Portugal VAT Reform Options | Tax Foundation

Note: This post is part of a series on Portugal’s taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities.

policy, examining how it compares internationally, providing a deeper analysis of current policy, and discussing pathways toward reform.

Portugal’s value-added tax (VAT) policy is a treasure trove of tax oddities. For example, beginning in January 2024, restaurant owners will need to think twice about offering wine or soft drinks on their menus, as doing so will hike the VAT rate applied to all their meals to the full rate. Following last year’s temporary VAT exemption for a rather arbitrary list of food items, this is the latest in a series of policy decisions that have made Portugal’s VAT system more complex to comply with, distorted consumption behaviour, and contributed to significant base erosion.

Portugal’s tax system faces important challenges, ranking 34th out of 38 OECD countries in the International Tax Competitiveness Index. Reform that prioritizes simplification and base expansion would make Portugal’s VAT an ideal instrument to efficiently raise revenue at a time when other parts of its tax system, such as the corporate tax, hamper the country’s international competitiveness and slow its economic growth. This makes it essential to understand the issues that plague the Portuguese VAT system today.

Generally, the VAT allows the government to raise revenue more efficiently than personal or corporate income taxes. Since the VAT is a tax on final consumption, workers’ tax liability increases with the income they spend on consumption goods, adding to the tax burden on labor. However, in contrast to taxes on personal and corporate income, it does not tax savings more than immediate consumption, making it a relatively efficient way to raise revenue.

Portugal levies its VAT at a standard rate of 23 percent, slightly above the European Union’s average standard rate of 21.6 percent (making it one of six Member States to apply a higher rate). Portugal also applies two reduced rates of 13 and 6 percent to select products and services, with the lowest rate mostly reserved for food items. In the International Tax Competitiveness Index, its VAT system ranks only 26th out of 38 OECD countries, as its above-average standard rate applies to a narrow base that covers only around half of final consumption.

