Methane Fee to Take Effect in 2024: A Mini Carbon Price

While a broad-based carbon taxA carbon tax is levied on the carbon content of fossil fuels. The term can also refer to taxing other types of greenhouse gas emissions, such as methane. A carbon tax puts a price on those emissions to encourage consumers, businesses, and governments to produce less of them.

is still only an idea in the United States, some incremental attempts at carbon pricing are more imminent. At the beginning of 2024, a fee on certain methane emissions took effect. While insignificant on its own, it is the first U.S. federal-level effort to price greenhouse gas emissions to combat climate change.

The InflationInflation is when the general price of goods and services increases across the economy, reducing the purchasing power of a currency and the value of certain assets. The same paycheck covers less goods, services, and bills. It is sometimes referred to as a “hidden tax,” as it leaves taxpayers less well-off due to higher costs and “bracket creep,” while increasing the government’s spending power.

Reduction Act of 2022 largely rejected the Pigouvian taxation approach to solving climate change, which would make polluters internalize the social costs of pollution by applying an equivalent taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities.

, instead opting to subsidize green energy production. However, the law accepts the taxation approach for certain methane emissions.

Methane, or CH4, is a greenhouse gas responsible for 11.5 percent of the U.S.’s greenhouse gas emissions when measured on a CO2-equivalent basis, as of 2021. While the volume of methane emissions is low, a ton of methane is much more potent than a ton of carbon dioxide in terms of climate impact, so methane emissions are often expressed in terms of CO2 equivalents.

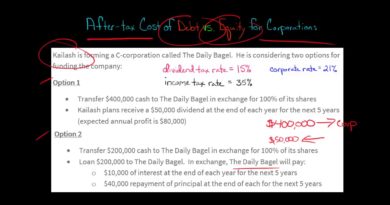

This year, the methane fee will be $900 per ton of methane emissions. The rate will rise to $1,200 per ton in 2025 and $1,500 per ton in 2026. When converted to CO2-equivalent terms, the tax rate will be $36 per ton in 2024, $48 per ton in 2025, and $60 per ton in 2026 and after.

The methane fee does not cover all methane emissions because it only applies to certain petroleum and natural gas industry operations. This limits the fee to just 29 percent of methane emissions, excluding major methane-producing activities like livestock agriculture.

Even when just considering methane emissions from petroleum and natural gas systems, the fee is not comprehensive. First, it has a de minimis threshold: it applies to emissions from facilities that produce more than 25,000 metric tons of CO2-equivalent emissions, which are already required to report emissions to the Environmental Protection Agency. Additionally, the charge only applies to emissions from a regulated facility above particular thresholds. According to the Congressional Research Service (CRS):

For petroleum and natural gas production facilities, the charge applies only to the number of reported tons of methane that exceed 0.2% of the natural gas sent to sale from such a facility.

For nonproduction facilities, such as gathering and boosting facilities, the charge applies to methane emissions that exceed 0.05% of the natural gas sent for sale from the facility.

For natural gas transmission facilities, the charge applies to methane emissions that exceed 0.11% of the natural gas sent for sale from the facility.

According to the CRS’s final estimates, the tax will apply to just 31 million tons of methane in CO2-equivalent terms. Relative to the 6.34 billion tons of CO2-equivalent emissions the United States produced in 2021, the tax will ultimately cover around half a percent of overall greenhouse gas emissions.

In a recent Tax Foundation paper, we analyzed how well carbon taxes around the world cover their intended tax bases. The paper calculates c-efficiency ratios for existing carbon taxes, dividing actual revenue collected by the potential revenue that could be collected from a carbon tax if it applied evenly to all emissions (calculated by multiplying emissions by the CO2-equivalent carbon tax rate). A higher c-efficiency ratio indicates a tax covers a substantial share of emissions, applies at relatively uniform rates, and is collected effectively, while a low c-efficiency ratio suggests the tax baseThe tax base is the total amount of income, property, assets, consumption, transactions, or other economic activity subject to taxation by a tax authority. A narrow tax base is non-neutral and inefficient. A broad tax base reduces tax administration costs and allows more revenue to be raised at lower rates.

is narrow, features reduced rates for certain types of emissions, or is enforced poorly.

If counted as a carbon tax, the methane fee would finish 32nd out of 32 in our rankings. In many respects, the methane fee is comparable to the Spanish “carbon” tax that is focused on hydrofluorocarbons and perfluorocarbons, other relatively marginal non-CO2 greenhouse gases, which finished 31st of 31 carbon taxes ranked in 2023.

The methane fee is not a broad carbon tax, or even a broad methane tax. Nonetheless, for the United States, it is a notable step towards emissions pricing.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Subscribe

Share