Spotlighting women in advisory practice: Alicia Shaul

In celebration of Women’s History Month, we are honored to launch “Spotlighting Women in Advisory Practice,” a blog series featuring four women who have transformed their accounting businesses with advisory services. These CPAs have moved beyond being solely tax providers, expanding their relationships with clients to become true business partners.

Alicia Shaul’s path to accounting was less than traditional. As an undergrad, she majored in political science and pre-law. She decided to skip law school and instead took a job as a bookkeeper, finding her chosen profession and going back to school to earn her CPA.

Once, one of Shaul’s professors spoke about the importance of business development, saying that if you ever want to become a partner in a firm, you need to become a rainmaker and start bringing in your own work. No matter what the culture of the firm is, you will be successful, the professor said.

That insight stuck with her, Shaul recalls, adding that it planted the seeds of her own path to success and owning her own firm.

A culture of happiness and growth

In the six years after she became a CPA, Shaul worked at several accounting firms and experienced some less-than-ideal managers. This strengthened her desire to have her own firm. By this time, she had also acquired a number of clients whom she had trusted relationships with.

Shaul remembers telling her clients, ‘I’m thinking of going out on my own. Would you follow me one more time?’ Their response? ‘Yes, it’s about time.’ That was 2004, and now she has her own place and is no longer sub-leasing. Her firm is also staffed by four full-time employees and a few part-time positions that are outsourced.

“I view the tax firm as my own Google experiment,” Shaul says. “I wanted to be the best manager and have the best firm, and create a culture where everyone is happy, and we can continue growing.” Another motivation is her love of advisory services and her passion to work closely with clients in “helping them plan and control the growth of their company,” she adds.

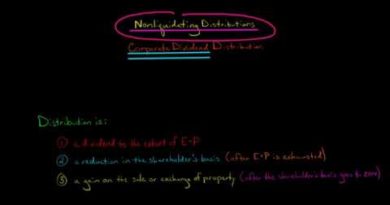

Advisory practice as a leap of faith

Shaul explains she moved her practice away from a compliance-focused shop because she remembers the pain points from the overwhelming workload during tax season — the feast during tax season and the famine for the rest of the year, she says. She also hated having to deliver “bad news” when her clients owed money. After some lengthy research, she found her answers through the advisory platform Practice Forward.

Moving to an advisory practice was “a big leap of faith for me,” explains Shaul, and bringing clients on the journey to transition into an advisory practice required finesse. However, she learned that the narrative that resonated with them was the importance of being able to control tax outcomes and company growth by making savvier decisions and “work proactively throughout the year.”

The value of offering bundled service packages

By being able to meet quarterly with her staff, clients were given better visibility into their business year and potential tax liabilities throughout the year, avoiding the big surprise every March. Clients were now offered bundled service packages which included quarterly or monthly financial statements and applicable payroll services.

Alicia Shaul

Shaul created bundled service packages with a quarterly schedule of meetings that highlighted various client touchpoints. The first quarter was about planning for the year; the second quarter focused on the client’s financial performance and profitability improvement; the third quarter focused heavily on financial statement projections; and the fourth quarter outlined the year-end wrap-up, including W-2 paperwork and tax projections.

Clients loved this approach, Shaul says. “Meeting with a tax preparer after the year has closed is like trying to drive your business forward in a car, while the car is in reverse and you’re only using the rearview mirror to guide you.” Most of her new approach and were willing to shift to a subscription model. For those that opted out, there still was the option to pay an hourly rate for ad-hoc services.

Confidence and communication: The key to effective advisory services

Reflecting on the necessary skills needed to make the leap to advisory, Shaul says that “Effective advisory services really come down to communication and confidence. Clients will not buy into those services unless I have.” For the firm to be successful with advisory services, the firm had to be proactive, she says.

For example, Shaul relates the situation of one client — a daycare center — where its salary costs were getting out of line. By having discussions with the owner around why salary costs had increased, Shaul observed that many employees were calling out sick every week, resulting in the center having to hire temporary staff for coverage. Working with the client, they created a simple but effective incentive to increase employee attendance — employees that worked a full week without calling out received a dinner out paid for by the daycare center. The result? A significant decrease in employees calling out and less need to hire temporary staff.

Indeed, Shaul says her staff members are encouraged and rewarded for working with customers directly, and they are part of the entire advisory process, including the quarterly meetings with clients. Members who bring in new clients receive a 20% commission when first-year cash is collected, and then they are listed as that client’s partner contact, allowing them to continue to develop the relationship with the client. All the while, staff continues working alongside Shaul as she mentors them during the process — she says that this is their best pathway to becoming a partner in the firm.

Being a woman in advisory

Generally, CPA firms are white male-dominated — at least in Shaul’s region — and it has been her mission as a business owner to have a firm that has true gender and racial equality, being as close to 50/50 ratio between men and women, and between white and non-white professionals.

Shaul says she is proud that her firm is comprised of diverse representation and takes pride in being a woman business owner and giving people from diverse backgrounds the opportunity to carve out their own successful career path.

Find more success stories like Shaul’s in the Spotlighting Women in Advisory Practice blog series, then start your advisory journey with Practice Forward.

|

How women can confidently and successfully build an advisory practiceHear from Thomson Reuters experts who have spent time with female-owned and operated firms positioning themselves for long-term success with an advisory-centric business model. Download white paper |