Strategies for dealing with upcoming e-invoice mandates

Over the next few years, dozens of countries will be rolling out mandates for e-invoicing and continuous transaction controls (CTCs) as part of a global trend toward the complete digitalization of tax reporting and remittance. Multinational corporations (MNCs) need to be prepared when these regulatory changes go into effect, but the path to compliance isn’t exactly straight—in fact, it’s more like a confusing zig-zag of government regulations, technical specifications, uncertain timelines, and lack of communication.

International tax managers and their departments are the personnel most directly affected by these digital tax initiatives. To help them understand the evolving international landscape for e-invoicing/CTC mandates, Thomson Reuters recently conducted a webinar outlining several strategies MNCs can use to prepare for any mandates they may encounter in the months and years ahead.

Illustrative example of e-invoicing mandate challenges

To illustrate some of the hurdles companies are soon likely to face if they haven’t already, Pagero’s director of sales, Brad Colie, begins the webinar by introducing listeners to a hypothetical character named Stephen, who represents a tax department that is in the midst of its digital transformation but still unprepared for the difficulties that lay ahead in the form of e-invoice/CTC mandates.

Overall, Stephen and his team are happy with the work they’ve done to get their data flowing seamlessly through the company’s ERP and extended business ecosystem. But then Stephen starts getting calls from colleagues in Poland, France, Spain, Australia, Japan, and elsewhere, asking him: how might e-invoicing/CTC mandates impact our operations?

Stephen doesn’t know, exactly, and when he starts investigating, he discovers not all countries that are initiating e-invoicing are coupling it with CTC, which adds real-time tax reporting to the mix. Furthermore, many countries are phasing in their requirements, for example, starting with the largest companies down to the smallest.

What’s a tax director to do?

After much frustration, Stephen realizes that he needs to know more to work proactively with his company and team to prepare for these upcoming mandates.

“There’s no standard with the government authorities and what they’re requiring and mandating,” explains Jesse Shannon, Senior Product Manager for indirect tax at Thomson Reuters. Shannon says the question many companies are asking is: “How, as a multinational, do we approach all of these countries globally? Do we centralize tax with our headquarters office, or do we take a more regional, country-by-country approach?”

As Pagero’s Brad Colie explains, using a country-by-country, or “point-to-point” approach, companies must build a separate integration module to comply with each government tax authority’s individual specifications.

The advantage of the point-to-point approach, Colie says, is that companies are “extracting data in exactly the format the government asks for.” The downside, he says, is that these integrations are time-consuming, expensive, and can be difficult to manage if a tax team is dealing with more than one or two countries, and inevitable changes to each country’s rules and specifications only add to the burden.

“A lot of these governments, they go live with e-invoicing knowing that there will be changes within 12,18, or 24 months,” Colie says—and in a point-to-point approach, this means that a tax team must “go back to the drawing board every time they change their system or the government changes their requirements.”

Another option, says Colie, is a “network” solution that employs a third-party service provider to manage invoices and connect a company’s financial systems to the systems of the host government. If a company employs a different service provider in each country, however, tax teams must manage those relationships and accept that third-party providers have “limited capabilities to enrich and validate the data . . . all of which means more maintenance and work.”

_____________________________________________________________________________________________

REGISTER NOW to the webinar, and learn more about upcoming e-invoicing / CTC mandates and how to manage them

_____________________________________________________________________________________________

A ”universal” solution to e-invoicing mandates

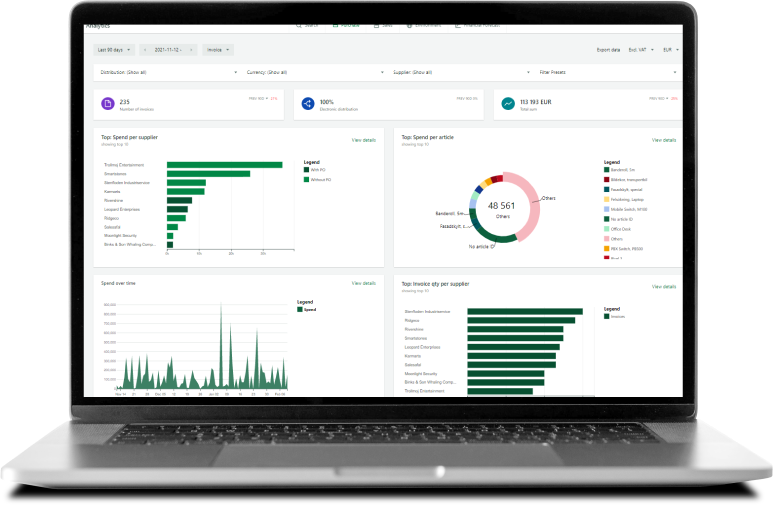

A third, better option, says Colie, is a “universal” network solution that funnels transaction data through a centralized platform and then converts it to meet the specifications of each government’s tax authority. This approach “creates a very scalable solution and reduces a lot of the costs” associated with other, more piecemeal solutions, Colie explains; it’s also ideal for companies that want to manage e-invoicing within their existing automation strategy.

“Organizations are looking for a cloud-based solution that makes it easier to deploy and simplify management of the data and requirements for countries around the world,” says Shannon. MNCs are also looking for a solution that makes compliance easier and more reliable, he says.

Pagero and Thomson Reuters have partnered to create just such a solution – a universal e-invoicing module that works within the Thomson Reuters ONESOURCE tax platform. In addition to supporting the exchange of electronic documents between businesses, governments, and customers, the Thomson Reuters/Pagero solution also helps companies manage any changes a government may make to the system, network, or data specifications they require.

Concerning upcoming e-invoice/CTC mandates, “Compliance is an obligation that organizations and tax departments must get right on day one,” Shannon emphasizes. “By having a universal solution for the indirect tax life cycle—from tax calculations to compliance reporting and e-invoicing—now they can get it right.”

Comply with global e-invoicing mandates by leveraging a fully integrated electronic invoice compliance solution