Still More Evidence for Cultural Persistence

In my recent report, “More Evidence for Cultural Persistence”, I reviewed studies from the fields of history, political science, and sociology showing that the cultural traits brought by immigrants do not always disappear into a melting pot. In fact, differences in values and behaviors among immigrant groups tend to persist into the third generation and beyond.

This persistence is especially striking when observed among the descendants of European immigrants in the United States. Despite generations of opportunity to dissipate, and despite seeming minor or even non-existent to the casual observer, cultural differences between, say, German-Americans and Irish-Americans are still evident in the data. If such apparently similar groups retain key aspects of their ancestors’ cultures, then it is practically certain that today’s immigrants will also change the culture of the U.S. over the long term.

The previous report’s summary of the academic literature focused mainly on civic culture, with varying levels of community attachment, tolerance, and subjective well-being found among different European groups. The countries of Northern Europe generally score higher on these measures than Southern Europe, and that pattern is replicated in the U.S. among the descendants of immigrants from those countries. In this follow-up analysis, I elaborate on social trust, which is a key component of civic culture, and then I present new evidence that savings behavior also fits an ancestral pattern.

Social Trust

Social trust deserves special attention for several reasons. First, trust is an essential ingredient in forming both social and economic relationships within communities. Second, surveys in the U.S. and Europe have measured trust the same way for decades, allowing for robust comparisons. Finally, these comparisons reveal significant differences among European-Americans, showing that cultural persistence is not simply an artifact of racial division.

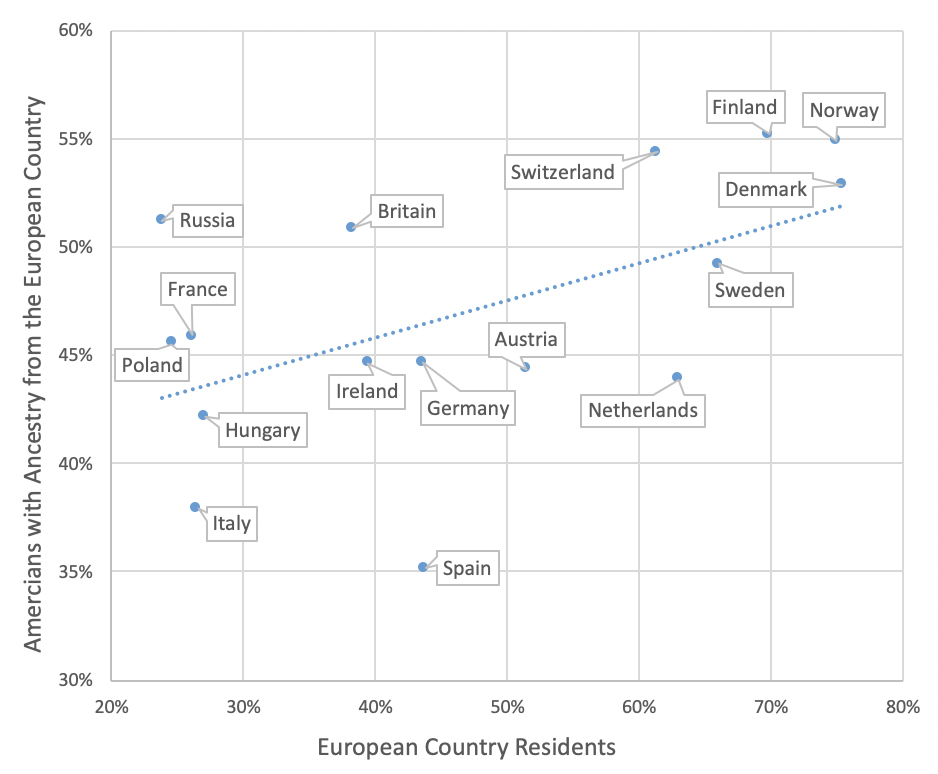

Figure 1. Percentage Who Believe That “Most People Can Be Trusted” |

|

Source: General Social Survey (U.S.) and World Values Survey (Europe). The correlation is 0.55. |

Figure 1 shows a strong correlation between the level of social trust among European-Americans (vertical axis) and the level of social trust in their ancestral countries (horizontal axis). For example, in Europe, Norwegians are more trusting than Germans, who are themselves more trusting than Italians. Despite over a century passing since their peak period of immigration, those three ancestral groups order themselves the same way in the United States: Norwegian-Americans are more trusting than German-Americans, who in turn are more trusting than Italian-Americans. That these differences can endure across time and space is a testament to the cultural change that any immigrant-receiving country is likely to experience.

