Navigating Fiscal Uncertainty: Weak State Revenue Forecasts for Fiscal Year 2024

With more fiscal data coming in, the long-term health of state budgets looks murky.

After a run up in 2022, preliminary data show a substantial weakness in state tax revenues for the first 11 months of fiscal year 2023 (July 2022 through May 2023). Overall, state tax revenues declined 5.3 percent in nominal terms, largely driven by declines in personal and corporate income tax revenues, while sales tax revenues increased in nominal terms.

States are continuing to feel the impact of high inflation, volatility in the stock market and oil prices, as well as the shift in federal monetary policy and changes in consumer spending. But due to differences in state economic conditions, employment rates, industry compositions, and tax structures, these macroeconomic factors are affecting individual states differently.

Revenue forecasts for fiscal year 2024

Strong rainy-day funds helped states pass their fiscal year 2024 budgets without too much drama. Almost every state adopted its budget on time despite looming fiscal and economic uncertainty.

But about half of all states have updated their fiscal year 2024 revenue forecasts since then, anticipating a slowdown in revenues.

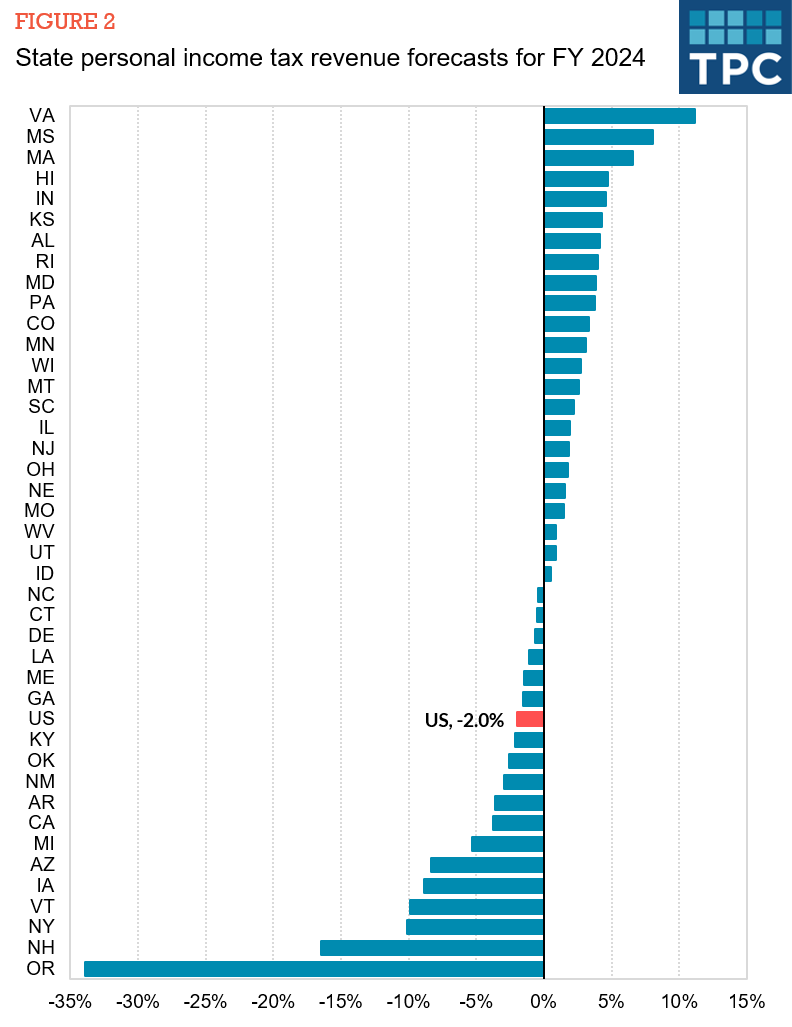

Projected year-over-year growth for total state revenues is negative 1 percent for fiscal year 2024. About half of states are projecting declines in overall tax revenues. Seven states are projecting revenue growth of over 5 percent in nominal terms, while another 7 states expect declines of over 5 percent.

