The Crédit Suisse-UBS Merger: Ceci N’est Pas Competition Law

The collapse of Crédit Suisse and its subsequent takeover by UBS has produced far-reaching effects, affecting the global banking landscape. Financial stability considerations and market turmoil surrounding the takeover have been widely discussed in the media. Other perspectives, however, have received relatively little attention. In this blog post, we consider a number of competition law issues arising in the slipstream of the creation of this new “megabank”. The Crédit Suisse-UBS merger has created one of the largest banks in Europe with a massive amount of assets under management, thereby inevitably influencing competition dynamics in the Swiss and European financial sectors.

Crédit Suisse Collapse and UBS to the rescue

When financial markets are nervous it does not take much for a situation to get out of hand. In an already troubled market situation, following the collapse of Silicon Valley Bank, it did not take much to raise serious doubts about Crédit Suisse, Switzerland’s second-biggest bank and a symbol of national pride. Although it was certainly not the Bank’s first controversy – one can easily think of the Mozambican tuna bonds or the private detective scandal – an initially rather small news item on accounting irregularities appeared enough to lead to major concerns, eventually resulting in a dramatic drop of the stock price and a massive outflow of clients, taking their deposits and assets with them.

During the weekend of 18-19 March, the Swiss government stepped in to force a solution, before the markets would open on Monday morning and push Crédit Suisse irrevocably over the verge of bankruptcy. By Sunday evening, Switzerland’s biggest bank, UBS, was found willing to take over Crédit Suisse for 3 billion CHF. The deal was pushed through by the Swiss authorities, and despite the carefully drafted banking resolution regulations which have been developed since the Global Financial Crisis of 2008, it soon became clear that the entire takeover relied upon politics and power rather than on the law. This was not only illustrated by the controversial decision to entirely write off the AT1 bonds, but also by the fact that it was prohibited by the Swiss competition commission (ComCo) to assess the UBS-Crédit Suisse merger under Swiss merger control.

The UBS takeover: no merger control, please

Normally, Swiss and EU competition law would undoubtedly have been applicable to the merger. The Swiss competition law regime is laid down in the Federal Act on Cartels and other Restraints of Competition (ACart). It highly resembles European competition law but is not part of the Swiss-EU Bilateral Agreements, a series of international agreements that have established a harmonization and a certain level of Swiss integration in the Union acquis in several areas. Swiss competition law, on the other hand, is still largely autonomous. Nevertheless, an Agreement was concluded between Switzerland and the EU in 2014 to foresee better cooperation and coordination in the area of competition law.

According to the standard procedure, the merger would have been subject to a merger control by ComCo in accordance with Article 9 Acart. The gross income thresholds were clearly met, which normally allows ComCo to assess and potentially prohibit the concentration, for example, if it is deemed able to lead to a deterioration of the competitive conditions of the market.

However, Article 10(3) Acart was invoked by the Swiss authorities. This provision, which was implemented in the slipstream of the banking crisis of 2008, foresees the possibility of not submitting a merger to ComCo in case of bank mergers if this is required in the interest of the creditors. In such a case, it suffices that the Financial Market Authority (FinMa) approves the deal, while ComCo shall only issue non-binding Advice. During the hectic takeover weekend, this provision was used to exempt the deal from ComCo’s assessment. Moreover, until today it remains unclear whether ComCo has even been able to give an Advice on the matter.

Nonetheless, this does not rule out the possibility that other competition authorities might want to have a look at the merger. UBS and Crédit Suisse easily meet the thresholds determined in Article 1(2) jointly read with Article 5(3) of the EU Merger Control Regulation (EUMR), which obliges them to submit a notification to the European Commission, which can subsequently proceed to examine the deal. Before such notification, the deal cannot be implemented.

However, to enable this acquisition, the Commission has waived the standstill obligation under Article 7(3) EUMR. The Commission can nevertheless still investigate the merger. If it decides to make use of this power, UBS and Crédit Suisse could invoke the “state action defence”. According to this doctrine, undertakings cannot be held liable for competition infringements if a certain behaviour or transaction is forced upon them by state powers. Considering that the merger was concluded with close involvement and under the pressure from the Swiss government, FinMa and the Swiss National Bank, it seems that this line of defence would make sense.

