“The Taxes Are Falling, The Taxes Are Falling!” Maybe?

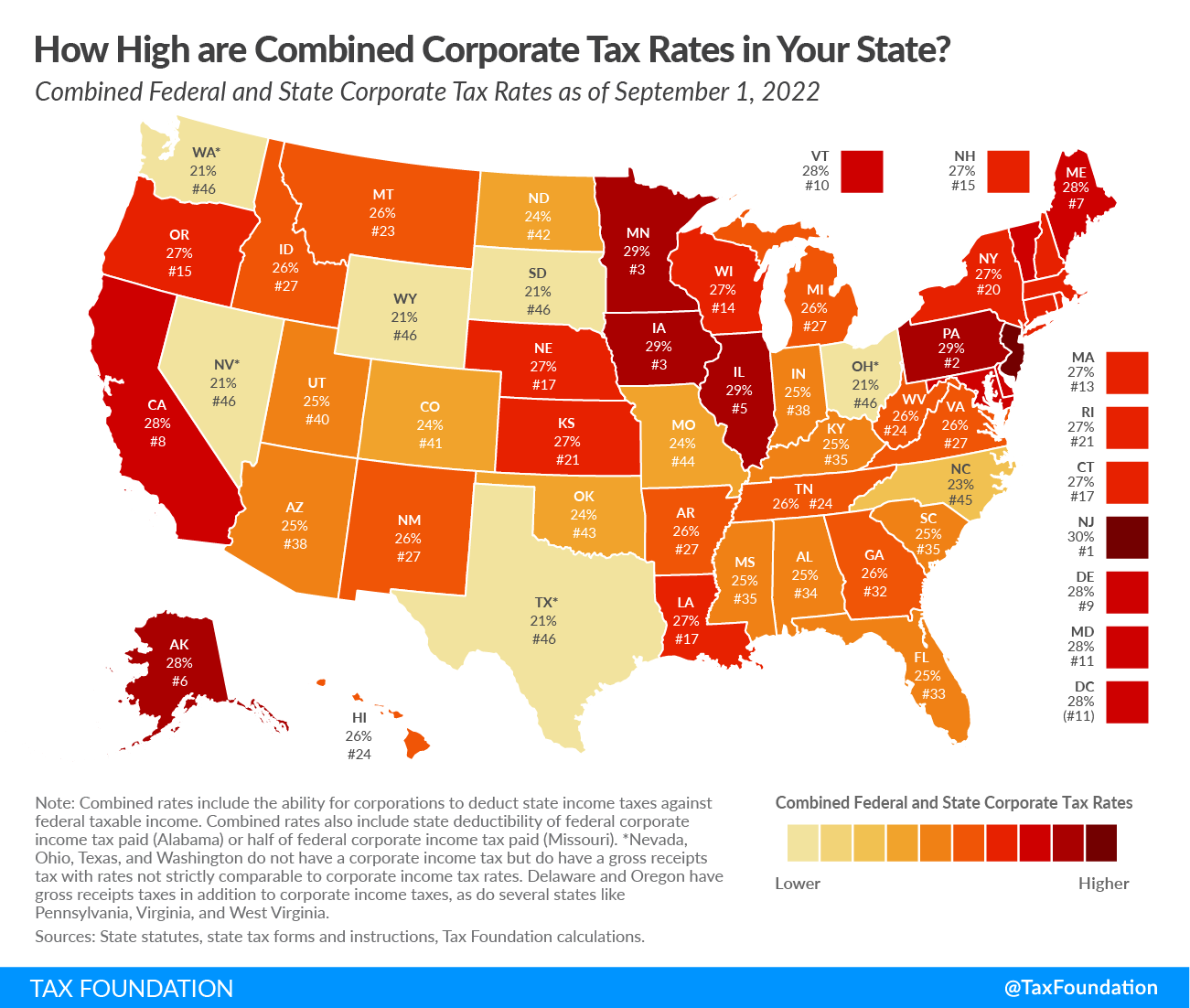

Are billionaires’ taxes falling? The answer lies in your view of corporate taxes. TPC’s Howard Gleckman examines the question from multiple angles. Who pays the corporate tax, and when do they pay it? Who benefits from corporate tax cuts? How one answers those questions will shape their view of efforts to change the corporate tax rate.

Republican lawmakers call for repeal of firearms tax. The , enacted in 1934, authorizes a $200 tax on the sale of short-barreled shotguns and rifles, supressors, and certain explosives. Sens. John Cornyn (R-TX), Tom Cotton (R-AR), and 11 other Senate Republicans have introduced the Repealing Illegal Freedom and Liberty Excises (RIFLE) Act to repeal the tax.

“Hakuna matata,” Great White Way. The New York Times takes a look at New York State’s tax credit program for the theater industry, which hit hard times during the pandemic. “The Lion King” is among the top-grossing productions on Broadway, with nearly $2 billion in revenue over 26 years. Does the production need a $3 million tax break? New York has so far given $100 million in tax credits to commercial productions in three years. Democratic Gov. Kathy Hochul is considering whether to renew the program after its expiration next year.

Kansas lawmakers head back to the tax plan drawing board. Democratic Gov. Laura Kelly vetoed the latest tax cut plan from the state legislature and has called them back to the state capitol for a special session. She’ll announce the date this week, and wants lawmakers to deliver a bipartisan plan with “comprehensive, sustainable tax cuts.”

A VAT on financial transactions in Kenya. The Kenyan government plans to charge a value-added tax on financial transactions. An industry lobbying group argues the plan would increase total taxation on financial services from 15 percent to 40 percent. “The increased cost of banking to customers will hamper financial inclusion efforts, particularly affecting low-income individuals and small businesses,” Kenya Bankers Association Chief Executive Officer Raimond Molenje said.

For the latest tax news, subscribe to the Tax Policy Center’s Daily Deduction. Sign up here to have it delivered to your inbox weekdays at 8:00 am (Mondays only when Congress is in recess). We welcome tips on new research or other news. Email Renu Zaretsky.