Tampa Student Loan and Bankruptcy Attorney Blog — February 5, 2024

Remember, any private or federal student loan debt that is forgiven before December 31, 2025 is not subject to federal tax.

Due to the American Rescue Plan Act of 2021 loans that are forgiven are not considered taxable income for federal income tax purposes. Since state and local tax implications will vary, we recommend you contact a tax advisor for more information.

I’m working on a new blog about 1098s that we are hearing going out to borrowers for interest that is rolled into a consolidation or forgiveness under the Borrower Defense program. That should be out in a couple days.

The IDR audit is progressing nicely. Got another client where we helped him consolidate his Parent Plus loans with his own, opt out of forgiveness this fall until that could be completed, and now he received notice that all of his loans are forgiven – roughly 130k as of 11/28/23. All he paid us was the small fee for the strategy session.

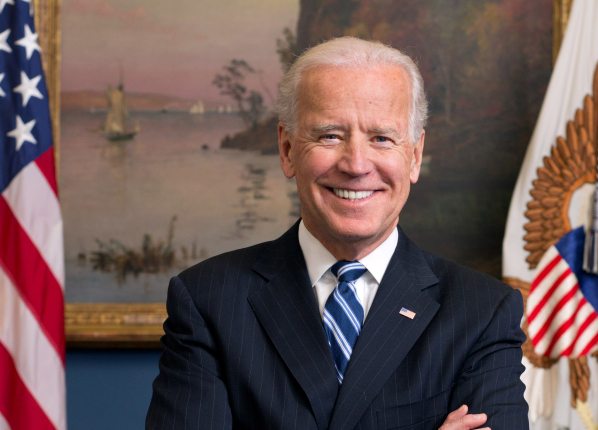

- Congratulations! The Biden-Harris Administration has forgiven your federal student loan(s) listed below with Aidvantage in full.

- This debt relief was processed as part of the Biden-Harris Administration’s one-time account adjustment because your student loan(s) have been in repayment of at least 20 or 25 years. An adjustment to your account updated the number of payments that qualify towards income-driven repayment (IDR) forgiveness. This forgiveness is effective as of 11/28/23.

- Loan

Program

First Disbursement

Date

Original Principal

Balance

DLUSUBCONS

11/28/23

$106,773.36

DLSUBCONS

11/28/23

$ 22,812.97

Unsure about whether you are doing all that you can to make sure you are paying down or obtaining forgiveness where possible? Reach out to us below: