Review

Since Since it became applicable, in 2020, the number of FDI regimes in place in Europe has almost doubled (from 14 to 24), leading to an aggregate screening of over 4,000 transactions by the European Commission and the EU Member States authorities.

The geopolitical stage has not been particularly favourable to global trade and investments in recent years, and the EU’s adoption of investment screening mechanisms (such as the FDI Regulation and the Foreign Subsidies Regulation) might have played a role in this downward investment trend.

Are investors’ concerns justified, though? Our The For the vast majority of transactions subject to FDI proceedings, the greatest challenge for investors remains the handling and coordination of proceedings, minimising document and information disclosures, and obtaining timely approvals.

In this review and outlook of the EU’s FDI regime, we take stock of the first five years of the EU FDI Regulation, and we give tips to clients as to how to approach and handle FDI proceedings in the future.

Brief recap on the EU FDI Regulation

The EU’s FDI Regulation was adopted in order to identify and address risks that foreign investments could pose for security or public order beyond the EU Member State where the investment is made.

Before the FDI Regulation was adopted, there was no comprehensive framework at EU level for the screening of foreign direct investments on the grounds of security or public order. Some In The However, the emergence of this patchwork of national FDI authorities and procedures might have come at a cost…

A chilling effect on (certain) foreign investments

The FDI Regulation introduces significant challenges for foreign trade and investments. It Notwithstanding this, the FDI Regulation failed to introduce common substantive rules and criteria to structure these mechanisms, leading to fragmentation.

It is difficult to predict the specific impact of the EU’s FDI regimes at a macro-economic level, especially in the context of generally decreasing net FDI flows. For example, in 2020, foreign investors made approx. 1,800 requests to EU Member State authorities for authorisation of their investments, of which 80% were found to be inapplicable (e.g., the request had been made out of an abundance of caution, but actually did not fall under the respective local FDI rules).

By 2023, 44% of FDI requests in the EU were found to be inapplicable, still a significant number that reflects investors general risk-averse approach and wariness of FDI regimes.

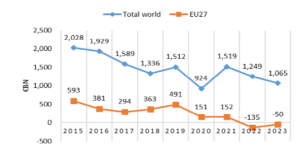

Official data also shows that foreign direct investments into the EU have taken a downwards turn or have offered a negative net balance since 2021.[1] [2]

World and EU inward net FDI flows

Source: OECD data, cited in European Commission Report, Fourth Annual Report on the screening of foreign direct investments into the Union, 17 October 2024

In 2022 and 2023, national FDI regimes captured investments originating predominantly from the U.S. and the UK, both in terms of acquisitions and greenfield operations. The The The Investor Are The In In For example, in Spain, the two most renown investment prohibitions/withdrawals since the regime came into force in 2020 concerned acquisitions from other EU investors: Vivendi (notified acquisition of up to 29.9% of PRISA, notified in 2021, then withdrawn) and Ganz-Mavag Europe (notified acquisition of Talgo, notified and prohibited in 2024).

In France, several high-profile deals have been blocked under the FDI regulation. In In In The Pre The The biggest costs and risks continue to be those associated with the analysis, coordination and handling of FDI approvals.

To minimise these costs and risks, investors are encouraged to engage early on with counsel in order to confirm and prepare any necessary FDI filings, further to the analysis of relevant factors:[3]

Are the relevant jurisdictions triggered by the presence or assets or a formal establishment in the territory, or by the mere generation of revenue (e.g., Italy, Estonia, Lithuania, Czech Republic)?[4]Do the relevant jurisdictions have an investor criterion (e.g., third-country investors, non-OECD investors), a sector-related criterion (e.g., highly specialised technologies), or both?

Do the activities of the establishments or revenues generated in the relevant jurisdictions relate to target sectors (e.g., manufacturing, supply), or to mere support/overhead activities (e.g., marketing, sales)?

Does the investor have any precedent, or is it willing or in need of setting any precedent, regarding the filing for FDI approval in particular jurisdictions?

What are the sanctions, penalties or other consequences resulting from a failure to make an FDI filing for a transaction (e.g., nullity of the contract)?

Are formal or informal consultations available for investors to resolve easy cases and questions in an expedited manner (e.g., Spain, Netherlands, Italy)?[5]

Depending on the activities of the companies involved in a transaction, and the possible jurisdictions concerned, foreign investors can generally avoid the need to make a request for FDI authorisation. The Even The In some instances, however, this harmonisation effort might come at the cost of eliminating high thresholds, informal consultations or other procedural advantages that characterised certain jurisdictions:

The new FDI Regulation will oblige all EU Member States to have a screening mechanism in place. It It is still unclear whether this harmonisation will come at a cost, e.g., in relation to informal consultations.

The new FDI Regulation will identify a minimum sectoral scope that all EU Member States are required to screen, while leaving Member States freedom to go beyond the minimum scope, depending on their own national security interests.

The new FDI Regulation will extend the scope of EU screening to cover transactions within the EU, where the direct investor is ultimately owned by third-country individuals or entities.

****

- See European Commission, First Annual Report on the screening of foreign direct investments into the Union, 23 November 2021.

- See European Commission, Fourth Annual Report on the screening of foreign direct investments into the Union, 17 October 2024.

- See European Commission, Fourth Annual Report on the screening of foreign direct investments into the Union, 17 October 2024.

- See European Commission, Commission Staff Working Document on Foreign Direct Investment in the EU, 13 March 2019, especially Figure 2.8.

- See European Commission, First, Second, Third and Fourth Annual Reports on the screening of foreign direct investments into the Union, published between 2021 and 2024.