Main Developments in Competition Law and Policy 2024 – Chile

Significant competition law developments emerged in Chile during 2024. While this summary does not provide a detailed description of how Chile’s competition enforcement system operates (for that, please refer to the previous series), it is important to recall that the Chilean system involves the intervention of three authorities:

- Fiscalia Nacional Economica (“FNE”): its main powers are investigating, filing complaints, assessing merger control and conducting market studies.

- Tribunal de Defensa de la Libre Competencia (“Competition Tribunal” or “TDLC”): independent and specialised court that hears and rules on conflicts arising from anti-competitive conducts. The TDLC can also determine, within a non-contentious proceeding, whether a certain contract or act infringes competition law, being able to impose remedies and further, it can issue general instructions that are mandatory and regulate a whole industry.

- Supreme Court: TDLC’s judgments can be challenged before the Supreme Court, which conducts a complete judicial review, both on the merits and on their legality.

Institutional Developments

There are no developments in 2024 concerning new laws or administrative regulations related to competition law and policy. However, in June 2024, the Central Bank of Chile appointed two new judges in the TDLC: Silvia Retamales (lawyer) and Ignacio Parot (economist) whose period will expire in 2030. They replaced former judges Daniela Gorab and Maria de la Luz Domper.

Antitrust Enforcement

Cartel agreements

During 2024, neither the TDLC nor the Supreme Court issued judgments related to collusive conduct. Yet, it is interesting that the FNE filed two complaints alleging hard-core cartels. Both cases are still under review by the TDLC:

Market allocation complaint. In April, the FNE filed a complaint against the oxygen gas supplier companies Indura S.A. (Indura) and Linde Gas Chile S.A. (Linde), as well as their respective general managers. The complaint stated that the defendants had entered into a collusive market allocation agreement in the production and commercialization of industrial, medical, and specialty gases nationwide. According to the FNE, the agreement was in effect at least between November 2019 and January 2021, meaning it took place in the context of the COVID-19 pandemic.

Bid rigging complaint. Then, in October, the FNE filed a complaint against the casino operators Dreams S.A. (Dreams), Enjoy S.A. (Enjoy), and Inversiones Marina del Sol S.A. (Marina del Sol), and its top executives for entering into a collusive agreement aimed at affecting the outcome of the bidding processes for the granting or renewal of casino operation licenses in Chile during 2020 and 2021. According to the FNE, the execution of this agreement allowed the companies to renew their casino operating licenses by submitting lower economic bids than they would have in a competitive scenario.

Abuse of dominance

Football matches broadcasting and arbitrary price discrimination. The TDLC upheld a complaint filed by the FNE and VTR (cable TV operator) against Canal del Futbol (CDF), a company that holds exclusive broadcasting rights for the National Football Championship (NFC). The TDLC concluded that the defendant had abused its dominant position in the market for live broadcasting of the NFC. Particularly, the TDLC determined that CDF had engaged in anti-competitive practices – mainly, arbitrary price discrimination- through contractual clauses with cable operators and consequently imposed a fine of US$ 27.6 MM. This is an unprecedented fine: the highest ever imposed to a company due to anticompetitive practices.

Additionally, the TDLC ordered that the existing contracts with pay TV operators be modified so that (i) CDF will not be allowed to condition the sale of its premium signals on the purchase of its basic channel, nor force the inclusion of some of its signals in television plans; and (ii) CDF will not be allowed to establish discriminatory minimum guarantees. This judgment was challenged before the Supreme Court and the final decision is still pending.

Several cases in the electric energy industry. It is also worth noting that during 2024 the TDLC issued four rulings in adversarial cases involving the electricity sector. Although all proceedings alleged conduct amounting to abuse of dominance, in only two of them the Competition Tribunal ruled in favour of the claimants and sanctioned the defendants. Among these cases, Ruling No. 196/2024, issued in October, stands out. In this decision, the TDLC upheld the lawsuit filed by Ferrovial Power Infrastructure Chile SpA (Ferrovial) against the Independent Coordinator of the National Electricity System (Electric Coordinator). The claimant argued that it had been arbitrarily disqualified from a bidding process for works related to the expansion plan of the national electricity transmission system. The Competition Tribunal concluded that the disqualification by the Electric Coordinator constituted a discriminatory and arbitrary action. Consequently, it imposed a fine of US$ 430,000.

Private Enforcement

The Chilean system encompasses follow-on actions to pursue compensation damages derived from anticompetitive offenses, that is, private compensation actions must be pursued after a ruling by the TDLC have established a competition law infringement.

Football membership fee. In December, by Ruling No. 199/2024, the TDLC upheld the damages claim filed by Club Deportes Melipilla S.A.D.P. (Deportes Melipilla) against the National Association of Professional Football (ANFP), ruling that the membership fee charged by the association for the club’s promotion to the First B League not only constituted an abuse of dominant position (as sanctioned in TDLC Ruling No. 173/2020), but also amounted to compensable actual damages. As a result, the Competition Tribunal ordered the ANFP to pay the club US$ 950,000.