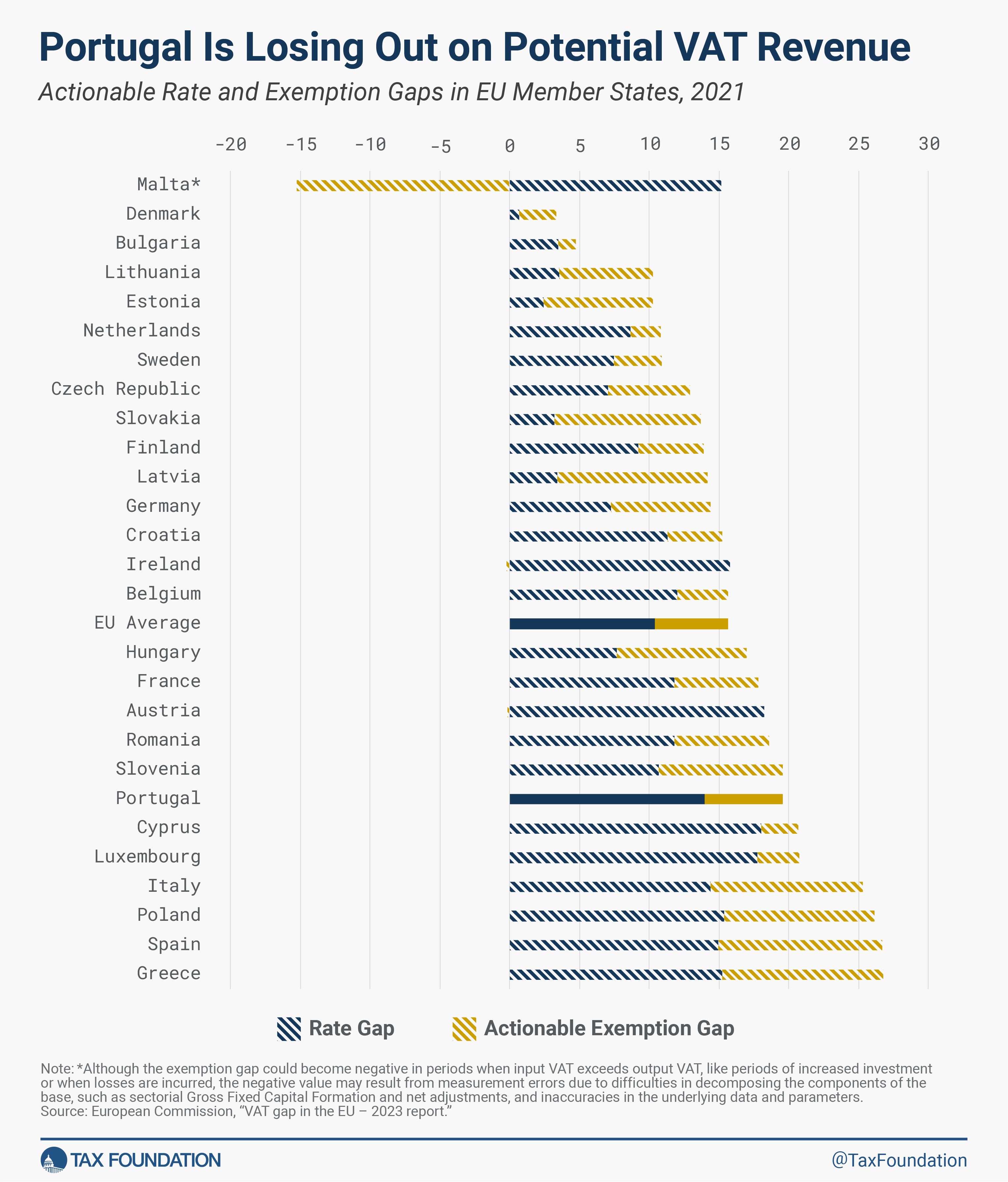

In 2021, Portugal’s VAT collected only 51 percent of notional ideal revenue (i.e., the revenue that would result from taxing all final consumption at the standard VAT rate), below the EU average of 58 percent. This gap between actual and ideal VAT revenues can be broken down into two components: the compliance gap and the policy gap. The compliance gap results from non-compliance with VAT law through evasion, bankruptcies, insolvencies, or administrative errors. In contrast, the policy gap is the result of identifiable policy choices that erode the tax baseThe tax base is the total amount of income, property, assets, consumption, transactions, or other economic activity subject to taxation by a tax authority. A narrow tax base is non-neutral and inefficient. A broad tax base reduces tax administration costs and allows more revenue to be raised at lower rates.

, such as VAT registration thresholds, reduced rates, and exemptions. There are some services—namely, imputed rents, the provision of public goods, and financial services—that are VAT-exempt because they are often considered too difficult to levy a VAT on. Subtracting the amount of lost VAT revenue caused by these services from the policy gap leaves us with the actionable policy gap.

In Portugal, the use of reduced rates and exemptions for select goods and services bear most of the blame for its large VAT gap. In 2021, Portugal lost out on 19.6 percent of potential revenue, significantly above the EU average of 15.7 percent. If the country were to close the actionable policy gap in its VAT base entirely, the majority of revenue, 13.9 percentage points, would arise from lifting reduced rates up to the standard rate. A smaller portion, 5.6 percentage points, would come from including actionable exemptions in the VAT base.

Portugal’s VAT already accounts for 25.5 percent of total tax revenues, or EUR 20 billion, compared to only EUR 5.2 billion raised by taxes on corporate income in 2021. Closing Portugal’s actionable VAT policy gap would increase its VAT revenues by 42.5 percent, raising EUR 8.1 billion in 2021. This revenue would come at a low efficiency cost, as abolishing reduced rates and exemptions would eliminate the distortions to consumption choices and compliance costs associated with applying multiple different rates. This makes VAT base broadeningBase broadening is the expansion of the amount of economic activity subject to tax, usually by eliminating exemptions, exclusions, deductions, credits, and other preferences. Narrow tax bases are non-neutral, favoring one product or industry over another, and can undermine revenue stability.

an ideal instrument to give the Portuguese government the fiscal room to implement pro-growth tax reforms, including more ambitious corporate tax reform or personal income tax cuts. For example, Tax Foundation’s most recent report on VAT expansion and labour tax cuts finds that closing the actionable VAT policy gap would provide Portugal with enough revenue to reduce the standard VAT rate to 13 percent or cut the first two personal income tax brackets to 0 percent and the third from 28.5 percent to 5 percent.

The next post in this series will dive more deeply into the structure of Portugal’s personal income tax system.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Subscribe

Share