The New Child Tax Credit Proposal Versus Old Concerns About Work Incentives

A tax plan drafted by Senate Finance Committee Chair Ron Wyden (D-OR) and House Ways and Means Committee Chair Jason Smith (R-MO) has restarted a debate about whether a more generous child tax credit (CTC) would prompt people to leave the workforce. Some of these claims lack context that both policymakers and taxpayers should understand.

The Wall Street Journal, in an editorial last week, blasted the CTC portion of the Wyden-Smith tax legislation, citing numbers from a new American Enterprise Institute study. That report suggests part of the CTC proposal could prompt hundreds of thousands of parents to stop working, thus offsetting the economic benefits of some parents who would start working because of the program changes and of reducing poverty among the least well-off families.

A review of the evidence suggests the issue is more complicated, given the ways in which the bill would also strengthen the CTC’s work incentives.

Differing incentives

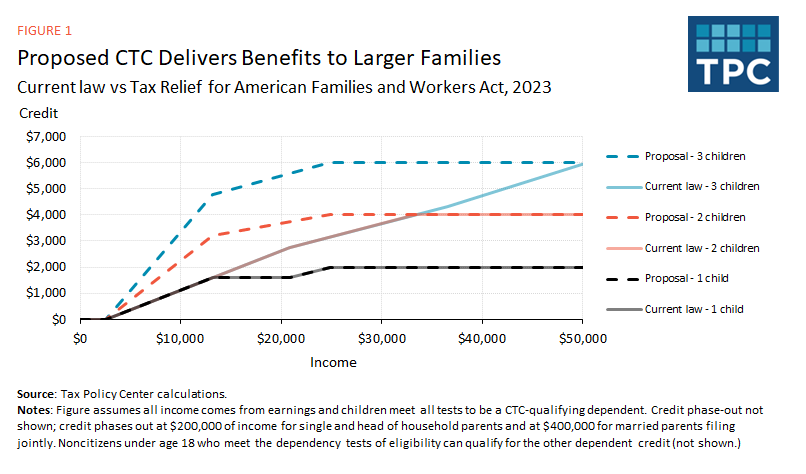

The current CTC offers a tax break of up to $2,000 per child, of which up to $1,600 can be available as a tax refund in excess of taxes due. The refundable portion of the credit phases in at a 15-percent rate with each dollar a taxpayer earns above $2,500 annually.

The Wyden-Smith proposal would leave in place the $2,500 income threshold before earnings start counting toward CTC benefits. But it would gradually increase the maximum refundable credit so that, by 2025, more low-income families could receive the full credit as a tax refund.

The bill would also phase the credit in faster for families with more than one eligible child: at a 30-percent rate for two children, 45-percent for three, and so on. By contrast, the current credit phases in at the same rate for all households regardless of size. As a result, some low-income families’ CTC benefits don’t reflect the increased costs of raising multiple children.

Figure 1 below illustrates how the current credit phase-in compares to the Wyden-Smith proposal.

Evidence on the Earned Income Tax Credit (ETIC) indicates how the faster CTC phase-in would increase the incentive to work, since the tax benefit would rise for each dollar these larger families earn. “[T]here’s robust evidence that the EITC succeeds in increasing [labor force participation], particularly among low-educated women and those workers with multiple children,” economists Hilary Hoynes, Jesse Rothstein, and Krista Ruffini write in their review of EITC research.

The Wyden-Smith plan would also allow taxpayers, starting in 2024, the option of using the prior year’s income to determine their benefits when filing taxes. The AEI study says the lookback could cause as many as 700,000 people to leave the workforce every other year (the study projects a net loss of 150,000 workers on average each year, on balance). While in principle this is possible, it’s highly unlikely.

For example, a tax filer with three kids and $20,000 in income could work in 2024 and then quit the labor force entirely in 2025, but still get the same CTC benefits in 2025. However, that same family could lose EITC benefits (around $4,000 for a family with one child, or $7,500 for a family with three or more children), in addition to forgoing their labor income by not working for a year.

The lookback provision itself would also increase the incentive to work for some households, as noted here by AEI’s Kyle Pomerleau. If a tax filer didn’t work in year one, they could receive two years of benefits by going back to work in year two. Returning to work would thus be more beneficial for them under the Wyden-Smith lookback provision than current law.

Many lower-income households already have volatile incomes, making it difficult to predict changes in their tax benefits. These families’ decisions around work are complicated by other factors, with many having to leave the workforce to help raise a child.

A new Joint Committee on Taxation economic analysis predicts little overall change from the Wyden-Smith tax bill, noting that the CTC expansion “on net increases labor supply,” while the increase in after-tax incomes for households would have a “small, offsetting income effect that reduces labor supply. Therefore, the Joint Committee staff estimates that the increase in aggregate effective labor supply relative to the baseline forecast is too small to be significant.”

Gathering more evidence

The concerns about the CTC discouraging work arose with the 2021 American Rescue Plan Act (ARPA). ARPA raised the CTC to a maximum of $3,600 per child under 6 years of age (and $3,000 for children under the age of 18) and made it fully refundable in 2021, meaning eligible households could get the full benefit, regardless of income.

Evidence thus far suggests that the 2021 CTC did not prompt major changes in labor force choices among recipients. However, the credit was only in place for one year because efforts to extend the ARPA version fell short. That was one reason CTC expansion critics at the time cautioned that data from 2021 should be reviewed carefully before jumping to conclusions.

Whether we’re debating temporary or permanent policy, there are indeed tradeoffs involved in any reform of the tax code. Measuring whether people could leave the workforce is worth consideration, but so are the potential reductions in child poverty and economic gains for those with the lowest incomes.