The Value-at-Risk Report: Assessing Integration Risk & Readiness During Due Diligence

Assessing Integration Risks Leads to Understanding Target Value Drivers

By Jack Prouty, Past President of M&A Leadership Council

While the due diligence process certainly can reveal the financial worthiness of the target, it often does not include an examination of the buyer or target’s business operational, organizational or cultural characteristics, or their readiness to become integrated.

The focus of leadership’s attention after a target has been identified is typically consumed with “doing the deal.”

The investment bankers are concerned with valuation and pricing, and the due diligence professionals are wrapped around the financials.

Whether the plan is to preserve, consolidate or integrate the two businesses, the non-financial characteristics of the deal have proven to be crucial to the planning and execution of a successful integration.

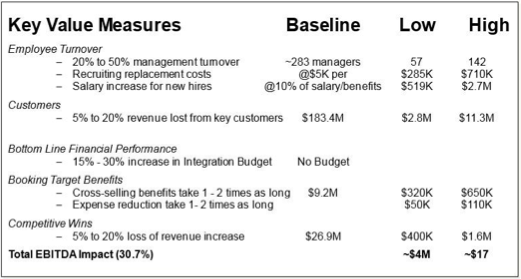

SAMPLE VALUE-at-RISK REPORT

$4 to $17 Mil in Value are Potentially at Risk

One of the essential keys to a successful outcome for an M&A is to conduct an assessment of the integration risks and organizational readiness for change as early as possible in the process…. i.e., during the period you are doing your normal due diligence.

The fundamental purpose for assessing the risk of integration for a potential acquisition is to identify possible issues, barriers and opportunities that may not have surfaced as a result of the formal due diligence.

These are the same issues and barriers that, left unresolved, could challenge the strategic, operational and financial objectives and goals of the deal.

Every potential acquirer must ask itself how ready it is to bring the target into the fold. Are the goals of the deal realistic? Is this target operationally sound and are their best qualities transferable?

There is a scientific methodology and approach to these questions that will identify the risks and readiness for both companies to make the strategic vision a reality.

An Integration Risk Assessment can assess, at a high level, their preparedness to successfully integrate the organizations and thereby achieve the strategic, operational and financial goals of the deal.

It can also help identify the areas of potential business risk that could present a challenge to meeting the deal’s stated objectives and goals.

An Integration Risk Assessment could assist the companies in determining the potential areas of value erosion, value realization (recovering the price premium and integration costs as well as achieving the expected synergies), and leveraging the value creation opportunities. It can also provide an integration framework that quantifies and qualifies any potential risk associated with critical asset erosion. It would also help to identify the path forward for successfully integrating the businesses.

Activities surrounding a typical Integration Risk Assessment would include:

- Validating the acquisition strategy and rationale

- Assessing the strategic fit with your business and your operating model

- Identifying the value drivers and determining the ability to capture or leverage

- Determining areas of business risk and integration complexities (organizationally, strategically, operationally and culturally)

- Outlining a Critical Success Factor Readiness Report Card

- Developing as an output the Value-at-Risk for this acquisition / integration

The first thing a company should do is clearly understand the value drivers of the acquisition candidate. What does the term “value drivers” really mean?Values drivers are what separate a company from competitors. They are the key elements that either build the value of a business or protect the value created.

Value drivers of a company will vary by industry, but here are the typical value drivers to be identified, understood and assessed for a potential acquisition candidate.

Each has some key questions to be addressed:

Organization Value

- : How well is it aligned with our organization structure (functions, job titles, staffing levels, etc.)? Does it have established processes and procedures? Are they mature, evolving, or very embryonic in nature? Does the company have a strong infrastructure to support its business (support functions that are properly staffed, operated and skilled; back office/core functions, etc. )? How well managed is the business, both at the senior and functional levels? Customer Value

What is their customer base compared to ours? How similar are our customer bases? Is the customer base of their company concentrated or diversified? What is the customer value proposition of their company? What are their customer’s characteristics and attributes? What is their market share? What is the market pull for their products/services? - Employee Value

: Do they have strong, capable management? Does it have strong functional/technical knowledge workers? Does it have an employee-focused, positive culture? Do its business values and its treatment of its staff align with ours? Strategic Value - : Does the business value chain of its competitor align well with yours? Does it have a strong brand recognition on its market and with its customers? Are there barriers to entry? Does it have a realistic, solid business plan? Does it have a strategic vision for growth and a solid, realistic plan? Does it have a strong competitive position?

- Product and Service Value: Does it have high quality products or services? Is it in a growth industry or market niche? Does it align, complement or expand our service and product offering? Does it have a positive reputation on the market for its product/service reliability and performance? What is its R&D/Product Development pipeline? What is the R&D/Product Development pipeline?

– - Goodwill value Does it have strong brand names and product names

? What is the company’s reputation among key stakeholders, including customers, employees and suppliers, as well as community members and investors? Do they have unique and protected patents? What are their intangible assets, such as trademarks, logos, and copyrights? What is their “special sauce”…. those things that make them special or unique? - It may not be possible to assess all of the questions brought up here, but these are the value drivers that need to be considered in evaluating an acquisition candidate.With an understanding of the value drivers, and within the context of the Integration Risk Assessment activities outlined above, the end objective is to quantify the potential business value at risk (i.e. Value @Risk. This value-at-risk needs to be addressed and managed during the integration planning and implementation that follows the due diligence.

Here are the typical areas of value erosion that must be assessed and quantified as a buyer seeks to integrate an acquisition candidate into a business:

What percent of the combined customer base will we lose upon integration (and why)? (Note: In some acquisitions, it may be a best practice to retain 85-90% customers)?

–

- Are we going to cannibalize some products or services as a result (and what will the implications be)? What are the risks of changing the brand, logo, or company name of the acquired firm? Note: Macy’s purchase of Marshall Fields, followed by renaming the stores Macy’s, is a good example. Note: How often do successful founders of game-changing technologies want to be a part of a large bureaucratic organization? )

-

Given the differences between our customer value propositions, how we face the customer, and how we reward and manage our sales forces, how successful are we going to be in effectively integrating this function in the new organization?

-

….. and the list goes on!

Bottom Line… to change the paradigm and be more successful at M&A integration, we need to start earlier in the process of understanding the areas of value and risks in the integration and thereby be in a position to better plan and manage the integration effort. -

The Integration Risk Assessment resulting in a Value-at-Risk report-out, is an extremely valuable tool to add to every M&A toolkit.

——————————————————— -

Learn more about mergers, acquisitions and divestitures at M&A Leadership Council’s virtual or in-person training courses. Our expert consultant trainers prepare you for your next transaction or help with an ongoing transaction through practical insights, case studies, group discussions, and breakout exercises.