The largest projected revenue decline is in Oregon, at 30.1 percent. Officials in Oregon warn that the previous surge in revenues was mostly driven by nonwage sources of income, which are likely to be temporary. Moreover, forecasters in Oregon are anticipating a $5.5 billion revenue loss due to the issuance of “kicker” rebates, where the state distributes the prior year’s surplus back to taxpayers, in the spring of 2024.

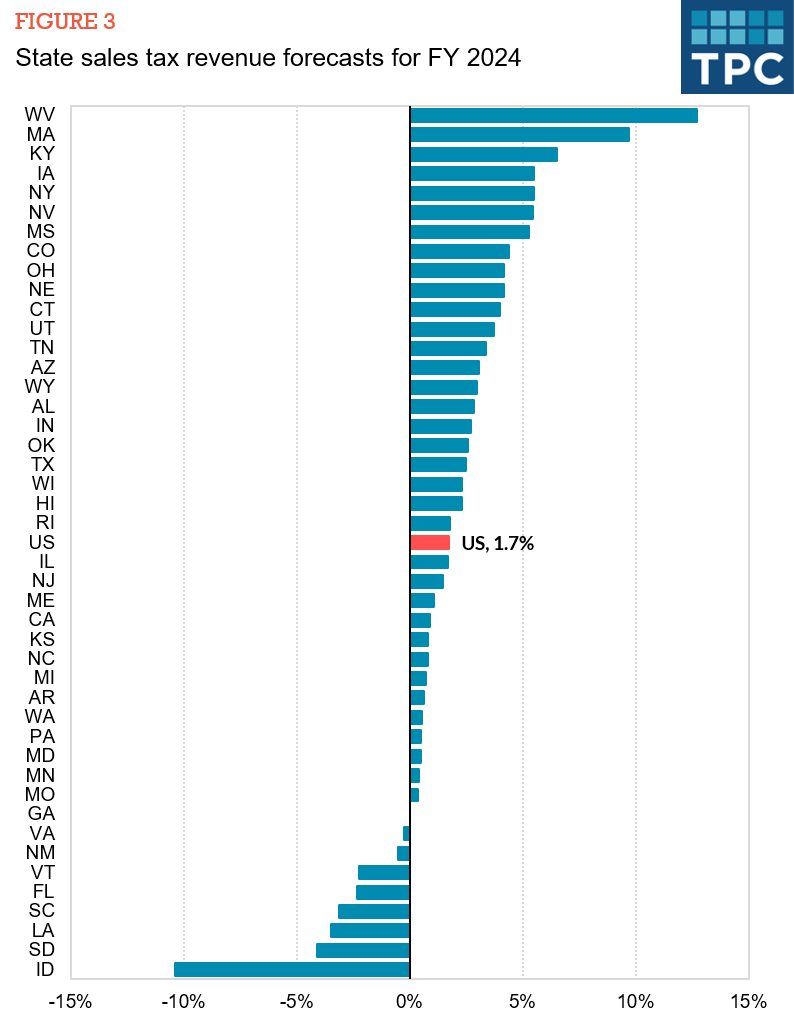

Focusing on the state personal income tax, revenues are projected to decline 2.0 percent in fiscal year 2024; the median state forecast is 0.9 percent growth. Eighteen states are forecasting declines in fiscal year 2024.

There are several factors behind the weaker personal income tax revenue forecasts. State policy actions, namely income tax rate cuts, rebates and the introduction of elective pass-through entity taxes, have led to weaker growth in personal income taxes.

Stock market volatility is another factor contributing to weaker personal income tax revenue forecasts. The average annual growth in the S&P 500 was 10.5 percent in 2020 and 32.8 percent in 2021. However, the index declined 4.1 percent in 2022 and is off to a weaker start this year. The dip in the stock market is expected to lead to weaker state personal income tax revenues, primarily due to reduced capital gains realizations.

