Louisiana Tax Reform Options that Boost Competitiveness

Note: The following is the testimony of Manish Bhatt, Senior Policy Analyst with the TaxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities.

Foundation’s Center for State Tax Policy before the Louisiana House Ways and Means State Tax Structure Subcommittee on October 3, 2024. My name is Manish, and I’m a senior analyst at the Center for State Tax Policy at Tax Foundation, an independent and nonprofit tax policy and research organization. The Tax Foundation was founded in 1937. It analyzes and tracks global, federal and state tax issues and educates stakeholders about the principles of sound policy – simplicity, transparency, neutrality and stability. I am honored to be able to answer your questions today.

Louisiana’s tax code features a number inefficient and non-competitive policies which are causing the state to fall further and further behind. I’m here to discuss state-level tax trends and reforms which could be adopted in order to improve the lives and future of residents of this great State. These include the proposals made by Governor Landry and others on October 1. Louisiana competes regionally and nationally with other states for residents and capital investment. The State Business Tax Climate Index (Index) is published annually by the Tax Foundation, which compares each state’s competitiveness and tax structure. The Index is constructed using five components: individual taxation, sales taxes and corporate income taxes. Importantly, all components are not weighed equally. Components with the most variation among the 50 states receive a higher value. Some states do not levy any of the major tax categories, such as

individual Income Tax. An individual income tax is a tax imposed on wages, salaries, investment income, or other types of income that an individual or household earns. The U.S. has a progressive income-tax system where rates increase as income increases. The Federal Income Tax was created in 1913, with the ratification 16th Amendment. Individual income taxes, which are only 100 years old but are the biggest source of tax revenue for the United States, have been around since 1913.

