Optimizing your accounts payable workflow process

Accounts payable (AP) is an important signal in understanding the financial health of a business. By optimizing your accounts payable workflow, you can gain insight into cash flow, make better business decisions, and ensure strong relationships with vendors and suppliers.

To optimize your accounts payable workflow, automation is key. An automated accounts payable process enables visibility into your company’s financial wellbeing and can unlock insights that help your business grow.

What is the correct accounts payable workflow?

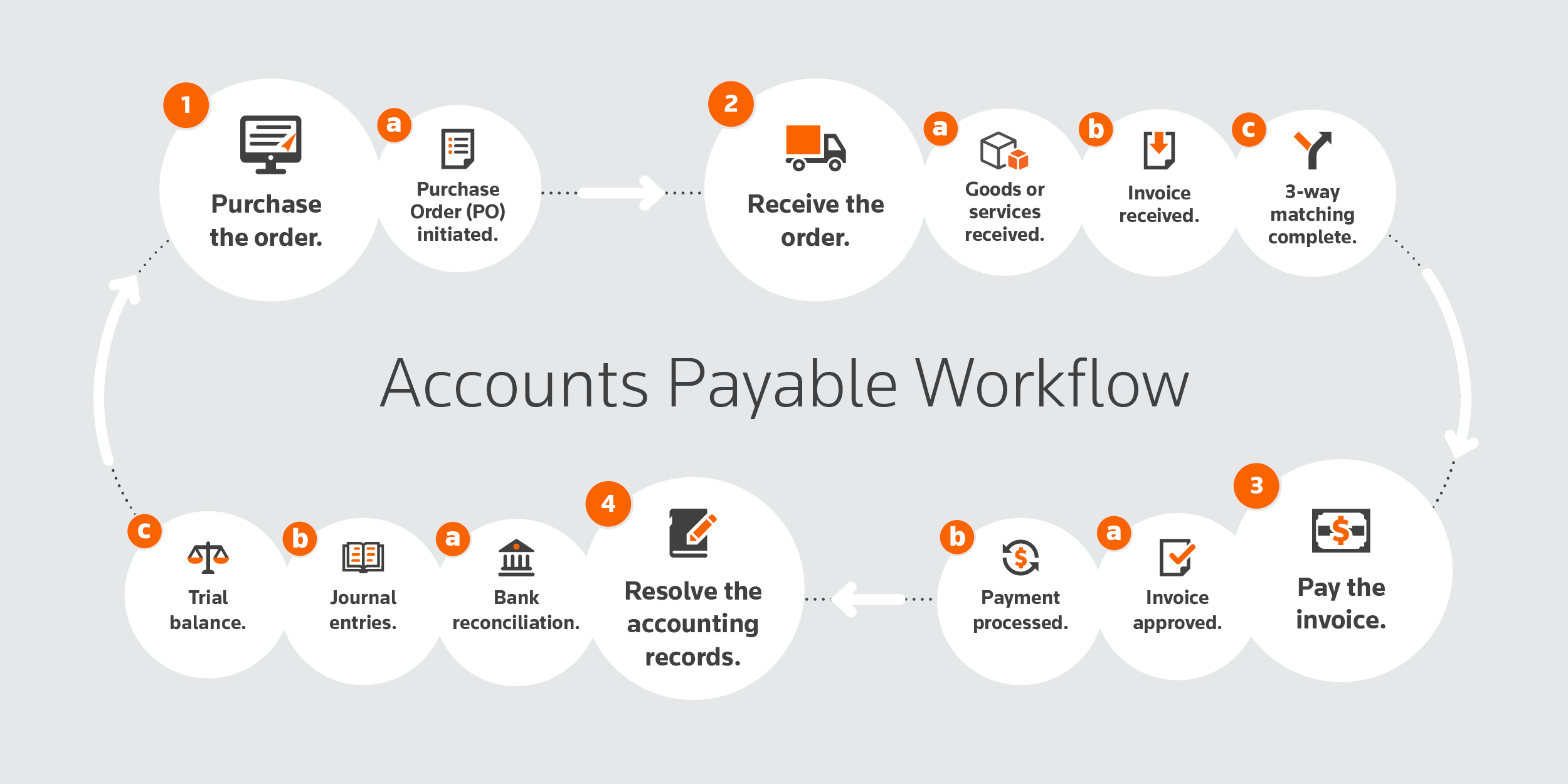

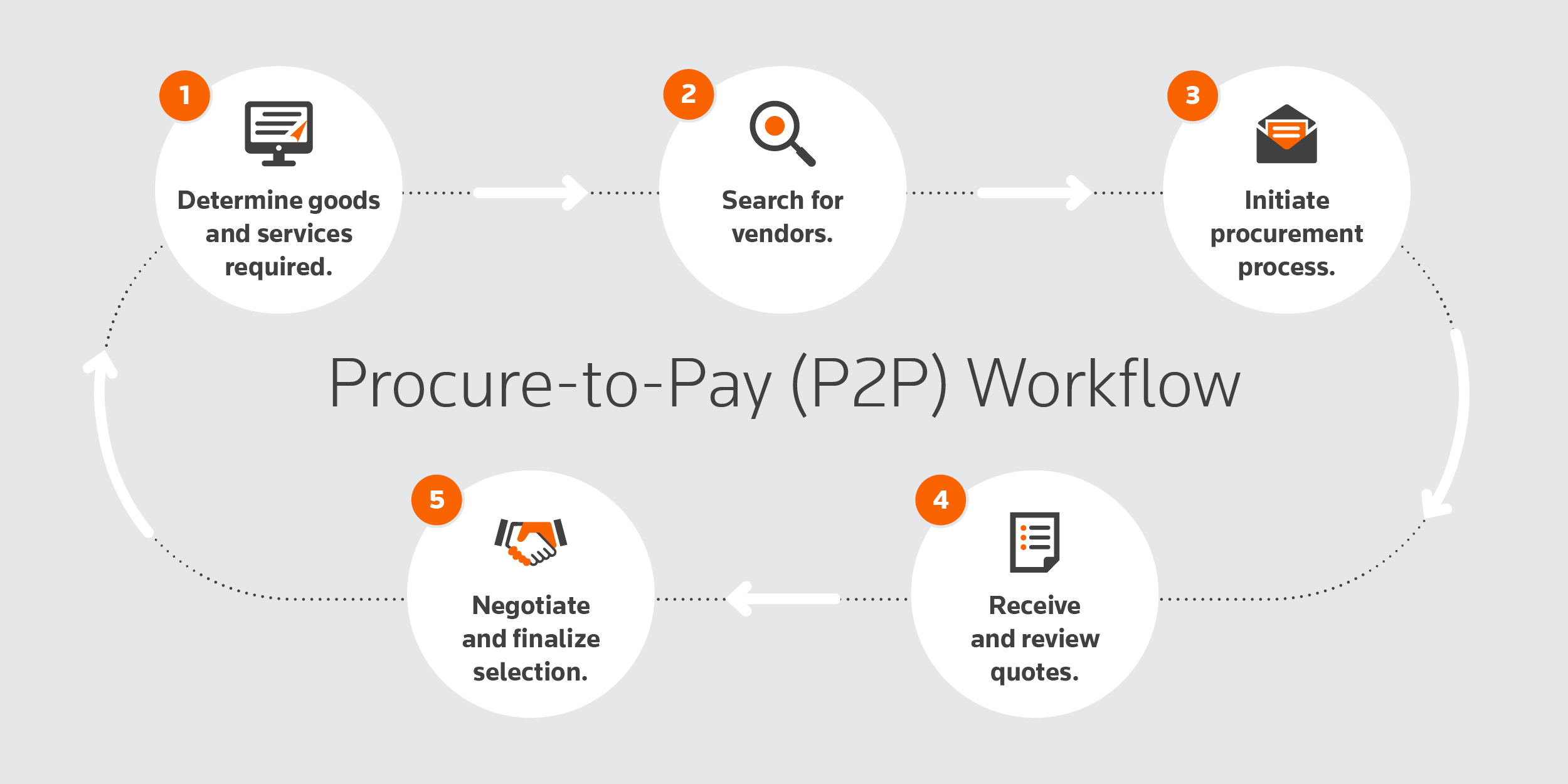

The accounts payable workflow consists of upstream and downstream processes. Upstream processes ensure strong vendor selection, relationship management, and mutually beneficial contracts. When upstream processes are included in the accounts payable workflow, it is commonly known as Procure-to-Pay (P2P).

