Medicaid Programs for Seniors in Indiana

If you are a senior, or you will be soon, you are likely hoping to avoid the need to move to a nursing home for as long as possible. The cost of alternatives to long-term care, however, may seem prohibitive. What you may not realize is that Medicaid not only covers LTC expenses, but it may also cover alternatives to LTC that can help you remain in your home longer. To help ensure that you understand your options, an Indianapolis Medicaid planning attorney at Frank & Kraft explains Medicaid programs for seniors in Indiana.

What Is Medicaid?

Medicaid is a health care program that is primarily funded by the federal government, though individual states have the option to supplement that funding. Each individual state administers its Medicaid program which is why the eligibility criteria and benefits provided can vary somewhat among the states. Overall, however, Medicaid is a “needs-based” program, meaning that an applicant must demonstrate a financial need for the benefits to qualify.

Indiana Medicaid for Seniors

Indiana offers two Medicaid programs for seniors: traditional Medicaid and Hoosier Care Connect. Traditional Medicaid provides full health care coverage to individuals with low income. Eligibility is based on the member’s aid category. Members in the following categories will be covered by Traditional Medicaid:

- Members eligible for home and community-based services

- Members who are dually eligible for Medicare and Medicaid

- Members in nursing homes, intermediate care facilities for the intellectually disabled, and state-operated facilities

Hoosier Care Connect is a health care program for individuals who are aged 65 years and older, blind, or disabled, and who are also not eligible for Medicare.

Indiana Medicaid Waiver Programs

Medicaid waivers are programs that provide additional services to specific groups of individuals, limit services to specific geographic areas of the state, and provide medical coverage to individuals who may not otherwise be eligible under traditional Medicaid rules. Indiana offers the following waiver programs for seniors:

- Aged and Disabled Waiver. The Aged and Disabled (A&D) Waiver allows individuals who are aged, blind, or disabled to remain in their homes as an alternative to nursing facility placement. Home and community-based services (HCBS) are provided through the A&D Waiver to supplement informal support for people who would require care in a nursing facility if HCBS or other supports were not available. Individuals must meet HCBS waiver eligibility and Medicaid eligibility guidelines to be eligible for a Medicaid HCBS waiver. To be eligible, individuals must:

- Be aged, blind, or otherwise disabled

- Reside in or transitioning into an HCBS-compliant setting (non-institutionalized)

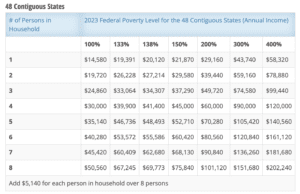

- Have income no greater than 300 percent of the maximum Supplemental Security Income (SSI) amount (parental income for children under 18 years of age is disregarded)

- Meet “nursing facility level of care”

- Available Waiver Services. Eligible individuals may receive authorized waiver services in conjunction with Traditional Medicaid. Authorized waiver services may include:

- Self-Directed Attendant Care

- Environmental Modifications

- Environmental Modification Assessments

- Personal Emergency Response System

- Specialized Medical Equipment and Supplies

- Structured Family Caregiving

Contact an Indianapolis Medicaid Planning Attorney

For more information, please download our FREE estate planning worksheet. If you have additional questions or concerns about Indiana Medicaid programs for Seniors or about Medicaid planning, contact an experienced Indianapolis Medicaid planning attorney at Frank & Kraft by calling (317) 684-1100 to schedule an appointment.

Paul Kraft is Co-Founder and the senior Principal of Frank & Kraft, one of the leading law firms in Indiana in the area of estate planning as well as business and tax planning.

Mr. Kraft assists clients primarily in the areas of estate planning and administration, Medicaid planning, federal and state taxation, real estate and corporate law, bringing the added perspective of an accounting background to his work.

Latest posts by Paul A. Kraft, Estate Planning Attorney (see all)