Portugal Corporate Taxes Stifle Investment and Economic Growth

Note: This post is part of a series on Portugal’s taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities.

policy, examining how it compares internationally, providing an analysis of current policy, and discussing pathways toward reform. For a complete analysis of this and other tax reform options in Portugal, download our Portuguese-language primer below.

Download Primer

Portugal’s corporate income taxA corporate income tax (CIT) is levied by federal and state governments on business profits. Many companies are not subject to the CIT because they are taxed as pass-through businesses, with income reportable under the individual income tax.

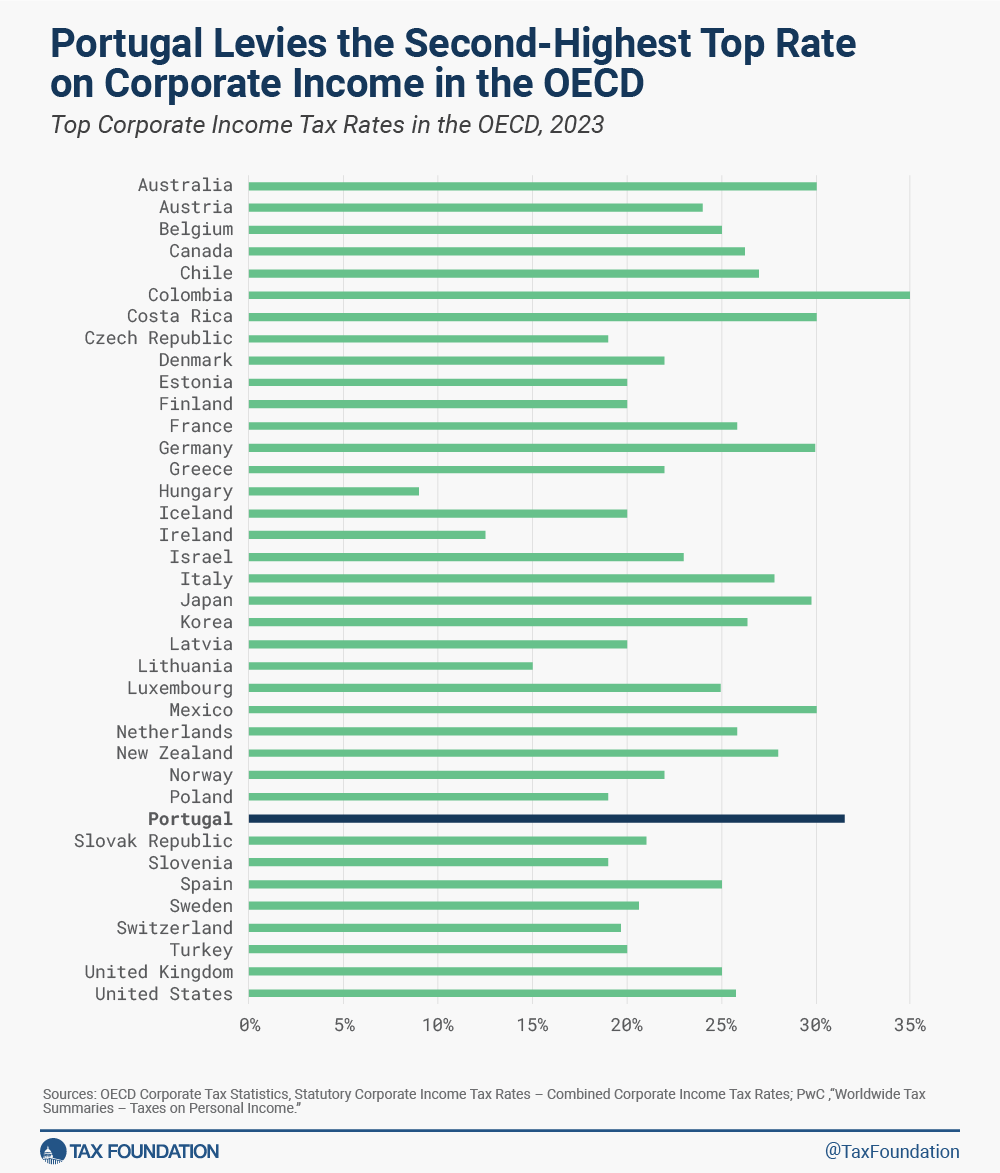

system is one of its most serious tax barriers to investment and economic growth. In the International Tax Competitiveness Index 2023, Portugal ranks second to last (37th) due to its high top rate of 31.5 percent on corporate income and multiple layers of complexity introduced by its distortive top-up taxes and corporate incentives.