Downstream processes are the more traditional accounts payable processes that ensure products and services are paid for and the vendor is notified of any issues.

By automating your accounts payable workflow, you can overcome the challenges associated with tedious, manual tasks and optimize the accounts payable process from start to finish.

What is P2P in accounts payable?

P2P stands for Procure-to-Pay and is used by businesses to define the entire set of processes relating to sourcing, negotiating, requesting, and purchasing. The P2P process spans procurement all the way through to paying for goods and services through the account payable process.

What are AP workflow best practices?

To ensure accuracy and transparency in your accounts payable process, follow these best practices.

1. Implement 3-way matching

As part of the accounts payable workflow, 3-way matching matches up the purchase order, goods or services received, and invoice details to validate the purchase prior to issuing a payment to a vendor or supplier.

Similarly, 2-way matching ensures the details on only the purchase order and invoice are aligned.

2. Separate AP and AR duties

The segregation of accounts payable and accounts receivable is considered a fundamental accounting principle and reduces the risk of fraud. With two different individuals handling accounts payable and accounts receivable, discrepancies can often be immediately identified and resolved due to the use of double checks on each side.

3. Review your data regularly

Consistent visibility into your financial data provides insight into your company’s cash flow and helps to identify bottlenecks or trends in the account payable process. It can also mitigate risk by providing an audit trail. With advanced reporting and analytics, your company is empowered to make better business decisions.

4. Automate the accounts payable process

Successful businesses optimize accounts payable by simplifying their workflow through automation.

Accounts payable automation automatically finds and verifies financial information and integrates it with other applications automatically, so businesses spend less time searching for and entering data. This makes tracking and retrieving accounts payable details easy.

By following these accounts payable best practices, your business can establish controls, prioritize invoices, eliminate fraud, strengthen vendor/supplier relationships, eliminate paper-based processes, and easily reconcile accounts.

How to manage accounts payable effectively

An accountant’s hands are often full with the day-to-day work that keeps your practice running. That doesn’t leave much time for building new business or offering more high-value services. To take a more strategic approach, it might make sense to turn to technology to streamline your firm’s accounts payable and better serve your clients.

For accountants who serve business clients, professional accounting software enables you to provide your clients with accounting, bookkeeping, and financial support—with maximum efficiency through automation.

With the right tools and technology, you and your clients can:

- Reduce or eliminate manual data entry

- Confidently take on new business

- Standardize firm data and maintain consistency of financial statements across all clients

- Access real-time financial transactions and reporting to make informed business decisions

Accounts payable workflow solutions

With smarter approval workflows and simplified vendor onboarding and payment, accounts payable workflow solutions provide total data transparency and completeness, ensuring an accurate balance sheet and the ability to optimize data for financial analysis and reporting.

With the latest technology, an intelligent interface automatically finds and verifies financial information and integrates with other applications automatically, so you spend less time searching for and entering data. Cloud-based accounting lets you work securely with others in real time from anywhere.

With an accounts payable workflow solution, your firm can better serve business clients by:

- Pulling data directly from your clients’ spreadsheets or QuickBooks® and integrating transactions with their financial institution.

- Working with different entity types, reporting periods, and locational and departmental clients.

- Processing multiple clients at once and having multiple users within your firm working within a single client project at the same time.

- Setting up controls so you choose how much information your clients can see. Plus, monitor activity by date, time, and staff member.

- Customizing reports based on client needs, while also maintaining standardized reporting and financial statement formatting.

- Collaborating with your clients in real time, using this shared online portal to handle their bookkeeping tasks.

Whether you’re an accountant or a small business owner, automating your accounts payable workflow enables you to optimize critical financial data for better decision-making.

For more information about automating AP for your firm, visit the Accounting CS contact page.

Still have other questions about accounts payable? Check out our Accounts payable FAQ.