The effects of GenAI on tax firm rates

.

Generative artificial intelligence (GenAI) is just starting to make inroads in the tax profession. But even in these early days, it promises to significantly impact the ways the profession operates. Though professionals have concerns about GenAI’s accuracy and its potentially fraudulent abuses, they anticipate that it could help streamline workflows and reduce time spent on repetitive tasks.

2024 GenAI in Professional ServicesDiscover perceptions, usage, and impact on the future of work

|

The professionals surveyed in the Thomson Reuters Institute’s 2024 Generative AI in Professional Services report express, in general, positive perceptions of this technology and the current and potential benefits of GenAI. Focusing specifically on tax and accounting practices, leveraging GenAI could provide opportunities for tax firms and departments to serve their clients and companies in new ways—for instance, by offering new types of services, notably advisory.

All this could lead to major changes in how tax professionals price their services. To understand GenAI’s potential impact on tax firm rates, we talked to Zach Warren, who spearheaded the Generative AI in Professional Services report. As Thomson Reuters Institute’s manager for enterprise content for technology and innovation, he charts the future of professional services industries, including legal, tax, and risk and fraud, with a particular focus on technology and innovation.

Question: How much have tax firms embraced GenAI so far?

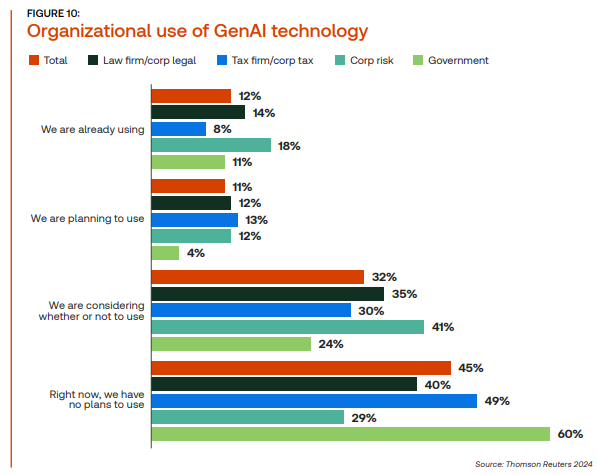

Warren: What we found in the survey is that only about 10% of tax firms have been using generative AI on a large scale. It’s very much still in the consideration phase. Historically, tax has been a little bit reticent to embrace new technologies for a variety of reasons. Some of it is due to risk aversion. They don’t want to run afoul of any particular regulations, so they haven’t really hopped on board with AI or the cloud as quickly as other professional services have.

The people who have adopted it are using it in many different ways. We’re seeing it a lot in:

- Tax return preparation

- Tax research for clients

- General accounting and bookkeeping

- Compliance.

We’re also seeing it being used by people starting to develop tax advisory businesses. With that said, many tax firms and their clients haven’t had too many conversations around generative AI. We asked firms, “Has this been included in RFPs or any contracts?” More than 90% said, “No, not really. This is just an initiative that we’ve taken on our own to prepare.” More than 80% of corporate tax departments said that they haven’t had that conversation yet, and about two-thirds don’t know what their outside tax firms are doing. It’s still very much in the early planning stages, but they are looking ahead to when this becomes more of a reality.

Question: In what ways could GenAI be helpful to tax firms?

Warren: Probably the main issue we’re seeing is that there’s a lot of work for not many people. The tax and accounting profession is really struggling to get new hires in the door. As all this complexity builds, it’s becoming really tough for the people who are already there, and it’s tough to grow tax firms and tax departments. That’s where I think people are going to be relying on generative AI: being able to do more with less, really leaning on the efficiency that generative AI brings.

There are many regulatory issues that are specific to tax where this could come into play. One is the upcoming Pillar 2 Regulation. It’s going to require a great deal of process change within both corporate tax departments and the outside tax firms they work with. Technology could be especially helpful here. It could help firms do the research to make sure that they are complying with this new regulation, which will be global in scale.

Another area is e-invoicing. Many states and other countries will require that much of the invoicing be sent electronically. A lot of business data that has tax implications will be electronic versus paper, which means a change in how firms function to stay on top of that through accounting and bookkeeping. Tax firms are looking to generative AI to potentially help them organize that data and make sure that they’re staying on track.

Question: Are clients expecting faster turnarounds and lower fees from tax firms through the use of GenAI?

Warren: We did ask in the report, “Should your outside firms be using this technology?” More than half said yes. The other half didn’t necessarily say no–there were a substantial number of don’t-knows. More than half of corporate tax departments said, “Yes, we want our firms to be using this technology.”

Now the devil’s always in the details of what that means in terms of rates, where those efficiencies are going to go, and who captures the ultimate efficiencies, whether it’s the clients or the firm itself. But I think it will be a question here very soon where clients will be asking firms, “Are you using technology in the large to be as efficient as you can?” Probably the way to be as efficient as possible will be through generative AI.

PODCAST

The future of GenAI @Stanford University’s CodeX FutureLaw conference

Listen in the website

Listen in Apple Podcast

Listen in Spotify

Question: With GenAI’s ability to reduce time spent on repetitive tasks and mundane work, might firms offer new premium advisory services at higher price points?

Warren: Tax advisory was one area that was above 50% use case for firms. They’re saying “Yes, we’re moving into tax advisory increasingly, and we think that developing content and recommendations are good ways to use generative AI.” I think generative AI is going to be a way to help supercharge that.

Question: Any final takeaways you want to emphasize based on your discussions with tax professionals?

Warren: I’ve talked with some smaller tax firms that see all of this as something that large accounting firms and large consultancies are going to be investing in. But that doesn’t have to be the case. This really can drive efficiencies across the board in small ways as well as large, whether it is supercharging tax research or preparing tax returns. No matter the size of the firm, I do believe that in the future, generative AI will be baked into how people work.

Read the full post →

Zach Warren is the manager of enterprise content for technology and innovation with the Thomson Reuters Institute. At Thomson Reuters, Zach charts the future of professional services industries, including legal, tax, and risk & fraud, through writing, podcasts, and more.

Zach Warren is the manager of enterprise content for technology and innovation with the Thomson Reuters Institute. At Thomson Reuters, Zach charts the future of professional services industries, including legal, tax, and risk & fraud, through writing, podcasts, and more.