The State of Corporate Sustainability: Key findings for CFOs

CFOs lead ESG integration, leveraging ERP, AI, and third-party tools for strategic advantage amid rising regulations.

– Blog home

As the global business environment continues to evolve, the 2024 State of Corporate ESG report by Thomson Reuters Institute sheds light on the shifting dynamics of Environmental, Social, and Governance (ESG) initiatives. As stewards of financial integrity and sustainability, CFOs and sustainability officers are at the forefront of this transformation, tasked with integrating ESG into the core of daily business operations.

This year’s report highlights the increasing regulatory pressures and the strategic role of technology and leadership in navigating these complexities. Here, we explore the key insights from the report, focusing on the essential integration of ERP systems in ESG software deployment.

Highlights:

|

Jump to |

The growing importance of ESG in corporate strategy

The report highlights the increasing importance of ESG in corporate strategy. The report highlights the growing importance of ESG in corporate strategy. This shift is particularly relevant for CFOs, who are now more involved in ESG management and leveraging their expertise in assurance and compliance. This shift is particularly relevant for CFOs, who are now more involved in ESG management, utilizing their expertise in assurance and compliance.

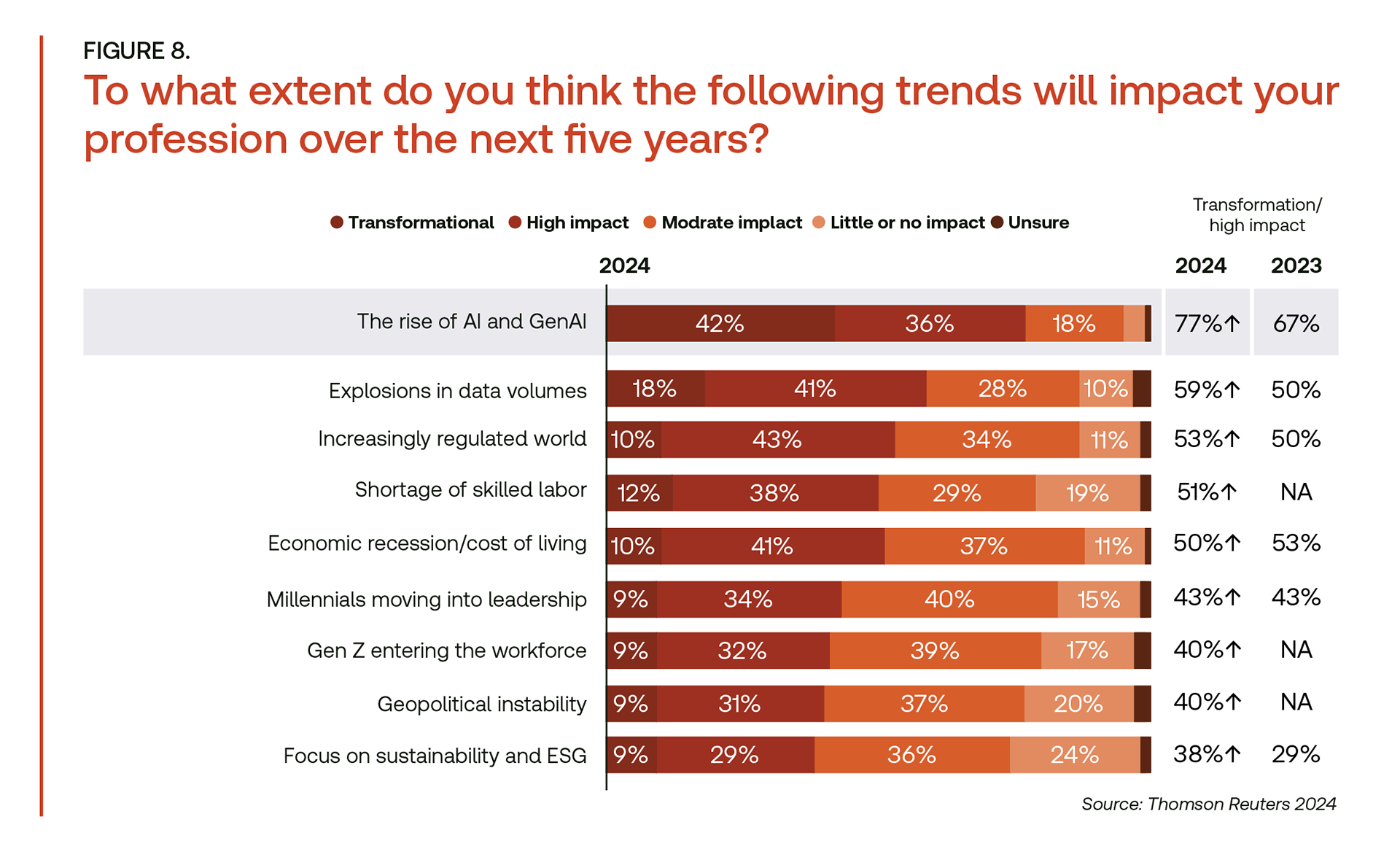

Despite geopolitical tensions, extreme weather events, and economic challenges, companies are increasingly prioritizing ESG as a core component of their business strategy. The report shows that 82% of the C-suite believes ESG will have a critical role in corporate performance. This is up from 72% back in 2023. This growing emphasis is driven by the need for compliance and the potential competitive advantages ESG initiatives offer, such as enhanced brand reputation and improved business resilience.

As companies deepen their commitment to ESG, their agendas are expanding beyond traditional greenhouse gas emissions. The report highlights a greater focus on water usage and biodiversity, as well as human rights. This reflects a holistic approach to sustainability. This broadened focus is essential as companies navigate the complexities of new regulations and societal expectations.

ERP integration: A must for ESG software deployment

One of the critical insights from the report is the necessity of integrating ESG software with existing Enterprise Resource Planning (ERP) systems. ERP compatibility is a priority for companies as they strive to streamline their data collection and reporting process. Companies can effectively manage and report ESG information by leveraging their existing ERP systems. This is a vital capability as regulatory requirements continue to grow. This integration ensures that ESG tools work seamlessly within a company’s existing data ecosystem.