According to research from the OECD, taxes on corporate income are the most harmful to economic growth, with personal income taxes and consumption taxes being less harmful. Taxes on immovable property have the smallest impact on growth. Empirical research finds that more than half of the corporate tax burden is borne by workers in the long run, as lower investment in the capital stock reduces their productivity and wages.

Portugal has the second highest top corporate tax rate in the OECD at 31.5 percent, including multiple top-up taxes. This puts Portugal’s corporate tax rate 8 percentage points above the OECD average of 23.6 percent. If adopted, the Colombian government’s recent plan to reduce its corporate income tax rate from 35 to 30 percent would leave Portugal with the highest corporate rate in the OECD.

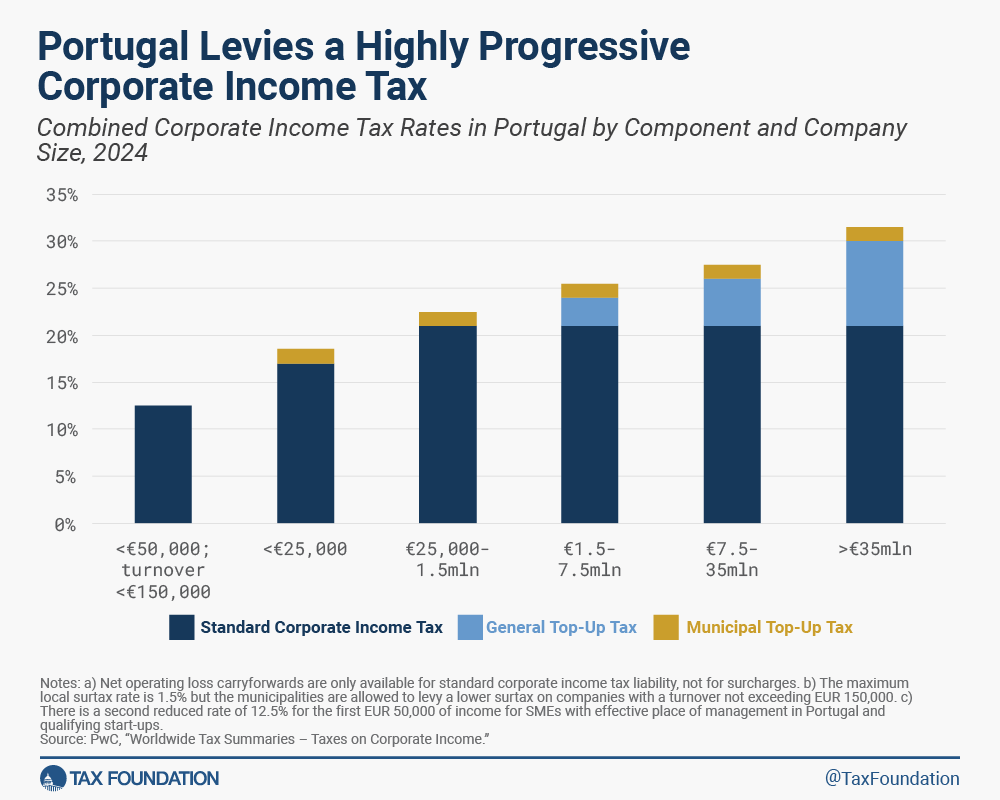

Beyond its high headline rate, Portugal’s system of progressive top-up taxes and various incentives cause considerable structural problems and distortions. The municipal top-up tax of up to 1.5 percent and the general top-up tax employ a progressive structure with three different rates (3 percent, 5 percent, and 9 percent) on taxable incomeTaxable income is the amount of income subject to tax, after deductions and exemptions. For both individuals and corporations, taxable income differs from—and is less than—gross income.

, before the deduction of any carried forward losses.

Progressive Rate Structure

Unlike most OECD countries, Portugal imposes a highly progressive taxA progressive tax is one where the average tax burden increases with income. High-income families pay a disproportionate share of the tax burden, while low- and middle-income taxpayers shoulder a relatively small tax burden.

structure on corporate income. Businesses located in the same jurisdiction may be subject to marginal tax rates ranging from 12.5 percent for domestic small and medium-size enterprises (SMEs) and qualifying start-ups to 31.5 percent for companies with taxable income above EUR 35 million, which are unable to offset losses against a large and increasing portion of their tax liability.

