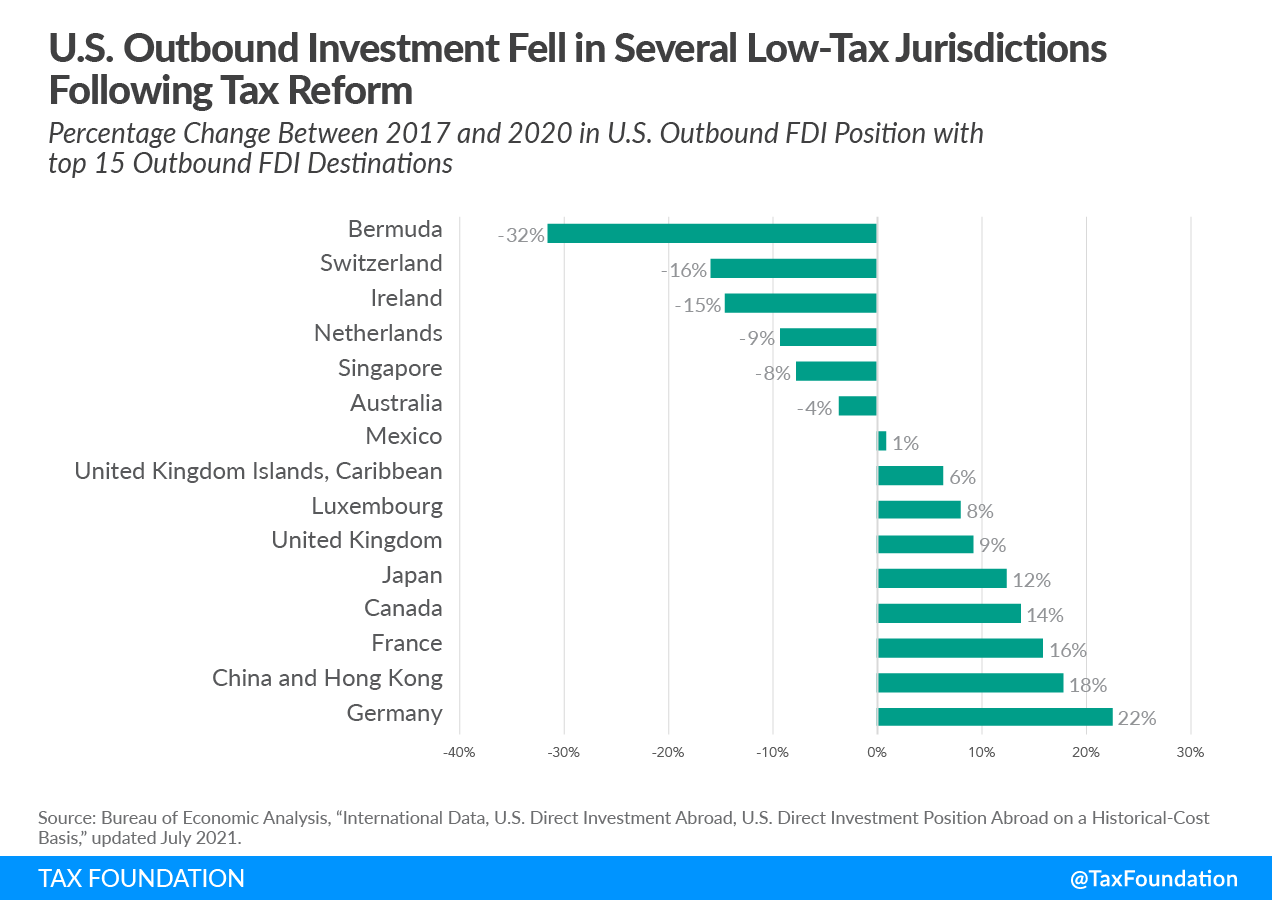

We estimate the proposed tariffs would reduce long-run GDP by 0.8 percent, the capital stock by 0.6 percent, and hours worked by 685,000 full-time equivalent jobs. In other words, the new tariffs alone—absent foreign retaliation—would threaten more than two-thirds of the increased output from the tax cuts (69 percent), while covering less than two-thirds of the cost (60 percent). Tariffs have no impact on pre-tax wages in our estimates because, in the long run, the capital stock shrinks in proportion to the reduction in hours worked. The capital-to-labor ratio, and thus the level of pre-tax wages, remains unchanged.

We estimate the US-imposed tariffs would increase revenue by nearly $2.6 trillion over the 10-year budget window. Our revenue estimates include noncompliance and changes in the level of imports based on a price elasticity of imports of -0.997, both of which reduce the tax baseThe tax base is the total amount of income, property, assets, consumption, transactions, or other economic activity subject to taxation by a tax authority. A narrow tax base is non-neutral and inefficient. A broad tax base reduces tax administration costs and allows more revenue to be raised at lower rates.

, and offsets for income and payroll taxes, which reduce the overall revenue raised from higher tariffs.