This is the second time that the TDLC has ruled on a contentious damages claim. However, the ANFP challenged the decision, and the case is currently under review by the Supreme Court.

Supreme Court on damages arising from a cartel in the toilette paper industry. In 2023, the TDLC issued Ruling No. 188/2023, where it rejected the damages claim filed by Papelera Cerrillos S.A. (Papelera Cerrillos) against CMPC Tissue S.A. (CMPC) and SCA Chile S.A. (SCA, now Essity Chile S.A.). In its lawsuit, Papelera Cerrillos argued that the collusive agreement between CMPC and SCA had caused its bankruptcy. However, the TDLC concluded that Papelera Cerrillos’ financial losses during the collusive agreement resulted from multiple causes, all of them unrelated to CMPC and SCA’s anticompetitive conduct.

Following Papelera Cerrillos’ appeal, the Supreme Court issued a ruling in December 2024, overturning the TDLC’s decision and holding CMPC and SCA jointly liable for damages, ordering them to pay US$ 200,000 for actual damages and US$ 7,500 for lost profits.

The Supreme Court’s decision is a landmark ruling, as it recognized the partial liability of the colluding companies in the claimant’s financial collapse. However, the ruling has been criticised by some scholars, particularly on how the Supreme Court established the causal relationship between the cartel agreements and the damages as well as the lack of a counterfactual scenario and justification for the calculation of the damages.

Out of Court settlements

The FNE has continued stressing the use of out-of-court settlements to prevent and correct competition in the markets. This year, the FNE submitted four out-of-court settlements reached with several companies, showing the efficiency of this tool to avoid long trials. All of them were approved by the TDLC.

Two out of court settlements addressed coordinated conducts. FNE and JJD Comunicaciones Limitada y Empresa de Transacciones Max Facil S.A., in the market of prepaid mobile phones top-up; and FNE and Colada Continua, in the market of copper wire rods. The FNE has emphasised that it is willing to reach settlements for coordinated conducts, except for hard-core cartels where participants are aware of the illegality of their actions.

Out of court settlement regarding abuse of dominance. In FNE and Sociedad de Inversiones ATB S.A., the company had refused to grant access to its buses terminal (facilities) in the city of La Serena to competitors in the downstream market (passengers bus transportation) as well as other unilateral conducts. The firm committed to undertake several behavioural commitments and to pay US$ 270,000 (to the Treasury).

First out of court settlement involving interlocking. In FNE and Cencosud, Alpa, y M. Paulmann, the TDLC cleared an out of court settlement between the FNE and Cencosud, ALPA and Manfred Paulmann concerning horizontal interlocking. Mr. Paulmann had been a director in Cencosud and ARS (ALPA’s affiliate) while holding a relevant executive position in ALPA. Both companies were competitors in the market of retail convenience stores, service station stores and local neighbourhood shops. Cencosud, ALPA and Mr. Paulmann committed to pay US$1.3 MM (to the Treasury) and to undertake several behavioural commitments aimed to prevent information exchange between competitors and, consequently, concerted practices or collusive agreements.

Settlements within a trial: unprecedented settlement in an appeal proceeding before the Supreme Court

In October 2023, the TDLC issued Ruling No. 186/2023, upholding the complaint filed by the FNE against Banco Credito e Inversiones (BCI) for abuse of dominant position in the market for the provision of group credit life insurance to mortgage clients and for arbitrarily excluding competitors from the bidding process for such insurance. The ruling was challenged before the Supreme Court. During the appeal, the FNE reached a settlement agreement with BCI, which was approved by the Supreme Court in September, bringing the appeal to an end.

This marked the first time that a complaint was resolved through a settlement approved by the Supreme Court.

Procedural law

Although there were no modifications to the procedural rules governing competition proceedings, certain milestones indicated a shift in the TDLC and Supreme Court’ s criteria regarding two aspects, as explained below.

Arbitrability of damages claims. The TDLC addressed the arbitrability of damages claims for anticompetitive offenses in the previously mentioned Ruling No. 199/2024. In that proceeding, the ANFP raised an objection of lack of jurisdiction before the TDLC, arguing that the dispute should be judged by the Tribunal of Patrimonial Affairs (TAP), invoking an arbitration clause contained in its by-laws. After analysing this claim, the Competition Tribunal admitted that some damages claims may be subject to arbitration, but only if certain requirements are met: (i) the offense must have already been determined by a final and binding ruling at the time the arbitration clause was agreed upon; (ii) the clause must explicitly refer to a damages action derived from a clearly identified final and binding ruling; and, (iii) the jurisdiction of the arbitral tribunal must be solely limited to determining the existence of damages, their quantification, and the causal link between the damages and the already declared offense.

