Report Shows Downward Patent Filing Trend for World’s Most Innovative Companies

“Global Innovation 100 companies saw an average 2.3% reduction in patent application filings between 2019 and 2022, lower than the 1.5% increase to overall global patent filings during that same period.”

Source: PatSnap report

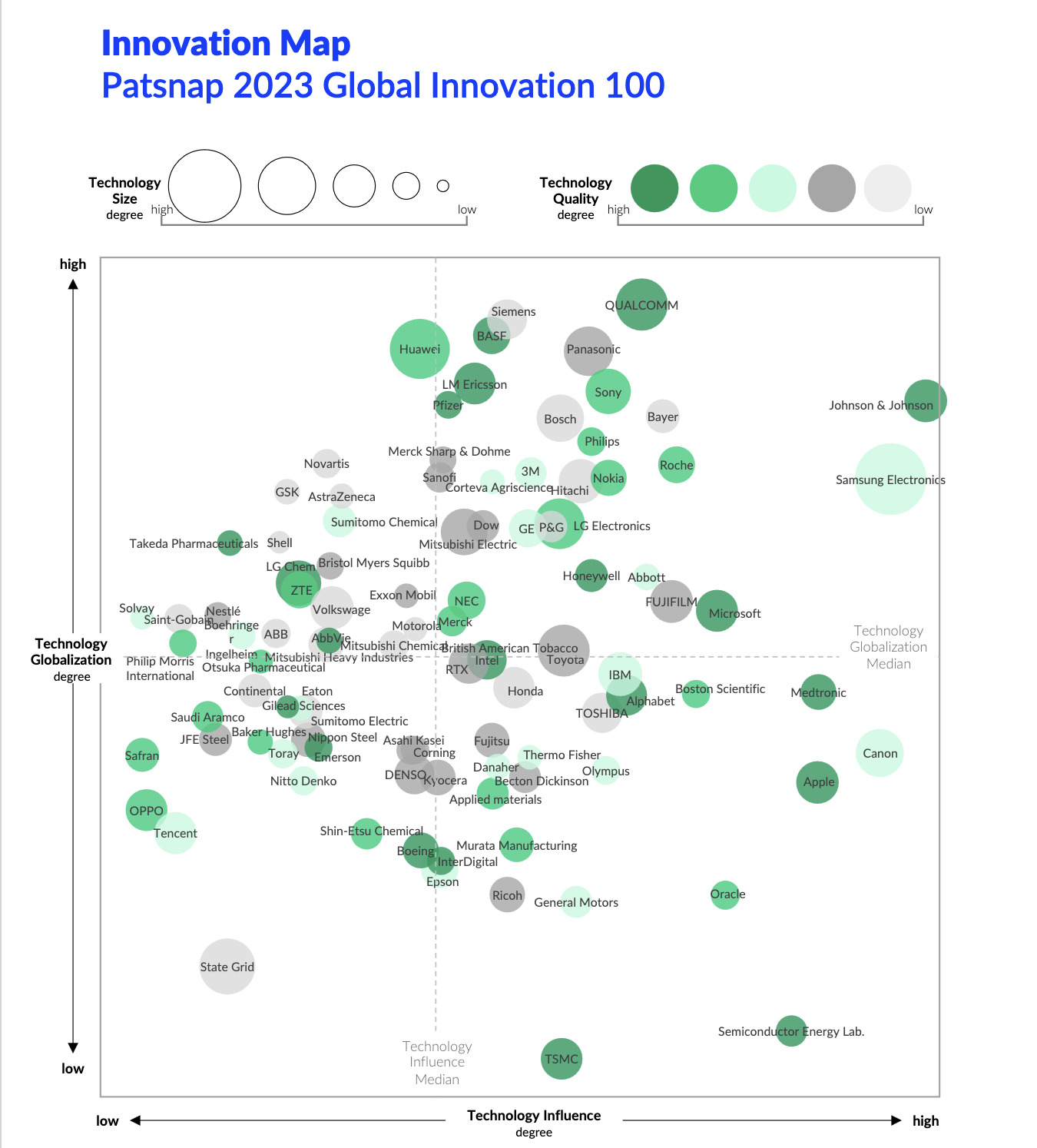

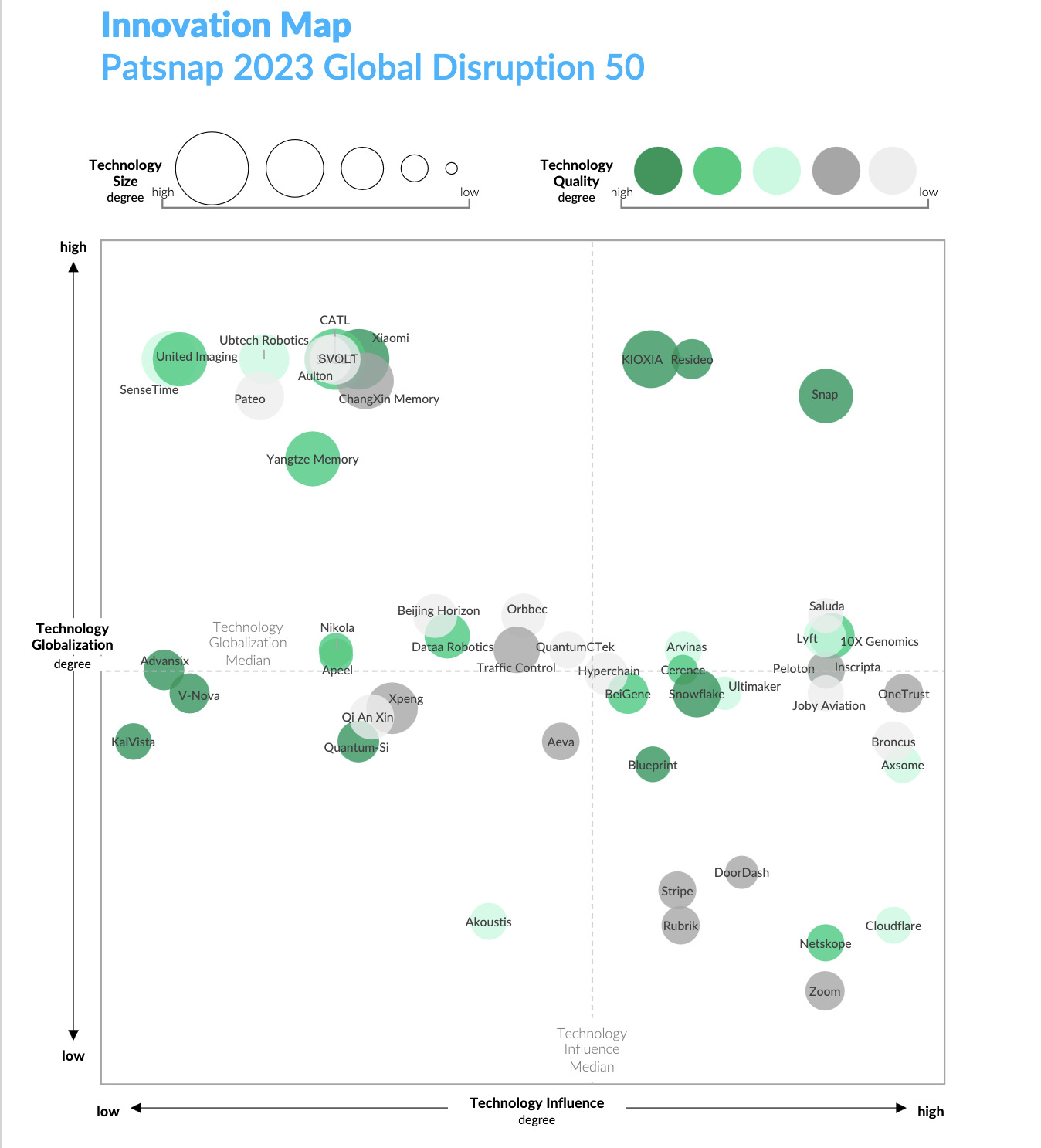

On November 16, innovation intelligence firm Patsnap published the results of its 2023 Global Innovation Report, which measures a range of patent metrics to determine the most innovative companies in the world. This year’s Global Innovation 100 listing represents about a quarter of the globe’s entire patent filing activity. The report also includes a Global Disruption 50 listing of actively growing and young companies, reflecting the strength of both the United States and China in emerging technology fields.

