If It Moves, Stop Taxing It.

Note: This post is part of a series on Portugal’s taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities.

policy, examining how it compares internationally, providing an analysis of current policy, and discussing pathways toward reform. See here and here. For a complete analysis of this and other tax reform options in Portugal, download our Portuguese-language primer.

In its approach to taxing real estate, Portugal applies both recurrent taxes on immovable property (Imposto Municipal sobre Imóveis, or IMI) as well as a turnover tax on property transfers. While Portugal could implement improvements to its property taxA property tax is primarily levied on immovable property like land and buildings, as well as on tangible personal property that is movable, like vehicles and equipment. Property taxes are the single largest source of state and local revenue in the U.S. and help fund schools, roads, police, and other services.

base, recurrent taxes on property are one of the most efficient types of taxes, and Portugal’s property tax burden lies at the European average. In contrast, Portugal’s turnover tax on real property transfers (Imposto Municipal sobre as Transmissões Onerosas de Imóveis, or IMT) places a serious drag on economic growth by making it harder for people to relocate for better jobs and living conditions while constraining investment into the development of housing and buildings. Reform efforts should concentrate on eliminating the transfer tax and replacing it with VAT on new buildings and structures. Any resulting revenue losses from eliminating the transfer tax can be easily offset with less harmful measures.