Settlement agreements before the Supreme Court. As previously mentioned, the termination of the case between the FNE and Banco BCI marked the first time the Supreme Court approved a settlement agreement effectively bringing an end to a complaint filed before the TDLC. This decision was controversial, as applicable regulations stipulate that settlement agreements must be approved by the TDLC. Moreover, both the agreement and the Supreme Court ruling endorsing it faced criticism from consumer associations because the settlement explicitly excluded any acknowledgment of liability or wrongdoing by BCI, while the Supreme Court, in its ruling approving the agreement, expressly stated that it did not constitute a final decision on the merits. Consequently, under Chile’s follow-on actions system, this decision might hinder the filing of complaints pursuing damages.

Merger Control

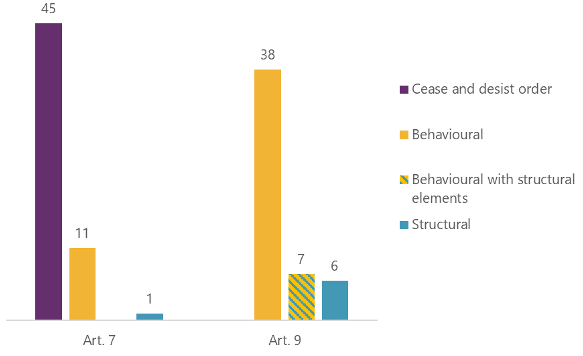

Main statistics. During 2024, the FNE concluded the assessment of 30 mergers. Overall, 93% of these mergers were cleared unconditionally (27/30 in Phase 1 and 1/30 in Phase 2). Two mergers were approved in Phase 1 with behavioural remedies (Merck/Elanco, in the aquaculture market, including a remedy regarding a non-compete clause affecting Elanco; and Minerva/Marfrig, in the beef meat industry, including a behavioural remedy on expansion restrictions affecting Marfrig).

Provision of false information during a merger notification as breach of merger control regulation. In 2019, the FNE had previously cleared the merger between TWDC y Twenty-First Century Fox, Inc. (with remedies). Notwithstanding the foregoing, in 2020, the FNE filed this complaint alleging that the defendant had submitted false information during the notification of the merger, since it had stated that they didn’t have certain information on the relevant market. The FNE also accused TWDC parent company of failing to comply with one of the behavioural remedies imposed in the merger approval. However, the FNE and TWDC parent company reached a settlement during the trial addressing this accusation.

In this context, in February, the TDLC issued Judgment No.190/2024, upholding the complaint filed by the FNE and for the first time it condemned the submission of false information within a merger notification and imposed a fine to TWDC of US$ 2.6 MM. The judgment was challenged before the Supreme Court and the final decision is still pending.

Non-contentious proceedings

Shopping centres: lease agreements entered into with stores

In October 2020, the Retail Trade Association (Retail AG) submitted a consultation before the TDLC requesting a review of (i) the lease agreements between stores and the main shopping centre operators in Chile, and (ii) the vertical integration between these operators and certain retail stores.

In February 2024, the TDLC issued Resolution No. 80/2024, establishing a set of behavioural remedies for shopping centre operators after determining that several of them were vertically integrated with retail stores. Additionally, the ruling analysed various contractual clauses governing the relationship between stores (tenants) and operators, concluding that some of them were potentially anticompetitive. Consequently, the TDLC ordered to modify the executed agreements.

Liquid fuel agreements: horizontal cooperation between competitors give rise to coordinated and unilateral risks

In September, the TDLC issued Resolution No. 84/2024, concluding that a horizontal cooperation agreement concerning the storage of liquid fuel by three companies (Compania de Petroleos de Chile (Copec S.A.), Empresa Nacional de Energia (Enex S.A.) y Esmax Distribucion SpA (Esmax) would comply with competition law, provided that they adopt some behavioural remedies. These remedies were imposed to mitigate coordinated risks -strategic information exchange between competitors- and unilateral risks -exclusion of vertical non-integrated fuel distributors downstream. The ruling was challenged and the final decision by the Supreme Court is still pending.

General Instructions: bidding conditions concerning Municipality public works

In December, the TDLC issued General Instructions No. 6, concerning the bidding terms for the procurement of municipal public works.

In its analysis, the Tribunal observed that, among other identified risks, the way in which the bidding terms weighted fixed factors of the offer over variable factors could negatively impact competition in the bidding processes, creating an entry barrier for qualified bidders capable of executing municipal public works. In response, through its instructions, the tribunal established a two-stage bidding mechanism: (i) the assessment of eligibility or qualification factors for submitting proposals, such as experience and financial capacity; and (ii) the evaluation of the economic offer.

Market enquiries by the FNE: higher education and e-commerce

In January, the FNE started a market study on higher education. The preliminary conclusions are expected to be published in April 2025. It is worth mentioning that the three main higher education institutions have denied the provision of information to the FNE and this issue is currently being discussed before the Courts of Appeals in a constitutional law proceeding.

In addition, in November, the FNE launched a new market study on e-commerce in Chile. According to the FNE, the preliminary conclusions should be available in December 2025.