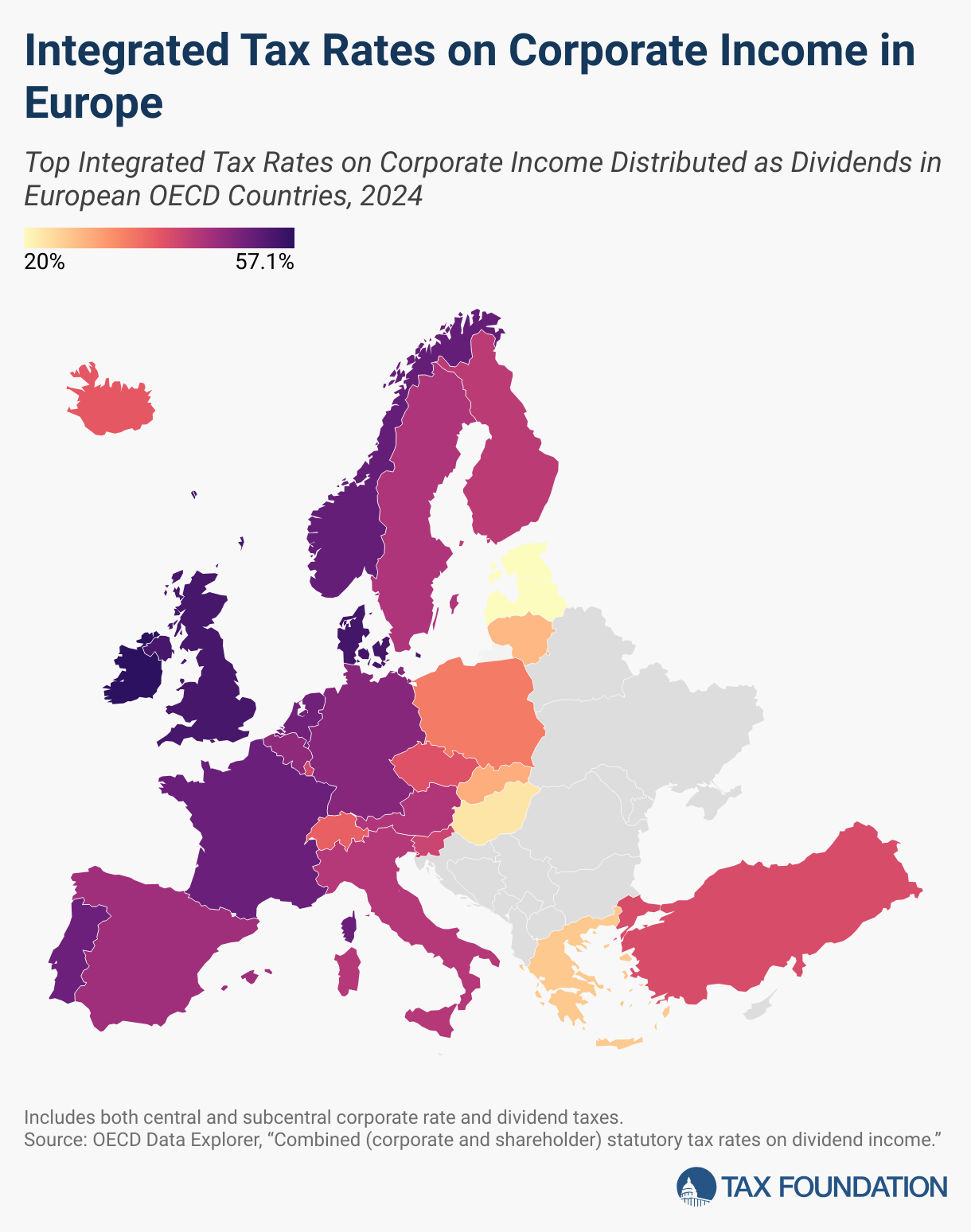

Integrated Tax Rates for Corporate Income in Europe 2024

For the taxation of dividends, Ireland had the highest integrated tax rate among European OECD nations (57.1%). This was followed by Denmark (54.8%) and the United Kingdom (54.5%). Estonia (20%), Latvia (20%), and Hungary (22.7%) have the lowest rates. Estonia and Latvia’s tax on distributed profits means that the corporate income tax is the only layer of taxation on corporate income distributed as dividends.

For capital gains, Denmark (54.8 percent), Norway (51.5 percent), and France (51 percent) have the highest integrated rates among European OECD countries, while Switzerland (19.7 percent), the Czech Republic (21 percent), and the Slovak Republic (21 percent) levy the lowest rates. Several European OECD nations, including Belgium, Czech Republic and Luxembourg, Slovakia and Slovenia, Switzerland and Turkey, do not levy a capital gains tax for shares held for a long time without substantial ownership. This makes the corporate tax the sole tax layer on corporate income realized in the form of long-term capital gain. Comparatively, the United States has an average integrated tax rate of 47.4 percent for capital gains and 40.9 percent for dividends.

In order to reduce or eliminate the negative effects of double taxation on corporate income, several OECD countries have integrated corporate and individual tax codes. Several OECD nations have integrated corporate and personal tax codes to eliminate double taxation of corporate income or reduce its negative effects.

2024 Significant Changes

Overthe past year, several countries have increased their statutory corporate tax rates, including the Czech Republic, Iceland, Slovenia, and Turkey. Other countries have increased their top rates of personal taxation on capital gains. For example, the Netherlands has raised its top rate from 32 to 36 percent and Spain has raised it from 26 to 28 percent. In contrast, Austria has reduced its statutory corporate rate from 24 to 23 percent.The United Kingdom’s government is planning to raise the top rate on capital gains from the sale of shares from 20 to 24 percent, which would move the country’s integrated tax rate on capital gains from 40 to 43 percent.

Stay informed on the tax policies impacting you.

- Subscribe to get insights from our trusted experts delivered straight to your inbox.

- Subscribe to our Newsletter