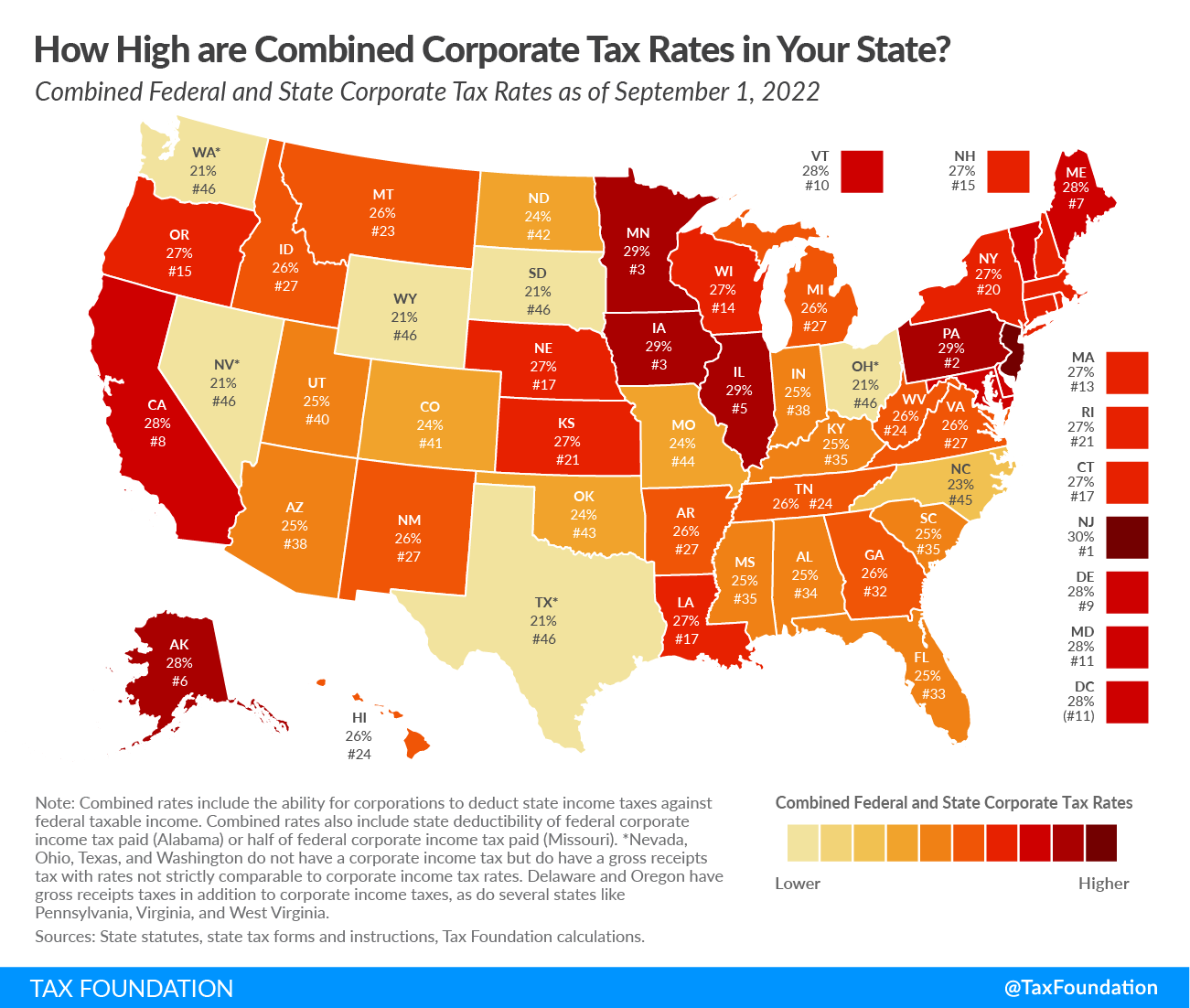

The federal and state governments levy a corporate income tax on business profits. Many companies are exempt from the CIT, as they are taxed under the individual income taxes.

or the sales taxesA sales tax is imposed on retail sales of goods, services, and other items. It should, in theory, apply to all final consumption, with very few exemptions. Many governments exempt certain goods, like groceries. Broadening the base, by including groceries, would allow rates to be lower. A sales tax should exclude business-to-business transfers that, when taxed cause tax pyramiding.

. In the Index, these taxes are given a higher weighting. In contrast, all state codes include property and unemployment insurance tax. These components are therefore given the least weight. As Utah and Indiana have shown, a state can tax every major category and still remain competitive. Both are in the top 10 of the Index and their tax codes have low rates and wide bases. Louisiana’s tax code had significant room for improvement in the most recent Index. The state is ranked 40th in the nation, but only for property taxes. A property tax is levied primarily on immovable properties like land and buildings as well as tangible personal property which is movable like vehicles and equipment. Property taxes are a major source of revenue for state and local governments in the U.S. They help fund schools, roads and police services, among other things.

, and unemployment insurance tax components are among the top 25. In recent years, however, the legislature has sought to reduce taxes by reducing the rate of the franchise tax, eliminating the throwback rules, and reforming the economic nexus rule for sellers without a physical presence in the State.

Louisiana is a net-out-migration state, just like New York or California. Andrey Yushkov, my colleague, analyzed data on migration trends within the states and found that there are differences in intrastate migration patterns. In Texas, for example, the larger metropolitan areas gained more residents and adjusted

gross IncomeFor individuals, Gross income is the total earnings before taxes from wages, tips and investments. For businesses, Gross income is total revenue less cost of goods sold.

, while more rural areas experienced an out-migration. In Louisiana, however, very few parishes saw gains. This means that the vast majority of parishes lost residents and adjusted gross revenue. Taxes are not the only factor that influences migration trends. However, they can play a role in solving this problem. Aligning with the principles of sound policy can help businesses and individuals alike.

National trendsIn the past few years, many states have enjoyed strong revenues and surpluses. These funds were used by lawmakers to implement tax relief and improve competitiveness. Since 2021, 28 state have reduced the individual income tax rate, and 15 states have cut the corporate tax rate. Louisiana was one of the states that did both. In 2021 and 2022 many states implemented reforms and rate relief. Even in 2023 the trend continued, with eight states enacting rate reductions for individual income taxes, while scheduled rate reductions or triggered rate cuts took place in seven other states. In 2024 the trend continued, with 34 states implementing significant tax changes on January 1, 2024. This included 17 states that cut individual or corporate income taxes, or both, such as Arkansas, Iowa, Nebraska. Wyoming updated its economic-nexus rules on July 1, 2020 by removing the transaction threshold for marketplace facilitators, remote sellers and other entities. In some states, such as Louisiana, there is still work to do–and the desire to get it accomplished. Arizona began phasing-in a flat rate tax of 2.5 percent in July 2021 using tax triggers which made the timing of transition dependent on revenue availability. Iowa will gradually implement a flat rate of 3.9 per cent by 2026, as part of comprehensive tax reforms enacted in the year 2022. Mississippi’s flat taxAn income taxes is called a “flat rate” when it is applied to all taxable income, regardless of the income level or assets.

came into effect in 2023. The rate was originally set at 5 percent, but later reduced to 4 7 percent. It is scheduled to be decreased to 4.4 per cent in 2025 and to 4.0 per cent in 2026. Georgia’s flat-tax was enacted by 2022 and went into effect in 2024. The rate was originally set at 5.49 per cent, but the legislature reduced it retroactively to 5.39 per cent. In a 2022 special session, Idaho adopted a flat rate of 5.8 percent, effective in 2023.

