Pending Passage, Plans, Tears, And Wellness

The Senate is set to vote on the House-passed funding package. The Senate is expected to vote on a bill that extends funding for four federal agencies through September. Upon passage, President Biden is expected to sign it into law, averting a partial government shutdown at midnight tonight.

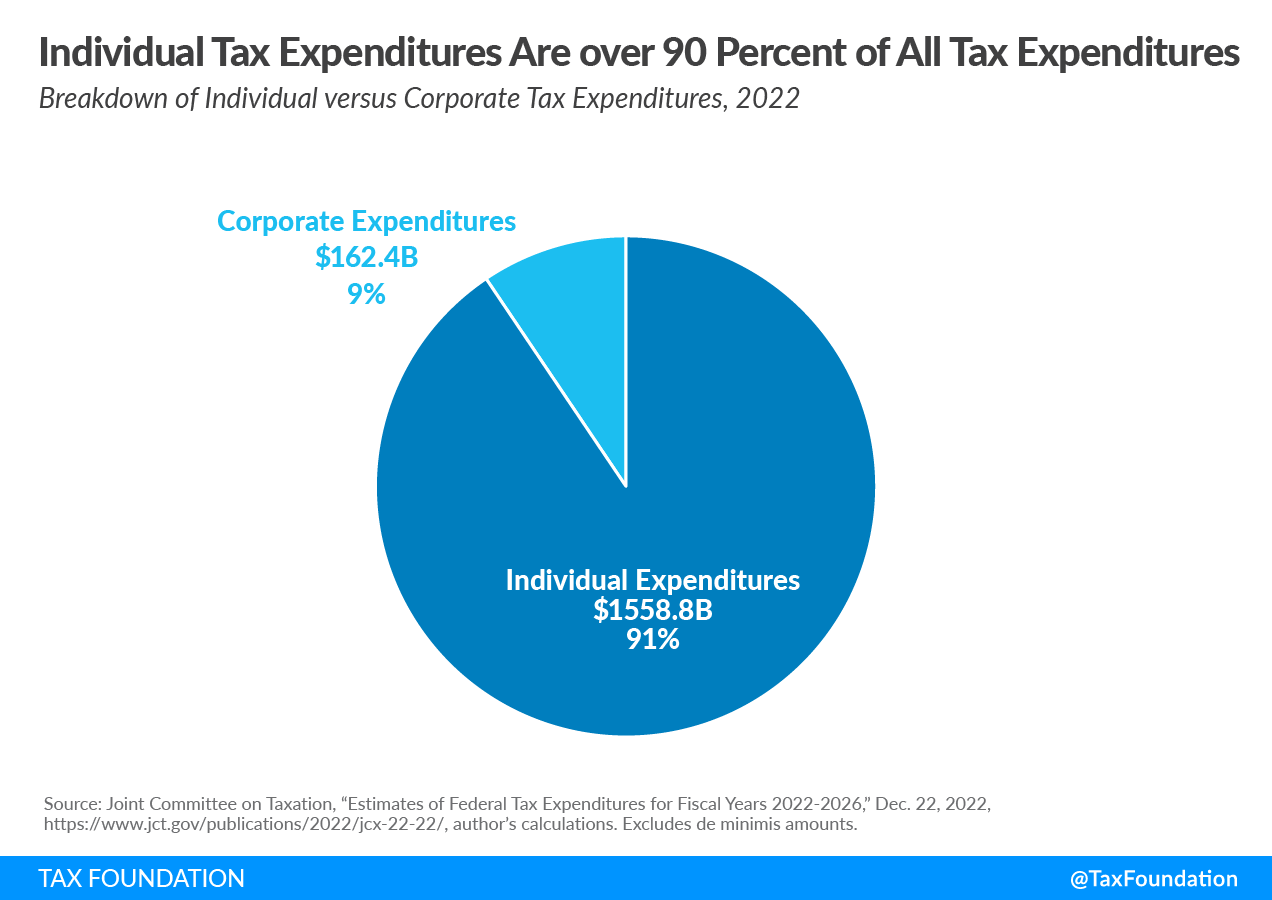

The State of the Union is filled with tax plans. Last night, President Biden shared some proposals in his State of the Union address. They include enhanced efforts to increase taxes paid by wealthy Americans, a ban on firms deducting as costs executive salaries that exceed $1 million, and an increase to the corporate income taxes paid by large multinational companies. His proposed budget aims to cut the federal deficit by $3 trillion over ten years while simultaneously cutting taxes for Americans with lower incomes. Meanwhile, TaxNotes reports that the Senate’s upcoming agenda does not include the House-passed $79 billion tax bill, given other priorities.

Speaking of the House-passed bill… It might be stuck in the Senate, leaving a proposed expanded child tax credit in limbo. But TPC’s Richard Auxier and Nikhita Airi note “there are places where a more generous CTC that benefits families with very low income is not just a theoretical debate: the states… If Congress wants more evidence about the tradeoffs involved in constructing a more generous child tax credit, state CTCs are a great place to learn.”

Taxes are taxing Gen Z’s mental health. A survey by Cash App shows that 54 percent of members of Generation Z (born between 1997 and 2012) and 38 percent of Millennials (born between 1981 and 1996) report that the stress of filing taxes has either brought them to tears in the past or they expect tears this year. One in four Gen Z-ers reported a need for help from a therapist to recover from the experience. If it helps, the IRS notes that as it continues efforts to improve taxpayer service, special Saturday hours (9am to 4pm) at 70 Taxpayer Assistance Centers will be held on March 16.

But the IRS might not believe your doctor’s note for HSA or FSA funds. The Washington Post reports on the IRS concern that some companies mislead consumers about the eligibility of some expenses under tax-advantaged Health Savings Accounts (HSAs) and Flexible Savings Accounts (FSAs). The IRS says pretax funds are not for health and wellness items, and a doctor’s note cannot transform such items into medical expenses.

For the latest tax news, subscribe to the Tax Policy Center’s Daily Deduction. Sign up here to have it delivered to your inbox weekdays at 8:00 am (Mondays only when Congress is in recess). We welcome tips on new research or other news. Email Renu Zaretsky at [email protected].