.png)

Top Five Integration Best Practices to Achieve Maximum Revenue Synergies

It Is Up To You to Stack the Deck

By Mark Herndon, Chairman of the M&A Leadership Council

Integration is tough. There are no formulas. No cookie-cutter patterns. Seldom a simple solution. But as my friend and President Emeritus of the M&A Leadership Council, Jack Prouty, says – there is a way you can “stack the deck for success.”

Your organization can diligently apply specific integration best practices – proven to yield demonstrable business results, and do just that. For the last 10 years, most organizations have principally pursued revenue growth acquisitions. Even post-COVID, according to research conducted by the M&A Leadership Council and published in early April 2020, Global M&A Reset: During and After the COVID-19 Storm, 57% of skilled acquirers reported that even post-COVID they planned to continue pursuing revenue growth synergies in existing segments. Unfortunately, relatively few organizations have an adequate understanding of the specific integration best practices that are both statistically and experientially linked to outperforming revenue synergy capture objectives.

The Council, together with a partner organization, M&A Partners, led a study among over 150 skilled acquirers that shed light on this critical linkage. This distinctive study, The State of M&A Integration Effectiveness®, assessed 40 specific integration best practices and over twenty business result outcomes – among them achieving revenue growth synergy estimates, cost synergy objectives, accelerating the pace of integration, and minimizing “value erosion” or unanticipated business disruption, among other outcomes. Working with an external statistician, we then conducted extensive regression analyses and predictive modeling – testing each specific integration best-practice against each business result outcome to determine the highest correlation between each best practice and business results.

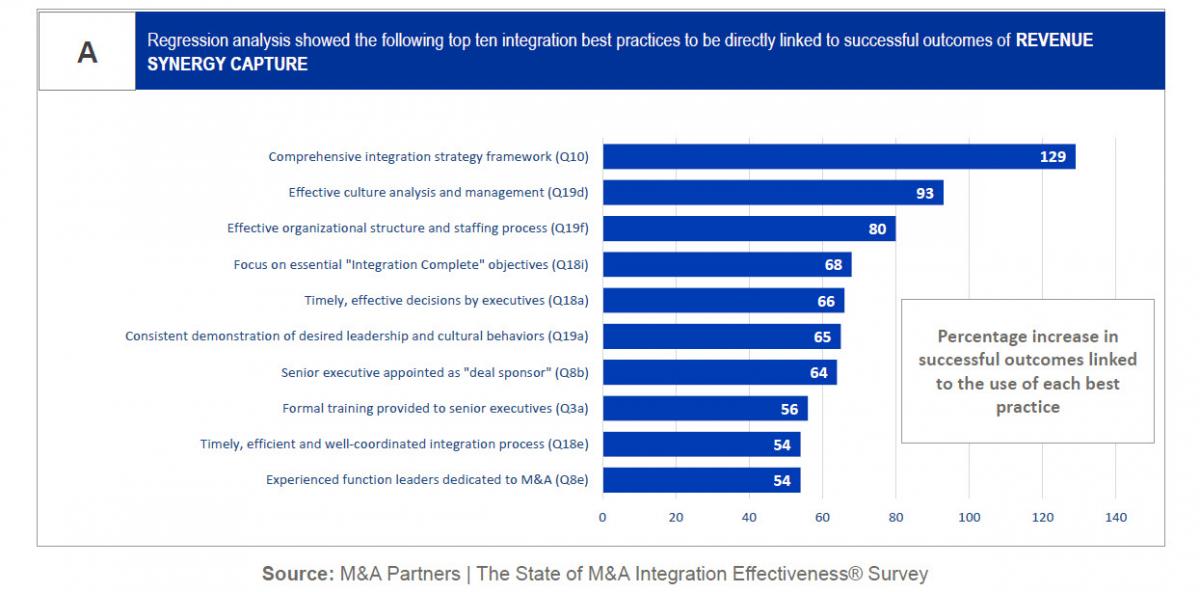

So, what are the top specific integration practices proven to have a direct correlation to achieving revenue growth synergies? I’ll bet one or two of them will be a surprise. Others confirm what we have long known. We’ve summarized the top ten integration best practices most highly correlated with achieving revenue growth synergies in this downloadable resource, Integration Practices That Drive Maximum Revenue Growth Synergies.

To learn more about the entire survey design, objectives, methodology, etc., I need to refer you to the webinar overview deck linked here. But let’s clarify what you are looking at in the charts attached in this inset chart and available download. We analyzed 40 integration practices and primary business result outcomes. We also conducted a regression analysis on each best method for each business result outcome to determine which best practices made the most significant impact on business results. While this specific chart shows only the “top ten” integration practices most effective at driving revenue growth synergies, many of the other integration practices had a robust statistical correlation.