Single-rate taxes introduce simplicity into the tax code, but there are other benefits. A flat tax structure makes it easier to forecast revenue. Taxpayers can also better estimate their tax liabilities, and how they will change at different income levels. This provides a greater level of transparency than codes with graduated rates. This is true for both individuals and businesses in states like Pennsylvania that have a single-rate corporate income tax. It is also a practical consideration that it tends to be more difficult to raise the rates for single-rate taxes and easier to reduce them as revenues permit. It’s not impossible, nor should it ever be, to increase the rate of a single-rate tax. But, if the flat-rate structure becomes part of the state constitution, it tends to limit future efforts to impose higher rates. It’s probably the only reason, for instance, that Illinois–a high-tax state in most regards, but with a constitutionally imposed, single-rate income tax system–has kept its individual income tax rate below 5 percent.

Additional reform efforts have included structural enhancements to grow competitiveness and efficiency. Oklahoma and Mississippi, concerned about the future of the favorable provisions in the federal Tax Cuts and Jobs Act that were enacted in 2015, decoupled themselves from the Internal Revenue Code and implemented permanent

full expensed. Full expensed allows businesses to immediately deduct all costs of certain investments made in new or improved equipment, technology, or buildings. It eliminates a bias within the tax code, and encourages businesses to invest more. This, in turn, increases worker productivity, increases wages, and creates new jobs.

. This permits businesses in the state to immediately deduct the full cost of a qualifying expense, allowing investments to become profitable in year one rather than employing complicated depreciationDepreciation is a measurement of the “useful life” of a business asset, such as machinery or a factory, to determine the multiyear period over which the cost of that asset can be deducted from taxable income. Depreciation is a method of reducing the value of assets over time.

schedules.

Louisiana recently removed the transaction threshold from its economic nexus rule, and Wyoming, South Dakota and South Dakota have also considered a similar measure. Reforming economic nexus so that it only includes a sales threshold is a sound tax policy, as it prevents small businesses with no physical presence within the state from being burdened by high costs of sales tax compliance even when the dollar amount in the state is relatively low. Evaluating the Proposed ReformsIndividual Income Taxes Transitioning Louisiana’s tax code from the current graduated-rate income tax to a single rate is sound tax policy. As I said, this will simplify and increase transparency in the tax code. It also sends the message to individuals and businesses alike that the state is serious in maintaining a competitive and fair tax code. Louisiana’s tax bands are currently in effect. A tax band is the range of incomes that are taxed according to a given rate, which usually varies depending on filing status. In a progressive income tax system for individuals or corporations, rates increase as income increases. The federal income tax system has seven brackets for individual income; the corporate income tax is flat.

are not indexed for

inflationInflation is when the general price of goods and services increases across the economy, reducing the purchasing power of a currency and the value of certain assets. The same paycheck will cover less goods, bills, and services. It is sometimes called a “hidden” tax, as it makes taxpayers less wealthy due to increased costs and “bracket-creep”, while increasing government spending power.

. This is

bracket crumb. Bracket crumb occurs when inflation forces taxpayers into higher tax brackets or reduces their value of credits, exemptions, and deductions. Bracket creep causes an increase in income tax without an increase in actual income. Many tax provisions, both at the federal level and in state levels, are adjusted for inflation.

is what happens when inflation pushes the taxpayer from one bracket to another when nominal income increases, but real income doesn’t or even decreases. By moving to a single tax rate, you can avoid this pitfall. The standard deduction is The standard deduction reduces the taxpayer’s taxable earnings by a certain amount set by the government. The 2017 Tax Cuts and Jobs Act, also known as TCJA, nearly doubled the standard deduction for all taxpayers.

also is not inflation-indexed. This would be a positive step. Louisiana also needs to reconsider its current treatment of S corporations. Louisiana does not recognize the S Corporation. An S corporation is an entity that elects to pass on business income and losses to its shareholders. The shareholders must pay individual income tax on this income. S corporations (S Corp) are not subject to corporate income tax, unlike subchapter C companies.