Following the state action defence doctrine, liability can, under certain conditions, shift from the undertaking to the State who encouraged or imposed the anti-competitive behaviour. In this case, State liability seems however very unlikely, considering that Switzerland is not an EU Member State and does not fall under the jurisdiction of the Court of Justice with regard to competition law. Furthermore, given the exceptional circumstances and the surrounding market turmoil, it seems anyhow very unlikely that the Commission would push through a European Merger Control on the deal. Nevertheless, the General Court already confirmed the Commission’s competence to review and potentially prohibit a merger which had previously been approved by the South-African authorities, so this risk cannot entirely be ruled out.

Competition concerns

Putting aside competition merger control, there are other competition concerns which could arise from this scenario. The merger of UBS and Crédit Suisse has created one of the largest banks in the world, as it came down to an acquisition of the country’s second-largest bank by its largest bank. The two biggest players are thus now one very big player. Undoubtedly, this comes with certain power – as some call this a “megabank” with “superpower”.

Will the merger undermine free competition? On the global level, the situation does not seem to be too worrisome. As a result of the acquisition of Crédit Suisse, UBS currently has almost 4 trillion EUR of assets under management (AUM). Its nearest rivals globally are Morgan Stanley and the Bank of America, respectively holding 1.7 trillion EUR and 1.6 trillion EUR of AUM, meaning that combined they have 78% of UBS’ AUM. These US banks seem sufficiently able to challenge UBS in this sector, especially considering that Crédit Suisse did not have any onshore wealth management presence. It thus looks as if the market will be able to maintain or restore the global competitive balance.

But what about competition dynamics within Switzerland? The importance of the financial sector for Switzerland is well-known, as the country has dozens of smaller regional and savings banks, including 24 cantonal banks. Due to its acquisition of Crédit Suisse, UBS is the only ‘Globally Systemically Important Bank’ (so-called G-SIBs) left in the Swiss market. The list of G-SIBs is annually composed by the Financial Stability Board on the basis of a multifaceted assessment methodology. Banks qualifying as G-SIB are subject to higher capital buffers, stricter supervision and a number of other measures because they are held essential to the global financial system.

In the Swiss market, four Domestically Systemically Important Banks – the counterparts of G-SIBs, but on the national level – still remain, of which Raiffeisen Group is the only other bank with a nationwide branch network, apart from UBS. When compared to its Swiss competitors, the enormous size of UBS immediately becomes clear. The combined Assets Under Management (AUM) of UBS and Crédit Suisse in Switzerland mount to 800 billion EUR. The united entity, therefore, has little to fear from its closest Swiss competitor, Julias Baer, whose total AUM from Swiss clients is only 64 billion EUR. UBS is thus 12 times as large as its nearest rival in Switzerland.

The merger thus provides UBS with a very powerful position. As stated by economics professor Gersbach: “Everything they do […] will impact the market”. Indeed, the evidence of this statement can already be observed. First, the acquisition of Crédit Suisse will have a considerable impact on employment in this sector. UBS has announced that it intends to cut costs to improve its financial situation, thereby considering letting go of up to 30% of its staff. This would come down to more than 10.000 jobs in Switzerland and 25.000 worldwide. However, though labour market considerations might influence competitive conditions on the market, this remains an issue which is not the main, nor the exclusive concern of competition law.

Second, UBS’ position as a “megabank” provides it with pricing power that can have negative results for its business clients. Specifically, Swiss pension funds and small-and-medium-sized enterprises have raised concerns, fearing that the lack of competition emerging from the takeover will harm their ability to negotiate prices and conditions with the banks. Indeed, with one main big player, it becomes considerably harder to leverage competition – as competition simply reduces – to your advantage.

Third, although there are still other banks on the market competing with UBS to offer a wide range of financial services, UBS seems to have established a quasi-monopolist position with regard to certain categories of services. For the private wealth management market, for example, UBS is undoubtedly the biggest service provider on the market.