If the tariffs are met with in-kind retaliation, matching the increases on all goods exports plus additional tariffs on goods exports to China, we estimate they would reduce US GDP by an additional 0.4 percent in the long run while raising no additional revenue for the US government. Because foreign retaliation would reduce US output and incomes, it would lead to a drop in tax revenues on a dynamic basis.

While Trump’s proposals would cut taxes overall, they would raise revenue in a more distortive way, resulting in a smaller economy with fewer jobs. Further, the increase in the budget deficit would lead to higher interest payments made to foreigners, resulting in a reduction in American income (GNP) of 0.4 percent.

Trump has discussed other, smaller tax policies as part of his campaign, but due to the lack of details and small magnitude of the proposals, we exclude them from our revenue and macroeconomic estimates. For instance, he has proposed excluding tips from taxation, but whether that would include income and payroll taxes, or just income taxes, has not been specified. If the exclusion was just for income taxes, we estimate a lower bound for the revenue reduction would be about $107 billion from 2025 through 2034. Such a policy has no clear rationale and would worsen distortions in the tax code, providing a carveout for one industry and type of labor compensation but not others.

The major policies outlined by Trump would reduce distortions in one part of the tax system only to replace them with new distortions in another part of the tax system, which risks shrinking the economy and growing the debt. If anything, our modeling likely understates the potential downsides of a global trade war, as the tariffs may threaten the broader economic benefits of a globalized economy.

Download Full Revenue Table

Modeling Notes

We assume TCJA permanence entails the following changes, described here in our recent publication:

- Lower rates and reconfigured brackets

- Larger standard deductionThe standard deduction reduces a taxpayer’s taxable income by a set amount determined by the government. It was nearly doubled for all classes of filers by the 2017 Tax Cuts and Jobs Act (TCJA) as an incentive for taxpayers not to itemize deductions when filing their federal income taxes.

- Eliminated personal exemption

- Larger child tax creditA tax credit is a provision that reduces a taxpayer’s final tax bill, dollar-for-dollar. A tax credit differs from deductions and exemptions, which reduce taxable income, rather than the taxpayer’s tax bill directly.

- Limited itemized deductions, including for state and local taxes paid, home mortgage interest, and miscellaneous

- Eliminated Pease limitation

- Larger AMT exemption and exemption phaseout thresholds

- 20 percent deduction for pass-through businessA pass-through business is a sole proprietorship, partnership, or S corporation that is not subject to the corporate income tax; instead, this business reports its income on the individual income tax returns of the owners and is taxed at individual income tax rates.

income and limitation on noncorporate losses - Larger estate tax exemptionA tax exemption excludes certain income, revenue, or even taxpayers from tax altogether. For example, nonprofits that fulfill certain requirements are granted tax-exempt status by the Internal Revenue Service (IRS), preventing them from having to pay income tax.

- 100 percent bonus depreciationBonus depreciation allows firms to deduct a larger portion of certain “short-lived” investments in new or improved technology, equipment, or buildings in the first year. Allowing businesses to write off more investments partially alleviates a bias in the tax code and incentivizes companies to invest more, which, in the long run, raises worker productivity, boosts wages, and creates more jobs.

- Expensing for research and development (R&D)

- Deduction for net interest limitation based on EBITDA

To model the economic effects of tariffs, we treat them as an excise taxAn excise tax is a tax imposed on a specific good or activity. Excise taxes are commonly levied on cigarettes, alcoholic beverages, soda, gasoline, insurance premiums, amusement activities, and betting, and typically make up a relatively small and volatile portion of state and local and, to a lesser extent, federal tax collections.

. As an excise tax, tariffs create a wedge between the price a consumer pays and the price a producer receives. In Tax Foundation’s modeling, we hold the price level constant, passing tariffs back to the factors of production. In other words, tariffs reduce the amount of revenue businesses have to compensate their workers and shareholders, resulting in a reduction in real incomes.

To model the revenue effects of US-imposed tariffs, we first take the affected imports based on 2023 levels multiplied by the inclusive tariff rate (consistent with the revenue estimating convention that the price level remains constant). We then apply a noncompliance rate of 15 percent, based on the average tax gapThe tax gap is the difference between taxes legally owed and taxes collected. The gross tax gap in the U.S. accounts for at least 1 billion in lost revenue each year, according to the latest estimate by the IRS (2011 to 2013), suggesting a voluntary taxpayer compliance rate of 83.6 percent. The net tax gap is calculated by subtracting late tax collections from the gross tax gap: from 2011 to 2013, the average net gap was around 1 billion.

, an elasticity of import demand with respect to price of -0.997, and income and payroll taxA payroll tax is a tax paid on the wages and salaries of employees to finance social insurance programs like Social Security, Medicare, and unemployment insurance. Payroll taxes are social insurance taxes that comprise 24.8 percent of combined federal, state, and local government revenue, the second largest source of that combined tax revenue.

offsets of approximately 29 percent. On a dynamic basis, revenue falls further as tariffs result in a reduction in real incomes and output.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Subscribe

Share