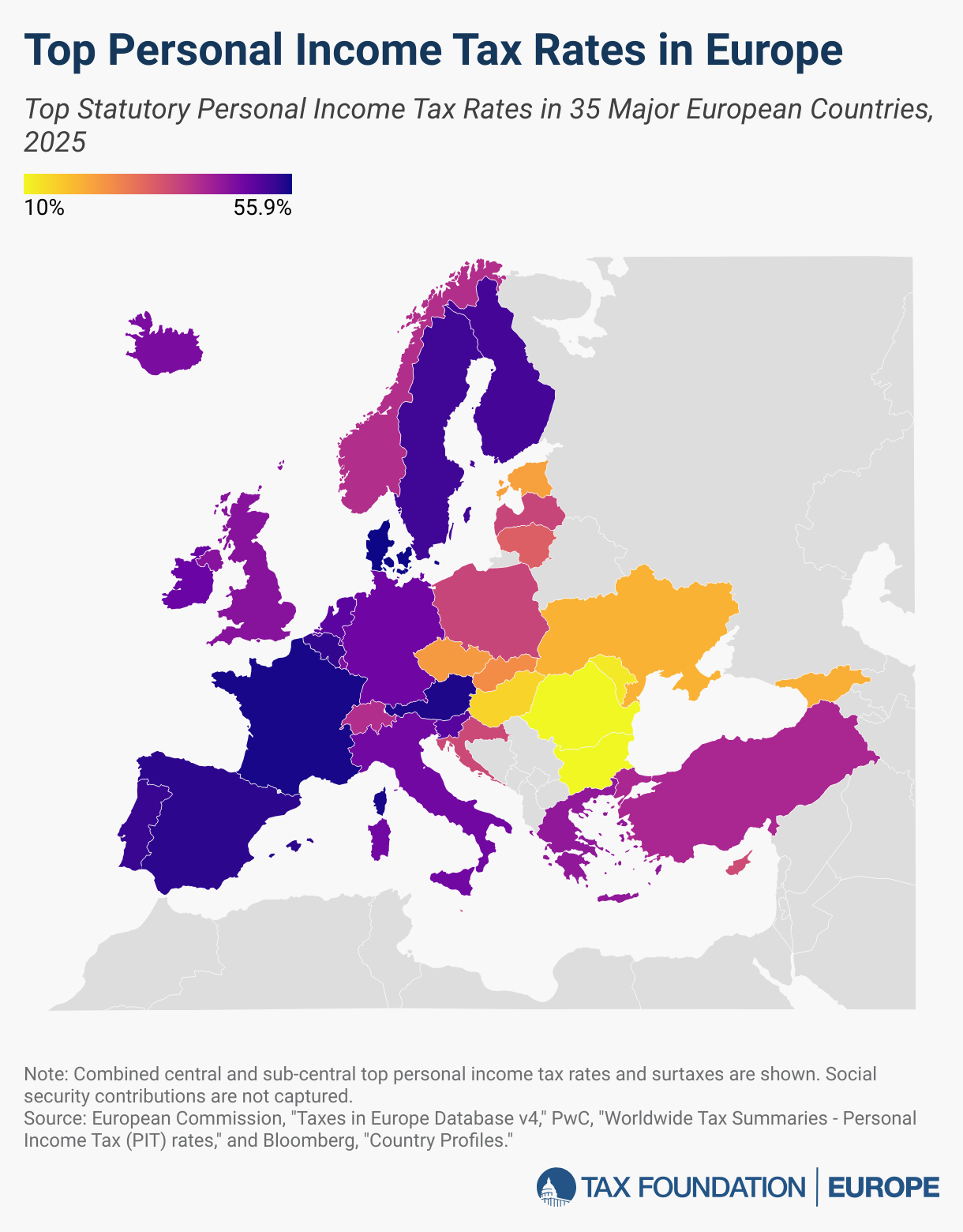

Top Personal Income Tax Rates for Europe in 2025

In 2025, the average top rate of personal income tax in OECD countries will be 42.8 percent. Denmark (55.9%) France (55.4%) and Austria (55%) have the highest top tax rates. Hungary (15 percent), Estonia (22 percent), and the Czech Republic (23 percent) have the lowest top rates.

European countries that are not part of the OECD tend to feature lower rates and tax personal income at a single rate. Bulgaria and Romania (10 percent) levy the lowest rate, followed by Moldova (12 percent), Ukraine (19.5 percent), and Georgia (20 percent).

For comparison, the average combined state and federal top income tax rate for the 50 US states and the District of Columbia lies at 42.14 percent as of January 2025, with rates ranging from 37 percent in states without a state income tax to 50.3 percent in California.

Two European countries have increased their top personal income tax rates from last year. Estonia increased its flat income tax rate from 20 to 22 percent, while Latvia increased its top rate from 31 to 36 percent.

Other European countries are due for potential changes to their top personal income tax rates in the coming years. Austria plans to reduce its top tax bracket from 55 percent to 50% in 2026. Surtaxes are additional taxes that are levied over and above existing business or individual taxes. They can be flat or progressive. Surtaxes usually fund a particular program or initiative. However, revenue from broad-based taxes like the individual income tax is used to fund many programs and services.

–which increases the country’s top personal income tax rate from 45 to 47.475 percent–is currently undergoing judicial review.Stay informed on the tax policies impacting you.Subscribe to get insights from our trusted experts delivered straight to your inbox.