This is inefficient and uncompetitive, and should be reformed. This is inefficient and uncompetitive and should be reformed.Corporate Income TaxesThe proposed corporate tax reforms represent pro-growth and competitive tax policy. The proposed corporate tax reforms are pro-growth and competitive. The tax code will become more neutral if incentives are removed, which benefits all corporate taxpayers. In general, incentives that favor or target particular investments or industries tend to be economically inefficient and nonneutral. These incentives can also be found in the books for a long time, along with rules reflecting the economic and legislative priorities of policymakers and their expectations at a specific time. This can cause distortions if they are still in place. Repealing incentives that have been in place for a long time is not a move away from stability but a deliberate action to make the tax code more neutral, to the benefit of corporate taxpayers. Sales taxes

While Louisiana made improvements to its sales tax code, the state still lacks uniform administration of sales tax. This impacts sellers in Louisiana, but it also affects remote sellers and marketplace facilitators. They may be required by law to collect and remit Louisiana sales taxes even though they have no physical presence there. There has been progress over the years, but it is still true that remote sellers and marketplace facilitators are subject to heavy compliance obligations which disproportionately affect small and midsized business. Many of these sellers are left with higher compliance costs than revenue when they must collect and remit parish-by-parish sales taxes. It is possible that revenue collection increases when compliance burdens are reduced, given the importance of local control in Louisiana’s past and present. This makes the case for centralizing sales tax collection especially important for Louisiana’s competitiveness and fiscal well-being. Furthermore, a variety of business inputs is subject to sales taxes and the state has one of the highest average local options sales tax (5.1%). Louisiana and Tennessee are tied at 9.55 percent for the highest combined rate of state and local sales taxes. Expanding exemptions for farm equipment as a business input would be a sound tax policy that would alleviate

tax PyramidingTax Pyramiding occurs when a final good or service are taxed more than once along the production process. This results in vastly different tax rates depending on how long the supply chain is. Low-margin businesses are disproportionately affected by this. Gross receipts taxes represent a prime example where tax pyramiding is in action.

. Tax base is the total amount that is taxed by a tax authority. It includes income, property, assets and consumption. A narrow tax base can be inefficient and non-neutral. A broad tax base allows for lower tax rates and reduced administration costs.

reduces complexity. A lower rate could be considered if the base was widened to include more services that are personal.

Removing thresholds for economic nexus transactions remains a competitive reform. If centralized administration is possible in the future, this state will see further improvements to its sales tax ranking. Property Taxes

The Louisiana effective tax rate for owner-occupied properties is.51 per cent. This is among the lowest rates in the nation. The national average is.91 per cent, and the highest is 2.08 percent in New Jersey. Louisiana also boasts a relatively low property tax rate of 1.89 percent as a percentage to personal income. Louisiana’s property tax rate is competitive compared to Connecticut (4.07%), New Jersey (4.76%), and Texas (3.86%). Louisiana’s property taxes are ranked lower due to the franchise tax, which is a capital stock tax, and the inventory tax. Both taxes are inefficient, and they are levied irrespective of profitability.

The Franchise Tax is levied on the net worth of a business and penalizes investments in the state. Inventory taxation is disproportionately imposed on businesses with large inventories, and taxpayers are forced to make poor decisions about when and where they store their inventory. In 2023, the legislation was passed that would have gradually reduced the franchise tax if certain revenue targets had been met. A bill was passed that reduced the rebate rate for the Quality Jobs Program each year the franchise tax reduction was triggered. This helped to alleviate concerns about lost revenue due to the franchise tax phaseout. The administration vetoed this legislation despite it passing both chambers. They acknowledged that the franchise tax was “antiquated” and should be structurally reform or repealed. During the same legislative session, the inventory taxes was also considered for repeal but was ultimately unsuccessful.

Repealing these taxes would dramatically boost the state’s ability to compete, along with the corporate tax reforms that are being considered. Competitive gainsIf Louisiana implements comprehensive tax reforms, it will increase its competitiveness. It will also cultivate an environment that is pro-growth. If the reforms were in place when we conducted our previous Index, Louisiana could have been ranked higher than the bottom 10 with significant gains for most components. Our Index rankings are based upon the structure of each tax code. I cannot predict what future legislative sessions will bring. Louisiana’s current ranking is instructive, but comparing it to what it could have been can be a useful guide. Our Index reflects the fact that sound, pro-growth reforms lead to better outcomes for both the state and its taxpayers. I applaud the efforts of this body and administration to provide significant relief to Louisiana taxpayers, which could also help attract and retain individuals and business. I appreciate the opportunity to speak before this committee and look forward to answering your questions. Stay informed on the tax policies impacting you.Subscribe to get insights from our trusted experts delivered straight to your inbox.

Subscribe to our Newsletter