One-Fifth of Global Innovation 100 Companies Operate in Life Sciences and Healthcare

The companies making up Patsnap’s Global Innovation 100 list, which includes about 68,000 subsidiaries owning patent assets, generated 27% of international filings under the Patent Cooperation Treaty (PCT) and hold 22% of the globe’s patents currently in force. On average, companies listed on the Global Innovation 100 have filed 210,000 patent applications and hold patents to 36,000 inventions according to Patsnap. These companies also average 1.8 million citations total for their collective patent portfolios, with each patent averaging 8.6 citations. While there is no ranking in either list provided by Patsnap’s innovation report, an innovation map shows that Qualcomm, Johnson & Johnson and Samsung Electronics are among the outperformers on the Global Innovation 100.

Eleven industries are represented by Global Innovation 100 companies, although more than one-fifth of the companies listed operate in the life sciences & healthcare industry. This includes pharmaceutical, medical device and contract manufacturing companies. As Patsnap’s report notes, these firms tend to outperform other companies in the top 100 in terms of technology globalization. The life sciences & healthcare industry boasts eight of the 10 companies included in the top 100 that have filed patent applications in 120 or more countries and regions. American pharmaceutical firm Pfizer enjoys the greatest degree of globalization, filing patent applications into 138 countries and regions.

Although the Global Innovation 100 is dominated by companies from either the United States or Japan, which together account for nearly two-thirds of top 100 firms, a total of 15 countries and regions are represented by the list. North America and Europe account for a combined 90% of Global Innovation 100 firms in the life sciences & healthcare sector, whereas Asia is home to more than half of the top 100 firms in the electronics, machinery & equipment, and chemicals & materials sectors.

Patent Filings Drop 2.3% in Recent Years for World’s Most Innovative Firms

Companies across the Global Innovation 100 list are typified by a large degree of collaboration in technology development. These companies are named in 85,000 patent applications filed jointly with other top 100 firms, and 99 companies on the Global Innovation 100 have collaborated with other companies on the list. In the United States, which is home to 36 companies in the top 100 list, companies have filed joint patent applications with overseas Global Innovation 100 firms at a rate of 2.4 times the number of joint applications with other U.S. domestics on the list. Conversely, Japanese Global Innovation 100 firms co-apply with other Japanese top 100 firms much more regularly, filing 0.16 joint applications with overseas top 100 firms for each joint application filed with another Japanese company on the top 100 list.

At the same time that the pace of innovation is slowing for companies on the Global Innovation 100, high-growth tech subsidiaries are driving innovation in particular fields of emerging technology. Overall, Global Innovation 100 companies saw an average 2.3% reduction in patent application filings between 2019 and 2022, lower than the 1.5% increase to overall global patent filings during that same period. Only 19 members of the Global Innovation 100 saw positive growth in patent application filings during the survey period, including 12 Asian companies and 7 U.S. companies. China is home to 40% of the 336 high-growth tech subsidiaries having filed more than 20 patent applications in 2022 with a compound annual growth rate (CAGR) of greater than 20% in their filings between 2019 and 2022. More than half of all high-growth tech subsidiaries were innovating in smart grids, biomedical engineering, biopharmaceuticals and electronic components.

Snap, Resideo, KIOXIA Among Top Young and Actively Growing Innovators

Patsnap’s Global Disruption 50 list applies the same patent metrics as the Global Innovation 100 list but with additional criteria. These firms must be less than 15 years old since their founding and enjoy a CAGR for patent filings of greater than 10% between 2019 and 2022. Mapping the patent metrics measured for the Global Disruption 50 reveals Japanese flash memory company KIOXIA and U.S. firms Resideo Technologies and Snap as the top performers among this list in terms of technology influence, globalization, size and quality.

Patent applications filed by members of the Global Disruption 50 have increased by a CAGR of 51% between 2019 and 2022. While United States companies make up half the list, foreign economic rival China is close behind with 20 listed companies. Of the Global Disruption 50, 40 companies began at independent research foundations, five started at research institutes and the remaining five were spun off from larger tech firms.

Steve Brachmann

Steve Brachmann is a graduate of the University at Buffalo School of Law, having earned his Juris Doctor in May 2022 and served as the President of the Intellectual Property […see more]

![[Event] Business and Intellectual Property Litigation Super Conference – March 20th – 22nd, Philadelphia, PA | DRI [Event] Business and Intellectual Property Litigation Super Conference – March 20th – 22nd, Philadelphia, PA | DRI](https://jdsupra-static.s3.amazonaws.com/profile-images/og.16285_0706.jpg)