This progressive structure undermines Portuguese businesses’ ability to harness economies of scale that are essential to many industries and brings no economic benefit. Mergers and acquisitions (M&A), for example, can allow companies to increase their productivity by combining operations. The progressive rate structure discourages this type of productivity-enhancing M&A as combining the merging companies’ income shifts them into higher tax brackets. This distortion increases the income difference between companies, with the strongest deterrence effect applying to acquisitions of small start-ups or unprofitable businesses by larger companies. Portugal’s corporate tax structure drags down these drivers of productivity growth, keeping it an economy dominated by small and medium-sized enterprises with lower productivity.

Restrictions on Loss Offsets

Portugal’s top-up taxes make up to 10.5 percentage points of the corporate tax rate unavailable for loss offsets, in addition to the restriction of loss carryforwards to 65 percent of taxable income, disproportionately deterring investment projects with long time horizons and variable income profiles. For example, pharmaceutical companies typically undergo lengthy periods of research and development (R&D) investment before reaping the financial rewards from their products. Restrictions on firms’ ability to carry forward losses lead to these investments being taxed at higher rates. Ideally, a sound tax code should allow businesses to carry forward their operating losses without limits on time or expenses, ensuring that a business is taxed on its average profitability over time.

Portugal should consolidate its multiple layers of corporate tax into a single rate more aligned with those of other OECD countries and allow for loss carryforwards against the entire corporate tax baseThe tax base is the total amount of income, property, assets, consumption, transactions, or other economic activity subject to taxation by a tax authority. A narrow tax base is non-neutral and inefficient. A broad tax base reduces tax administration costs and allows more revenue to be raised at lower rates.

. To the extent municipal finances rely on local top-up taxes, it would be preferable for the federal government to apportion a share of local VAT revenue—a stable funding stream—back to its source jurisdictions.

Preferential Tax Incentives

Portugal’s non-neutral tax incentives such as its patent boxA patent box—also referred to as intellectual property (IP) regime—taxes business income earned from IP at a rate below the statutory corporate income tax rate, aiming to encourage local research and development. Many patent boxes around the world have undergone substantial reforms due to profit shifting concerns.

and R&D tax credits also distort economic decision-making. The patent box regime gives an 85 percent tax exemptionA tax exemption excludes certain income, revenue, or even taxpayers from tax altogether. For example, nonprofits that fulfill certain requirements are granted tax-exempt status by the Internal Revenue Service (IRS), preventing them from having to pay income tax.

to income derived from the use of various forms of intellectual property. Its R&D tax credits apply an implicit subsidy rate of 35 percent to qualifying expenses (nearly twice the OECD average), a reduction in tax liability that is independent of the marginal tax rateThe marginal tax rate is the amount of additional tax paid for every additional dollar earned as income. The average tax rate is the total tax paid divided by total income earned. A 10 percent marginal tax rate means that 10 cents of every next dollar earned would be taken as tax.

. Preferential tax treatment creates incentives to engage in tax planning by assigning income to intangible assets and focus on tax-advantaged expenses rather than those with the highest payoff. A more neutral approach to support innovation would be to improve Portugal’s cost recoveryCost recovery is the ability of businesses to recover (deduct) the costs of their investments. It plays an important role in defining a business’ tax base and can impact investment decisions. When businesses cannot fully deduct capital expenditures, they spend less on capital, which reduces worker’s productivity and wages.

for all types of investment and extend loss carryover provisions.

Recent Progress

In the past, Portugal has made some progress in the treatment of equity financing and loss offsets that policymakers can build on. Reform in 2017 allowed all businesses to claim an allowance for corporate equity (ACE), letting them deduct 4.5 percent of the net increase in eligible equity against taxable profit, just like interest on corporate loans. This reduced the corporate tax code’s bias towards more crisis-prone debt-financing. Further, the 2023 reform of loss carryforwards revoked the 12-year time limit on using loss carryforwards, following many of Portugal’s European neighbors, although it also restricted the allowed amount from 70 to 65 percent of taxable income and kept in place the unavailability of top-up taxes for loss offsets.

In summary, Portugal’s corporate tax system has considerable structural weaknesses that make it internationally uncompetitive for investment. Policymakers should consolidate its progressive and distortive corporate income tax schedule into a single corporate rate more closely aligned with the OECD average, allow companies to carry forward a larger share of their past losses against the entire corporate tax base, and discard preferential tax incentives in favor of better cost recovery for all types of investment. If policymakers are willing to pursue bold reform, Portugal has the opportunity to achieve sustainable economic growth by emulating the simpler, more neutral, distribution-based system that excludes retained and reinvested profits from taxation.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Subscribe

Share