The next thing to keep in mind is that these charts compare “success to success” as the best measure of the impact attributed to the specific integration practice. For example, we first isolated the response data where a successful business outcome was reported. Next, we reviewed each respondent’s data to determine which, if any, of the integration practices in our study were used in accomplishing that successful business outcome. Finally, we calculated the percentage differential between those who performed the successful business outcome with that specific integration best practices vs. those that still accomplished a successful business outcome – but did so without using our specific integration best practices. The results data in the inset chart show the percentage increase in successful business outcomes linked to the use of each integration best practice.

So how can your organization “stack the deck for success” in achieving revenue growth synergies? Rigorously apply these five essential best practices – each highly correlated in our study with successful outcomes of meeting or exceeding their revenue growth synergy objectives.

- Integration Strategy Framework. This best practice was the #1 most highly correlated best practice across multiple business result outcome categories, including revenue synergy capture. In this data set, those organizations effectively developing and deploying an integration strategy framework before launching integration were 129% more likely to accomplish their revenue synergy capture objectives than acquirers that did not use this best practice.

- Effective Culture Analysis and Management. This best practice was the second-highest in correlation to revenue synergy capture with a 93% differential over those organizations not able to accomplish this best practice. I know this should not be a surprise to us or any experienced M&A executives, after all, culture has only been identified as a critical success factor (and/or principal deal failure factor) by nearly every major M&A study since the beginning of time. But, quite frankly, we were still surprised by this finding. Conceptually, we get it and have said so in our prior work and current engagements. Financially and strategically, this can only be interpreted as one more haunting validation of the core principle, culture counts, and we have to get culture right at every stage of the M&A life cycle to ensure we achieve the deal’s most important stated objectives!

- Effective Organizational Structure and Staffing Process. This best practice was the third-highest correlation to revenue synergy capture, with an 80% differential over those organizations not practicing this discipline. There’s certainly no surprise here. Integration requires change. Even skilled acquirers often drop the ball when it comes to having well-developed organization design, restructuring, staffing, talent management, and exit procedures. Much less the leadership skills, empathy, on-point messaging, and support mechanisms to take these essential “must-do” initiatives to the level of right best practice.

- Focus on Essential “Integration Complete” Objectives. This best practice ranked fourth, at a 68% revenue synergy success differential. Our alumni have heard my true story of the non-client who called out-of-the-blue and asked that I review their integration project so I could advise them on why they were “stuck in the mud” and not nearly completed with integration after over 18 months of work. I reluctantly agreed. When the integration plan arrived, it was evident that this was a real piece of work – business analysis and program management overkill, consisting of over 5,000 “significant” milestones, complex dependencies, budgets, Gantt charts, and hundreds of pages of task-level detail.

- Timely, Effective Decisions by Executives. This best practice rounds out the top-five highest correlations to synergy capture objectives, with a 66% success differential. In our view, this makes sense from many perspectives. Successful integration requires hundreds, if not thousands, of decisions. Executives love to preach “speed of integration” but are often not adequately prepared or equipped to make the major decisions in an effective and timely manner. Thus, causing a delay, ambiguity – or worse, a vacuum, those other assumptions quickly fill. The solution, of course, requires multiple disciplines. A productive integration management office that drives the effort. A robust reporting/statusing cadence that shines the light of accountability on all integration actions and decisions, to include those needing executive choices, a decision calendaring and analysis process ensuring executives are equipped to decide when time, and the all-important “RAID management process,” which surfaces weekly risks, action items, and decisions needed for immediate attention.

Finally, let’s circle back to where we started. There is no formula, and no cookie-cutter solutions. These best practices provide a foundation for success, the proverbial “stacking the deck” in your favor. The best acquirers then carefully build on that foundation with a strategic, timely and effective go-to-market strategy, comprehensive sales training and sales team alignment plan, sales-lead triage process to effectively manage acquired product introductions to legacy accounts as well as introducing legacy products to acquired company accounts – and much more, all driven by a fully detailed commercial work-stream integration plan of record.

Interested in learning more about M&A Integration success? Registration is now open for our October 2022 Live-Online training – The Art of M&A® Executing Integration for Maximum Results – sign up today!

_____________________________________________________________________________________

Editor’s Note: for more insight about these, and other integration best practices driving business result outcomes, attend our upcoming training program, The Art of M&A® Executing Integration for Maximum Results.