Tobacco Tax Data Tool | Cigarette Tax Revenue & Cigarette Smuggling

Tobacco is the most highly taxed consumer product in the United States. The tools on this page allow you to explore state tax rates and the effects tax policy and tobacco regulations can have on state revenues, smuggling, and effective tax rates for different income groups.

Cigarettes are taxed at the federal, state, and sometimes even local levels. These layers of taxes often result in very high levels of taxation. Taxes make up nearly half of the retail price of cigarettes nationwide. In New York and Washington, D.C., more than 60 percent of the price paid by consumers comes from taxes.

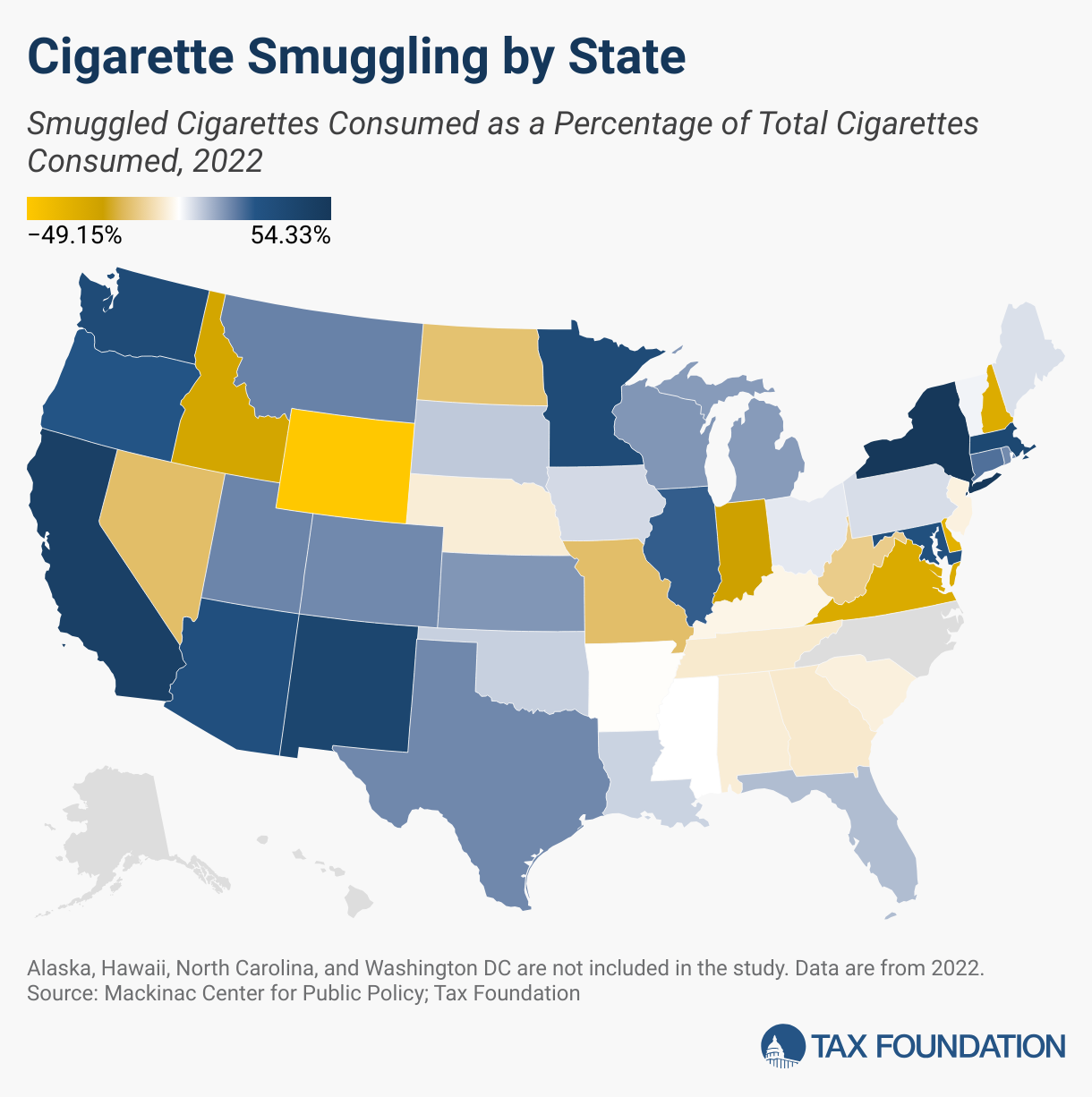

Taxation varies greatly from state to state, and large differences in prices drive smuggling. Low-taxed products commonly find their way into high-tax states. For instance, in 2020, New York was the highest net importer of smuggled cigarettes. 53.5 percent of cigarettes consumed in New York were purchased illicitly or from other states. New York also has one of the highest state cigarette taxes at $4.35 per pack, and New York City levies an additional $1.50 cigarette tax per pack.

Layers of taxation force state and federal governments to consider each other’s tax policies. Because consumption is impacted by price, a federal tax hike, which would increase retail prices and shrink consumption, would impact revenue generated by state governments. In other words, federal tobacco tax increases decrease state tax revenue by driving down legal consumption.

More recently, the U.S. Food and Drug Administration (FDA) proposed product standards that would further restrict the kind of tobacco products that can be legally sold. In 2022, the FDA proposed a ban on menthol cigarettes and flavored cigars. In 2020, menthol cigarettes accounted for 37 percent of the cigarette market. We estimate that a menthol ban would decrease tax collections by more than $6 billion per year.

Even more impactful would be a very low nicotine (VLN) product standard. The FDA could propose a product standard that would limit the (naturally grown) nicotine levels in tobacco. The result could be a de facto prohibition on cigarettes. The consequences of such a ban would be greater in magnitude than any tobacco regulation or tax implemented to date.

Finally, excise taxes on tobacco are highly regressive. This means that low-income Americans pay a greater share of their income in tobacco excise taxes than higher-income groups. Consumption taxes are almost always regressive, but cigarette taxes tend to be the most heavily burdensome on low-income households.

In this tool, you can explore state tax rates, smuggling rates, effective tax rates for different income groups for cigarette taxes, and the negative revenue effects of a $1 federal tax increase, a federal menthol ban, and a VLN product standard.

Explore Related Research