Justices discuss specificity of complaint in NVIDIA Securities Fraud suit

ARGUMENT ANALYSIS

on Nov 14, 2024

at 11:48 am

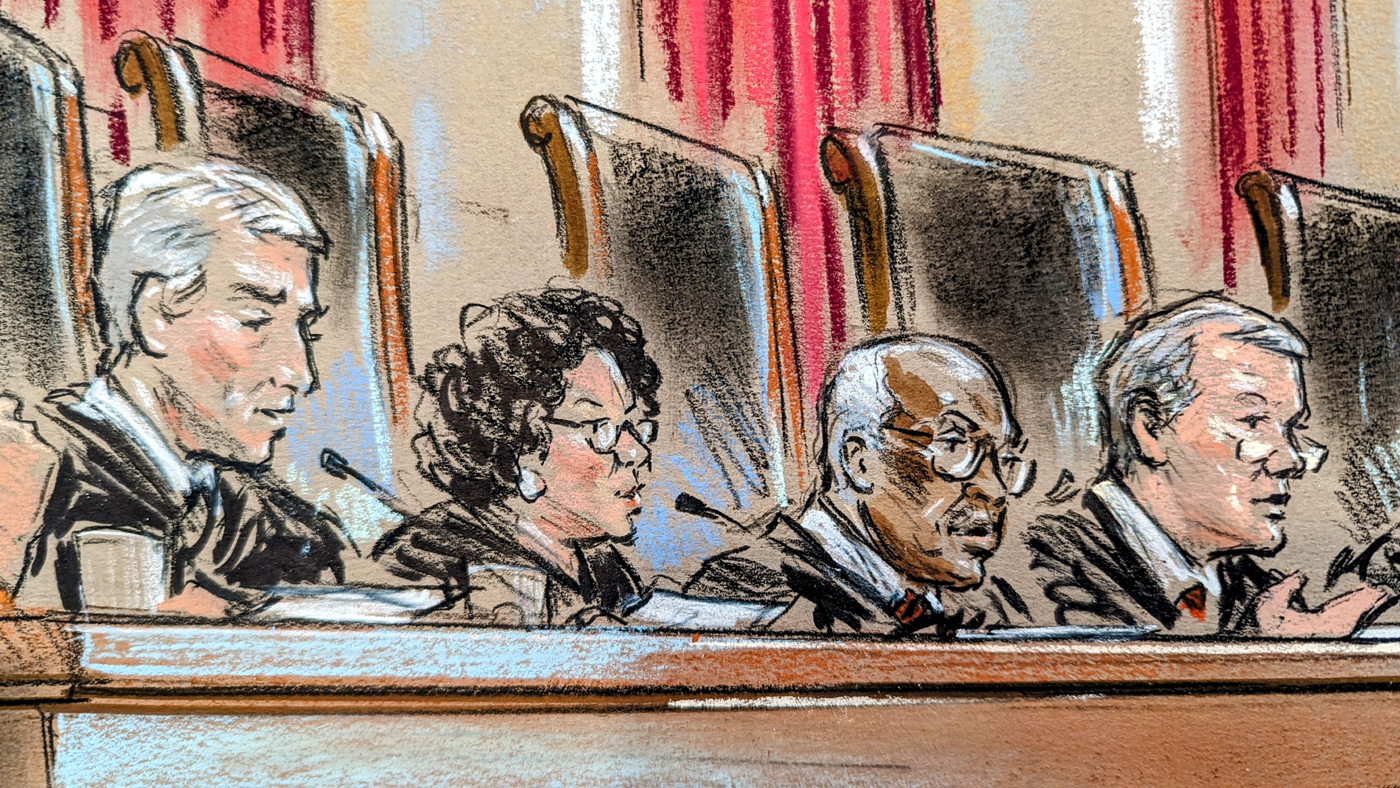

Wednesday’s argument was the second of two cases the justices heard this month involving securities fraud suits against major tech companies. (Katie Barlow).

The justices concluded the November session with NVIDIA Corp v. E. Ohman j:or Fonder AB on Wednesday. The case arose out of the use by crypto miners of NVIDIA chips. The legal problem presented for the justices is whether the complaint – which alleges that NVIDIA misled investors by downplaying the sale of its chips for crypto mining rather than gaming – was sufficiently particular to get over the relatively high pleading standard required for such cases.

Investors say the company did not disclose the extent to which sales to crypto-miners put their shares at risk. NVIDIA claims that shareholders lack the hard evidence needed to prove their case, namely internal documents that show executives knew about the information and withheld it. Neal Katyal, representing NVIDIA in court, argued that the court was too lax for allowing the case to proceed. However, he spent most of his time avoiding questions about why a factual dispute warranted a court’s attention. Justice Sonia Sotomayor, in particular, spent a lot of Katyal’s time insisting that he was only asking for “error correction,” a task they typically consider beneath them. It was not a great sign for him that the references to error correction kept surfacing from almost all the questioners during his argument: he got the same line from justices spanning “both sides of the aisle,” if you will: Elena Kagan, Amy Coney Barrett, and Neil Gorsuch.

About the only substantive discussion Katyal had on the merits was with Justice Ketanji Brown Jackson, who pretty clearly thought that he was asking for far too much. Katyal said that plaintiffs “need to have the evidence” in order to make their case. She also stated that the standards do not “require them to have the documents.” Chief Justice John Roberts has repeatedly stated that Congress intended the 1995 Private Securities Litigation Reform Act (PSLR) to limit this kind of lawsuit. Because in Roberts’ view Congress thought the law did “a good bit more than simply keep out frivolous lawsuits,” Roberts seemed to believe that the justices should put some content in the pleading standards that NVIDIA is challenging.

Justice Brett Kavanaugh echoed Roberts’ concern, as he worried openly about the ease with which the lower court’s decision would permit shareholders, “any time a stock price falls,” to “get past a motion to dismiss” by simply providing a vague expert report.

The shareholders in this case relied on an expert report that looked at the number of of crypto-mining processors built during the relevant time to estimate the likely share of chip sales sold by NVIDIA. Deepak Gupta representing the investors told the justices the group had presented other types of evidence.

Late in Katyal’s argument, Roberts interrupted him to ask about his repeated statements that the complaint approved in this case “eats itself.” Roberts commented that he found “the analogy … very vivid,” but he confessed that he’d “never heard” the phrase before and wondered “what does that mean?” After Katyal labored at some length to explain that he intended only to suggest that the complaint was internally inconsistent, Roberts responded that he remained “not sure how that’s ‘eating itself,’ but I’ll take your word

.”

It’s a little puzzling for so many justices to spend argument time asking an advocate why they’re hearing his case – four of the people sitting on the bench doubtless voted to hear it, and if they don’t regret that decision then it’s pretty likely the justices will proceed to decide the case. It’s puzzling that so many justices spend argument time asking an advocate why they’re hearing his case. Four of the people sitting on the bench doubtless voted to hear it, and if they don’t regret that decision then it’s pretty likely the justices will proceed to decide the case.