Quarterly Activist Ownership Analysis

This post outlines the major trends occurring globally amongst activist investors’ portfolios. Using a proprietary model quantifying criteria such as reputation, number of campaigns/outcomes, tactics/focus, board seats won, and recency of engagements we have produced the Morrow Sodali Top 40 Activists (MS40) list narrowed down from the pool of global investors. The MS40 is compiled across two tiers based on propensity for an active engagement. Further, this analysis solely reviews the equity ownership of publicly traded companies and excludes warrants, debt, ETFs and funds.

Importantly, the SEC’s Universal Proxy card rules applies to contested shareholder meetings held after August 31, 2022. This change gives dissident shareholders the ability to include their director nominees on the management ballot while potentially easing the cost burden on activist campaigns. As a result, we expect an increase in board level activism and the continued trend of first-time activist funds looking to make a name for themselves through the proxy contest arena.

In 2Q2022 we observed the following notable trends:

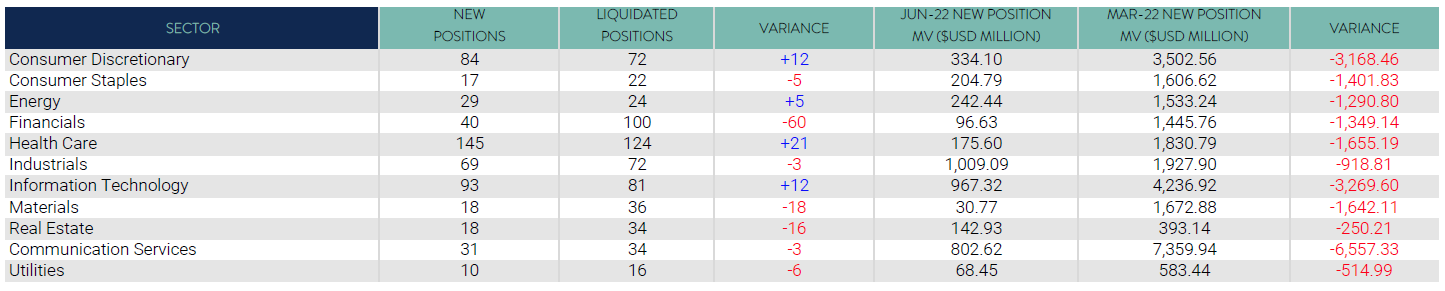

- With the drastic decline across equity markets for 2Q2022, a comparison of market value holdings would skew red. As such, we saw a decline in the market value of MS40 holdings in all eleven sectors during the quarter, but in terms of actual share ownership positions there were increases in three sectors: Industrials, Information Technology, and Utilities. We have replaced the Sector Variance Analysis with a Sub-Industry Analysis assessing the ten highest new positions as well as highest average market value of each position on a more granular basis. We saw the largest turnover in Small Cap Biotechnology with 98 new positions and 56 liquidated

- Elliott and Third Point each initiated four of the twenty largest new positions for the quarter and Southeastern Asset Management initiated three. All three investors were buyers in the Communication Service sector, each initiating two new stakes. Corvex’s new position in MDU Resources was the largest new holding and second overall increase for the quarter. We saw lower portfolio turnover among the quant investors (DE Shaw & Ancora) compared to last

- Among the MS40, investments in SPACs still represent in excess of $5 billion, with a 4% net increase in the number of shares held, though with the high rate of redemptions in SPACs in 2Q2022 these positions increasingly represent Arb plays rather than activism-driven events. Notably, for the second consecutive quarter 90% of Starboard’s new positions were in SPACs. With the continued downturn in the SPAC/deSPAC market, there has been increased speculation toward wave of

- Regionally, 2Q2022 saw buying in Europe and the Middle East, led primarily by increased holdings in the UK and Israel, respectively. There was selling in all other regions of the world with the outsized decline in Asia Pacific, predominantly due to Elliott’s liquidation of its holdings in the Hong Kong based Bank of East

- Arguably, as a result of broader market pressure during the quarter, new positions among the MS40 continued to decrease: the MS40 initiated a total of 554 new positions in 2Q2022, as compared to 572 for the prior quarter, and 1,054 for 4Q2021. In a year- over-year comparison, MS40 established 1,113 new positions in 2Q2021, 559 more than the current quarter. In 2Q2022, quants initiated 401 fewer new positions than in 2Q2021, representing an almost 10% reduction in the proportion of new quant positions relative to those of actively managed

The complete publication, including footnotes, is available here.