Savings

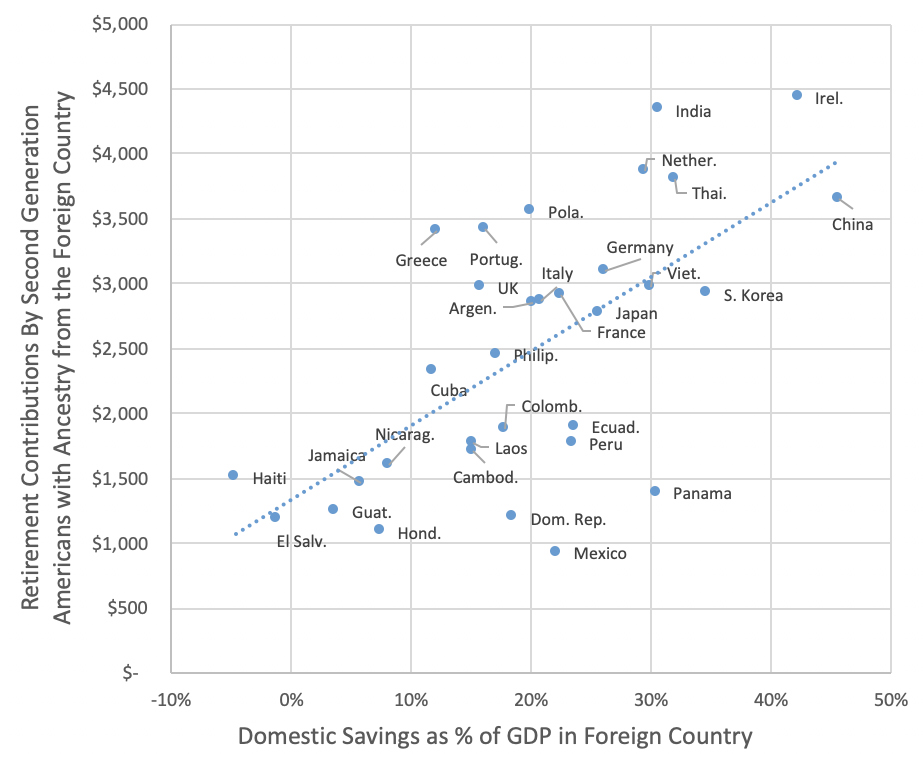

Growth-oriented economies require savings and investment. In his recent book The Culture Transplant, economist Garett Jones notes that the willingness to save money is a cultural trait that persists among groups who move to new places. He cites research from both the UK and Germany showing that the descendants of immigrants have savings behavior reminiscent of their ancestral countries.

Testing the degree to which savings cultures have been transplanted into the U.S. is more challenging, as it is difficult to find U.S. data sets that contain both ancestry information and a reasonable measure of savings. Figure 2 represents my best effort, using new questions in the Current Population Survey (CPS) about retirement saving. Displayed along the horizontal axis is the national savings rate of foreign countries, while the vertical axis shows the retirement account contributions made by Americans with corresponding ancestries from those countries. These Americans are exclusively second-generation immigrants, meaning born in the U.S. with at least one foreign-born parent. (The ancestry of third-generation and higher immigrants cannot be identified in the CPS.)

Figure 2. Savings |

|

|

Source: Current Population Survey (U.S.) and World Bank (foreign countries). The correlation is 0.65. |

Despite the limitations in identifying ancestry, the large CPS sample allows for the inclusion of far more countries than in Figure 1. Expanding beyond Europe demonstrates the wide range of savings behavior found throughout the world, and it also reinforces how persistent such behavior can be among immigrants’ adult sons and daughters, who have an average age of 42 in the data. As with social trust in Figure 1, the relative ordering of countries on the horizontal axis is quite similar to the ordering of American ancestral groups on the vertical axis. The clear implication is that immigrants bring their savings behavior with them from their home countries and then (partially) transmit that behavior to their offspring.

Conclusion

Although some advocates insist that immigrants will blend into a “melting pot”, leaving America no different than it was before, that view is inconsistent with the evidence. Studies continue to show that some of the distinctive values and behaviors brought by immigrants to the U.S. persist through later generations, with trust and savings being just two of the many examples documented in the literature. As a consequence, today’s immigration will cause the culture of the U.S. to change in important ways. Policymakers should carefully consider that impact when setting immigration policy.

Methodological Notes

Figure 1. All European ancestries with at least 100 cases in the cumulative General Social Survey (GSS) file are included in the analysis. The source of European data is the most recent World Values Survey, begun in 2017. To facilitate direct ancestral comparisons, respondents in both data sets are limited to native-born individuals who are not members of a minority religious group such as Judaism or Islam.

Figure 2. Included in the analysis are all ancestral groups with at least 100 cases of second-generation immigrants ages 25 to 60 in the 2019-2022 March CPS. Gross domestic savings as a percentage of GDP comes from the World Bank. Following the UK savings study linked above, I created a 20-year average (2000-2019) of the World Bank data to avoid year-to-year anomalies, but similar results occur when using only 2019.