Finally, there is a divide between the growth rates of wages and personal income versus inflation, resulting in bracket creep. Inflation pushed individuals into higher tax brackets, which led to stronger income tax revenues, particularly in the states that have progressive income tax structures and where income tax brackets are not adjusted for inflation.

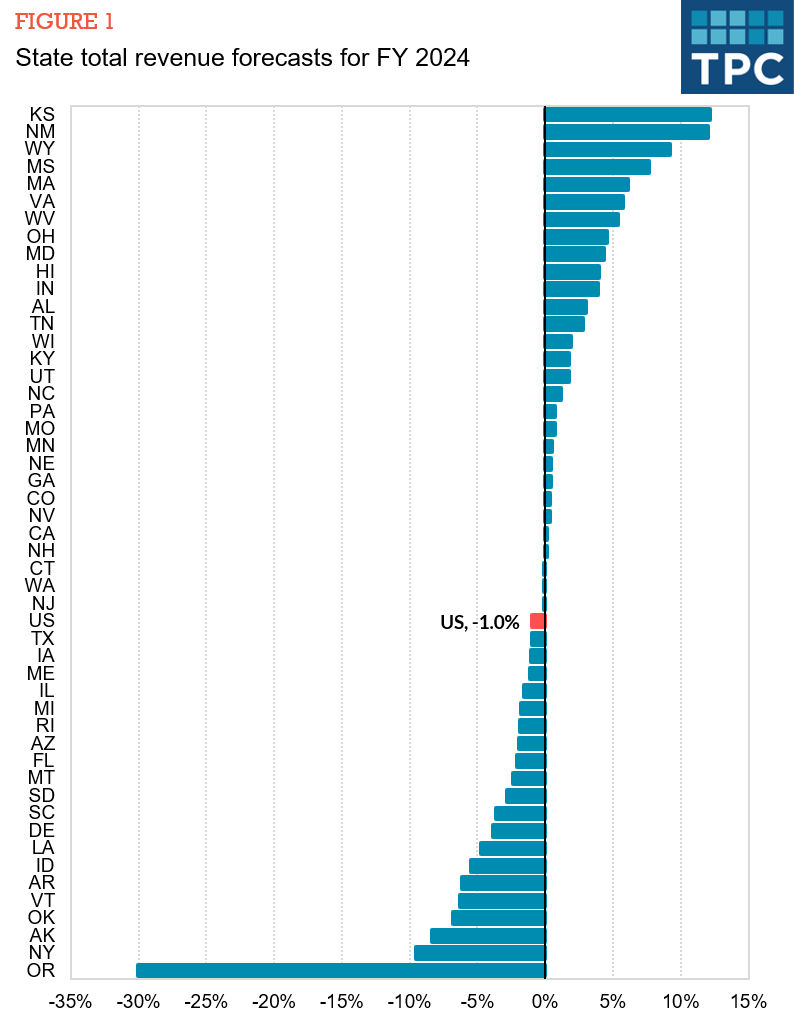

Looking at state sales taxes, revenues are projected to increase 1.7 percent in fiscal year 2024. However, this is down sharply from the double-digit growth observed in fiscal year 2022. Only seven states are forecasting growth of over 5 percent, while eight states are forecasting declines in sales tax revenues in fiscal year 2024.

These sales tax forecasts are in response to changes in spending patterns and cooling inflation.

An uncertain transition period

The federal government took unprecedented actions in response to the pandemic and injected trillions of dollars into the economy, which had a significant positive impact on state budgets.

But the post-COVID expansion is ending, and states’ fiscal path forward remains highly uncertain, particularly for states that chose to enact permanent tax rate cuts. Prior surpluses are helping ease the transition to slower growth. But those resources will soon run out, forcing states to again grapple with the need for more revenue or spending cuts in the coming years.