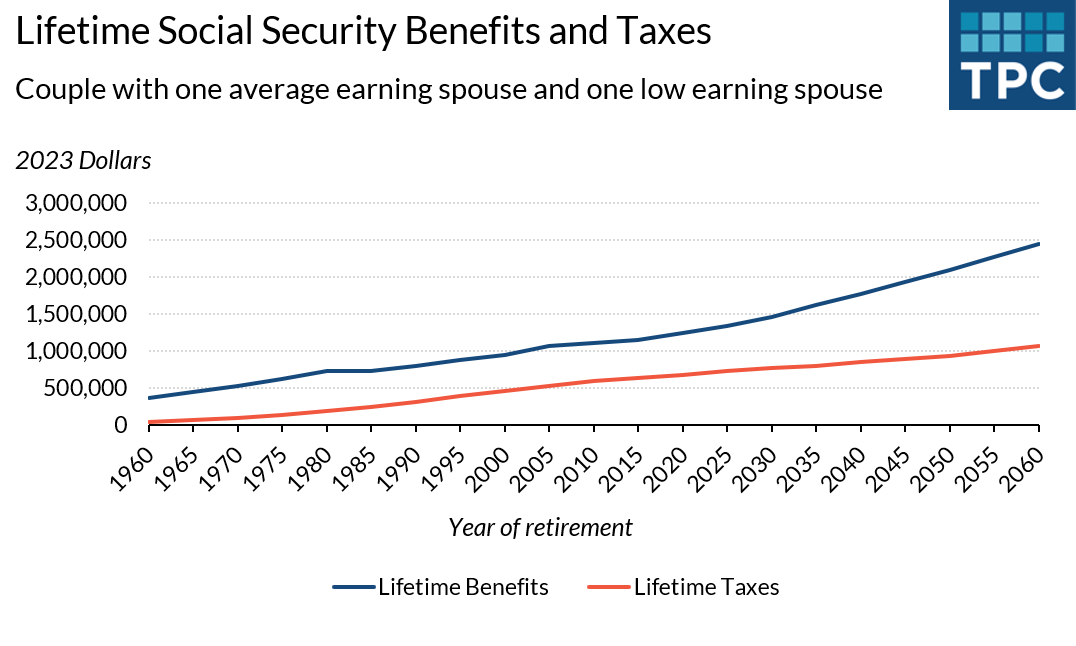

Lifetime Social Security Benefits And Taxes: 2023 Update

The Congressional Budget Office and government actuaries for decades have shown that Social Security and Medicare remain on unsustainable tracks, but it is often hard to visualize how $100 billion here or $1 trillion there translates in a country with national income of more than $25 trillion. A new report on lifetime Social Security and Medicare benefits and taxes provides a different and useful vantage point.

This report focuses on how much hypothetical workers receive in lifetime benefits compared to how much they pay in taxes that help fund these programs. For a single male earning an average wage every year and who retired in 2020 at age 65, lifetime Social Security and Medicare benefits would equal about $640,000, while total taxes paid would be just shy of $470,000. For a couple with one average earner and one low-wage earner, benefits would total about $1.24 million, while taxes would reach $680,000. Those amounts rise and fall for other hypothetical households as their incomes rise and fall relative to average wages.

The imbalance between taxes paid and earnings received is expected to increase. For Social Security, the growth is being driven by a growth in real wages, while Medicare benefits face upward pressure from higher health care costs and new health services. Both programs will also pay more in benefits due to the increase in life expectancies. Lifetime benefits would double for those turning 65 in 2060. A couple with one average and one low earner retiring in that year is projected to receive about $2.5 million in benefits.

Without going into great detail, lifetime benefit payments in excess of dedicated taxes have been supported for a long time by a number of factors–in particular, a ratio of workers to beneficiaries that has been declining especially rapidly as the baby boomers retire. Medicare has been relying relatively more on general revenues to finance it’s the non-hospital or Part B part of the program. As Social Security and Medicare trust funds cash in their bonds, general revenues must come up with the necessary money The consequences are reflected in both higher government-wide deficits and a smaller share outlays dedicated to other programs.

Absent reform, lifetime benefits scheduled to be received by households increasingly exceed the taxes dedicated to these programs. Consider the couple retiring in 2060 scheduled to receive close to $2.5 million in benefits. Under current projections, their dedicated taxes would be about $1.1 million.

Given the near-term depletion of the Social Security and Medicare hospital insurance trust funds (expected in 2034 and 2028, respectively), this report allows policy makers to visualize how much scheduled lifetime Social Security and health benefits:

- increase on a lifetime and annual basis

- vary among people with different earnings and marriage histories

- vary across several decades of cohorts

Reforms could scale back the rate of growth of benefit increases and still allow lifetime benefits to increase significantly for each cohort of future retirees. Policymakers could also consider tax increases and longer work lives to address the challenge of having fewer workers supporting more and more retirees. But whatever mix of reforms Congress chooses, these findings reflect how the current math for these programs doesn’t add up.

Regardless, reform should target lifetime benefits and taxes across generations directly, not just accidentally as a byproduct of other choices.