It may be clear that merging the two largest banks in Switzerland has resulted in an undeniable loss of competition. If this had been subject to merger control, authorities would have been very careful – and rightly so – with such an acquisition. However, the waiver of merger review does not necessarily lead to a full exclusion of competition law. EU and Swiss competition law remain applicable. What are the implications of the merger from an EU competition law perspective? Most importantly, the prohibition on the abuse of a dominant position can play an important role in this regard. UBS seems to be a dominant undertaking in the Swiss banking market that can significantly influence the market (Art. 7 ACart).

Due to its dominant position, UBS can distort competition and negatively impact the competitive process. More specifically, the cost of financial services can rise and innovation can go down, as UBS might feel less incentivized to innovate because of its position as a quasi-monopolist. A high degree of concentration on financial markets has proved to adversely affect consumer welfare. For example, dominant banks might not feel pressured to raise interest rates on deposits, although they receive higher interest rates themselves following central bank interest rate hikes. The Belgian National Bank recently issued a warning that this might be the case in Belgium. Competition authorities can – and should – thus clearly keep an eye out for possible abusive behaviour and intervene when necessary.

Nationalisation as an alternative?

On the basis of this analysis, it becomes clear that the Crédit Suisse-UBS merger may pose clear threats to the competitive conditions in Europe and (especially) Switzerland. But what alternative was there, for a “too big to fail” bank adrift?

Swiss finance professor Marc Chesney has argued that the Swiss government should have taken over Crédit Suisse itself, instead of putting it on the plate of UBS. By doing so, it could have appointed new directors, restructure and “de-risk” the bank, with a view to selling it off again later. Indeed, also from a competition law point of view, this scenario seems to make sense: Crédit Suisse would have remained a separate and autonomous entity, and the Swiss banking market would not be dominated by one megabank. A more diluted market would have been better able to guarantee free and undistorted competition. Moreover, the Swiss government anyhow had to assume potential liabilities of up to 9 billion EUR to cover expenses for corpses which might still fall out of the Crédit Suisse closet. The liability risk and exposure to losses for the Swiss government would presumably not have been much bigger if it had acquired Crédit Suisse itself. Also, state aid concerns do not seem insurmountable: Switzerland does not have specific rules addressing state aid, and on the European level Article 106 TFEU is not applicable to non-EU Member States. On top of that, the European Commission would probably have shown the same restraint towards nationalisation as it did now to a State-induced merger. Finally, public banks are common in Switzerland anyway, where every canton is the most important owner of its respective cantonal bank.

From a financial stability perspective, the uneasy question raises of how the new Crédit Suisse-UBS megabank can ever be saved if it goes wrong again. The bank that has been created now has a balance sheet twice the size of the entire Swiss economy. The creature arising from the merger deal is thus of such a magnitude that the Swiss government will not be able anymore to cope with its collapse, were it to happen.

There, thus, seem to be several reasons speaking in favour of nationalisation instead of a private, though state-induced, merger. However, nationalising Crédit Suisse would undoubtedly have resulted in other problems. Nevertheless, it seems to have been the best solution amongst the words – at least from a competition law perspective.

Conclusion

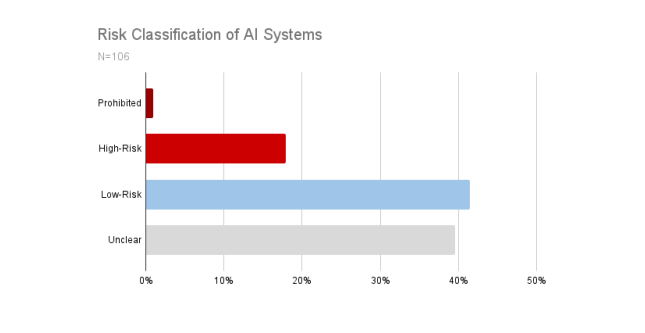

Time will tell how the new UBS “megabank” will behave and how consumers will react. What is clear, however, is that an undertaking has been created possessing an enormous market power due to a state-induced merger. This state-induced power should not be taken lightly. The exclusion of merger control, though vital to avoid instability in financial markets, has non-neglectable consequences for competition.