Recurrent Taxes on Property

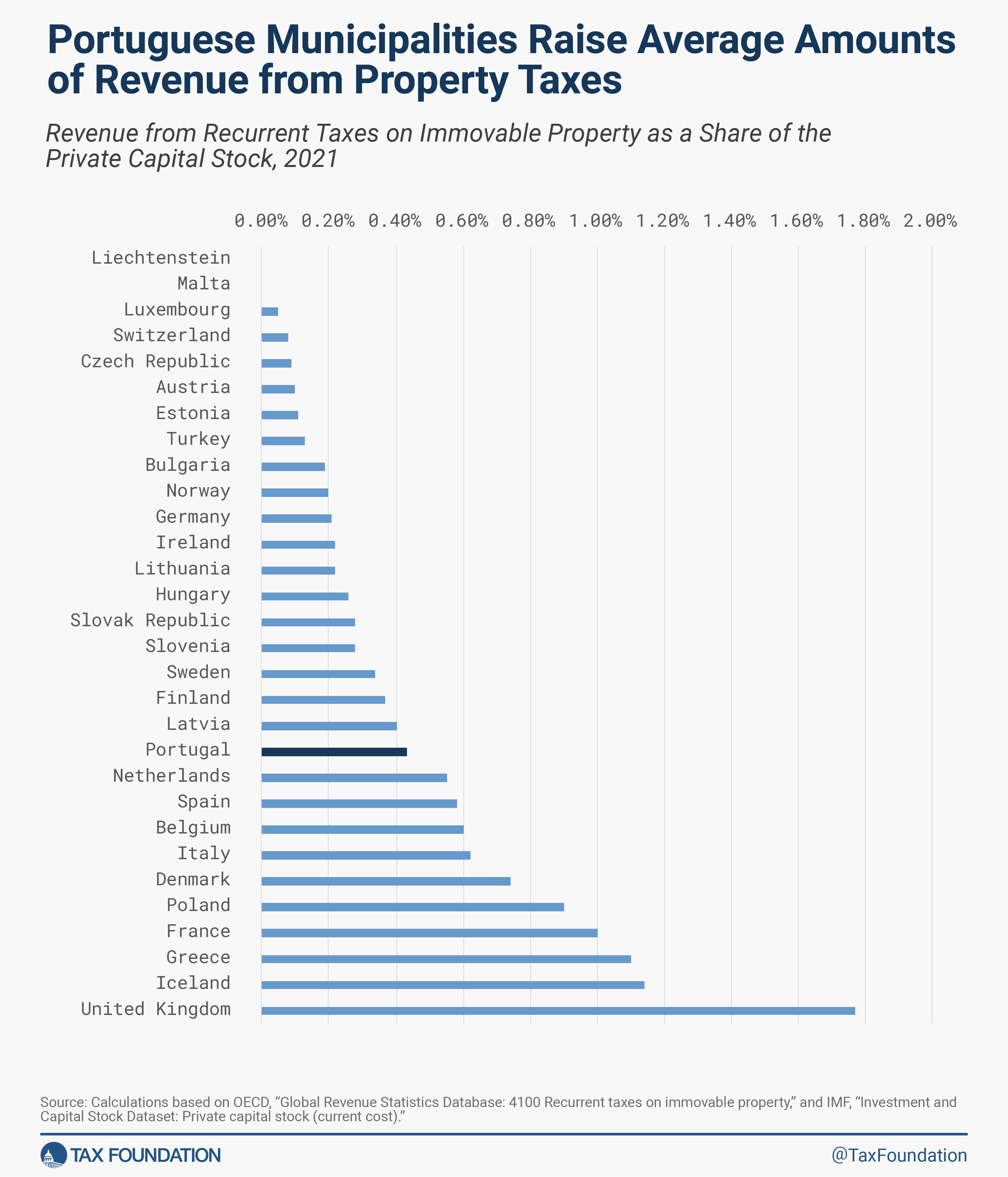

For local governments, recurrent taxes on immovable property represent an important source of tax revenue. In 2021, Portuguese municipalities collected EUR 1.6 billion in property tax revenues. This is equivalent to 0.43 percent of the value of Portugal’s private capital stock, a figure identical to the average of the 30 European countries with available data.

Like most European countries, Portugal’s property tax is levied on the value of both land and buildings and is deductible from the corporate income taxA corporate income tax (CIT) is levied by federal and state governments on business profits. Many companies are not subject to the CIT because they are taxed as pass-through businesses, with income reportable under the individual income tax.

. Compared to most other types of taxes, recurrent taxes on immovable property tend to have the least harmful impact on economic growth.

Nonetheless, high property taxes can discourage investment in infrastructure, which businesses would have to pay additional taxes on. For this reason, businesses may choose to locate away from places with high property taxes. One option to improve the efficiency of property taxes would be to repeal exemptions for specific uses of property, such as renewable energy infrastructure. Further improvements could be made by shifting the tax base towards land and away from buildings and structures, an approach taken by Estonia and some federal states of Australia and Germany.

