The annual tax revenue from the FDA Cigarette Ban would be $33 billion

Last Monday, the US Food and Drug Administration sent a draft rule to the White House which would ban the sale and consumption of cigarettes in the form we know them today. A new product standard would require that all cigarettes sold in America meet a minimum nicotine content. This new threshold, a very low nicotine product standard (VLN), would likely be substantially less than the amount nicotine that occurs naturally in tobacco plants and in cigarettes. While the FDA may not declare that their VLN product standards are a prohibition on smoking, implementation of a VLN Standard would function as such. VLN King cigarettes would likely meet FDA requirements and be available for purchase, but consumers show little interest in the product. The FDA has approved the first low nicotine product, but it has almost no market shares. The company responsible for producing VLN King operates at massive deficits and has become a penny stock, trading for an all-time low price as of the writing of this article.

Smokers don’t want low-nicotine cigarettes. The same argument explains why decaf coffee and low-alcohol beers aren’t Starbucks’ top sellers. Alcohol prohibition was also formulated similarly. The Volstead Act, also known as the “National Prohibition Act”, did not prohibit all alcohol sales. The Volstead Act can be described as a product description with a very low level of alcohol. The Volstead Act defined “beer, wine, or other intoxicating malt or vinous liquors” as “any such beverages which contain one-half of 1 per centum or more of alcohol by volume.”

Alcohol prohibition failed. The prohibition of cigarettes would be even less successful in eliminating the banned product from the market. The bulk of cigarettes is easily transportable and cigarette smuggling has already become a massive operation due to the excessive

tax. A tax is a mandatory payment collected by local, national, and state governments to cover costs for general government services, products, and activities.

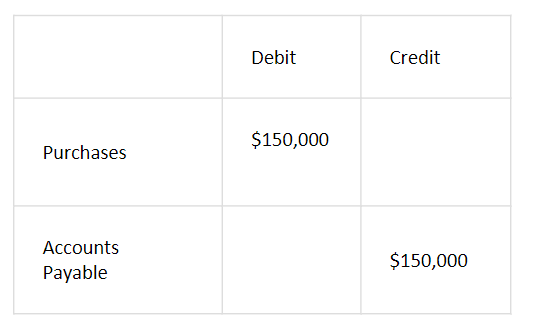

rates. In 2022, 54 per cent of cigarettes consumed in New York had been smuggled in. Nearly half of cigarettes consumed in California or New Mexico were not purchased legally in those states. To enforce the prohibition and combat illicit markets, law enforcement expenditures would have to be increased substantially. The decline in tax revenues would be the biggest hit on the public budget. Taxing cigarettes is a lucrative business for all levels in the US. In 2023, federal, state, and local governments brought in more than $37 billion from taxing cigarettes and another $3 billion from taxing other tobacco products (OTP).Cigarettes Generate $37 Billion in Tax Revenue for US Governments Each YearCigarette Revenue by Source and Level of Government, 2023

Source: Orzechowski and Walker, The Tax Burden on Tobacco, Volume 58, 2023; Author calculations.

A VLN product standard that reduced legal sales by 90 percent–likely a conservative estimate–would reduce tax revenues by roughly $33 billion per year. Even if the OTP market doubled, and users switched to legal alternatives like vaping or modern oral tobacco products, governments would still need to fill a budget hole of nearly $30 billion. Cheap, illicit, and internationally smuggled tobacco products could very well dominate the market. China produces up to 400 billion “cheap” or “illicit” whites per year. These generic-looking, white cigarettes are manufactured legally in countries with low taxes but are often meant for smuggling. Economic forces may make it cheaper to smuggle Chinese cigarettes through ports due to the huge volume of product that ships to global ports from China. Reports indicate that China’s tobacco monopoly is already playing a significant role in illicit markets throughout North, Central and South America. A VLN standard for cigarettes would be devastating for tax coffers and push smokers towards what could become the largest illicit market in the world. To reduce the harms caused by cigarette smoking, it is better to encourage smokers switch to less harmful substitutes. Again, FDA policy is counterproductive. Inaction by the FDA in authorizing less harmful tobacco products and allowing it to sit on many applications for alternative tobacco products for several years, without making a decision has made it difficult for smokers to switch to less harmful products. The availability of a greater variety of less harmful products to smokers, including those that they can actually consume, will save lives, shrink the illicit market, and allow governments a gradual transition away from the shrinking

tax basis. The tax base is the amount of income, assets, consumption or transactions subject to taxation. A narrow tax base can be inefficient and non-neutral. A broad tax base allows for lower tax rates and reduced administration costs.

that is combustible cigarettes.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Subscribe to our Newsletter

Share this article

TwitterLinkedInFacebook