For CFOs, ensuring ERP compatibility is a top priority when selecting third-party ESG software solutions, as it allows for effective utilization of existing data and systems. A CFO from a consumer goods manufacturer stated, “We wanted to ensure our ESG data solution was easily compatible with our existing ERP system.” This sentiment is echoed across industries, highlighting the need for cohesive data management solutions that support comprehensive ESG reporting

The rising role of CFOs in ESG reporting

CFOs are increasingly taking center stage in ESG management, leveraging their expertise in regulatory compliance and financial reporting. As ESG regulations tighten, CFOs are well-positioned to lead these initiatives that ensure companies meet new standards and maintain transparency.

As experts in financial reporting and compliance, CFOs oversee ESG activities, particularly where these intersect with product or innovation teams. This role requires ensuring that processes are rigorous to meet financial and non-financial standards, as required under regulations such as the European Sustainability Reporting Standards.

CFOs advocate for strategic investments in ESG, seeing it as a competitive advantage. This involves collaborating with cross-functional teams to ensure accurate data gathering and compliance with emerging ESG regulations.

Despite this, the complexity and costs associated with ESG reporting remain a concern, highlighting the need for guidance and support in navigating these challenges. Only 22% of CFOs are ready to meet climate reporting and assurance obligations, indicating the need for more investment in ESG compliance. By integrating ESG into their broader financial strategies, CFOs can drive sustainable growth and mitigate non-compliance risks.

Third-party solutions and AI: Transforming ESG management

The report highlights the growing reliance on third-party solutions and AI technologies to manage ESG activities. Outsourcing is on the rise, with 97% of companies relying on external tools to perform at least one ESG task. AI is transforming ESG decision-making and reporting. It streamlines regulatory and internal data gathering and report writing. This reduces workloads, allowing ESG departments to focus more on value-added initiatives and stakeholder engagement. Moreover, AI’s predictive modeling and analytics capabilities enhance decision-making, guiding ESG strategies, and identifying areas for improvement.

Embracing change for long-term success

The 2024 State of Corporate ESG report underscores the importance of strategic investment in ESG initiatives and technology solutions. By prioritizing ERP, empowering CFOs, leveraging third-party software, and utilizing AI, companies can navigate a complex regulatory landscape, and position themselves for success. By doing so they can position their company for sustainable growth and competitive edge in an increasingly ESG focused world.