Tax Relief for American Families and Workers Act of 2024

On January 19, 2024, the Ways and Means Committee made a significant bipartisan move by approving the Tax Relief for American Families and Workers Act of 2024.

Jump to:

On January 19, 2024, the Ways and Means Committee made a significant bipartisan move by approving the Tax Relief for American Families and Workers Act of 2024. This legislation is designed to provide crucial support to American job creators, small businesses, and working families.

By accelerating the end of the COVID-era Employee Retention Tax Credit and implementing proven tax policies from the 2017 GOP tax reform, this act aims to save taxpayers over $70 billion while promoting American competitiveness and supporting working families. With a focus on alleviating the burden of rising prices and interest rates, this tax relief package is a vital step towards fostering a healthier economy and creating greater opportunities for all.

In this blog, we will explore key provisions of the act and their potential impact on taxpayers.

Enhanced Child Tax Credit

The act expands the Child Tax Credit to provide additional support to working families. Key provisions include:

- Increased Refundable Portion: The refundable portion of the child tax credit will gradually increase over the years 2023-2025, offering more financiaTax assistance to families.

- Fairness for Larger Families: Adjustments will be made to ensure fairness for families with multiple children.

- Flexible Income Lookback: Taxpayers can choose to use either current or prior-year income to calculate the child tax credit in 2024 and 2025, providing flexibility in determining eligibility.

- Inflation Adjustment: Starting in 2024, the child tax credit will be adjusted for inflation to keep up with the rising cost of living.

Business tax relief

The act includes provisions to support businesses and promote economic growth. Key provisions include:

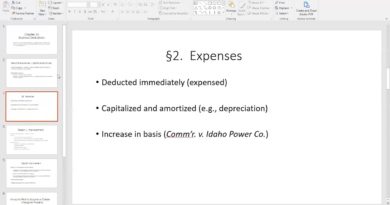

- Research and Experimental Expenses: The act allows businesses to immediately deduct research and experimentation expenditures, encouraging innovation.

- Bonus Depreciation:100% bonus depreciation is extended through 2025, allowing businesses to fully expense qualified property.

- Increased Section 179 Deduction: The act raises the deduction limit for qualifying property, providing businesses with greater flexibility in deducting investment costs.

- Interest Deductibility: Businesses can deduct interest expenses, supporting their ability to meet payroll obligations and expand operations.

Support for small businesses

The act recognizes the importance of small businesses and introduces measures to support their growth and resilience. Key provisions include:

- Increased Small Business Expensing Cap: The limit for immediate expensing of investments is raised, providing small businesses with more financial flexibility.

- Reducing Administrative Burdens: The reporting threshold for businesses using subcontract labor is adjusted, reducing administrative burdens and streamlining operations.

- Disaster Tax Relief: Tax relief measures are extended to help families and businesses affected by natural disasters recover and rebuild.

Employee Retention Tax Credit (ERTC)

To address fraudulent claims related to the ERTC, the Tax Relief for American Families and Workers Act introduces measures to increase penalties on fraudulent promoters. It also accelerates the termination of the period for making new claims for the ERTC. These changes aim to ensure the integrity of the credit while providing support to businesses that have been relying on it.

Adjustments to 1099-MISC and 1099-NEC filing thresholds

The act recognizes the evolving business landscape by adjusting the filing thresholds for Form 1099-MISC and 1099-NEC. Under the new legislation, businesses will need to file these forms for payments made after December 31, 2023, exceeding $1,000, instead of the previous threshold of $600. This change aims to streamline reporting requirements while maintaining accurate tax reporting.

Support for affordable housing

The Tax Relief for American Families and Workers Act also includes provisions to support affordable housing. It increases the nine percent low-income housing tax credit ceiling by 12.5 percent for calendar years 2023 through 2025. Additionally, the act lowers the bond-financing threshold to 30 percent for projects financed by bonds issued before 2026. These measures aim to promote the availability of affordable housing options for individuals and families.

Empowering American families and businesses: The Tax Relief for a stronger future

The Tax Relief for American Families and Workers Act of 2024 aims to provide tax relief to American families, workers, and businesses. By expanding the Child Tax Credit, offering business tax incentives, and supporting small businesses, this act seeks to stimulate economic growth and alleviate financial burdens. It is important for taxpayers to stay informed about the provisions of this act and consult with tax professionals to understand its impact on their specific circumstances.

White paperStay ahead of the pack in the tax and accounting industry We understand the challenges you face in today’s rapidly changing business environment. To assist you with strategies for your clients, we created this white paper

|