Property Transfer Tax and Stamp Duty

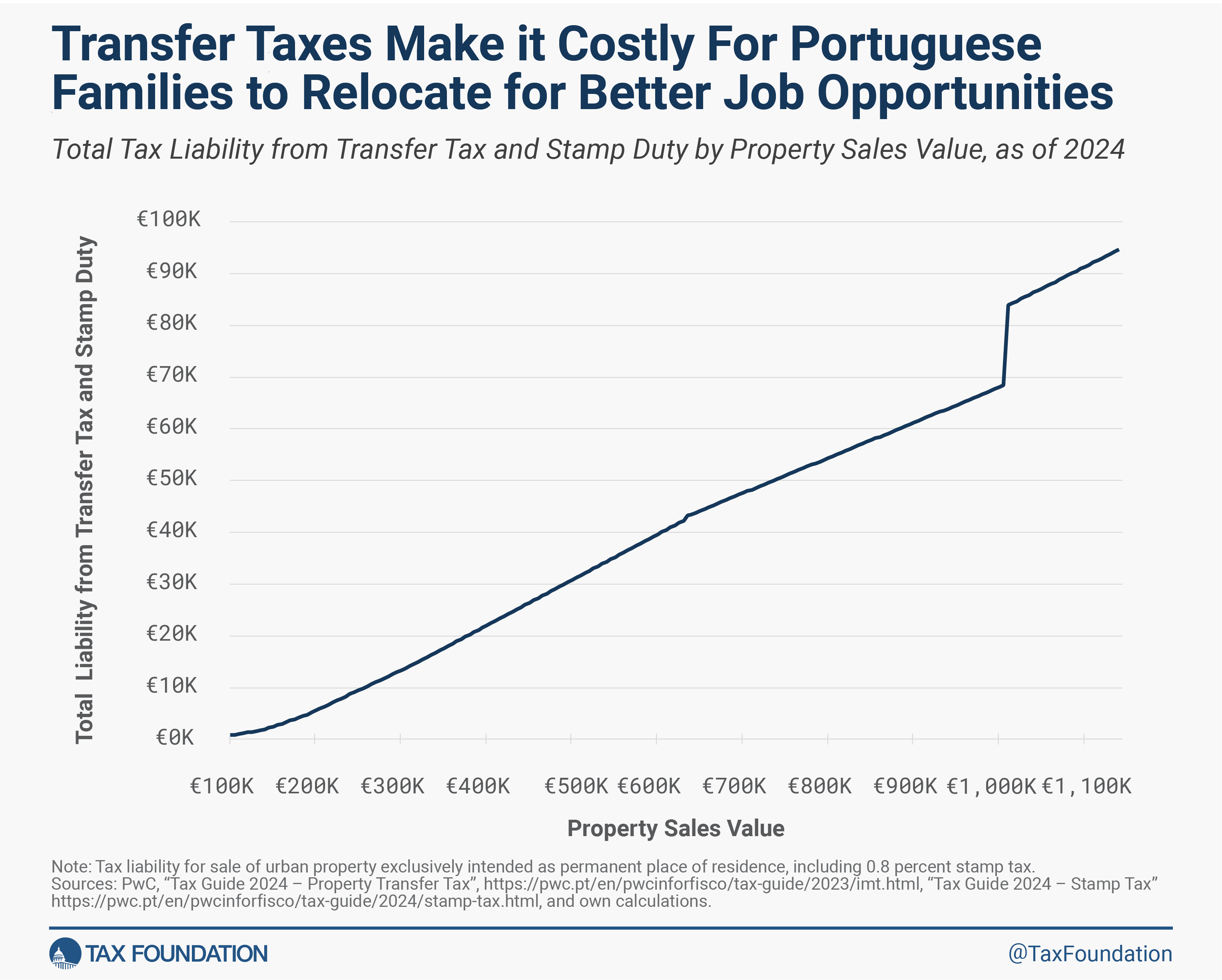

Portugal also levies a property transfer tax (IMT) on the sales price of real estate at every transfer of ownership, using a graduated rate schedule with rates between 0.8 and 8.8 percent on urban residential property, including a 0.8 percent stamp duty.

The transfer tax takes the form of a turnover tax, without any deductions for purchasing and investment costs, making this type of tax design particularly harmful to capital investment.

The property transfer tax places a hefty price tag on the reallocation of real estate that limits people’s ability to make changes in their living and working spaces. Close to 80 percent of the Portuguese live in households that own their home rather than rent it. For these households, the property transfer tax makes it harder to relocate for better job opportunities while keeping elderly people in homes that are too large for them. For businesses, transfer taxes also make it harder to adjust the size of their operations based on their spatial requirements.

Research also finds that high transaction tax rates reduce capital investment in buildings and structures as the transaction costs reduce the value of a building over its lifetime. The decrease in property values translates into reductions in new developments, driving up rental prices and decreasing housing affordability. A recent study on transfer tax rates in German states finds that the volume of new residential construction lost due to an increase in transfer taxes from 3.5 percent to rates between 5.5 and 6 percent is higher than the revenue raised by higher rates.

Given these outsized efficiency costs, Portugal should eliminate its property transfer tax and instead levy VAT on new buildings and structures. This would improve the incentives for the development of housing and structures to align with those for other goods and services, allow homeowners to make the most of their living space, and help people relocate to better jobs.

In 2021, revenues from the transfer tax stood at EUR 1.3 billion. Municipalities can compensate for the revenue loss through a mix of higher property tax rates and lower government spending on housing development, which constituted EUR 400 million in 2021. The central government could also support municipalities by apportioning a share of VAT revenue back to its source jurisdictions.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Subscribe

Share